How To Compare Insurance Quotes Online

Delving into How to Compare Insurance Quotes Online, it’s essential to understand that securing the best insurance deal involves more than just a quick glance at prices. In today’s digital age, where information is just a click away, being savvy about comparing quotes can lead to significant savings and better coverage tailored to your needs.

Insurance quotes are not only numbers; they represent a crucial step in the purchasing process that can impact your financial security. Different types of insurance, such as auto, home, and health, each have varying factors that influence their quotes, making it vital to gather accurate information and compare options thoughtfully.

Understanding Insurance Quotes

Source: slidesharecdn.com

Insurance quotes are estimates provided by insurance companies detailing the premium you would pay for a specific type of coverage. They play a crucial role in the insurance purchasing process, as they help consumers assess different options and make informed decisions. By comparing quotes, individuals can find the best coverage for their needs at the most competitive rates. When considering insurance, it’s essential to recognize that different types of insurance—such as auto, home, and health—have unique factors influencing their quotes.

Each type of insurance is tailored to specific risks and coverage needs, leading to variations in pricing and coverage options. For example, auto insurance quotes may factor in your driving record and the type of vehicle you own, while home insurance quotes will include details about your property’s location and value.

Factors Affecting Insurance Quotes

Several common factors can significantly impact the quotes you receive for various types of insurance. Understanding these factors can help you anticipate changes in pricing and coverage options.

- Age: Younger individuals, particularly teens, often face higher auto insurance premiums due to their lack of driving history. In contrast, older adults may benefit from lower rates as their experience generally leads to fewer claims.

- Location: Your geographical area plays a vital role in determining insurance quotes. High-crime areas can lead to increased home insurance costs, while regions prone to natural disasters may warrant higher premiums.

- Coverage Levels: The amount of coverage you choose directly affects your premiums. Opting for higher coverage limits or additional riders will increase your quotes, while selecting minimal coverage will result in lower costs.

- Credit Score: Many insurers utilize credit scores as a risk assessment tool. A higher credit score can lead to lower premiums, as it suggests responsible financial behavior. Conversely, a poor credit score may result in elevated rates.

- Claims History: A history of frequent claims can signal risk to insurers, causing them to raise premiums. Maintaining a clean claims record can help keep your insurance costs manageable.

“Insurance quotes are essential tools in finding the right coverage at the best price, taking into account various personal and situational factors.”

Understanding these factors not only helps in navigating the intricacies of insurance quotes but also empowers consumers to make choices that align with their financial goals and protection needs.

Benefits of Comparing Insurance Quotes Online

Comparing insurance quotes online offers numerous advantages for consumers seeking the best coverage tailored to their needs. With the rise of digital technology, the process of obtaining multiple quotes has become simpler, more efficient, and significantly more transparent.One of the primary benefits of using online platforms for insurance comparisons is the convenience and speed they provide. Consumers can gather information from various insurers in just a few clicks, allowing for a broader perspective on available options.

Online quote comparison tools are designed to be user-friendly, often featuring instant estimates that help users gauge potential costs without extensive paperwork.

Time-Saving Features of Online Quote Comparison Tools

These tools are equipped with several features that significantly reduce the time and effort required to compare insurance quotes. Some of the key time-saving features include:

- Instant Estimates: Most online platforms provide real-time quotes based on the information entered, allowing users to see potential premiums immediately.

- Streamlined Processes: Users can fill out one form applicable to multiple insurers, eliminating the need to enter the same data repeatedly.

- Comprehensive Filters: Many tools allow users to refine their search based on specific criteria such as coverage type, deductible amounts, and customer ratings, making it easier to find the right policy quickly.

- Comparison Charts: Visual aids in the form of charts and tables quickly summarize the differences between policies, helping users make informed decisions at a glance.

The ability to save time while gathering critical information is a game changer for many consumers. For instance, a recent study found that individuals using online comparison tools saved an average of 30% on their premiums by quickly identifying the best options available.

Examples of Cost Savings Through Comparing Multiple Quotes Online

The potential for significant cost savings is another compelling reason to compare insurance quotes online. When consumers take the time to review multiple offerings, they often uncover substantial differences in pricing for similar coverage.

“Comparing insurance quotes online can lead to savings of hundreds of dollars annually.”

For example, a driver shopping for auto insurance might find that one insurer quotes $1,200 annually for a standard policy, while another offers the same coverage for just $850. This $350 difference can represent a considerable budget relief over the course of a year. Moreover, home insurance quotes can vary widely as well. A homeowner could explore multiple insurers and discover policies ranging from $800 to $1,500 for the same level of coverage.

By opting for the lower quote, they not only save money but also retain the flexibility to allocate funds to other important areas of their lives.In conclusion, the advantages of comparing insurance quotes online are clear. The combination of convenience, time-saving features, and the potential for significant cost savings makes this approach not only efficient but also financially beneficial for consumers.

