Dental Insurance Plans What’S Actually Covered

Dental Insurance Plans: What’s Actually Covered provides a clear roadmap through the often confusing world of dental insurance. Understanding what these plans truly offer is essential for making informed decisions about your dental health and finances. From preventive care to major dental procedures, this guide breaks down what you can expect when you choose a dental insurance plan.

In this overview, we’ll explore the types of dental insurance available, common coverage categories, and what exclusions you might encounter. Whether you’re a first-time buyer or looking to switch providers, this information will help ensure you select a plan that meets your needs while maximizing your benefits.

Understanding Dental Insurance Plans

Dental insurance plans play a crucial role in promoting oral health by providing financial assistance for dental care services. These plans aim to minimize the out-of-pocket costs for patients seeking preventive, restorative, and emergency dental treatments. By having dental insurance, individuals can access necessary dental care without facing overwhelming costs, ultimately contributing to better overall health.The different types of dental insurance plans cater to various needs and preferences, each with its structure and coverage options.

Some common types include employer-sponsored plans, individual plans, and government programs such as Medicaid and CHIP. Each of these plans has unique characteristics regarding coverage limits, network restrictions, and eligibility requirements, allowing individuals to choose the one that best suits their dental care needs.

Types of Dental Insurance Plans

Understanding the various types of dental insurance plans helps consumers make informed decisions. Below are the most common types, along with their features:

- Preferred Provider Organization (PPO): Offers flexibility to choose any dentist but provides greater cost savings when using an in-network provider. These plans typically feature lower copays and deductibles for in-network care.

- Health Maintenance Organization (HMO): Requires members to select a primary dentist and obtain referrals for specialist care. These plans often have lower premiums but less flexibility in choosing providers.

- Indemnity Plans: Also known as fee-for-service plans, these allow members to visit any dentist and are reimbursed for a portion of the costs. They generally provide higher coverage limits but may come with higher out-of-pocket expenses.

- Discount Dental Plans: Not insurance but rather a membership program that offers discounts on dental services through a network of providers. Members pay an annual fee to access reduced rates on various dental services.

Common Terms in Dental Insurance

Familiarizing oneself with the terminology associated with dental insurance is essential for understanding how these plans work. Here are some of the key terms:

- Premium: The amount paid, usually on a monthly basis, to maintain the dental insurance coverage.

- Deductible: The amount that the insured must pay out-of-pocket before the insurance coverage kicks in. For instance, if a plan has a $50 deductible, the insured must pay this amount for dental services before the insurance starts covering costs.

- Copay: A fixed amount that the insured pays for each dental visit or service. For example, a plan might require a $20 copay for routine check-ups.

- Coverage Limit: The maximum amount the insurance plan will pay for dental care within a specified period, usually annually. Exceeding this limit means the insured must cover additional costs.

“Understanding your dental insurance plan is key to maximizing benefits and minimizing unexpected expenses.”

By grasping the essentials of dental insurance plans and familiarizing oneself with critical terms, individuals can navigate their dental care options more effectively. This knowledge not only aids in making informed decisions but also ensures that one receives the necessary care without unnecessary financial strain.

