How To Structure A Real Estate Partnership For Profit

How to Structure a Real Estate Partnership for Profit sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

In the world of property investment, forming a real estate partnership can be a strategic move, allowing individuals to pool resources, share expertise, and mitigate risks. This guide explores the intricacies of structuring a partnership that not only fosters collaboration but also enhances profitability. From understanding the fundamental components of a partnership to navigating legalities and financial implications, this discussion provides invaluable insights for both novice and seasoned investors.

Understanding Real Estate Partnerships

Real estate partnerships are collaborative arrangements formed between two or more individuals or entities to invest in and manage real estate properties. These partnerships are significant because they allow investors to pool resources, share risks, and leverage collective expertise, making it easier to undertake larger projects that might be out of reach for a single investor. By working together, partners can enhance their investment potential while minimizing the individual burden associated with property management.Real estate partnerships can be structured in various ways, each catering to the needs and goals of the investors involved.

The primary types include general partnerships, limited partnerships, and joint ventures. General partnerships involve all partners sharing equal responsibility and liability for the management and debts of the partnership. In contrast, limited partnerships consist of general partners who manage the business and limited partners who contribute capital but have restricted liability. Joint ventures are temporary partnerships formed for a specific project, enabling flexibility and focused collaboration.The benefits of entering into a real estate partnership are numerous.

Partners can access larger capital pools, which can facilitate investments in bigger or more lucrative properties. Collaborating with others also means sharing expertise, which can lead to better decision-making and strategic planning. However, it’s essential to recognize the risks involved. Disagreements among partners can arise, potentially leading to conflict and legal issues. Financial instability of one partner can also jeopardize the entire partnership’s investments.

Understanding these dynamics is crucial for anyone considering a real estate partnership.

Types of Real Estate Partnerships

When exploring real estate partnerships, it is essential to be aware of the distinct structures available, as each presents unique advantages and responsibilities. Understanding these variations can help investors make informed decisions.

- General Partnerships: All partners are involved in managing the property and share unlimited liability, meaning that personal assets may be at risk if the partnership incurs debt.

- Limited Partnerships: This structure includes at least one general partner who manages the property and assumes full liability, while limited partners contribute capital and have limited liability, protecting their personal assets.

- Joint Ventures: Often formed for specific projects, joint ventures allow partners to collaborate without the ongoing commitment of a traditional partnership. Each party typically contributes specific resources or expertise and shares profits relative to their investment.

The benefits and risks associated with each partnership type vary significantly, shaping the investor’s experience.

“Pooling resources in a real estate partnership can amplify investment potential, but it requires careful planning and clear communication to navigate challenges.”

Key Components of a Successful Partnership

Source: realized1031.com

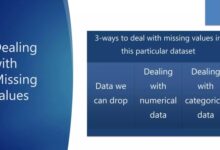

A successful real estate partnership hinges on a variety of essential elements that create a strong foundation for the venture. These components not only enhance collaboration but also ensure that each partner’s contributions and expectations are met, fostering a conducive environment for achieving shared goals. Understanding these elements is crucial for anyone looking to embark on a real estate partnership.A well-defined partnership includes several key components, which can significantly influence the success of the venture.

Establishing clear roles and responsibilities, maintaining open lines of communication, and implementing effective conflict resolution strategies are among the most vital aspects that partners must consider. These elements work together to build trust, accountability, and operational efficiency within the partnership.

Essential Elements for a Successful Partnership

Identifying the essential elements that form the foundation of a successful real estate partnership is imperative. Each partner must be aware of their individual strengths and how they contribute to the overall success of the venture. The following components are critical:

- Shared Vision: Partners should align on the long-term goals and objectives of the partnership, ensuring everyone is working towards a common purpose.

- Defined Roles and Responsibilities: Clarity in each partner’s role minimizes confusion and promotes accountability.

- Financial Contributions: Partners must agree on their financial responsibilities, including capital contributions and profit-sharing arrangements.

- Communication: Regular and open communication channels help address issues proactively and build trust among partners.

- Conflict Resolution Mechanism: Establishing a systematic approach for resolving disputes is crucial for maintaining harmony within the partnership.

Roles and Responsibilities of Partners

Creating a list of roles and responsibilities ensures that all partners understand their contributions to the partnership. This clarity helps in managing expectations and streamlining operations. Here are some common roles that may be defined in a real estate partnership:

- Lead Investor: The partner responsible for securing financing and managing investor relationships.

