Is It Better To Rent Or Buy Property In A High-Interest Economy?

Is It Better to Rent or Buy Property in a High-Interest Economy? This question has become increasingly relevant as interest rates climb and the cost of living fluctuates. Many potential buyers and renters find themselves in a dilemma, trying to navigate the complexities of the real estate market amidst economic uncertainty. Understanding the implications of high-interest rates and inflation on property decisions can make a significant difference in financial outcomes.

As we delve into the current economic climate, it’s essential to examine how these factors impact housing prices, rental costs, and the overall decision-making process for individuals considering their options. Whether renting appears more attractive in the short term or if buying a home remains a solid long-term investment, these are critical considerations in today’s market.

Understanding the Current Economic Climate

In today’s economy, characterized by rising interest rates and persistent inflation, the real estate market is experiencing significant shifts. These factors can heavily influence the decision-making process for potential buyers and renters. Understanding the current economic conditions is crucial for evaluating whether renting or buying property is a more advantageous choice.High-interest rates have a profound effect on the real estate market.

When interest rates are elevated, borrowing costs for mortgages increase, leading to a decrease in housing demand. This can result in fewer home sales, as potential buyers may feel priced out of the market. Additionally, high-interest rates can lead to a slowdown in new construction projects, further tightening the housing supply.

Impact of Inflation on Rental and Purchase Decisions

Inflation is another critical factor to consider when deciding to rent or buy. As inflation rises, the cost of living increases, affecting everything from groceries to housing. This environment can lead to varying rental and purchase prices. Understanding the interaction between inflation and real estate is vital.

Rising Rental Prices

In an inflationary environment, landlords may increase rents to keep pace with rising costs. This can make long-term renting more expensive over time, potentially pushing tenants toward considering homeownership as a more stable option.

Home Purchase Prices

Conversely, inflation can lead to higher prices for homes as sellers adjust their asking prices to reflect increased costs. This can intensify competition among buyers, especially in desirable areas.

Investment Considerations

Investors often look for tangible assets like real estate during inflationary periods, which can drive prices up further as demand increases.

Trends in Housing Prices During High-Interest Economies

Housing prices tend to follow distinct trends in a high-interest economy. It’s essential to recognize these trends to make informed decisions regarding property investment.

Price Stagnation or Decline

In many cases, high-interest rates can cause home prices to stagnate or even decline as demand decreases. Buyers may be deterred by increased monthly payments, leading to prolonged listing times for sellers and potentially forcing price reductions.

Regional Variations

Certain regions may experience different trends based on local economic conditions. For example, urban areas with high job growth may maintain stronger housing prices compared to rural areas with limited economic opportunities.

Long-Term Growth Potential

Despite initial declines, many experts suggest that real estate can still be a sound long-term investment. Historically, housing prices have tended to increase over time, even in economic downturns, making it essential for buyers to consider their long-term financial goals.

The relationship between high-interest rates and housing prices is significant; as rates rise, the affordability of homes decreases, impacting market dynamics.

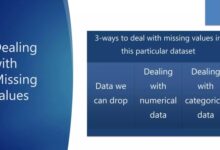

Financial Implications of Renting vs. Buying

Source: cloudfront.net

When considering whether to rent or buy property, it’s crucial to understand the financial implications involved in each choice. The decision isn’t purely based on personal preference; it entails a thorough analysis of long-term costs, upfront expenses, and hidden fees that could significantly impact your financial health.Long-term costs can vary widely between renting and buying. Owning a home typically means dealing with mortgage payments, property taxes, maintenance, and homeowner’s insurance.

Conversely, renting often includes monthly rent payments and utilities, but it may also come with hidden costs that renters should not overlook.

Long-Term Cost Comparison

Over time, the financial responsibilities of renting can accumulate, which can impact overall savings. Below is a breakdown to illustrate the differences:

Buying a Property

Mortgage payments

Fixed over time, providing stability.

Property taxes

Typically increase annually based on local tax rates.

Maintenance costs

Vary but average around 1-2% of the home’s value annually.

Homeowner’s insurance

Essential for protecting your investment.

Renting a Property

Monthly rent

Paid consistently, but often increases at lease renewal.

