The Pros And Cons Of Buying Off-Plan Property

With The Pros and Cons of Buying Off-Plan Property at the forefront, this topic offers a unique perspective for potential homeowners and investors. As the real estate market evolves, off-plan properties have captured the interest of many due to their potential benefits and risks. Understanding these dynamics can help buyers make informed decisions in this exciting yet uncertain space.

Off-plan properties refer to homes or developments that are sold before they are built, setting them apart from traditional property purchases where buyers can view and assess the completed structure. The appeal lies in various factors such as lower entry prices, customization options, and opportunities in emerging markets, even as buyers must navigate the complexities and challenges that come with investing in properties that exist only on paper.

Introduction to Off-Plan Property

Off-plan property refers to real estate that is sold before it has been constructed or completed. This type of property investment allows buyers to purchase units based on architectural plans and renderings rather than viewing a finished product. The key distinction between off-plan and traditional property purchases lies in the timing and visibility of the property; while traditional purchases involve acquiring existing structures, off-plan buyers commit to an investment with the hope of future value appreciation.The allure of off-plan properties often revolves around several compelling factors.

Buyers are drawn to the potential of securing properties at lower prices compared to completed developments. Additionally, off-plan purchases typically come with flexible payment plans, allowing for staggered payments during the construction period. As urban areas continue to develop and evolve, many investors see off-plan properties as a way to capitalize on emerging neighborhoods or areas undergoing revitalization. Current market trends indicate a surge in demand for off-plan developments, particularly in regions where housing shortages are prevalent, driving both investor interest and potential returns.

Attraction to Off-Plan Properties

The attraction to off-plan properties can be attributed to a variety of factors that appeal to both investors and homebuyers. Understanding these motivations is essential for anyone considering entering this market. The benefits often include:

- Potential for Price Appreciation: Many buyers anticipate that purchasing off-plan will enable them to capitalize on property value increases by the time of completion.

- Customization Options: Buyers may have the opportunity to influence design and layout choices, tailoring the property to their personal style.

- Lower Entry Costs: Off-plan properties generally have lower initial costs, making them more accessible for first-time buyers or those looking to invest.

- Flexible Payment Plans: Many developers offer phased payment structures, easing the financial burden on buyers during the construction phase.

- Access to New Developments: Buyers can secure units in sought-after developments that may have limited availability once completed.

The current landscape of off-plan property investments reflects a robust interest in urban development and infrastructure projects. For instance, cities experiencing rapid growth and regeneration often see increased off-plan activity, with investors eager to be part of these emerging markets. As urban centers evolve, the potential for substantial returns remains a driving force behind the attraction of off-plan acquisitions.

Pros of Buying Off-Plan Property

Source: cloudfront.net

Purchasing off-plan property offers a unique set of advantages that can be enticing for both first-time buyers and seasoned investors. This approach often presents opportunities that are not readily available in the conventional market, making it a strategy worth considering for those looking to optimize their investment.One of the most appealing financial benefits of purchasing off-plan properties is the potential for lower prices compared to completed properties.

Since these properties are often in the early stages of development, developers frequently offer competitive pricing to attract buyers. Additionally, many developers provide flexible payment plans, allowing buyers to secure their property with a manageable upfront investment while spreading the remaining payments over the construction period. This can lead to significant cost savings.

Financial Benefits of Off-Plan Purchases

Investing in off-plan properties can yield several financial advantages, making it an attractive option for buyers looking to maximize their investment. Here are some key financial benefits associated with off-plan purchases:

- Lower Purchase Prices: Developers often set initial prices below market value to stimulate interest and secure early buyers. This means you can lock in a property at a lower cost before it appreciates once completed.

- Capital Appreciation: As the development progresses and the area around it becomes more popular, property values typically rise. Early purchasers can benefit from significant capital appreciation by the time the property is completed.

- Potential Rental Income: If you intend to rent out the property, you may witness increased rental demand as the area develops, potentially leading to higher rental yields.

- Reduced Competition: Buying off-plan often means less competition compared to purchasing completed homes. This can provide more negotiating power and favorable terms.

The option to customize off-plan properties is another significant advantage. Buyers often have the choice to influence the design and layout of their future home, which can enhance their living experience.

