Best Insurance For Freelancers And Gig Workers

Best Insurance for Freelancers and Gig Workers is an essential topic as the gig economy continues to expand, bringing unique challenges and opportunities. Freelancers often navigate a landscape of fluctuating income and varying workloads, making the right insurance coverage not just a luxury but a necessity. With the rise of remote work and the freelance lifestyle, understanding insurance needs has never been more crucial.

This discussion delves into the specific insurance requirements of freelancers and gig workers, highlighting common risks they face, the types of insurance available, and key factors to consider when selecting a policy. Whether it’s protecting against liability claims or securing health coverage, freelancers must stay informed to safeguard their interests.

Overview of Insurance Needs for Freelancers and Gig Workers

Source: cloudinary.com

In the evolving landscape of work, freelancers and gig workers face unique challenges that set them apart from traditional employees. Unlike salaried workers, they lack employer-provided benefits, which makes understanding their insurance needs essential. This audience often juggles multiple clients and projects, exposing them to various risks that can impact their financial stability. Freelancers and gig workers encounter specific insurance needs due to their work structure and the nature of their engagements.

One of the most critical aspects is the absence of employer-sponsored health insurance, which puts them at risk of high medical costs in the event of injury or illness. Additionally, they may require liability insurance to protect against claims made by clients, especially in service-oriented fields. Also, the variability of income can make it challenging to secure adequate insurance coverage, leaving many underinsured or without sufficient protection.

Common Risks Faced in Freelance Work

Understanding the common risks that freelancers and gig workers face is crucial for determining the types of insurance they may need. These risks can significantly affect their livelihood, making it essential to address them proactively.

Health Risks

Freelancers often lack access to affordable healthcare, which can result in high out-of-pocket expenses during medical emergencies.

Liability Risks

Service providers, such as consultants or designers, may encounter client lawsuits claiming negligence or failure to deliver, leading to costly legal battles.

Income Instability

Fluctuating workloads can lead to inconsistent income streams, making it difficult to maintain regular payments for insurance.

Property Risks

Freelancers working from home may face theft or damage to their equipment, which can disrupt their business operations.

Cyber Risks

With increasing reliance on digital platforms, freelancers are susceptible to data breaches and cyberattacks, which can compromise sensitive client information.According to a survey by Freelancers Union, only about 38% of freelancers have health insurance through a marketplace or private plan. Furthermore, nearly 60% of freelancers expressed that they are not adequately covered for liability, highlighting a significant gap in insurance awareness and provision within this workforce segment.

“Freelancers need to proactively seek insurance solutions that cover health, liability, and income stability to safeguard their financial future.”

Types of Insurance Available for Freelancers

Freelancers and gig workers often operate without the safety net of traditional employment benefits, making insurance a crucial consideration. Understanding the types of insurance available can help protect against unforeseen circumstances that could impact both health and livelihood. Below, we explore essential insurance types freelancers should consider to safeguard their work and personal well-being.

Essential Insurance Options for Freelancers

Various types of insurance cater to the unique needs of freelancers, allowing them to mitigate risks associated with their work. Here are the key types of insurance to consider:

- General Liability Insurance: This insurance protects against claims of bodily injury, property damage, and personal injury. For example, if a client gets injured on your work premises, this policy can cover legal fees and settlements.

- Professional Liability Insurance: Also known as errors and omissions insurance, this covers legal costs arising from claims that you provided inadequate or faulty services. For instance, if a client claims that your project didn’t meet the agreed specifications and results in a financial loss, this insurance would protect you against those claims.

- Health Insurance: This is vital for freelancers to manage medical expenses due to illness or accidents. Freelancers can explore options like individual health plans or join professional associations that offer group health insurance, which can often reduce costs.

- Property Insurance: This insurance covers loss or damage to your business equipment and property. For instance, if your laptop, crucial for your freelance work, gets stolen or damaged, property insurance can help cover the repair or replacement costs.

- Disability Insurance: This offers income protection if you’re unable to work due to a disability. For example, if an accident prevents you from completing your projects, this insurance can provide financial support during your recovery.

Differences Between General and Professional Liability Insurance

Understanding the distinction between general and professional liability insurance is essential for freelancers to choose the right protection. While both types of insurance provide coverage in legal matters, they cater to different risks.

General liability insurance covers claims related to bodily injuries and property damage, while professional liability insurance focuses on claims resulting from professional mistakes or negligence.

General liability typically addresses issues such as slips and falls on your premises or damage to a client’s property during a job. On the other hand, professional liability is crucial for freelancers providing advice or services. For instance, if a marketing consultant’s strategy leads to a client’s loss of sales, the client may file a complaint, making professional liability insurance vital to handle such risks effectively.

