How To Predict Property Price Trends Before They Happen

How to Predict Property Price Trends Before They Happen sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

In the ever-evolving world of real estate, understanding property price trends is essential for buyers, sellers, and investors alike. This discussion will delve into the intricate factors that shape property values over time, including economic indicators and local market dynamics. With insights drawn from historical data and modern analytical methods, you’ll gain the knowledge necessary to anticipate shifts in the market before they occur.

Understanding Property Price Trends

Source: slideteam.net

Understanding property price trends is essential for investors and homeowners alike. These trends not only reflect the current market conditions but also provide insights into potential future movements. By analyzing historical data and current factors, we can identify patterns that help in making informed property investment decisions. The fundamental concept of property price trends revolves around the changes in real estate values over time.

Property prices can be influenced by a variety of factors including economic conditions, interest rates, demand and supply dynamics, and local market characteristics. Recognizing these influences enables stakeholders to anticipate shifts in the market and adjust their strategies accordingly.

Factors Influencing Property Prices

Several key factors play a vital role in influencing property prices. Understanding these can help forecast future trends more effectively.

- Economic Indicators: Economic growth, employment rates, and inflation significantly impact consumer confidence and purchasing power, which ultimately affect property demand and pricing.

- Interest Rates: Lower interest rates make borrowing cheaper, often leading to increased demand for properties, while higher rates can dampen buyer enthusiasm.

- Supply and Demand: The balance between housing supply and buyer demand is crucial. A shortage of available homes typically drives prices up, whereas an oversupply can lead to price declines.

- Location: Properties in desirable locations tend to hold their value better and appreciate faster. Factors such as proximity to amenities, schools, and public transport can significantly influence price trends.

- Government Policies: Policies such as tax incentives for buyers or changes in zoning laws can directly affect property values and market activity.

Historical trends provide valuable insights into how these factors can converge to impact property prices. Consider the housing market crash of 2008; driven largely by a combination of high-risk lending practices and economic downturn, property values fell dramatically. This event highlighted the importance of regulatory measures and economic conditions in maintaining a stable property market. A more recent example can be observed in the post-pandemic market dynamics.

As remote work became prevalent, suburban and rural properties saw increased demand, driving prices up in those areas. In contrast, urban properties faced stagnation or declines.

“Understanding the historical context of property price trends can serve as a compass for navigating future market shifts.”

Analyzing these historical trends and understanding how they relate to current market dynamics can aid in making more accurate predictions about property prices. Investors and homeowners must stay informed and adaptable to capitalize on these evolving real estate trends.

Data Sources for Property Price Prediction

Reliable data sources are crucial for accurately predicting property price trends. With a plethora of information available, knowing where to look can significantly enhance your prospective investment decisions. By utilizing trustworthy platforms and databases, one can analyze previous market performances and make informed forecasts about future price movements.The accuracy of property price predictions heavily relies on the quality and specificity of the data used.

While national trends provide a broad overview of the market, local market data offers the granularity needed to make decisive investments. Local factors such as neighborhood demographics, school district rankings, and regional employment rates can greatly influence property values. Investors should prioritize gathering data that reflects these localized conditions to refine their predictions and gain a competitive edge.

Reliable Data Sources

Identifying trustworthy data sources is essential for effective property price prediction. Below is a list of reliable platforms where you can find relevant real estate market information:

- Zillow: Known for its comprehensive database of listings, Zillow provides insights into home values and market trends, making it a go-to resource for investors.

- Realtor.com: Features up-to-date listings and analytics on home prices, neighborhood trends, and property history.

- CoreLogic: Offers extensive data on property transactions and market analytics, focusing on both macro and microeconomic factors.

- Redfin: Provides real-time data on home prices, sales, and market conditions, allowing users to track shifts in property value.

- Local County Assessors: Local government offices can offer information on assessed property values, tax records, and historical sales data.

- Multiple Listing Service (MLS): A platform that provides detailed information on property listings, including sales and price trends.