Customization and Choice

The customization options available when buying off-plan properties can make the purchasing experience much more rewarding. These properties often allow buyers to personalize various aspects, from layout to interior finishes.

- Layout Flexibility: Many developers provide several layout options, allowing buyers to select what best fits their lifestyle. This means you can choose between open-plan designs or more traditional room setups.

- Finishing Options: Buyers can often select flooring, wall colors, kitchen styles, and bathroom fittings. This level of customization ensures that the final product aligns closely with the buyer’s personal taste and preferences.

- Energy Efficiency: New developments often incorporate the latest energy-efficient technologies and materials. Buyers can choose features that enhance energy efficiency, which can lead to long-term savings on utility bills.

Lastly, investing in off-plan properties in emerging markets can offer significant long-term growth potential. As these areas develop, the influx of new businesses and infrastructure can lead to increased property values.

Advantages of Emerging Markets

Emerging markets often present unique opportunities for investors looking to capitalize on growth. Buying off-plan in these areas can be particularly advantageous due to the following reasons:

- Rapid Development: Emerging markets typically experience rapid urbanization and infrastructure development, which can significantly increase property values over time.

- Early Entry Advantage: Investing early in a developing area can lead to substantial financial gains as more buyers enter the market, driving up demand and prices.

- Government Incentives: Many emerging markets offer incentives for real estate investments, such as tax breaks or subsidies, which can enhance the overall return on investment.

Cons of Buying Off-Plan Property

Source: com.au

Purchasing off-plan property can present various challenges and drawbacks that potential buyers must consider. While the allure of acquiring a new home at a discounted rate is enticing, there are significant risks involved that can impact both the buyer’s financial health and peace of mind.

Risks of Developer Reliability

One of the foremost concerns when buying off-plan property pertains to the reliability of the developer. Buyers often rely heavily on developers to complete projects on time and according to the promised specifications. Unfortunately, delays and construction issues are prevalent in the industry. Various factors, including unforeseen site conditions, financial instability of the contractor, or even supply chain disruptions, can significantly hinder a project’s timeline.

“Delays in construction can lead to increased costs, extended wait times, and potentially lost investment opportunities.”

Moreover, if a developer faces financial difficulties or goes bankrupt, it can jeopardize the entire project. In such cases, buyers may find themselves in a precarious situation where their investment is at risk, with little recourse to recover lost funds.

Market Fluctuations Impacting Value

The real estate market is inherently volatile, and potential buyers must be aware of how market fluctuations can affect the value of off-plan investments. By the time the property is completed, changes in the economic landscape, such as shifts in demand, interest rates, or regional development, can dramatically influence property values.For instance, if an area that was once considered up-and-coming suddenly experiences economic downturns or a rise in crime, the value of the off-plan property may decrease significantly.

This scenario can leave buyers with a property worth less than what they initially invested, impacting their equity and long-term financial goals.

Financing and Mortgage Challenges

Securing financing for off-plan properties can present its own set of challenges. Lenders often view off-plan properties as riskier investments, which can lead to stricter mortgage requirements. Buyers may face higher interest rates or lower loan-to-value ratios, which can make the overall purchase more expensive.Additionally, some lenders may hesitate to provide financing until the property is completed or at least until significant progress is made.

This limitation can create delays in the purchasing process and may require buyers to have substantial cash reserves to cover the full purchase price upfront.

“Understanding the financing landscape is crucial, as it directly impacts the feasibility of purchasing off-plan properties.”

Potential buyers should engage with financial advisors or mortgage brokers to navigate these complexities and secure the best possible financing for their needs.

Factors to Consider Before Buying Off-Plan

When considering the purchase of off-plan property, it’s crucial to approach the decision with a clear understanding of various factors that can influence the investment’s success. This stage is all about ensuring you are well-informed and prepared before making such a significant commitment.Assessing the developer’s reputation and past projects is vital in this process. Buyers should not only be aware of the financial implications but also of the quality of construction, delivery timelines, and customer service provided by the developer.

In addition, understanding the location of the property, along with any potential future developments in the area, can significantly affect the investment’s long-term value.

Essential Questions for Developers

Before signing any agreements, prospective buyers should inquire about specific aspects of the development. These questions can provide clarity on the project and help mitigate risks associated with off-plan purchases. Consider the following essential questions:

- What is the estimated completion date of the project?