Significance of Health Insurance Options for Freelancers

Freelancers do not usually have employer-sponsored health plans, making it vital for them to secure health insurance independently. This insurance protects them from high medical costs and provides access to necessary healthcare services.Given the unstable income most freelancers face, having health insurance can alleviate the financial burden associated with unexpected medical emergencies. Options such as Health Maintenance Organizations (HMOs) or Preferred Provider Organizations (PPOs) can offer tailored plans depending on individual needs.

Freelancers should also explore tax credits available through the Affordable Care Act, which can make health coverage more affordable.Through careful consideration of these insurance types, freelancers can better navigate the uncertainties of their work environment, ensuring they safeguard their health and financial security.

Factors to Consider When Choosing Insurance

Source: com.au

When it comes to selecting the right insurance policy, freelancers and gig workers have unique needs that differ significantly from traditional employees. Understanding these needs is crucial for ensuring adequate protection against unforeseen circumstances. With a variety of policies available, evaluating the right options can feel overwhelming, but focusing on key factors can simplify the decision-making process.

Key Factors to Evaluate

Before committing to an insurance policy, freelancers should consider several critical aspects that directly impact their coverage. These factors include the nature of their work, potential risks involved, and their financial situation. Evaluating these elements helps in selecting a policy that caters specifically to individual needs.

- Nature of Work: The type of freelance work significantly influences the kind of insurance needed. For example, a graphic designer may require professional liability insurance to protect against claims of negligence, while a rideshare driver may need auto insurance tailored for commercial use.

- Risk Assessment: Understanding the potential risks associated with their work allows freelancers to identify which insurance policies provide the necessary coverage. Assessing industry standards and common claims can highlight essential areas of protection.

- Financial Considerations: Budget constraints often play a role in decision-making. Freelancers must evaluate not only the premiums but also the overall value and coverage provided by the policy.

Policy Limits and Coverage Exclusions

When evaluating insurance options, it’s essential to understand policy limits and exclusions, as these can significantly affect the level of protection offered. Policy limits refer to the maximum amount an insurance company will pay for a covered claim, while exclusions detail the specific situations or conditions that are not covered under the policy.

“Choosing a policy with adequate limits and minimal exclusions is crucial to ensure comprehensive protection.”

Policies with low limits may leave freelancers exposed to significant financial risks, especially in industries where claims can be high. For instance, if a freelancer offers consulting services and incurs a claim of $100,000, but their policy only covers $50,000, they would be responsible for the remaining amount. Moreover, exclusions can vary widely among policies. Some common exclusions include:

- Intentional acts or illegal activities

- Claims resulting from professional errors or omissions

- Liability arising from specific situations, such as data breaches or cyber incidents

Freelancers should closely examine these exclusions to determine whether the policy aligns with their specific needs.

Impact of Premiums on Insurance Selection

The cost of premiums is a significant consideration for freelancers and gig workers when selecting insurance. Premiums vary based on several factors, including the level of coverage, risk assessment, and the insurer’s underwriting criteria. While it might be tempting to opt for the lowest premium, it’s crucial to examine what is provided in return.Higher premiums typically correlate with better coverage, fewer exclusions, and higher policy limits.

However, freelancers should also ensure that the premiums fit within their budget without sacrificing necessary protection. For instance, a freelancer paying a slightly higher premium for a comprehensive policy may ultimately save money by avoiding costly out-of-pocket expenses related to claims. Additionally, many insurers offer discounts for bundling policies, which can be a cost-effective strategy for freelancers needing multiple types of coverage.Understanding the balance between premium costs and the value of coverage allows freelancers to make informed decisions that provide both financial security and peace of mind.

Comparison of Insurance Providers

Finding the right insurance provider as a freelancer or gig worker can be a daunting task, especially with so many options available. Each insurance company offers unique features, coverage options, and pricing structures that can significantly impact your financial security and peace of mind. This comparison aims to simplify the decision-making process by examining the top insurance providers catering to freelancers.To effectively compare insurance providers, it’s essential to take into account various factors including coverage options, pricing, and user reviews.