Importance of Local Market Data

The significance of local market data cannot be overstated when predicting property prices. National trends often mask localized fluctuations that can greatly impact investment outcomes. For example, while national home prices may be rising, a specific neighborhood could be experiencing a downturn due to new developments or changes in local employment rates. Focusing on local indicators helps investors identify potential growth areas or warning signs before they become evident in broader trends.

Key local factors to consider include:

- Neighborhood Development: New schools, parks, and commercial areas can increase property values.

- Crime Rates: A decrease in crime can enhance neighborhood desirability and property prices.

- Local Economy: Job growth and economic stability within the area directly affect property demand.

- Transportation Links: Access to public transport and major highways can significantly impact property values.

Methods for Gathering and Validating Property Price Data

Gathering accurate property price data involves utilizing multiple methods to ensure reliability. Employing diverse sources helps mitigate the risk of relying on a single dataset.One effective approach is to cross-reference data from various platforms. For instance, comparing property listings from Zillow with those on Realtor.com can uncover discrepancies and provide a clearer picture of the market. Another method involves utilizing data analytics tools to assess patterns and forecast future trends.

Tools like Tableau or Google Data Studio can visualize data and reveal insights that might be missed when viewing raw numbers. Additionally, validating data sources through user reviews and industry recognition can enhance reliability. Engaging with local real estate professionals can also provide context and insights that raw data may overlook. In summary, a systematic approach to gathering and validating property price data enhances the accuracy of predictions, allowing for more informed investment decisions.

Analytical Methods for Forecasting Property Prices

Predicting property prices is an intricate process that relies on various analytical methods. These methods can be broadly categorized into statistical techniques and machine learning approaches. Understanding these analytical frameworks enables investors and stakeholders to make informed decisions in the real estate market.

Statistical Methods for Predicting Property Prices

Statistical methods form the backbone of property price forecasting. These methods leverage historical data to identify patterns and trends, which can be extrapolated to make future predictions. Some common statistical techniques include:

- Multiple Linear Regression: This method estimates the relationship between property prices and multiple independent variables, such as location, size, and amenities. The formula can be expressed as:

Price = β0 + β1(Location) + β2(Size) + β3(Amenities) + ε

This approach helps in understanding how different factors contribute to property values.

- Time Series Analysis: This technique analyzes data points collected or recorded at specific time intervals. By examining historical price trends over time, analysts can identify seasonal patterns and cyclical trends. Methods like ARIMA (AutoRegressive Integrated Moving Average) are frequently used in this context.

- Hedonic Pricing Model: This method breaks down property prices into their constituent factors, allowing for the assessment of how specific characteristics—like square footage and the number of bedrooms—affect overall property value.

Machine Learning Techniques for Real Estate Forecasting

Machine learning has revolutionized property price forecasting by enhancing the ability to analyze large datasets and uncover complex patterns. Key machine learning techniques include:

- Decision Trees: This method uses a tree-like model to make predictions based on various input features. Decision trees are intuitive and can handle both numerical and categorical data, making them effective for real estate analysis.

- Random Forest: An extension of decision trees, random forests aggregate predictions from multiple trees to improve accuracy and reduce the risk of overfitting. This ensemble approach enhances reliability in property price predictions.

- Support Vector Machines (SVM): SVM is a powerful classification technique that can also be used for regression tasks. It works by finding the optimal hyperplane that separates different classes of data points, which can help in predicting property values based on various features.

Comparison of Predictive Models and Their Effectiveness

When evaluating the effectiveness of different predictive models for property price forecasting, it’s essential to consider various factors such as accuracy, interpretability, and computational efficiency. The following table provides a comparative analysis:

| Model | Accuracy | Interpretability | Computational Efficiency |

|---|---|---|---|

| Multiple Linear Regression | Moderate | High | High |

| Time Series Analysis (ARIMA) | High | Moderate | Moderate |

| Decision Trees | Moderate | High | High |

| Random Forest | High | Moderate | Low |

| Support Vector Machines | High | Low | Low |

This comparison highlights that while machine learning techniques often provide higher accuracy, they may sacrifice some interpretability and computational efficiency. In contrast, traditional statistical methods like multiple linear regression remain popular for their ease of interpretation, despite potentially lower accuracy compared to advanced machine learning models.