- Can you provide details about the quality of materials being used in construction?

- Have similar projects been completed by the developer in the past? What were the outcomes?

- What is included in the purchase price, and are there any additional fees?

- What is the policy on changes to the project design or specifications?

- How is the payment schedule structured, and what happens if there are delays?

- What warranties or guarantees are provided for the property?

- How is the development funded, and is there a risk of financial instability?

The answers to these questions can provide a comprehensive overview of the developer’s plans and capabilities, ensuring buyers can make informed decisions.

Researching the Developer’s Reputation

Understanding the track record of the developer is a non-negotiable step in the buying process. Researching their reputation involves looking at past projects, customer reviews, and any legal issues that may have arisen. This research is essential as it can reveal patterns of behavior that indicate reliability or, conversely, a history of unfinished projects and dissatisfied customers. Reputable developers typically showcase their completed projects and customer testimonials, providing insight into their quality of work and adherence to timelines.

Buyers can also consider engaging local real estate agents who may offer additional perspective on the developer’s standing within the community.

Assessing Location and Future Developments

The location of the property plays a pivotal role in its value appreciation over time. Evaluating the surrounding area involves looking into current amenities and infrastructure, as well as potential developments that could enhance or detract from property values.Buyers should focus on:

- Proximity to public transport, schools, and shopping centers

- Planned infrastructure projects (roads, hospitals, etc.) that could increase accessibility

- Upcoming commercial developments which might boost the local economy

- Overall growth trends in the neighborhood, including crime rates and demographic shifts

By gathering this information, buyers can better predict the future desirability of the property, thereby making a more informed investment decision.

“The value of a property is not solely determined by what is on paper today; it’s shaped by the potential that lies in its surroundings and the reputation of those building it.”

Legal Considerations

When purchasing off-plan property, it’s crucial to navigate the legal landscape carefully. Understanding the legal documents and agreements involved can safeguard your investment and ensure a smooth transaction. Additionally, knowing the cancellation policies and potential penalties can help you avoid unexpected costs and complications down the line.The following legal documents and agreements are essential to review before committing to an off-plan property purchase.

Each document serves a specific purpose and understanding these can help buyers make informed decisions.

Key Legal Documents and Agreements

The primary documents that need thorough examination include:

- Sale and Purchase Agreement (SPA): This is the core document outlining the terms of the sale, including price, payment schedule, and completion dates. Ensure all details are accurate and reflect your understanding of the deal.

- Title Deed: Verifies the seller’s ownership of the property and their right to sell it. Confirm that the property is free of any encumbrances or claims.

- Building Permit and Plans: These documents confirm that the development complies with local regulations and codes. They should include detailed architectural plans and specifications.

- Disclosure Statement: This statement provides important information about the property, including any known issues or risks associated with the development.

- Home Warranty or Guarantee: A warranty can provide peace of mind regarding the construction quality and potential defects that may arise after purchase.

Understanding cancellation policies is another critical aspect of the legal framework when buying off-plan. Cancellation terms can vary significantly depending on the developer and the jurisdiction.

Cancellation Policies and Penalties

Buyers should be fully aware of the cancellation policies that come with their purchase. These policies dictate the conditions under which a buyer can withdraw from the agreement and may include penalties. Typically, cancellations could result in the loss of a deposit or additional fees.A checklist of important points regarding cancellation policies includes:

- Timeframe for Cancellation: Note the period during which you can cancel without penalty, usually stated in the SPA.

- Deposit Refund Conditions: Understand under what circumstances, if any, your deposit will be refunded.

- Penalties for Late Cancellation: Familiarize yourself with any fees or penalties you may incur for cancelling after the grace period.

- Force Majeure Clauses: Check if the agreement includes clauses that allow for cancellation under extraordinary circumstances, such as natural disasters.

Lastly, to ensure that all legal aspects are covered before proceeding with your off-plan property purchase, here’s a detailed checklist:

Legal Checklist for Off-Plan Property Buyers

Having a checklist can simplify the review process and ensure nothing is overlooked:

- Confirm the developer’s credibility and track record by researching their previous projects and reputation.