Utilities

Can vary but are frequently the tenant’s responsibility.

Rental insurance

While optional, is advisable to protect personal belongings.Buying may seem more expensive at first glance, but the property often appreciates over time, while rent payments contribute nothing toward ownership. This difference can lead to substantial wealth accumulation through home equity.

Upfront Costs of Purchasing a Property

Purchasing a property comes with several upfront costs that potential buyers should be aware of. These are essential to consider when budgeting for a home purchase:

Down payment

Typically ranges from 3% to 20% of the home price, significantly affecting your mortgage amount.

Closing costs

Usually 2-5% of the purchase price, covering fees for appraisals, loan origination, and title insurance.

Home inspection fees

Necessary to ensure the property is in good condition, averaging between $300 and $500.

Moving costs

Include logistics and transportation, which can vary based on distance and size of the move.Understanding these costs is vital for potential homeowners. They can considerably affect the overall financial layout required to successfully buy a home.

Hidden Costs of Renting

Renting might appear more straightforward, but it comes with its own set of hidden costs that can catch tenants off guard. Here’s a closer look at some of these potential expenses:

Security deposits

Often equivalent to one or two months’ rent, which may delay access to funds.

Renter’s insurance

While affordable, it is an additional monthly expense that protects personal belongings.

Pet fees

If applicable, these can vary widely between properties and can add significantly to monthly costs.

Maintenance requests

While often covered by landlords, there can be circumstances where tenants are responsible for minor repairs.Considering these hidden costs can provide a more comprehensive understanding of the financial impact of renting versus buying. Ultimately, weighing these factors carefully can guide your decision in a high-interest economy, ensuring you choose the option that aligns with your financial goals and lifestyle.

Pros and Cons of Renting in a High-Interest Economy

The decision to rent in a high-interest economic environment comes with its own set of advantages and disadvantages. With the rising costs associated with homeownership, many individuals and families are reconsidering their options. Understanding these pros and cons can help potential renters navigate their choices more effectively.

Advantages of Renting in a Volatile Economic Climate

Renting offers several benefits, particularly in an unstable economy characterized by high-interest rates. These advantages can provide a level of financial flexibility that homeownership may not afford.

- Lower Upfront Costs: Renting usually requires less initial investment compared to buying a home. Security deposits and first month’s rent are typically more manageable than a down payment, which can be substantial.

- Financial Flexibility: Renters are not tied down by long-term financial commitments associated with mortgages. This flexibility allows for easier relocation if job opportunities arise or personal circumstances change.

- No Maintenance Costs: Landlords are generally responsible for maintenance and repairs, allowing renters to avoid unexpected expenses that homeowners might face in times of economic uncertainty.

- Access to Amenities: Many rental properties come with amenities such as pools, gyms, and communal spaces, which might be financially out of reach for homeowners, enhancing quality of life without additional cost.

Disadvantages of Renting in a High-Interest Economy

Despite its advantages, renting also has notable drawbacks that can impact long-term financial stability. These disadvantages must be considered carefully by anyone contemplating renting during periods of economic volatility.

- Lack of Equity: Renters do not build equity over time, meaning monthly payments contribute to the landlord’s investment rather than their own financial future. This can be particularly disheartening as home prices increase.

- Instability of Renting: Rental agreements are typically short-term, exposing renters to potential rent increases or the possibility of having to move if the landlord decides to sell the property or not renew the lease.

- Limited Control: Renters often have restrictions on modifications to the property, limiting personalization and investment in the living space compared to homeowners.

- Potential for Higher Rental Prices: In a high-interest economy, demand for rental properties can drive prices up, making it challenging to find affordable housing without compromising on quality or location.

Scenarios Favoring Renting

There are specific situations where renting might be the more advantageous option compared to buying. These scenarios highlight the practicality of renting over homeownership during challenging economic times.

- Job Uncertainty: Individuals in industries with fluctuating job markets may benefit from renting to maintain flexibility without the burden of homeownership during potential employment changes.

- Short-Term Living Arrangements: Those who plan to move within a few years for personal or professional reasons may find renting to be more cost-effective, avoiding the costs of buying and selling a home.