- Property Manager: This partner oversees property operations, tenant relations, and maintenance issues.

- Marketing Specialist: Focuses on promoting properties, managing listings, and attracting potential buyers or tenants.

- Financial Analyst: Handles budgeting, forecasting, and performance analysis to ensure profitability.

- Legal Advisor: Responsible for ensuring compliance with laws and regulations, and managing contracts and agreements.

Importance of Communication and Conflict Resolution

Clear communication is vital for the smooth functioning of any partnership. It encompasses not just the exchange of information, but also the ability to listen and understand each other’s perspectives. Here’s why effective communication is essential:

“Open communication can prevent misunderstandings and foster a culture of transparency, leading to stronger relationships among partners.”

To navigate conflicts, partners should adopt structured conflict resolution strategies. This includes:

- Active Listening: Partners should ensure that everyone’s voice is heard during discussions.

- Agree on a Protocol: Establishing a set process for addressing conflicts helps maintain professionalism and focus.

- Utilize Mediation: Involving a neutral third party can help resolve disputes fairly and amicably.

Constructing a real estate partnership requires careful consideration of these key components. By focusing on shared vision, clearly defined roles, and effective communication practices, partners can build a successful and profitable venture.

Structuring the Partnership Agreement

Source: stessa.com

Creating a real estate partnership agreement involves a thorough understanding of various components that define the relationship between partners. This legally binding document Artikels the expectations, responsibilities, and financial arrangements of each partner, ensuring clarity and minimizing conflicts. A well-structured partnership agreement serves as a roadmap, guiding partners through the complexities of managing real estate investments together.When drafting a partnership agreement, it is crucial to include several key components that address both legal requirements and the operational dynamics of the partnership.

These components not only protect the interests of all parties involved but also provide a framework for the partnership’s activities. Below are critical elements that should be incorporated into every partnership agreement.

Critical Components of a Partnership Agreement

A robust partnership agreement should encompass various important aspects to ensure smooth operations. These include:

- Partnership Structure: Clearly define the type of partnership (general or limited) and the legal entity under which the partnership will operate, such as an LLC or partnership corporation.

- Capital Contributions: Specify the initial investment amounts from each partner, detailing how these contributions will be made and allocated.

- Profit and Loss Distribution: Establish how profits and losses will be shared among partners, often reflecting their respective contributions or other agreed-upon ratios.

- Decision-Making Authority: Artikel the decision-making process, including who holds authority for various types of decisions, such as financial expenditures or property acquisitions.

- Roles and Responsibilities: Detail the specific roles of each partner, including management duties and operational responsibilities.

- Dispute Resolution: Include mechanisms for resolving disputes, such as mediation or arbitration, to manage conflicts without escalating to legal action.

- Exit Strategy: Define terms under which a partner can exit the partnership and how the remaining partners will handle the buyout or sale of their interest.

Drafting a partnership agreement requires a careful approach, considering both legal obligations and the specific needs of the partnership. It’s advisable to consult with legal professionals experienced in real estate and partnership law to ensure compliance with local regulations and to protect all partners’ interests. The process typically involves:

1. Consultation with Partners

Discuss the terms and conditions among partners to ensure everyone’s interests are represented.

2. Drafting the Agreement

Create a draft that includes all agreed-upon terms, ensuring clarity and specificity to minimize ambiguity.

3. Legal Review

Have the agreement reviewed by a real estate attorney to ensure it meets legal standards and addresses essential legal requirements.

4. Signing the Agreement

Once all partners agree on the terms, finalize and sign the document, making it legally binding.

Negotiable Terms in the Partnership Agreement

Several terms within the partnership agreement can be negotiated to better align with the partners’ goals and expectations. Understanding these negotiable terms can help tailor the agreement to suit the partnership’s unique circumstances.Important negotiable terms include:

- Profit Distribution: Partners can negotiate how profits will be distributed, considering various factors like investment size, involvement level, or predetermined percentages.

- Decision-Making Powers: Partners should discuss and agree on how decisions will be made, including whether a simple majority is sufficient or if certain decisions require unanimous consent.

- Management Fees: Determine if management fees will be charged, and if so, how they will be structured, such as a percentage of profits or a flat fee.

- Duration of the Partnership: Partners can negotiate the length of the partnership agreement and the terms for renewal or termination.