Below is a table summarizing key aspects of the leading insurance companies for freelancers.

| Insurance Provider | Coverage Options | Pricing | User Reviews |

|---|---|---|---|

| Hiscox | General Liability, Professional Liability, Business Equipment | Starts at $22/month | 4.5/5 – Great customer service |

| Next Insurance | General Liability, Professional Liability, Workers’ Compensation | Starts at $30/month | 4.7/5 – Fast quotes |

| Thimble | General Liability, Professional Liability, Event Insurance | Starts at $10/month | 4.6/5 – Flexible coverage |

| CoverWallet | General Liability, Professional Liability, Business Owner’s Policy | Starts at $25/month | 4.4/5 – Easy online platform |

Benefits and Drawbacks of Major Insurance Companies

When choosing an insurance provider, it’s crucial to understand both the benefits and drawbacks of each. Here are some insights into a few major insurance companies that cater to freelancers.

Hiscox

*Benefits*

Known for excellent customer service and tailored coverage for various professions. They offer a variety of plans that can be customized.

*Drawbacks*

Pricing can be on the higher side compared to other providers, especially for comprehensive coverage.

Next Insurance

*Benefits*

Provides fast online quotes and is highly rated for its user-friendly interface. Offers affordable premiums for freelancers.

*Drawbacks*

Some users reported limited coverage options compared to more established insurers.

Thimble

*Benefits*

Offers flexibility with short-term coverage options, making it ideal for freelancers with varying project timelines.

*Drawbacks*

Limited customer service options can be a downside for those who prefer more direct support.

CoverWallet

*Benefits*

The online platform is designed for easy navigation, enabling users to compare quotes from different insurers quickly.

*Drawbacks*

May have higher policy fees for specific types of coverage compared to standalone providers.

Testimonials from Freelancers

Freelancers often share their experiences with insurance providers, helping others make informed decisions. Here are a few testimonials from freelancers regarding their insurance experiences:

“I switched to Hiscox after my previous provider raised their rates. The customer service has been outstanding, and I feel secure knowing I have tailored coverage for my graphic design work.” – Jenna, Graphic Designer

“Next Insurance was a game-changer for me. The online quotes were quick, and my policy was up and running in no time. I love that I can manage everything online!” – Mark, Software Developer

“I appreciate Thimble’s flexible coverage options. I only need insurance for specific events, and having the option to get coverage by the month is perfect for my freelance photography business.” – Sarah, Photographer

These testimonials illustrate the diverse experiences freelancers have with insurance providers, emphasizing the importance of selecting a company that aligns with individual needs and preferences.

Resources for Finding Insurance

Freelancers and gig workers often face unique challenges when it comes to securing insurance. With a multitude of options and providers available, it’s crucial to have reliable resources at hand to navigate this landscape effectively. Below are some valuable tools and platforms that can assist freelancers in comparing insurance options, as well as networks and government programs that may offer support.

Online Resources and Platforms

Navigating the insurance market can be overwhelming, but several online resources are specifically designed to help freelancers find and compare insurance plans. Utilizing these platforms allows you to filter options based on your specific needs and budget.

- Insureon: This platform specializes in helping small businesses and freelancers find appropriate insurance coverage. By answering a few questions about your work, you can receive tailored quotes from multiple providers.

- CoverWallet: CoverWallet offers a user-friendly interface that allows freelancers to compare insurance quotes quickly. Their tools help you assess various policies and coverage levels.

- Policygenius: Offering a wide range of insurance types, Policygenius simplifies the comparison process. It’s especially useful for freelancers looking for health insurance, life insurance, or liability coverage.

- eHealth: For freelancers seeking health insurance options, eHealth provides a comprehensive comparison of individual health plans available in your area, including options under the Affordable Care Act.

Utilizing Professional Networks

Leveraging professional networks can provide freelancers with personal recommendations for insurance providers. Connecting with peers in your industry can yield valuable insights and experiences regarding which insurance options work best for specific professions.

- LinkedIn Groups: Many industry-specific groups on LinkedIn allow freelancers to share experiences and recommendations regarding insurance providers they have used.

- Freelancer Associations: Joining organizations such as the Freelancers Union can connect you with other freelancers who can share their insurance experiences and recommendations.

- Local Meetups: Attending local meetups or networking events can help you engage directly with other freelancers, facilitating discussions around the best insurance solutions in your field.