Economic Indicators Affecting Real Estate Prices

Economic indicators play a crucial role in shaping the real estate market. These indicators provide valuable insights into economic conditions that can influence property prices, helping investors, homebuyers, and market analysts make informed decisions. Understanding how these indicators correlate with property price changes can significantly enhance your predictive capabilities in real estate.

Key Economic Indicators Correlating with Property Prices

Several economic indicators are vital for understanding trends in property prices. These indicators offer insights into the health of the economy and consumer behavior, leading to fluctuations in real estate demand and prices. The most significant indicators include:

- Gross Domestic Product (GDP): A growing GDP typically signals a robust economy, which can lead to increased home buying activity and consequently higher property prices.

- Employment Rates: Higher employment rates usually lead to greater consumer confidence and increased demand for housing, contributing to rising property prices.

- Inflation Rates: Inflation can erode purchasing power but can also lead to higher property prices as property is often seen as a hedge against inflation.

- Consumer Confidence Index (CCI): A high CCI indicates that consumers feel optimistic about their financial situation, which often translates to increased home purchases and higher property values.

Impact of Interest Rates on the Housing Market

Interest rates are a fundamental economic factor that directly affects housing affordability and, by extension, property prices. When interest rates are low, borrowing costs decrease, making mortgages more affordable for homebuyers. This can lead to an increase in demand for homes and escalating property prices. Conversely, when interest rates rise, borrowing becomes more expensive, potentially cooling down the housing market and leading to a stabilization or decline in property values.For example, in the years following the 2008 financial crisis, interest rates were kept at historic lows to stimulate the economy.

This led to a surge in home sales and an upward trajectory in property prices. However, as interest rates began to rise in 2022, many potential buyers were priced out of the market, resulting in a slowdown in price growth in several regions.

Demographic Trends Influencing Property Demand

Demographic trends significantly shape the real estate landscape, affecting not only the demand for housing but also the type of properties that are in demand. Key demographic factors include:

- Population Growth: An increasing population typically leads to higher demand for housing, driving up property prices.

- Age Distribution: The preferences of different age groups can influence the types of properties that are in demand, such as the growing trend of millennials seeking urban housing.

- Migration Patterns: Areas experiencing an influx of residents, whether domestic or international, often see increased property demand and price appreciation.

- Household Formation: Trends in household formation, such as more individuals choosing to live alone or in multi-generational households, can influence the types and sizes of homes in demand.

Local Market Analysis Techniques

Source: co.uk

Conducting a thorough local market analysis is essential for understanding property price trends in specific neighborhoods. This analysis provides valuable insights into price fluctuations, helping investors and buyers make informed decisions. By evaluating various neighborhood characteristics, one can identify which areas are poised for growth or decline, ultimately influencing property investment strategies.A systematic approach to conducting a local market analysis involves several key steps.

Firstly, gather data from reliable sources to establish a baseline understanding of the market dynamics. Next, evaluate neighborhood characteristics that significantly affect property prices. Finally, compare property values across different neighborhoods to identify trends and potential investment opportunities.

Step-by-Step Approach to Local Market Analysis

The following steps Artikel a comprehensive method for conducting a local market analysis:

1. Define the Geographic Scope

Determine which neighborhoods or areas you want to analyze. This could be a single community or multiple neighborhoods based on specific criteria.

2. Collect Data

Use various data sources such as public property records, real estate websites, and local government databases to gather information on recent sales, property types, and market trends.

3. Evaluate Neighborhood Characteristics

Assess factors such as:

Property age and condition

School district ratings

Proximity to amenities (parks, shopping centers, public transport)

Crime rates

Future city planning or developments

4. Analyze Recent Sales Data

Look at recent property sales to determine the average price per square foot and identify any notable trends in pricing over time.

5. Compare Similar Properties

Analyze similar properties within the same neighborhood to understand how they differ regarding size, features, and overall condition.

6. Create Visual Representations

Use graphs and tables to illustrate your findings, making it easier to visualize trends and comparisons.