- Market Volatility: In uncertain real estate markets, renting can serve as a hedge against potential declines in property values, allowing individuals to wait for more favorable conditions before purchasing.

- Higher Interest Rates: With mortgage rates on the rise, potential homebuyers may find that the cost of financing a home outweighs the benefits, making renting a more prudent choice in the short term.

Pros and Cons of Buying in a High-Interest Economy

In the current economic climate, where interest rates are on the rise, the decision to buy property can be complex. This landscape presents both opportunities and challenges for potential homeowners. Understanding these dynamics is crucial for making an informed choice that aligns with your financial goals.The benefits of homeownership can be enticing, especially in a high-interest environment. Owning a home not only provides a sense of stability and personal freedom but also serves as a long-term investment.

Historically, real estate has appreciated over time, making it an attractive option for those looking to build wealth. Additionally, homeowners can benefit from tax advantages, such as mortgage interest deductions and property tax deductions, which can significantly reduce the overall cost of homeownership.

Investment Potential and Tax Advantages

Owning property in a high-interest economy can still yield positive financial outcomes when approached strategically. Here are the key investment benefits and tax advantages associated with buying a home:

- Appreciation Over Time: Real estate generally appreciates in value over the long term, which can result in significant returns when selling the property later.

- Equity Building: Monthly mortgage payments contribute to building equity in the home, unlike rent payments that do not offer any ownership stake.

- Tax Deductions: Homeowners can deduct mortgage interest and property taxes on their federal income tax returns, which can lower their taxable income and result in substantial savings.

- Stability in Payments: Fixed-rate mortgages allow homeowners to shield themselves from future interest rate hikes, providing predictability in housing costs compared to renting.

However, buying in a high-interest economy also presents notable risks that need careful consideration.

Risks Associated with Buying in a High-Interest Environment

The decision to purchase a home during a period of elevated interest rates comes with its share of challenges that can impact overall financial health.

- Higher Monthly Payments: Increased interest rates lead to higher monthly mortgage payments, potentially straining budgets and leaving less room for savings or other investments.

- Market Volatility: Economic uncertainty may affect property values, with the risk of buying at a peak price during market fluctuations.

- Affordability Challenges: Higher interest rates can reduce the purchasing power of buyers, making it harder to afford desired properties or neighborhoods.

- Investment Risk: If market conditions worsen or personal circumstances change, homeowners may struggle to sell their property without incurring a loss.

Even with these risks, there are specific situations where buying might still be advantageous despite high-interest rates.

When Buying May Be Advantageous

Certain circumstances can make buying a home a wise decision, even in a challenging economic environment. Here are instances where purchasing could be beneficial:

- Long-Term Commitment: If you plan to stay in a location for several years, the appreciation potential and equity building can outweigh the initial costs of higher interest rates.

- Strong Job Security: Those with stable employment or a guaranteed income could benefit from locking in a long-term asset, making the potential risks more manageable.

- Access to Favorable Loan Programs: Some government-backed loans, such as FHA or VA loans, may offer lower rates or favorable terms that mitigate the impact of high-interest environments.

- Rental Market Pressures: In areas with rising rental prices, buying a home may ultimately be more cost-effective over time, providing a stable housing solution.

Case Studies and Real-Life Examples

Source: cloudinary.com

In the ongoing debate of whether to rent or buy property during high-interest rates, real-life experiences often provide the clearest insights. This section will share various case studies of individuals who navigated these tough economic waters, highlighting the outcomes of their decisions. By examining both sides of the coin, we can better understand the implications of renting versus buying in a high-interest environment.A number of individuals and families have faced the choice of renting or buying amidst rising interest rates.

Their experiences illustrate the diverse outcomes based on their financial situations, goals, and market conditions. Below are some key case studies and testimonials that reflect the realities of these decisions.

Case Studies of Renting vs. Buying

Exploring specific cases can shed light on the implications of renting and buying in the context of high-interest rates. Below are two representative examples highlighting the financial and emotional outcomes.