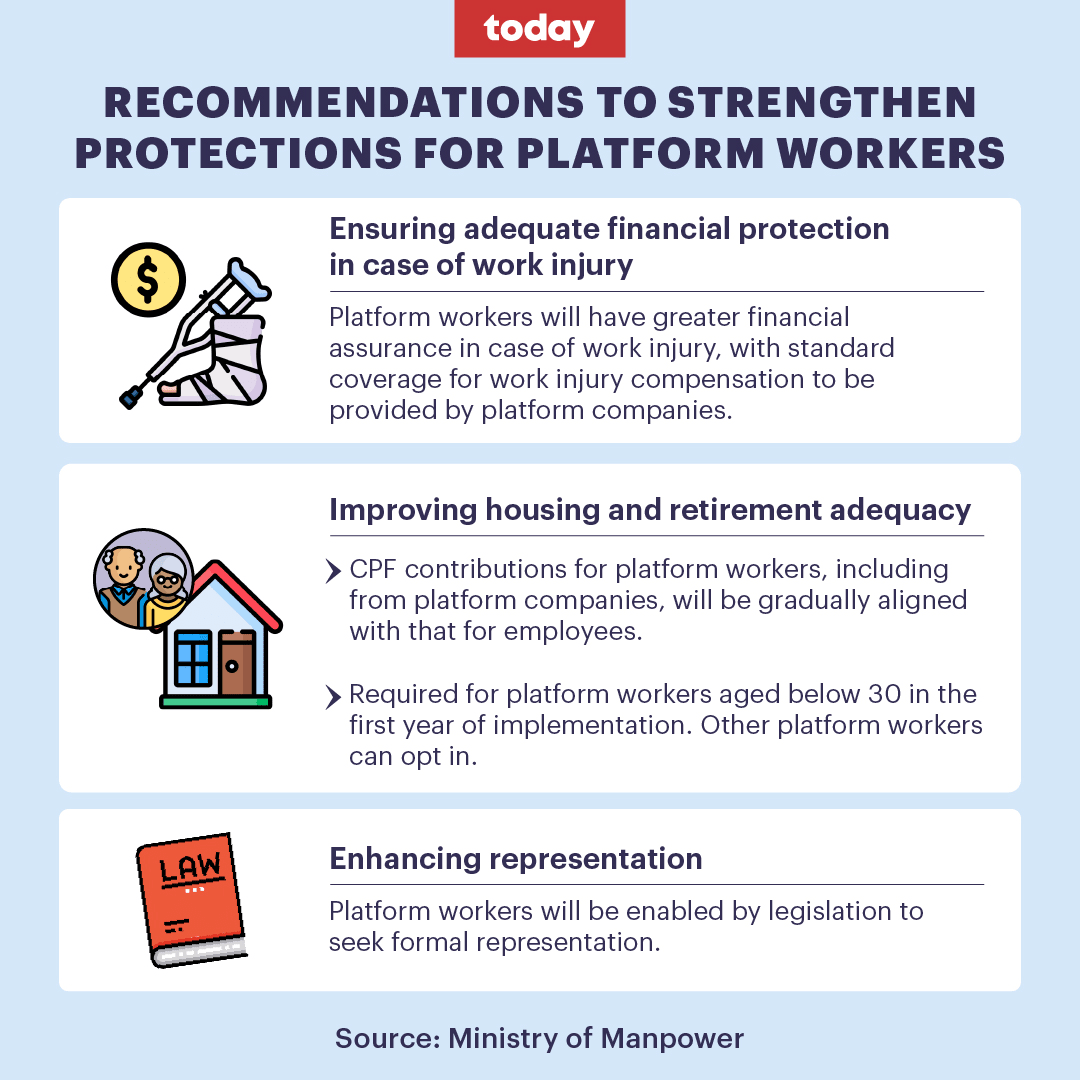

Government Programs for Insurance Assistance

Freelancers may benefit from various government programs designed to help them secure insurance coverage. Understanding these options can make a significant difference in managing healthcare and financial risks.

- Healthcare.gov: This government website provides information about the Affordable Care Act, including health insurance marketplaces where freelancers can purchase coverage at subsidized rates.

- Small Business Health Options Program (SHOP): This program is available for small businesses and self-employed individuals, offering access to affordable health insurance plans.

- Medicaid and CHIP: Depending on your income level, you may qualify for Medicaid or the Children’s Health Insurance Program (CHIP), which offer low-cost or free health coverage.

The Importance of Regular Review

Regularly reviewing insurance policies is crucial for freelancers and gig workers, as their professional landscape often shifts. Changes in income, project types, and personal circumstances can affect coverage needs substantially. Without consistent evaluations, individuals may find themselves underinsured or overpaying for unnecessary coverage.As freelance work evolves, so do the risks and exposures associated with it. For instance, taking on larger projects may increase the need for liability insurance, while a shift to remote work could change property insurance requirements.

It is essential to stay proactive about these adjustments to ensure that your insurance reflects your current situation.

Checklist for Annual Insurance Evaluation

An effective way to ensure your insurance coverage remains relevant is to follow a checklist during your annual review. This checklist will help assess your needs and make informed decisions about your insurance policies.