- Request a copy of the SPA and all associated documents to review before signing.

- Engage a real estate lawyer to help interpret legal jargon and ensure your interests are protected.

- Verify the property’s planning permissions and compliance with local zoning laws.

- Examine the estimated completion timeline and any penalties associated with delays.

- Ensure there are clauses for dispute resolution in the agreement, offering you a clear path if issues arise.

This thorough approach to legal considerations will help you navigate the complexities of purchasing off-plan property, ensuring that your investment is secure and well-informed.

Financing Options for Off-Plan Properties

When considering an off-plan property purchase, understanding the financing options available is crucial. Buyers often have a range of choices, each with its own benefits and drawbacks. This section will explore different financing avenues that can facilitate your investment in off-plan properties, as well as provide insights on securing pre-approval for mortgages and alternative financing methods.

Comparative Financing Options

When looking into financing off-plan properties, buyers can choose from several traditional and alternative options. Here are the most common financing methods:

- Conventional Mortgages: Traditional banks and lenders typically offer fixed or adjustable-rate mortgages. Fixed rates provide stable monthly payments, while adjustable rates can fluctuate based on market conditions.

- Specialty Lenders: Some lenders specialize in financing for off-plan properties. They often have more flexible terms and can cater specifically to the unique circumstances of such purchases.

- Developer Financing: Many developers offer in-house financing which may include attractive payment plans or incentives to buyers who commit to purchasing off-plan.

- Equity Release: Homeowners can leverage the equity in their current properties to finance the purchase of an off-plan property. This method allows for tapping into existing assets and may offer favorable loan terms.

Obtaining Mortgage Pre-Approval

Securing pre-approval for a mortgage is a vital step for prospective buyers of off-plan properties. It gives buyers a clear understanding of their budget and strengthens their negotiating position with developers. The process typically involves submitting financial documentation to the lender and undergoing a credit assessment. Pre-approval not only clarifies financial capabilities but also instills confidence in developers that the buyer is serious and financially capable.

Alternative Financing Methods

In addition to traditional mortgages, buyers can consider alternative financing methods that may suit their financial situations better. Below are some viable options:

- Joint Ventures: Partnering with another investor can provide the necessary capital for purchasing off-plan properties. This method allows for shared risk and the pooling of resources.

- Personal Loans: For buyers needing quick funds, personal loans can be a short-term solution. However, they often come with higher interest rates compared to mortgages.

- Seller Financing: In rare cases, developers may allow buyers to finance their purchase directly through them, which can involve more flexible terms than traditional lenders.

“Understanding your financing options is essential in making a sound investment in off-plan properties.”

The Role of Real Estate Agents

Navigating the waters of off-plan property purchases can be complex and overwhelming for many buyers. Real estate agents play a crucial role in this process, providing expertise that can make a significant difference in the buying experience. Their knowledge of the market, the intricacies of negotiations, and the various aspects of purchasing off-plan properties can be invaluable to prospective buyers.Real estate agents can assist in every step of the off-plan purchasing process, from helping buyers identify suitable developments to providing guidance on the legalities involved.

They often have access to exclusive listings and pre-launch opportunities that buyers may not find on their own. Moreover, agents can represent buyers during negotiations, ensuring that their interests are protected and that they secure the best possible deal.

Benefits of Expert Advice and Representation

Having a seasoned real estate agent on your side can lead to numerous advantages during the off-plan buying process. These benefits include:

- Market Knowledge: Agents are often well-acquainted with current market trends, allowing them to provide insights on which developments are likely to appreciate in value.

- Negotiation Skills: Experienced negotiators can advocate on behalf of buyers, often resulting in better terms, price reductions, or added incentives such as upgrades.

- Access to Resources: Agents have connections in the industry, including lawyers, mortgage brokers, and developers, which can streamline the purchasing process.

- Legal Guidance: Real estate agents can help buyers understand the contracts involved and ensure that all legal aspects are covered, mitigating potential risks.

Selecting a Knowledgeable Agent

Choosing the right real estate agent is critical when considering off-plan property investments. Here are some key factors to evaluate while selecting an agent who specializes in off-plan properties:

- Experience with Off-Plan Sales: Look for agents with a proven track record of successfully closing off-plan deals. Their familiarity with the specifics of these transactions can be a great asset.