How to Gather Insurance Quotes

Collecting insurance quotes online can seem daunting, but breaking it down into manageable steps can streamline the process. By following a structured approach, you can ensure that you gather comprehensive and competitive quotes from different providers, helping you find the best coverage for your needs at the right price.

To effectively collect insurance quotes, it’s crucial to understand the essential information required for obtaining accurate estimates. This involves not only your personal details but also specifics regarding the coverage you seek. Below are the steps to gather insurance quotes efficiently.

Steps to Collect Insurance Quotes

Start by preparing the necessary information and deciding what type of insurance you need. This will help you provide accurate details to insurers, ensuring that the quotes you receive are both relevant and comparable.

- Research Insurance Providers: Identify various insurance companies that offer the type of coverage you’re interested in. Look for reputable companies with positive reviews and solid financial ratings.

- Prepare Personal Information: Be ready to provide essential details such as your name, address, date of birth, and contact information. If applicable, have your driver’s license number and Social Security number handy.

- Define Your Coverage Needs: Determine what type of coverage you need. For instance, if it’s auto insurance, consider factors such as liability, collision, and comprehensive coverage.

- Fill Out Quote Forms: Visit the websites of the selected insurance providers and fill out their online quote forms accurately. Ensure that all details are consistent across applications to avoid discrepancies.

- Compare Quotes: Once you receive the quotes, compare them based on coverage limits, deductibles, premiums, and additional features offered. Make sure to note the differences in policy terms.

Gathering accurate quotes involves not just providing your information but also understanding the coverage you’re inquiring about. Having a clear picture of your needs will help you communicate effectively with the insurers, leading to more accurate quotes.

Checklist for Requesting Quotes Online

A checklist can help ensure that you don’t miss any critical details when you’re requesting insurance quotes online. Following these steps will help you stay organized and efficient throughout the process.

- Gather personal information: name, address, phone number, date of birth.

- Determine the type of insurance you need and what coverage options you’re interested in.

- Compile details about existing coverage, if any, including policy numbers and renewal dates.

- Identify any discounts you may qualify for, such as multi-policy or safe driver discounts.

- Review the requirements of each insurance provider to ensure you provide all requested information.

- Make a note of each provider’s contact information for follow-up questions.

Using this checklist can simplify the process, ensuring that you have everything you need at your fingertips. It’s important to be thorough and accurate when gathering quotes, as this will directly impact the quality and competitiveness of the quotes you receive.

“Being informed and organized is the best approach to finding the right insurance at the right price.”

Evaluating Insurance Quotes

Source: security-guard.ca

When it comes to securing the right insurance policy, evaluating quotes is a critical step in the decision-making process. Insurance quotes can vary significantly, and understanding what to look for can save you money while ensuring you have the necessary coverage. This guide focuses on the essential criteria to consider when comparing different insurance quotes, helping you make an informed choice.When evaluating insurance quotes, several key factors should be considered to ensure that you receive adequate coverage at a competitive price.

These criteria include premiums, deductibles, coverage limits, and additional features or benefits that may be included in the policy.

Criteria for Comparing Insurance Quotes

Before diving into the specifics of the comparison, it’s important to acknowledge that understanding these criteria can help you better analyze the different quotes available to you.

- Premiums: This is the amount you pay for your insurance policy, usually on a monthly or annual basis. Lower premiums might be appealing but can sometimes lead to less coverage or higher deductibles.

- Deductibles: This is the amount you need to pay out-of-pocket before your insurance kicks in. A higher deductible often results in a lower premium, but it’s essential to assess whether you can afford to pay this amount in the event of a claim.

- Coverage Limits: These are the maximum amounts your insurance company will pay for a covered loss. Ensure the limits are sufficient for your needs, especially for property, liability, and medical coverage.

- Additional Features: Some policies may offer perks such as roadside assistance, rental car coverage, or accident forgiveness. These features can add value, depending on your individual needs.

To make the comparison process easier, a comparison table can be extremely helpful. This format allows you to visualize the similarities and differences across quotes effectively.

| Insurance Provider | Premium | Deductible | Coverage Limit | Additional Features |

|---|---|---|---|---|

| Provider A | $100/month | $500 | $200,000 | Roadside assistance, rental coverage |

| Provider B | $90/month | $1,000 | $150,000 | Accident forgiveness |

| Provider C | $110/month | $300 | $250,000 | Comprehensive coverage |

In addition to evaluating the main aspects of each quote, it’s crucial to read and understand the fine print of the insurance policies. This often contains important information regarding exclusions and limitations that can significantly impact your coverage.

Understanding the fine print is essential, as this is where insurance companies Artikel conditions that may affect your claims.