- Assess changes in income: Review your earnings from the previous year to determine if your coverage limits need adjustment.

- Evaluate project types: Consider the nature of the work you’re undertaking and whether your current policies adequately cover new risks.

- Review client contracts: Check if there are new requirements set by clients that may necessitate additional coverage.

- Check personal circumstances: Life changes like marriage or having children can influence your insurance needs, particularly in health and life coverage.

- Research new insurance providers: Explore the market for competitive rates and better options that may offer enhanced coverage at a lower cost.

- Consult with an insurance agent: A professional can provide insights and recommendations tailored to your changing needs.

By systematically evaluating these aspects, freelancers can ensure that their insurance coverage is both adequate and cost-effective, aligning with their unique work situation and personal circumstances.

“Regular reviews prevent gaps in coverage and help streamline expenses, ensuring freelancers can focus on their work without undue worry.”

Future Trends in Insurance for Freelancers

Source: co.uk

As the gig economy continues to expand, insurance products designed for freelancers and gig workers are evolving to meet the unique needs of these individuals. The landscape of insurance is being reshaped by technological advancements, changing workforce dynamics, and the growing recognition of freelancers as a significant segment of the economy. Understanding these future trends can help freelancers make informed decisions about their insurance needs.One of the most notable trends in insurance for freelancers is the customization of insurance products.

Providers are increasingly offering modular insurance plans, allowing freelancers to choose coverage that specifically suits their profession. This trend is driven by the diverse nature of freelance work, where one-size-fits-all policies often fall short. For example, a freelance graphic designer may need different coverage compared to a freelance writer. Customized plans might include options such as liability insurance that specifically addresses risks related to digital work or health insurance that caters to the irregular income patterns typical in freelancing.

Technological Advancements Impacting Insurance Offerings

Emerging technologies are significantly influencing the way insurance products are developed and delivered to freelancers. Insurtech companies are leveraging advanced data analytics, artificial intelligence, and machine learning to create more accurate risk assessments and personalized coverage options. With the ability to analyze vast amounts of data, insurers can offer tailored policies at competitive prices, which is crucial for freelancers who often operate on tight budgets.Additionally, mobile applications and platforms are becoming increasingly integral in the insurance landscape.

These tools simplify the purchasing process, enabling freelancers to obtain quotes, manage policies, and file claims directly from their smartphones. The convenience of technology not only enhances user experience but also fosters a proactive approach in managing insurance needs. For instance, real-time notifications about policy changes or renewal reminders can help freelancers stay on top of their insurance commitments.

Influence of the Gig Economy on Future Insurance Requirements

The continued growth of the gig economy is expected to reshape insurance requirements in several ways. As more individuals turn to freelancing, there is a rising demand for portable and flexible insurance options that can adapt to the changing nature of gig work. One possible evolution could be the introduction of pay-as-you-go insurance models, where freelancers pay premiums based on their actual work hours or income, rather than a fixed amount.Another important factor is the potential for group insurance plans tailored for freelancers.

By banding together, freelancers can leverage their collective bargaining power to access better coverage options and lower premiums. Initiatives like freelancer unions or cooperatives may emerge as viable solutions to address the insurance challenges faced by this workforce. These collaborative efforts can provide access to essential protections that freelancers may struggle to obtain individually.

Emerging trends indicate a shift towards personalized, flexible, and technologically driven insurance solutions tailored to the diverse needs of freelancers in an evolving gig economy.

Conclusive Thoughts

In conclusion, understanding the Best Insurance for Freelancers and Gig Workers is vital for anyone operating in the gig economy. By taking the time to assess insurance needs, comparing providers, and avoiding common pitfalls, freelancers can better protect their livelihoods and ensure peace of mind. Regularly reviewing and adapting insurance policies will also help navigate the ever-changing landscape of freelance work.

FAQ Section

What types of insurance do freelancers need?

Freelancers should consider liability insurance, health insurance, property insurance, and professional liability insurance depending on their specific work and risks.

How can freelancers find affordable insurance?

Freelancers can compare quotes online, seek recommendations from their professional networks, and explore government programs designed to assist with insurance needs.

Is professional liability insurance necessary for all freelancers?

While not every freelancer needs it, those who provide professional services or advice should strongly consider professional liability insurance to protect against claims of negligence.

How often should freelancers review their insurance policies?

Freelancers should review their insurance policies at least once a year or whenever there are significant changes in their work or income levels to ensure adequate coverage.

What are the risks of being underinsured?

Being underinsured can lead to significant financial loss in the event of a claim, resulting in out-of-pocket expenses that could impact a freelancer’s business and personal finances.