-

Case Study: Emily and Jacob – Renters

Emily and Jacob decided to continue renting when interest rates exceeded 5%. They were living in a vibrant city where housing prices soared, making homeownership financially daunting. They found a comfortable rental apartment at $2,000 per month. Over three years, they saved approximately $60,000, which allowed them to invest in a diversified portfolio. Their decision was reinforced by the flexibility renting provided, allowing them to move for job opportunities without the burden of selling a home. -

Case Study: Sarah – Homeowner

Sarah, on the other hand, chose to buy a home despite high-interest rates of 6.5%. She purchased a modest home for $350,000 with a 30-year mortgage. While her monthly mortgage payments were $2,400, she also benefited from tax deductions and home equity growth. After five years, Sarah’s property appreciated by 10%, providing her with a significant return on investment.However, she faced challenges related to maintenance costs and market fluctuations, which sometimes outweighed the benefits.

Testimonials from Homeowners and Renters

Personal testimonials often highlight the subjective experiences behind the financial statistics. Here are some insights from individuals who opted for renting or buying during this economic climate.

-

Testimonial from Mark (Renter):

“I chose to rent because the market was unpredictable. My rent is manageable, and I have the freedom to move if a better job opportunity comes my way. I’ve been able to save more than if I had committed to buying a home.” -

Testimonial from Lisa (Homeowner):

“Buying my home was a big decision, especially with high-interest rates. However, knowing that I’m building equity instead of paying someone else’s mortgage feels worthwhile. The tax benefits have also helped me a lot financially.”

Statistical Illustrations of Financial Outcomes

To further contextualize the renting versus buying debate, statistical data can provide a clearer view of the long-term financial outcomes of both choices. The following table summarizes some key statistics regarding the financial implications of renting and buying over a five-year period.

| Aspect | Renting (5 years) | Buying (5 years) |

|---|---|---|

| Initial Costs | $12,000 (Monthly Rent) | $25,000 (Down Payment + Closing Costs) |

| Monthly Payments | $2,000 | $2,400 |

| Total Payments (5 years) | $120,000 | $144,000 |

| Appreciation of Property | N/A | 10% ($35,000) |

| Equity Built | N/A | $35,000 |

“While renting may be less financially burdensome upfront, buying a property can lead to significant long-term financial growth through equity and appreciation.”

Tips for Making an Informed Decision

Making a well-informed decision between renting and buying property, especially in a high-interest economy, requires careful consideration of various factors. Understanding your personal circumstances, financial situation, and market conditions will better equip you to make a choice that aligns with your goals and lifestyle.Key factors to consider include your financial readiness, the duration you plan to stay in a location, and the overall housing market trends in your area.

Evaluating these elements can help clarify whether renting or buying is the more suitable option for you.

Checklist for Potential Homeowners

Assessing your readiness to buy a home is crucial before taking any steps toward ownership. Here’s a checklist to guide you through this important decision:

- Credit Score: Ensure your credit score is above 620 for conventional loans.

- Down Payment Savings: Have you saved at least 20% of the home price for a down payment?

- Debt-to-Income Ratio: Is your total debt-to-income ratio below 43%?

- Emergency Fund: Do you have a sufficient emergency fund (3-6 months of living expenses)?

- Job Stability: Are you in a stable job and have a reliable income?

- Market Research: Have you researched the local housing market trends?

Recognizing these factors will give you a clearer picture of your financial health and readiness to make homeownership a reality.

Resources for Financial Counseling and Property Investment Advice

Utilizing professional resources for financial counseling and property investment is essential in making informed decisions. Various organizations and platforms can provide valuable insights and guidance in your journey.A great starting point is to consult with certified financial planners who specialize in real estate. They can offer tailored advice based on your specific financial situation. Additionally, consider the following resources:

- National Foundation for Credit Counseling (NFCC): Provides credit counseling and financial education.

- U.S. Department of Housing and Urban Development (HUD): Offers information on home buying and local housing programs.

- Local Housing Authorities: Can provide insights on first-time homebuyer programs and workshops in your area.

- Real Estate Investment Groups: Join local or online groups to gain knowledge from experienced investors.

- Online Financial Education Platforms: Websites like Investopedia and NerdWallet offer articles, calculators, and tools for potential homeowners.