Be sure to look out for the following in the fine print:

- Exclusions: Policies may exclude certain events or types of damage, such as natural disasters, which could leave you unprotected in specific scenarios.

- Conditions: Some policies may require you to meet specific conditions to make a claim, like notifying the provider within a certain timeframe.

- Renewal Terms: Understanding how your premium may change upon renewal can help you budget accordingly and avoid surprises.

By carefully evaluating insurance quotes using these criteria and understanding the fine print, you can make a more informed decision that aligns with your coverage needs and financial situation.

Utilizing Online Comparison Tools

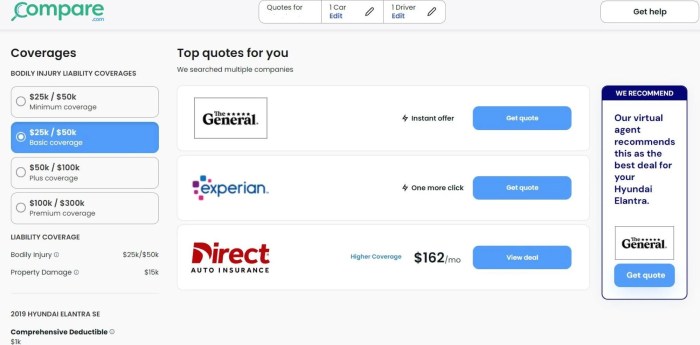

In today’s digital age, finding the right insurance quotes has never been easier, thanks to a variety of online comparison tools. These platforms allow consumers to streamline their search, providing quick access to multiple insurance options that fit their needs. Understanding how to effectively use these tools can significantly impact the final decision on coverage and cost. Online comparison tools bring together various insurers and their quotes, making it easier to evaluate multiple offers side by side.

Some of the most popular comparison websites include sites like NerdWallet, Policygenius, and Compare.com. Each of these platforms provides a user-friendly interface designed to help you navigate the complexities of insurance quotes.

Popular Online Comparison Tools and Their Features

When selecting an online comparison tool, it’s crucial to understand the features and benefits each offers. Here’s a list of some well-known tools and what they provide:

- NerdWallet: Provides detailed breakdowns of policy types, coverage options, and user ratings. Users can easily filter results based on their specific needs.

- Policygenius: Offers a wide range of insurance types and includes personalized recommendations based on user input. It provides educational resources to help users understand insurance terms.

- Compare.com: Focuses on car insurance but also includes home and health insurance options. It allows users to compare quotes from over 50 insurers in one place.

To effectively use these tools, follow these steps:

- Enter your personal details, such as age, location, and coverage requirements.

- Review the list of available options presented to you, taking note of coverage limits and premiums.

- Utilize the filtering options to narrow down your search based on factors like policy type, price range, and customer reviews.

Pros and Cons of Using Aggregator Sites Versus Direct Carrier Websites

Understanding the differences between aggregator sites and direct carrier websites can help you make informed choices during your insurance search. Each option has its advantages and disadvantages.

- Aggregator Sites:

- Pros: Allows for side-by-side comparisons, saving time and offering a wider range of options.

- Cons: May not always have the most up-to-date quotes or every insurance carrier represented.

- Direct Carrier Websites:

- Pros: Often provides the most accurate quotes, exclusive discounts, and personalized offerings.

- Cons: Requires more time to visit multiple sites individually, which can lead to a more cumbersome process.

A strategic approach often combines both methods to take advantage of the strengths of each. For instance, starting with an aggregator tool to identify potential options and then visiting direct carrier websites for deeper insights into specific policies and pricing can provide a balanced view, leading to better decision-making.

“Utilizing online comparison tools effectively can streamline the insurance shopping process, leading to better coverage at competitive prices.”

Common Mistakes to Avoid

Source: storyblok.com

When comparing insurance quotes online, consumers often stumble into traps that can lead to poor decision-making. Recognizing these common mistakes is crucial for securing the best coverage at the most appropriate price. Understanding the nuances of insurance quotes can empower you to make informed choices, ensuring that you don’t just land the lowest price but also the right policy for your needs.One major pitfall is the tendency to focus solely on price when evaluating insurance quotes.

While cost is undoubtedly an important factor, it shouldn’t be the only consideration. The cheapest option may not always provide the coverage you need, which can result in significant out-of-pocket expenses down the line. It’s essential to assess the overall value of the policy, including coverage limits, deductibles, and the insurer’s reputation for customer service.

Frequent Errors Consumers Make

When diving into the world of online insurance quotes, many consumers make specific mistakes that can hinder their ability to compare effectively. Here are some errors to watch out for:

- Ignoring Coverage Details: Many consumers overlook the specifics of what each policy covers or excludes. It’s vital to read the fine print and understand what you are paying for.