Coverage Categories in Dental Insurance

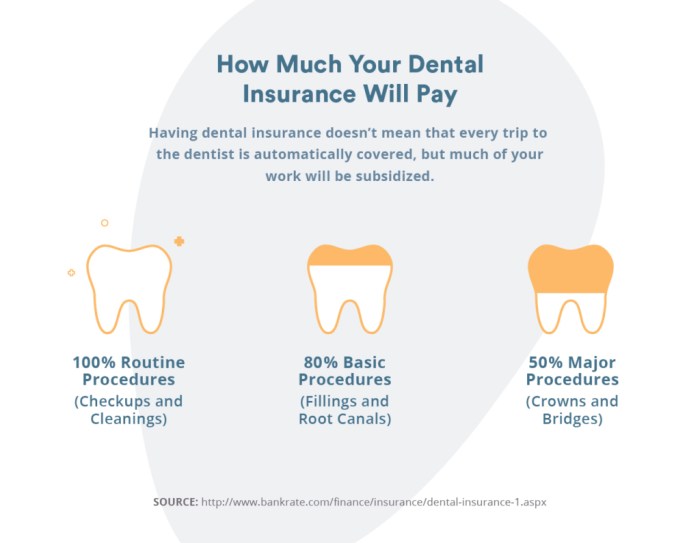

Dental insurance plans typically categorize coverage into distinct groups, which helps policyholders understand what services are available and the extent of financial assistance provided for each. These categories often include preventive, basic, and major services, each with its own set of procedures and coverage percentages.Understanding the categories of coverage is crucial for making informed decisions about dental care. Each category addresses different types of dental services, and the coverage percentages can vary significantly between plans.

Knowing what falls under each category can help individuals and families plan their dental health strategies effectively.

Coverage Categories Explained

Dental insurance coverage is generally divided into three main categories: preventive, basic, and major. Each category serves a specific purpose in maintaining and treating dental health.

- Preventive Services: These are routine dental care services aimed at preventing dental issues before they arise. Common examples include:

- Routine check-ups

- Teeth cleanings

- X-rays

- Fluoride treatments

Preventive services are typically covered at a higher percentage, often 100% under many plans, as they contribute to overall health and minimize future costs.

- Basic Services: This category includes treatments for common dental issues that require intervention. Examples are:

- Fillings

- Root canals

- Simple extractions

- Periodontal treatments

Basic services usually have moderate coverage rates, often around 70-80%, reflecting the necessity of these treatments as they address dental problems that have already arisen.

- Major Services: These services are necessary for significant dental problems and often involve more complex procedures. Examples include:

- Crowns

- Bridges

- Dentures

- Oral surgery

Coverage for major services tends to be lower, typically around 50%, acknowledging the greater costs associated with these procedures.

Coverage Percentage Comparison Table

To facilitate a clearer understanding of how different dental plans handle coverage, the following table compares typical coverage percentages for preventive, basic, and major services across various insurance plans:

| Service Category | Plan A | Plan B | Plan C |

|---|---|---|---|

| Preventive Services | 100% | 100% | 80% |

| Basic Services | 80% | 70% | 50% |

| Major Services | 50% | 60% | 40% |

Understanding the coverage percentages for each category can help you choose the right dental plan based on your specific needs and potential dental care requirements.

Exclusions and Limitations

Understanding the exclusions and limitations of dental insurance plans is crucial for policyholders. These components define the scope of what is and isn’t covered, which can significantly affect both financial planning and health outcomes. Often overlooked, exclusions can lead to unexpected out-of-pocket expenses, while limitations can restrict access to necessary treatments.Common exclusions are typically Artikeld in dental insurance policies, and they can vary by provider.

Familiarizing yourself with these exclusions can help avoid surprises at the dentist’s office.

Common Exclusions in Dental Insurance Policies

Exclusions are specific procedures or services that a dental insurance plan will not cover. It’s important for policyholders to be aware of these exclusions to avoid assuming that all their dental needs are covered. Here are a few common exclusions found in many dental insurance policies:

- Cosmetic Procedures: Treatments aimed at improving appearance, such as teeth whitening or veneers, are usually excluded.

- Orthodontics: Many plans do not cover braces or other orthodontic treatments, especially for adults.

- Pre-existing Conditions: Dental problems that existed before the start of the policy may not be covered.

- Implants: Some policies exclude coverage for dental implants or limit the amount they will pay for them.

Limitations Affecting Coverage Scope

Limitations in dental insurance can impose constraints on how often you can receive certain treatments or the duration of coverage for specific services. Understanding these limitations is essential for managing your dental care effectively. Here are some common limitations that policyholders may encounter:

- Waiting Periods: Some plans have waiting periods for certain services, meaning you must wait a specified time after purchasing the policy before you can receive those treatments.