- Responsibilities and Roles: Clearly define and negotiate the roles and responsibilities of each partner, ensuring that all parties are comfortable with their commitments.

Through careful negotiation and drafting, partners can establish a comprehensive agreement that fosters a successful and profitable real estate partnership.

Financial Considerations in Real Estate Partnerships

Source: creatrust.com

Entering a real estate partnership requires careful financial planning to ensure mutual benefit and long-term success. Understanding the methods for capital contribution among partners, conducting thorough financial analysis, and establishing clear expense allocation are crucial steps in forming a solid partnership foundation. These financial considerations will not only impact profit sharing but also dictate the operational efficiency of the partnership as a whole.

Methods for Capital Contribution and Impact on Profit Sharing

Capital contributions can take multiple forms, including cash, property, or services, and how these contributions are calculated directly impacts profit sharing among partners. It is essential to establish a transparent method for determining each partner’s financial commitment. Common approaches include:

- Equal Contribution: Each partner contributes the same amount, promoting equity in ownership and profit sharing.

- Proportional Contribution: Partners contribute based on their financial capacity, leading to profit distribution reflective of the investment size.

- Asset Contribution: Partners may contribute property or other assets, which require valuation and clear agreements on how these contributions translate into ownership percentages.

The impact of these methods on profit sharing can be significant. For instance, if one partner contributes substantially more capital, it may be reasonable for them to receive a greater share of the profits. Clearly defining these terms in the partnership agreement can mitigate potential disputes and ensure all partners feel valued and fairly compensated.

Importance of Conducting a Financial Analysis Before Forming a Partnership

Before entering a partnership, conducting a comprehensive financial analysis is paramount. This analysis should assess the viability of the partnership, including projected income, expenses, and potential return on investment. Key components to analyze include:

- Market Research: Understanding the local real estate market trends, property values, and rental rates to forecast potential earnings accurately.

- Financial Projections: Developing detailed financial projections that include anticipated income, operating expenses, and profit margins.

- Risk Assessment: Identifying potential financial risks and developing strategies for mitigation, such as diversifying investment types or having contingency funds.

A thorough financial analysis not only informs decision-making but also builds trust among partners, showcasing a commitment to transparency and due diligence.

Common Expenses and Their Allocation Among Partners

Every real estate partnership incurs various expenses that must be clearly Artikeld and allocated among partners to ensure a balanced financial approach. Common expenses include:

- Property Management Fees: Costs incurred for managing the property, which may need to be shared based on ownership percentage or agreed-upon terms.

- Maintenance and Repairs: Regular upkeep costs that should be budgeted and proportioned among partners according to their financial involvement.

- Utilities and Insurance: Ongoing expenses for utilities, insurance, and taxes that require clear communication about how these costs will be divided.

- Financing Costs: Any loan repayments or interest payments associated with the property should be accounted for and allocated based on initial capital contributions.

Clearly defining how these expenses are shared in the partnership agreement ensures that all partners are on the same page and can contribute to the financial health of the partnership without misunderstandings.

Strategies for Managing and Growing the Partnership

Effective management and growth strategies are vital for real estate partnerships to thrive in a competitive market. By employing the right techniques, partners can optimize their asset management, ensure consistent performance evaluations, and develop strategies for scaling investments over time. This section dives into these essential strategies, providing actionable insights for successful partnership management.

Techniques for Effective Asset Management

Successful real estate partnerships require a comprehensive approach to asset management. Implementing effective management techniques can lead to increased profitability and sustainability. Consider the following strategies:

- Regular Communication: Schedule monthly or quarterly meetings to discuss property performance, address concerns, and evaluate new opportunities. This fosters transparency and strengthens partnership relationships.

- Performance Metrics: Establish key performance indicators (KPIs) such as occupancy rates, rental income, and maintenance costs to measure asset performance consistently. Regularly review these metrics to identify areas for improvement.

- Property Management: Whether self-managed or using a property management firm, ensure that day-to-day operations are handled efficiently. A strong team can enhance tenant satisfaction and optimize maintenance processes.

- Investment in Improvements: Allocate funds for property upgrades and renovations, which can significantly enhance property value and attract higher-quality tenants.