7. Make Predictions

Based on your analysis, predict future price trends and identify potential investment opportunities.To illustrate the evaluation of neighborhood characteristics effectively, consider the following examples that play a significant role in determining pricing trends:

School District Ratings

High-rated school districts often lead to increased demand for homes in that area, driving up prices.

Crime Rates

Lower crime rates are attractive to buyers, which can positively impact property values.

Proximity to Employment Centers

Areas closer to major employment hubs tend to see higher property values due to the convenience of commuting.

Comparison of Property Values in Different Neighborhoods

Understanding property values across various neighborhoods can highlight potential investment areas. The following table provides a comparative view of property values in three distinct neighborhoods, showcasing the differences based on key characteristics.

| Neighborhood | Average Property Price | Median Income | School Rating |

|---|---|---|---|

| Downtown | $650,000 | $80,000 | 8/10 |

| Suburban Heights | $450,000 | $75,000 | 9/10 |

| Riverside | $300,000 | $55,000 | 7/10 |

This table effectively illustrates the variation in property values alongside other critical factors, providing a clearer picture for potential buyers and investors looking to target specific markets. By following these steps and evaluating the right neighborhood characteristics, one can gain valuable insights into local market trends and make more strategic property investment choices.

Predictive Analytics Tools for Real Estate

Real estate professionals increasingly rely on predictive analytics tools to gain insights into property price trends and market dynamics. These tools integrate data analysis, machine learning, and advanced algorithms to forecast property values, helping investors, agents, and developers make informed decisions. Understanding the various options available can significantly enhance the accuracy of predictions and strategic planning in real estate.

Popular Predictive Analytics Tools

The market offers a range of predictive analytics tools tailored for the real estate sector. These tools vary in their functionalities but share the common goal of enhancing decision-making through data-driven insights. Below is a list of some of the most notable tools utilized in the industry:

- Zillow: This platform provides comprehensive data on property values, trends, and neighborhood statistics. Zillow’s Zestimate feature offers automated home value estimates based on public data and market trends.

- CoreLogic: Known for its rich data sets, CoreLogic provides analytics and insights for real estate professionals. Its tools help assess risk and value properties, offering predictive analytics based on historical data.

- HouseCanary: This tool focuses on detailed property valuation and market analysis. HouseCanary uses machine learning to predict price changes over time, enabling accurate forecasting and investment decisions.

- Reonomy: A commercial real estate analytics platform, Reonomy utilizes big data to provide insights on property ownership, valuations, and market trends. Its predictive capabilities assist in identifying potential investment opportunities.

- PropStream: This tool enables real estate investors to analyze properties and markets. PropStream’s predictive analytics help users understand property trends and make informed investment choices.

These tools offer various functionalities, including data visualization, forecasting, and risk assessment. By leveraging robust algorithms and extensive databases, they can generate valuable insights into market conditions and property performance.

Advantages of Using Technology in Property Price Forecasting

Incorporating technology into property price forecasting brings several advantages that can significantly impact investment strategies and market understanding.

- Enhanced Accuracy: Predictive analytics tools utilize vast amounts of data and sophisticated algorithms, leading to more precise forecasts compared to traditional methods.

- Real-time Insights: Many tools provide up-to-date information, allowing users to respond quickly to market changes and emerging trends.

- Data-Driven Decisions: Technology facilitates evidence-based decision-making, reducing reliance on intuition or guesswork and increasing the likelihood of successful investments.

- Efficiency in Analysis: Automation of data collection and analysis saves time and resources, enabling real estate professionals to focus on strategic planning and client relations.

- Market Trend Identification: Advanced predictive analytics can identify patterns and trends that may not be immediately obvious, offering a competitive edge in property investment.

By embracing these technological advancements, real estate professionals can enhance their ability to predict property price trends, optimize investment portfolios, and navigate the complexities of the real estate market effectively.

Case Studies of Successful Property Price Predictions

Successful property price predictions often serve as benchmarks in the real estate field, showcasing the power of data and analytical methods. These case studies provide insights into how accurate forecasting can guide investment strategies and market understanding.One notable case study revolves around the prediction of property prices in San Francisco during the tech boom in the early 2010s. Analysts utilized a combination of historical data, demographic trends, and economic indicators to forecast a surge in housing prices.