- Frequency Limits: Insurance may limit the number of cleanings or exams per year, often to two cleanings and one exam annually.

- Coverage Caps: Many policies have maximum annual payout limits, restricting the total amount that can be claimed within a year.

- Age Limits: Some plans may have age restrictions for certain services, particularly orthodontic treatments.

“Understanding exclusions and limitations is vital for anyone with dental insurance, as it directly impacts your financial responsibilities and access to care.”

Reviewing policy documents thoroughly is the best way to understand the specific exclusions and limitations of your dental insurance. This knowledge empowers you to make informed decisions about your dental health and budget accordingly for any potential out-of-pocket costs. By gaining clarity on these aspects, you can better navigate your dental care needs without unexpected surprises.

How to Choose the Right Dental Insurance Plan

Selecting the right dental insurance plan can seem daunting given the variety of options available. However, understanding your specific needs and the features of different plans can make the process much easier. With the right information, you can confidently choose a plan that fits both your dental health requirements and your budget.When evaluating dental insurance plans, it’s essential to consider several factors that will impact your coverage and costs.

Different plans come with different levels of benefits, premiums, and coverage limits. A thorough assessment will help ensure you select a plan that aligns with your unique dental care needs.

Factors to Consider When Selecting a Dental Insurance Plan

There are several key factors to keep in mind while reviewing various dental insurance plans. These considerations will help you make a well-rounded decision.

- Premiums: This is the amount you pay monthly for your dental insurance. It’s crucial to find a balance between affordable premiums and adequate coverage.

- Deductibles: This is the amount you must pay out-of-pocket before your insurance starts covering services. Look for a deductible that fits your financial situation.

- Coverage Limits: Many plans set annual limits on what they will pay for dental care. Ensure the limit is sufficient for your anticipated needs.

- Network of Providers: Check if your preferred dentists are included in the plan’s network. Out-of-network services can lead to higher out-of-pocket payments.

- Types of Services Covered: Confirm that the plan covers the essential services you require, including preventive care, restorative services, and emergency procedures.

Checklist of Questions to Ask When Evaluating Different Plans

Having a checklist can streamline your evaluation process. Below are important questions to consider, which can guide your decision-making.

- What is the monthly premium, and how does it compare to my budget?

- What are the deductible amounts for both individual and family plans?

- What is the annual maximum payout for each plan?

- Which dental providers are in the network, and can I see my current dentist?

- What specific services are covered, including preventive, basic, and major services?

- Are there any waiting periods before certain services are covered?

Tips for Comparing Benefits and Costs Effectively

When comparing dental insurance plans, it’s important to approach the process methodically. Here are some tips for making effective comparisons that can enhance your decision-making.

- Create a Comparison Chart: List out key features of each plan side by side, including premiums, deductibles, coverage limits, and types of services covered.

- Utilize Online Tools: Many websites offer comparison tools that can highlight differences between plans and provide visual aids to assess benefits.

- Read Reviews: Customer reviews and ratings can give you insight into the experiences of others with specific plans and providers.

- Consider Future Needs: If you anticipate needing more extensive dental work in the future, consider plans that offer higher coverage limits and more comprehensive services.

- Consult with Insurance Agents: Speaking with a knowledgeable insurance agent can help clarify details and answer any specific questions you may have.

Choosing the right dental insurance plan is a balance of understanding your needs, financial considerations, and the specifics of care provided.

Common Procedures Covered by Dental Insurance

Source: smithdentalworks.com

Dental insurance plans often cover a variety of dental procedures, ensuring that patients can access necessary treatments without facing exorbitant out-of-pocket expenses. Understanding the coverage status of these procedures can help individuals make informed decisions about their dental care. The landscape of dental coverage can differ significantly based on the type of procedure performed. Common procedures typically include routine cleanings, fillings, crowns, and orthodontics.

Each of these has its own coverage specifics, which can influence the costs incurred by patients. Below is a comprehensive overview of these procedures and their typical coverage status.