Plan for Periodic Evaluation of Partnership Performance

Periodic evaluations are crucial to track the success and performance of the partnership. Developing a structured plan ensures that partners remain aligned with their goals. The following steps Artikel an effective evaluation strategy:

1. Set Evaluation Dates

Schedule evaluations at regular intervals, such as bi-annually or annually, to review the partnership’s progress.

2. Performance Review

Analyze financial statements, asset performance, and individual partner contributions. This helps in determining whether the partnership is meeting its objectives.

3. Feedback Mechanism

Create a process for partners to provide feedback about their experiences and suggestions for improvement. This can foster a culture of open communication.

4. Adjust Strategies

Based on evaluations, adjust strategies and goals to reflect changes in the market or partnership dynamics.

Strategies for Scaling Partnership Investments

As a partnership grows, scaling investments becomes essential to capitalize on market opportunities. Several strategies can facilitate this process:

- Diversification: Expand your portfolio by investing in various types of properties (e.g., residential, commercial, industrial) to mitigate risks and tap into different revenue streams.

- Leverage Financing Options: Explore various financing options such as joint ventures, private equity funds, or crowdfunding to fund larger projects without overextending resources.

- Network Expansion: Build relationships with real estate professionals, brokers, and other partnerships to share insights, seek co-investment opportunities, and enhance market reach.

- Reinvestment of Profits: Adopt a strategy of reinvesting profits back into the partnership, which can fund new acquisitions or enhancements without the need for external financing.

Tax Implications and Legal Considerations

Understanding the tax obligations and legal considerations is crucial when structuring a real estate partnership. These factors can significantly impact the profitability and longevity of the partnership. A well-structured partnership not only complies with legal standards but also optimizes tax benefits, allowing partners to maximize their returns on investment.Tax obligations in real estate partnerships can be complex and vary based on the partnership structure.

Each partner typically reports their share of income, deductions, and credits on their individual tax returns, following the guidelines set by the IRS. For a general partnership, profits and losses pass through to partners, avoiding double taxation. However, limited liability companies (LLCs) and limited partnerships may have specific tax considerations.

Tax Obligations in Real Estate Partnerships

It’s essential to recognize the different tax obligations that partners must fulfill. Here are the main points to consider:

- Pass-Through Taxation: Profits and losses are passed directly to individual partners, who report them on their personal tax returns. This system helps avoid the double taxation many corporations face.

- Self-Employment Tax: Partners may be subject to self-employment taxes on their share of the partnership income, particularly for active participation in the business.

- Capital Gains Tax: When a property is sold, partners may face capital gains tax on the profit realized from the sale. The rate can depend on the length of time the asset was held.

- Depreciation Deductions: Real estate partnerships can leverage depreciation to reduce taxable income, providing a significant tax advantage over time.

Legal considerations are equally important and should not be overlooked during the structuring of a real estate partnership. Partners must be aware of various legal issues that could arise, including liability and compliance with local, state, and federal laws.

Legal Issues in Real Estate Partnerships

Real estate partnerships can encounter several legal challenges that may affect their operation and success. Key considerations include:

- Liability Protection: Partners must determine the level of liability protection offered by the partnership structure. For example, general partners in a general partnership may face unlimited liability, while limited partners in a limited partnership enjoy limited liability.

- Contractual Obligations: All partners should clearly understand their rights and responsibilities as Artikeld in the partnership agreement. This document serves as a legal contract to govern the partnership’s operations.

- Compliance Requirements: Real estate ventures are subject to various regulations, including zoning laws, environmental rules, and fair housing regulations. Non-compliance can lead to legal disputes and financial penalties.

- Dispute Resolution: It’s advisable to include provisions in the partnership agreement for resolving disputes among partners, which can help avoid costly litigation.

Consulting with legal and financial experts is critical when structuring a real estate partnership. These professionals can provide valuable insights that ensure the partnership operates within legal frameworks while maximizing financial benefits. Partnering with experts can help in navigating complex tax regulations, drafting solid partnership agreements, and ensuring compliance with all applicable laws.

Importance of Professional Consultation

Engaging with legal and financial experts can make a difference in the success of a real estate partnership. Here are the benefits of consulting professionals:

- Tailored Advice: Experts can provide advice tailored to the specific needs and goals of the partnership, considering the unique circumstances of the real estate market.

- Risk Mitigation: Professionals can identify potential legal and financial risks, ensuring that partners are aware and can take appropriate action to mitigate them.