This case exemplifies how the alignment of various data sources can lead to precise predictions.

San Francisco Housing Boom

The analytical approach taken in San Francisco involved several key methodologies that contributed to the success of the predictions:

1. Historical Data Analysis

Analysts reviewed past market trends, focusing on price movements during previous tech booms. They identified a pattern where a significant influx of tech workers led to increased housing demand and price appreciation.

2. Demographic Insights

By evaluating demographic shifts, such as population increases in the 25-34 age bracket, they projected heightened demand for housing suited to young professionals, particularly in urban settings.

3. Economic Indicators

Factors such as job growth in the tech sector, wage increases, and venture capital investments were monitored closely. A rise in these indicators typically signaled a forthcoming increase in property prices.

4. Market Sentiment Analysis

Utilizing social media sentiment analysis, researchers gauged public perception regarding the housing market, providing additional context to forecasts.This case not only demonstrates successful prediction but also highlights the importance of integrating various methodologies for a comprehensive analysis.

Lessons Learned from the San Francisco Case

The success of the San Francisco housing predictions offers several key lessons that can be applied to other markets:

Integration of Diverse Data Sources

Combining historical, demographic, economic, and sentiment analysis ensures a multi-faceted view, enhancing prediction accuracy.

Adaptability to Market Changes

Real estate markets are dynamic; thus, methodologies must be flexible to adapt to sudden shifts in economic conditions or societal trends.

Collaboration across Disciplines

Engaging experts from various fields—economists, data analysts, and urban planners—can lead to richer insights and more reliable predictions.Another prominent example is the prediction of the housing market correction in the United Kingdom around 2016. Analysts employed predictive analytics tools and economic modeling to foresee a slowdown in property price growth due to uncertainties surrounding Brexit.

UK Housing Market Correction

In this case, the methodologies that yielded accurate predictions included:

1. Economic Modeling

Researchers developed models that incorporated macroeconomic factors such as interest rates and consumer confidence indices, allowing them to simulate various market scenarios.

2. Geopolitical Analysis

The potential impacts of Brexit on economic stability and housing demand were assessed, revealing significant risks to the housing market.

3. Local Market Trends

Analysis of regional variances in property prices enabled predictions about which areas would be more susceptible to downturns.These methodologies underscore the importance of understanding local nuances in property trends while also considering broader economic and political factors.

Lessons from the UK Case

The UK market correction case provides valuable insights, including:

Importance of Geopolitical Awareness

Real estate predictions must account for political events and their potential implications for market stability.

Effective Use of Predictive Analytics Tools

Leveraging technology and advanced analytics enhances forecasting capabilities and provides a competitive edge.

Continuous Monitoring

An ongoing analysis of economic indicators is crucial for timely adjustments to predictions and strategies.Overall, these case studies illustrate the effectiveness of combining various analytical methods and data sources to achieve accurate property price predictions. They also highlight the necessity for adaptability and continuous learning in the ever-evolving real estate landscape.

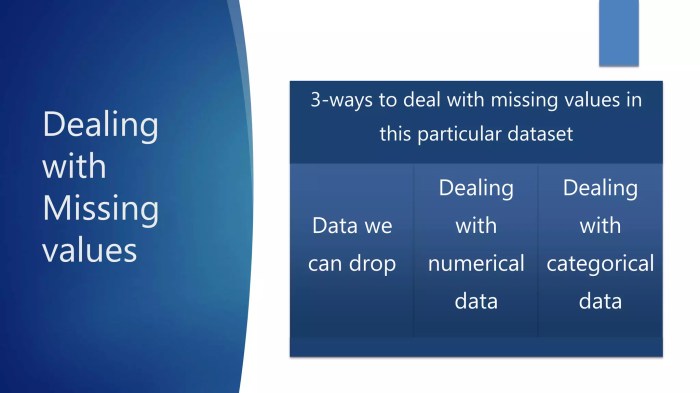

Risks and Limitations of Property Price Forecasting

Source: slidesharecdn.com

While predicting property prices can provide significant advantages for investors and homeowners, it is essential to acknowledge the associated risks and limitations inherent in such forecasting endeavors. The real estate market is influenced by a myriad of factors, many of which are unpredictable or volatile. Understanding these risks can help stakeholders make more informed decisions.Forecasting property prices is complicated by various limitations in predictive models and data sources.