Common Dental Procedures and Coverage Status

The following list Artikels common dental procedures alongside their coverage status under most dental insurance plans. This helps clarify what patients can expect when they require dental care.

- Routine Cleanings: Usually covered at 100% as part of preventive care, with most plans allowing two cleanings per year.

- Fillings: Generally covered at 70%-80% after the deductible, depending on the plan. The coverage is often influenced by the material used for the filling (e.g., amalgam vs. composite).

- Crowns: Coverage typically ranges from 50%-70% after the deductible is met. Crowns are often considered major restorative work, hence the lower percentage compared to preventive care.

- Orthodontics: Coverage for braces and other orthodontic treatments varies widely, often around 50%, and may have lifetime maximums in place. Some plans might exclude orthodontics altogether.

Out-of-Pocket Costs for Dental Procedures

Understanding the typical out-of-pocket costs associated with each dental procedure under various insurance plans can aid in financial planning. The table below presents a general estimate of these costs, which can fluctuate based on individual insurance plans and local pricing.

| Procedure | Average Cost | Insurance Coverage (%) | Estimated Out-of-Pocket Cost |

|---|---|---|---|

| Routine Cleaning | $100 | 100% | $0 |

| Filling | $200 | 70%-80% | $40 – $60 |

| Crown | $1,200 | 50%-70% | $360 – $600 |

| Orthodontics | $5,000 | 50% | $2,500 |

It is essential to review your specific dental insurance policy to understand the exact coverage details, as these can vary widely between plans.

Navigating Claims and Benefits

Navigating the intricacies of dental insurance claims can seem daunting, but understanding the process can significantly ease the experience. Knowing how to file claims effectively and maximize benefits can lead to better oral health outcomes without the added stress of financial burdens. This section will guide you through the essential steps and provide tips to ensure you receive the benefits you’re entitled to while addressing common challenges that may arise.

Filing a Dental Insurance Claim

Filing a claim with your dental insurance provider is typically a straightforward process, but it requires attention to detail. Here are the general steps involved in submitting a claim:

1. Obtain a Claim Form

Most dental insurance companies provide a standard form that can be downloaded from their website or requested from your dental office.

2. Fill Out the Necessary Information

Complete the form with your personal information, insurance policy details, and specifics of the dental services received.

3. Attach Supporting Documents

Include any required documentation, such as receipts, itemized bills from your dentist, and diagnostic records if necessary.

4. Submit the Claim

Send your completed form and documents to your insurance provider as directed, either via mail or electronically.

5. Follow Up

After submission, keep track of your claim status and follow up with the insurance company if you do not receive a response within the expected timeframe.

Completing each step accurately is crucial to avoid delays in claim processing.

Ensuring Maximum Benefits

To ensure that you receive the maximum benefits from your dental insurance plan, consider the following strategies:

Review Your Policy Details

Understanding your coverage limits, copayments, and what procedures are included can help in planning your treatments.

Stay In-Network

Whenever possible, choose dental providers that are part of your insurance network, as this often results in lower out-of-pocket costs.

Utilize Preventive Care

Many plans cover preventive services like cleanings and check-ups at 100%. Taking advantage of these can help you avoid more costly procedures down the line.

Ask for Pre-Authorization

For more extensive treatments, obtaining pre-authorization can help clarify what costs will be covered before the procedure is performed.

Keep Detailed Records

Maintain copies of all communications, claims, and payments related to your insurance. This documentation can be invaluable if disputes arise.

Common Challenges in Claim Navigation

Many individuals encounter challenges when navigating dental insurance claims. Here are some of the most common issues and how to address them:

Claim Denials

Claims can be denied for various reasons, such as incomplete information or services not covered. In such cases, review the denial notice, gather any necessary documentation, and appeal the decision by following the insurance company’s established process.

Delayed Payments

Delays in processing claims can occur, often due to administrative errors. If you’re experiencing delays, contact your insurance provider to inquire about the status of your claim and rectify any potential issues.