- Not Comparing Similar Coverage: Quotes may vary widely based on coverage options. Ensure you’re comparing apples to apples by looking at similar policies.

- Overlooking Discounts: Failing to consider available discounts can lead to higher premiums. Many insurers offer discounts for safe driving, bundling policies, or maintaining a claims-free history.

- Assuming All Insurers are the Same: Different insurance companies have varied underwriting guidelines and claim processes. Research the company’s reputation and customer feedback before making a selection.

- Rushing the Process: Taking time to gather and analyze quotes can lead to better outcomes. Rushing can result in missed details that are critical to your decision.

Importance of Evaluating Beyond Price

While it’s tempting to gravitate toward the lowest quote, this often results in a superficial evaluation of insurance options. Policies may vary significantly in terms of benefits and limitations. A cheaper policy might leave you underinsured when you need it the most.

“The best insurance is not always the cheapest; it’s the one that meets your needs without compromising on essential coverage.”

Avoiding Misinformation and Scams

The online insurance landscape can be rife with misinformation and potential scams. To protect yourself, consider the following strategies:

- Use Reputable Sources: Stick to well-known insurance comparison websites and official company sites to gather quotes.

- Verify Licensing: Ensure that the insurance providers you are considering are licensed to operate in your state. This can often be checked through your state’s insurance department website.

- Read Reviews: Look for customer reviews and testimonials to gauge the reliability and service level of the insurer.

- Beware of Too-Good-to-Be-True Offers: If an offer seems unusually low or generous, it may be a red flag. Always cross-check with multiple sources.

- Consult an Agent: If in doubt, consider speaking with a licensed insurance agent who can provide additional insights and clarify any confusing aspects of the quotes.

Final Tips for Effective Comparison

When it comes to comparing insurance quotes, staying organized and methodical can significantly enhance your experience. Utilizing effective strategies will not only help you keep track of the numerous quotes and providers you’ve encountered but will also empower you to make informed decisions. Here are some practical tips to ensure you get the most out of your comparison process.

Tracking Gathered Quotes and Providers

Maintaining a clear record of the quotes you’ve gathered is essential for effective comparison. This can be accomplished through:

- Spreadsheets: Create a simple spreadsheet to log details of each quote, including the provider’s name, policy features, coverage amounts, and premiums. This visual representation makes comparisons straightforward.

- Quote Comparison Apps: Use mobile apps designed for insurance comparison. These apps often allow you to input your information and receive quotes in one place, making tracking easier.

- Folders or Notebooks: If you prefer a more traditional approach, keep printed quotes and notes in a dedicated folder or notebook. Categorize them by provider and types of coverage for easy reference.

Creating a Summary Table for Comparison

A summary table is a practical tool that allows for quick visual comparisons of multiple insurance quotes. Constructing a table with relevant columns will help highlight differences in coverage and costs effectively. Here’s an example of how to structure your summary table:

| Provider | Policy Type | Coverage Amount | Premium | Deductible |

|---|---|---|---|---|

| Provider A | Auto Insurance | $50,000 | $800 | $500 |

| Provider B | Auto Insurance | $60,000 | $750 | $300 |

Using a table like this allows you to quickly identify which provider offers the best value based on your needs.

Periodic Review of Insurance Options

Even after selecting an insurance plan, it’s beneficial to periodically review your options. Insurance needs can change over time due to life events such as marriage, buying a home, or starting a family. Regularly assessing your policy ensures it remains adequate and cost-effective. Consider conducting a review annually or whenever significant changes occur in your life. This proactive approach can lead to better coverage or lower premiums, ultimately contributing to your financial well-being.

“Insurance is not a one-time decision; it’s an ongoing process that requires regular attention.”

Summary

In conclusion, navigating the world of insurance quotes doesn’t have to be overwhelming. By utilizing the right tools, being aware of common pitfalls, and regularly reviewing your options, you can ensure you’re getting the best coverage at the best price. Remember, a little effort in comparing quotes can lead to substantial benefits in the long run.

Clarifying Questions

What is an insurance quote?

An insurance quote is an estimate of the cost of coverage provided by an insurer based on specific information about the individual and the desired policy.

How do I choose the best quote?

Look beyond just the price; consider coverage limits, deductibles, and the reputation of the insurance company before making a decision.

Can I compare quotes from different types of insurance?

Yes, you can compare quotes across different types of insurance, but ensure you are comparing similar coverage options for an accurate comparison.

Are online comparison tools reliable?

Generally, yes, but it’s important to use reputable sites and double-check the information with the insurance providers directly for accuracy.

How often should I compare insurance quotes?

It’s a good idea to compare insurance quotes at least once a year or whenever there are significant life changes that might affect your coverage needs.