Engaging with these resources will enhance your understanding of the property market and help you navigate the complexities of buying a home amidst rising interest rates.

Future Outlook and Market Predictions

As we look ahead, the future of the real estate market is shaped by a variety of factors, including interest rate trends, policy changes, and broader economic conditions. Understanding expert opinions and market predictions can provide valuable insight for both renters and potential homebuyers in a high-interest economy.Analysts generally anticipate a gradual shift in interest rates over the next few years.

Many experts suggest that while rates remain high currently, they may stabilize or even decrease slightly as the economy adjusts. However, this stabilization will depend heavily on inflation rates and Federal Reserve policies. For instance, if inflation continues to decrease, the Federal Reserve might lower rates to stimulate growth, which would favor homebuyers. Conversely, if inflation persists, we could see sustained high rates that may discourage buying.

Expert Opinions on Interest Rate Trends

Several economists have provided predictions regarding future interest rates. Their insights are crucial for understanding how the housing market may evolve.

- According to a recent report from the National Association of Realtors, interest rates may not dip significantly until late 2024 or early 2025, which could keep borrowing costs elevated for potential buyers.

- Goldman Sachs analysts project a potential decrease in rates by 2025, suggesting that this could encourage more people to enter the housing market.

- Conversely, a report by Moody’s Analytics warns that if inflation remains high, rates could be sustained longer, impacting affordability nationwide.

Changes in housing policies can also significantly impact renting and buying decisions. For example, prospective rent control measures and first-time homebuyer incentives may alter the landscape for both groups. Some local governments are considering policies that aim to protect renters, particularly in rapidly gentrifying neighborhoods, which could lead to more favorable renting conditions.

Projected Changes in Housing Policies

Policy shifts can have a direct influence on market dynamics. It’s important to note the following potential changes:

- Increased government incentives for first-time homebuyers, such as down payment assistance and favorable loan terms, may encourage more purchases.

- Strengthening of rent control measures in urban centers could stabilize rental costs, making renting more attractive in high-demand areas.

- Expansion of housing development programs aimed at increasing affordable housing availability may alleviate some pressure from the rental market.

Looking at the rental and housing markets over the next few years provides further context. With the current economic pressures, many experts predict a mixed outlook. For renters, demand for rental properties is expected to remain high as potential buyers may wait for favorable interest rates. This demand could lead to increased rental prices unless new housing developments are initiated.

Projections for the Rental and Housing Markets

The following projections highlight the expected trends in the rental and housing markets:

- CoreLogic forecasts that rental prices may increase by 3% to 5% annually, particularly in metropolitan areas that have seen significant job growth.

- Freddie Mac projects that home prices will appreciate at a slower pace, potentially around 2% to 4% per year, reflecting ongoing supply constraints in the housing market.

- The Urban Institute notes that as more millennials enter the housing market, there could be an increase in demand for starter homes, influencing market dynamics further.

In summary, the future outlook for renting and buying property in a high-interest economy is nuanced. Economic indicators, interest rate predictions, and potential housing policy changes will play pivotal roles in shaping the landscape for both renters and buyers in the coming years.

Outcome Summary

Source: playchicinteriors.com

In conclusion, the choice between renting and buying in a high-interest economy is not straightforward and depends on various personal and financial factors. By weighing the pros and cons of each option and considering expert insights, individuals can make informed decisions that align with their long-term goals. Ultimately, understanding the economic landscape and its influence on property choices is key to navigating the real estate market successfully.

Commonly Asked Questions

What are the main advantages of renting in a high-interest economy?

The main advantages include flexibility, lower upfront costs, and avoiding the risks associated with property depreciation.

How do high-interest rates affect housing prices?

High-interest rates typically lead to higher mortgage costs, which can reduce demand for homes and consequently lower housing prices.

What hidden costs should renters be aware of?

Renters should consider costs like maintenance fees, renters’ insurance, and potential rent increases over time.

Is buying a home still a good investment in this economy?

Buying can still be a good investment if you plan to stay long-term, as it can provide equity growth and tax benefits, despite higher interest rates.

What should I consider if I decide to buy a house?

Consider your financial stability, the total costs involved, market conditions, and your long-term goals before making a purchase.