Confusing Policy Language

The terminology used in insurance policies can be complicated. If you find certain sections unclear, don’t hesitate to reach out to your insurance representative for clarification.

Persistence and thorough documentation are key when addressing challenges that arise during the claims process.

The Role of Preventive Care in Dental Insurance

Preventive care plays a fundamental role in maintaining not only oral health but also overall health, significantly influencing the cost and effectiveness of dental insurance plans. By focusing on preventive measures, individuals can reduce the risk of severe dental issues that may lead to costly treatments down the line.Preventive care consists of various services designed to prevent dental problems before they arise.

Insurance plans typically cover a range of preventive services, which can include regular check-ups, cleanings, and X-rays. These services are crucial for early detection of potential issues, allowing for timely intervention and treatment. Most dental insurance policies encourage preventive care by covering these services at little to no cost to the patient, often allowing for two cleanings and one comprehensive exam per year.

Covered Preventive Services and Their Frequency

Understanding what preventive services are usually covered by dental insurance can help individuals maximize their benefits. Here are the common preventive services included in most dental insurance plans:

- Routine dental exams: Typically covered twice a year, these exams allow dentists to assess oral health and identify potential problems early.

- Dental cleanings: Usually covered twice a year, cleanings help remove plaque and tartar buildup, which can lead to cavities and gum disease.

- Diagnostic X-rays: Often included once a year, X-rays assist in identifying hidden dental issues that may not be visible during a physical exam.

- Fluoride treatments: Generally covered for children and sometimes adults, these treatments help strengthen tooth enamel and prevent decay.

- Sealants: Commonly applied to children’s molars, sealants provide a protective coating that reduces the risk of cavities.

The importance of preventive care extends beyond individual health; it also has significant implications for overall healthcare costs. According to the American Dental Association, for every dollar spent on preventive dental care, around $8 to $50 can be saved on restorative and emergency treatments. This statistic highlights the economic benefits of prioritizing preventive measures in dental care.

“Investing in preventive dental care not only preserves individual health but also reduces overall healthcare costs.”

By regularly utilizing preventive services, individuals can avoid complex procedures like root canals or crowns, which can be both time-consuming and expensive. This proactive approach ensures better dental health and supports the financial sustainability of dental insurance plans.

Dental Insurance for Families

Source: opencare.com

Selecting the right dental insurance plan for a family can be a challenging endeavor. Families often have diverse dental needs, from routine check-ups to more complex treatments, making it essential to choose a plan that offers comprehensive coverage. Factors such as the number of family members, age ranges, and specific dental requirements must also be taken into account to ensure that everyone’s needs are met effectively.When considering dental insurance plans for families, it’s important to recognize that pediatric dental care often comes with additional benefits tailored specifically for children.

Many plans include coverage for services that focus on the unique dental needs of younger patients, ensuring they receive the preventive and restorative care necessary for healthy development.

Family-Oriented Dental Services Covered

Family-oriented dental services play a vital role in maintaining the oral health of family members, especially children. Understanding what services are typically covered can help families make informed decisions about their dental insurance. Here are some commonly covered services:

- Routine dental exams and cleanings for all family members

- X-rays as part of regular check-ups to monitor dental health

- Fluoride treatments, particularly for children to strengthen enamel

- Sealants to protect molars in children from decay

- Restorative treatments, such as fillings for cavities

- Orthodontic evaluations and treatments, including braces

- Emergency dental care for injuries or acute dental issues

- Oral surgery when necessary, such as tooth extractions

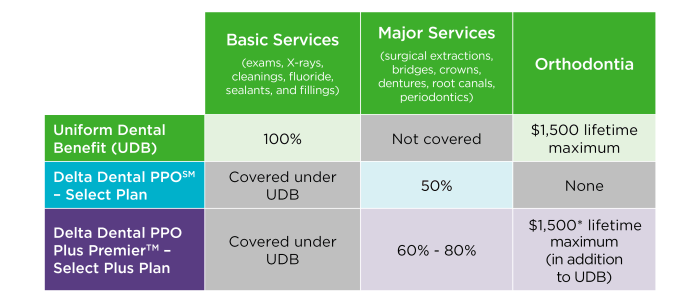

Changing Dental Insurance Plans

Source: deltadentalwi.com

Switching dental insurance plans can be a significant decision that impacts your oral health coverage and expenses. Understanding the process, potential consequences, and how to assess new options is crucial for making an informed choice. When considering a change in dental insurance providers, it’s essential to follow a thoughtful process. Start by reviewing your current coverage and identifying any gaps or needs that your existing plan does not meet.

Then, research potential new plans to find ones that better align with your dental care requirements. Be aware that changing plans might involve penalties or waiting periods, especially if you have ongoing treatments or conditions.

Process for Switching Dental Insurance Plans

Changing your dental insurance plan involves several steps to ensure a smooth transition. First, gather and analyze information about your current plan:

- Review Current Coverage: Assess what services are covered and any exclusions that might affect your dental care.

- Identify Needs: Consider any upcoming dental procedures that could influence your choice of a new plan.

- Research New Options: Look for plans that provide better coverage for the services you regularly use, such as preventive care or orthodontics.

- Check Network Providers: Ensure that your preferred dental providers are in-network with the new plan to avoid higher costs.

- Understand Costs: Compare premiums, deductibles, and out-of-pocket maximums to find a plan that fits your budget.

- Review Policy Terms: Read through the fine print to understand any penalties or waiting periods associated with the new plan.

Potential Penalties and Waiting Periods

When switching dental insurance plans, be aware of penalties and waiting periods that could affect your coverage.

“Many plans impose waiting periods for specific services, especially for major procedures like crowns or bridges.”

Waiting periods can vary significantly between plans, with some requiring you to wait several months before coverage kicks in for certain treatments. Additionally, if you have ongoing treatments, switching plans could mean that you have to start your treatment process over again or incur additional out-of-pocket expenses.

Assessing Current Coverage Against New Options

To make a well-informed decision, it’s critical to assess how your current coverage stacks up against new options. Start by creating a side-by-side comparison of your existing plan and potential new plans. Focus on key areas:

- Coverage for Preventive Care: Ensure that routine cleanings, exams, and X-rays are covered adequately.

- Major Services Coverage: Compare how each plan covers services like fillings, root canals, and crowns.

- Orthodontics and Cosmetic Procedures: If applicable, look for plans that provide benefits for braces or aesthetic treatments.

- Deductibles and Co-pays: Evaluate the cost-sharing structure to determine your total potential expenses.

- Claim Processes: Consider the ease of submitting claims and how the provider handles reimbursements.

By carefully reviewing these aspects, you can effectively determine which dental insurance plan offers the best value for your needs. Taking the time to understand the nuances of each plan will set you up for better oral health management and financial stability.

Final Wrap-Up

In conclusion, navigating the landscape of dental insurance can seem daunting, but understanding what’s actually covered can empower you to make the best choices for your dental care. With the right knowledge and resources, you can find a plan that not only fits your budget but also provides the coverage you need for a healthy smile. Remember to review your options carefully and stay informed about your benefits to make the most of your dental insurance.

FAQ

What is the typical waiting period for dental insurance?

Many dental insurance plans have a waiting period of 6 to 12 months for certain procedures, especially for major services.

Are orthodontic treatments covered by dental insurance?

Orthodontic treatments are often covered but can vary widely by plan, so it’s best to check specific coverage details.

Can I change my dental insurance at any time?

Most plans allow changes during open enrollment periods, but some may have restrictions or penalties for switching outside these times.

Do dental insurance plans cover cosmetic procedures?

Generally, cosmetic procedures are not covered. It’s important to confirm with your plan for any exceptions.

How often can I get a dental cleaning covered?

Most plans cover routine cleanings every six months, but some may allow for more frequent visits based on individual needs.