- Local Market Expertise: An agent who knows the local area thoroughly can provide insights into growth potential and neighborhood dynamics, crucial for off-plan investments.

- Client Testimonials: Seek out reviews or testimonials from previous clients to gauge the agent’s performance and reliability.

- Professional Affiliations: Membership in professional organizations can indicate a commitment to ongoing education and adherence to industry standards.

For buyers, aligning with a knowledgeable real estate agent can not only simplify the purchasing process but also enhance the potential for a sound investment.

“The right real estate agent can transform the daunting process of buying off-plan property into a streamlined and successful venture.”

Tips for Successful Off-Plan Property Investment

Investing in off-plan properties can be a rewarding venture, but it requires careful planning and consideration. Understanding the ins and outs of this unique real estate market is crucial to making a wise investment decision. Here’s a comprehensive guide to navigating the off-plan purchase process effectively.

Step-by-Step Guide for Navigating the Off-Plan Purchase Process

A clear step-by-step approach can simplify the complexities of purchasing off-plan properties. Below are the essential steps to follow:

- Research the Market: Look into the local property market trends, focusing on upcoming developments and areas with high growth potential.

- Set a Budget: Determine your financial limits, considering all potential costs associated with the purchase, such as deposits, legal fees, and maintenance.

- Choose a Reputable Developer: Investigate developers’ credibility by checking their track record and previous projects.

- Visit the Site: If possible, visit the location to assess the area’s amenities, transport links, and overall environment.

- Review the Contract: Have a legal professional go through the purchase contract thoroughly to understand your rights and obligations.

- Secure Financing: Explore various financing options and get pre-approval for a mortgage to streamline the buying process.

- Monitor Progress: Stay in touch with the developer and monitor the construction progress to ensure timelines are met.

- Prepare for Handover: Plan for inspections and ensure the property meets all specifications before completion.

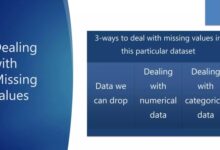

Comparison of Advantages and Disadvantages

Understanding both the benefits and drawbacks of buying off-plan properties is vital for making informed decisions. The table below Artikels the key pros and cons:

| Advantages | Disadvantages |

|---|---|

| Potential for capital appreciation before completion | Risk of delays in construction |

| Flexibility in customization options | Possible changes in market conditions |

| Attractive payment plans, often with lower upfront costs | Limited ability to physically inspect the property |

| Modern amenities and construction techniques | Potential for developer insolvency |

Investor Experiences and Testimonials

Hearing from those who have successfully invested in off-plan properties can provide valuable insights. Here are a few testimonials from investors:

“Investing in an off-plan property was a game-changer for me. The early bird incentives allowed me to secure a great price, and the development has already appreciated significantly.”

Sarah J.

“I was initially hesitant about buying off-plan, but after doing thorough research and choosing a reputable developer, I felt confident. The process was smoother than I expected.”

Mark T.

“My off-plan investment turned out to be a fantastic decision. I loved being able to customize some aspects of the property, and I can’t wait for the completion!”

Emily R.

Final Conclusion

Source: funphotobox.com

In conclusion, weighing The Pros and Cons of Buying Off-Plan Property is essential for anyone looking to venture into this market. While the benefits like potential capital appreciation and customization are enticing, the risks associated with project delays and market fluctuations cannot be overlooked. By conducting thorough research and seeking proper guidance, buyers can navigate this intricate landscape and make choices that align with their investment goals.

General Inquiries

What should I ask a developer before buying off-plan?

Inquire about their track record, completion timelines, and details about the project’s financing and buyer rights.

How can I find a reputable real estate agent for off-plan properties?

Look for agents with experience in off-plan sales, positive reviews, and a strong knowledge of the local market.

Are there specific legal documents I need to review?

Yes, you should review the purchase agreement, cancellation policy, and any warranties or guarantees offered by the developer.

What are the risks of buying off-plan property?

Major risks include project delays, changes in market conditions, and the possibility that the finished product may differ from what was promised.

Can I mortgage an off-plan property?

Yes, but securing a mortgage can be more complex, and it’s advisable to seek pre-approval before committing to a purchase.