These models rely heavily on historical data and trends, which may not accurately reflect future conditions due to sudden economic changes, regulatory shifts, or unforeseen events. For instance, a model might predict a steady increase in property values based on past performance, only to be thrown off by a sudden economic downturn or a crisis such as the pandemic, which drastically altered market dynamics.

Common Risks in Property Price Predictions

Several key risks are associated with property price forecasting that can impact the reliability of predictions. It is crucial to be aware of these challenges to mitigate their effects effectively.

- Market Volatility: Property markets can be highly volatile, influenced by fluctuations in demand and supply, interest rates, and consumer sentiment. Such unpredictability can lead to discrepancies between predicted and actual prices.

- Data Quality Issues: Inaccurate, outdated, or insufficient data can skew predictions. For example, relying on incomplete market statistics can lead to misguided investment decisions.

- External Economic Factors: Economic downturns, changes in government policy, and global events (like pandemics or financial crises) can dramatically impact property values, making predictions based on historical data unreliable.

- Behavioral Aspects: Human behavior can be unpredictable. Factors such as buyer sentiment and lifestyle changes can influence market trends in ways that models alone cannot anticipate.

Limitations of Predictive Models

Predictive models are invaluable tools in property price forecasting, yet they come with their share of limitations. Recognizing these constraints can help users apply these tools more effectively.

- Overreliance on Historical Data: Many models are built on past trends, which may not hold true in the face of new economic realities or technological advancements.

- Model Complexity: Some models may be overly complex, making them difficult to interpret or apply in real-world scenarios. This complexity can result in miscalculations if not understood properly.

- Inability to Adapt: Predictive models often struggle to adjust quickly to sudden changes in the market or economic landscape, reducing their efficacy during periods of disruption.

- Assumption of Rationality: Many models assume that all market participants act rationally, which is often not the case, especially during periods of economic uncertainty.

Strategies to Mitigate Forecasting Risks

To enhance the accuracy and reliability of property price predictions, several strategies can be employed to mitigate identified risks. These approaches can help refine the forecasting process.

- Diverse Data Sources: Utilizing a broad range of data sources, including local market statistics and socio-economic indicators, can improve the accuracy of models and provide a more holistic view of the market.

- Regular Updates: Continuously updating models with the latest data and trends allows for better adaptability to market fluctuations and changes in consumer behavior.

- Scenario Planning: Engaging in scenario planning can help stakeholders prepare for varying potential outcomes, enabling more strategic decision-making even in uncertain conditions.

- Expert Consultation: Seeking insights from market experts and real estate professionals can provide valuable contextual knowledge that enhances the interpretation of data and model outputs.

Last Word

In conclusion, mastering the art of predicting property price trends equips you with the tools to navigate the complex landscape of real estate confidently. By leveraging reliable data sources, analytical methods, and local market insights, you’re better positioned to make informed decisions that align with market fluctuations. Ultimately, understanding these trends not only empowers you as a participant in the real estate market but also enhances your investment strategy.

FAQ Insights

What are some common factors that influence property prices?

Factors include location, economic conditions, interest rates, and demographic trends.

How can I access reliable data for property price predictions?

Consider using platforms like Zillow, Realtor.com, and government reports for trustworthy information.

What role do interest rates play in property price trends?

Higher interest rates can dampen buyer demand, leading to lower property prices, while lower rates typically encourage purchasing activity.

Are machine learning techniques effective for forecasting property prices?

Yes, machine learning can analyze large datasets to uncover patterns and improve prediction accuracy.

How can I conduct a local market analysis?

Start by researching neighborhood features, recent sales data, and current listings to assess local pricing trends.