- Tax Optimization: Financial experts can help partners utilize tax strategies to enhance profitability and ensure compliance with tax laws.

- Comprehensive Partnership Agreements: Legal experts ensure that partnership agreements address all necessary provisions, including exit strategies and profit-sharing arrangements.

Exit Strategies for Partners

When partners in a real estate venture decide to exit the partnership, it is crucial to have a well-defined exit strategy in place. Exit strategies not only help ensure a smooth transition but also protect the interests of all parties involved. Understanding the various options available can prevent conflicts and financial losses, allowing the departing partner to leave the partnership on good terms.Several exit strategies can be employed when a partner wishes to exit a real estate partnership.

Each strategy can vary significantly in terms of execution and implications for both the departing partner and the remaining partners. The most common options include buyouts, transfers of ownership interests, and selling to third parties.

Buyouts and Ownership Transfers

Buyouts and ownership transfers are often the most straightforward methods for a partner to exit a partnership. A buyout involves one partner purchasing the ownership stake of the departing partner, while an ownership transfer may involve reassignment of the partner’s interest to another party.An effective buyout process can be broken down into clear steps:

1. Valuation of the Partnership Interest

Prior to any buyout, it is essential to determine the fair market value of the departing partner’s share. This can be achieved through professional appraisals or through a pre-established formula Artikeld in the partnership agreement.

2. Negotiation of Terms

Once the valuation is established, partners should engage in negotiations regarding the buyout terms. This includes discussing payment structures—whether it will be a lump sum or installments—and the timeline for completion.

3. Drafting the Buyout Agreement

The terms agreed upon should be carefully documented in a buyout agreement. This legal document should specify the purchase price, payment terms, and any other conditions of the buyout.

4. Execution of the Buyout

Following the agreement, the actual transaction should take place as per the Artikeld terms. This may involve transferring ownership rights and making the final payment.

5. Updating Legal Documents

Finally, ensure that all partnership agreements, titles, and other legal documents reflect the new ownership structure.In some instances, the departing partner may wish to transfer their ownership stake to another individual instead of engaging in a buyout. This process typically involves:

1. Identifying a Suitable Buyer

The partner looking to exit should identify a credible buyer who is interested in acquiring their share, either from within the partnership or externally.

2. Approval from Remaining Partners

Depending on the terms of the partnership agreement, the remaining partners may need to approve the transfer. This protects the integrity of the partnership and maintains its operational stability.

3. Drafting Transfer Documentation

Legal documentation should be prepared to formalize the transfer of ownership, ensuring all parties agree to the terms and conditions.

4. Completing the Transfer

Finally, the ownership stake is formally transferred to the new partner, alongside any financial considerations.For example, consider a real estate partnership formed to invest in rental properties. If one partner decides to exit, they may sell their 50% ownership stake to the remaining partner at an agreed valuation of $200,000. The buyout could be structured as a lump-sum payment, or the remaining partner may opt for a payment plan over a period of time, ensuring both parties are satisfied with the arrangement.In summary, exit strategies such as buyouts and ownership transfers are essential for partners in real estate partnerships considering an exit.

Having a strategic plan in place not only ensures a smooth transition but also secures the financial interests of all parties involved.

Final Review

As we conclude our exploration of how to structure a real estate partnership for profit, it’s clear that success hinges on careful planning and transparent communication. By understanding the dynamics of partnership agreements, financial considerations, and effective management strategies, investors can create a robust framework that maximizes returns while minimizing risks. Whether you’re entering your first partnership or looking to refine existing agreements, the principles discussed will serve as a solid foundation for thriving in the competitive real estate landscape.

Question & Answer Hub

What are the main types of real estate partnerships?

The main types include general partnerships, limited partnerships, and joint ventures, each differing in liability and management structure.

How can partners resolve conflicts effectively?

Effective conflict resolution can be achieved through open communication, mediation, and having a clear conflict resolution process Artikeld in the partnership agreement.

What should be included in a partnership agreement?

A partnership agreement should include roles and responsibilities, profit distribution, decision-making processes, and exit strategies.

Do I need a lawyer to draft a partnership agreement?

While it’s possible to draft one yourself, consulting a lawyer is highly recommended to ensure legal compliance and protection of interests.

What tax implications should partners be aware of?

Partners should be aware of potential self-employment taxes, income reporting requirements, and possible deductions related to real estate investments.