Best Life Insurance Plans For Families In 2025

Exploring the landscape of life insurance can be a bit daunting, especially for families looking to secure their financial futures. Best Life Insurance Plans for Families in 2025 provides essential insights into the various policies that can safeguard loved ones against unforeseen circumstances. With a myriad of options available, it’s crucial to understand what each plan offers and how it aligns with your family’s needs.

Life insurance isn’t just a safety net; it’s a pivotal part of sound financial planning. As we delve into the importance of life insurance, the benefits it provides, and the best options available in 2025, families can make informed decisions that will protect their financial stability and peace of mind.

Overview of Life Insurance

Life insurance serves as a crucial financial safety net for families, ensuring that loved ones are protected financially in the event of an untimely death. By providing a lump-sum payment to beneficiaries, life insurance can cover various expenses, such as mortgage payments, educational costs, and daily living expenses, thus enabling families to maintain their standard of living during challenging times.There are several types of life insurance policies available, each designed to meet different needs and financial situations.

The two main categories are term life insurance and permanent life insurance. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years, making it an affordable option for those who want to ensure their loved ones are protected during their working years. In contrast, permanent life insurance offers lifelong coverage with a cash value component that grows over time, providing both death benefits and potential savings.

Types of Life Insurance Policies

Understanding the types of life insurance policies is essential for families looking to make informed decisions. Here’s a breakdown of the primary options available:

- Term Life Insurance: Ideal for those seeking affordable coverage for a specific time frame. It pays a death benefit only if the insured passes away during the term, making it suitable for temporary financial obligations.

- Whole Life Insurance: Offers lifelong coverage with a cash value component that accumulates over time. Premiums remain level throughout the insured’s life, providing both security and an investment element.

- Universal Life Insurance: A flexible policy that combines a death benefit with a cash value account. Policyholders can adjust premiums and death benefits as their financial needs change.

- Variable Life Insurance: Allows policyholders to invest the cash value in various investment options, which can lead to varying returns. This type is suited for individuals comfortable with investment risks.

The role of life insurance in financial planning for families cannot be overstated. It ensures that in the event of a tragedy, families will not face a financial crisis while grieving. Life insurance can help cover outstanding debts, funeral expenses, and replace lost income, thereby allowing families to maintain their lifestyle and fulfill their financial obligations. Additionally, some policies offer a cash value that can be borrowed against for significant expenses, such as a child’s education or a home purchase, further enhancing financial flexibility.

“Life insurance is not just about protecting your family; it’s about securing their future.”

Importance of Life Insurance for Families

Life insurance is not just a financial product; it’s a safety net that ensures your family’s stability and security in times of uncertainty. As families navigate the complexities of life, having a solid life insurance policy can provide invaluable peace of mind. This protection can safeguard loved ones from the financial repercussions of unexpected events, allowing them to maintain their standard of living and pursue their goals without the added burden of financial instability.Without life insurance, families face significant risks that can disrupt their lives and compromise their futures.

The sudden loss of a primary income provider can lead to unaffordable expenses, such as mortgage payments, education costs, and day-to-day living expenses. The absence of adequate coverage can force families to deplete their savings, take on debt, or even face foreclosure. Studies indicate that nearly 40% of American households would face financial hardship within six months of losing their primary breadwinner, highlighting the critical role life insurance plays in family security.

Financial Security Through Life Insurance

The role of life insurance in ensuring financial security for families cannot be overstated. When a policyholder passes away, the death benefit provides critical support to the surviving family members. This benefit can be used to cover immediate expenses, such as funeral costs, as well as ongoing living expenses, ensuring that families can continue to live comfortably during a challenging time.

The statistics reflect the importance of this financial tool:

- According to a survey by LIMRA, approximately 60% of Americans believe they need more life insurance coverage, indicating a significant gap in the protection families feel they require.

- Data from the National Association of Insurance Commissioners suggests that nearly 30% of families would struggle to cover their basic living expenses after just three months without the income of the deceased.

- The National Funeral Directors Association reports that the average cost of a funeral exceeds $7,000, underscoring the necessity of a life insurance payout to cover such expenses.

Life insurance is a commitment to your family’s future, providing a foundation of support during life’s unpredictable moments.

In addition to immediate needs, life insurance can also impact long-term financial goals. Policies can contribute to funding children’s education, saving for retirement, or even investing in family businesses. Families equipped with life insurance can plan better for the future, knowing they have a buffer against life’s uncertainties. Thus, life insurance acts not only as a protective measure but also as a strategic financial tool that enhances family resilience and stability.

Best Life Insurance Plans for Families in 2025

Source: catholicunitedfinancial.org

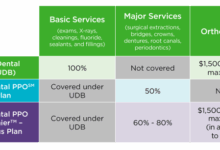

In 2025, selecting the right life insurance plan for your family is crucial, as it can provide financial security and peace of mind. With various options available, families can tailor their coverage to meet specific needs, ensuring loved ones are protected in case of unexpected events. Understanding the features and benefits of different plans will help families make informed decisions.Life insurance plans have evolved to include various coverage options, benefits, and premiums that cater specifically to families.

Here’s a comparison table showcasing the top life insurance plans for families in 2025, highlighting key aspects such as coverage options, premiums, and additional benefits.

Comparison of Top Life Insurance Plans for Families in 2025

The following comparison table illustrates several leading life insurance plans available for families in 2025. Each plan is evaluated based on its coverage options, monthly premiums, and notable benefits to help families identify the best fit for their financial situation.

| Insurance Plan | Coverage Options | Monthly Premiums | Benefits |

|---|---|---|---|

| Family Secure Plan | $500,000 – $2,000,000 | $50 – $150 | Child riders, terminal illness coverage |

| Whole Life Family Plan | $100,000 – $1,000,000 | $100 – $300 | Cash value accumulation, guaranteed premiums |

| Term Life Family Plan | $250,000 – $1,500,000 | $30 – $120 | Option to convert to whole life, no medical exam |

| Universal Life Plan | $500,000 – $5,000,000 | $60 – $250 | Flexible premiums, death benefit options |

“Choosing the right life insurance plan is not just about the coverage amount; it’s also about understanding the unique needs of your family.”

Features of Plans Suitable for Families

When selecting a life insurance plan, families should look for features that align with their specific needs. Key aspects include:

Flexible Coverage Amounts

Plans that offer adjustable coverage levels allow families to increase or decrease their insurance based on changing circumstances.

Riders for Children

Plans often include riders that cover children, providing additional protection for young family members without requiring separate policies.

Terminal Illness Benefits

Many plans offer benefits that allow policyholders to access funds if diagnosed with a terminal illness, providing financial support during difficult times.

Affordability

Premiums must be manageable within the family budget, ensuring that coverage doesn’t create financial strain. The importance of these features lies in their ability to provide comprehensive protection and adaptability as family dynamics evolve over time.

Choosing the Best Plan Based on Family Needs and Budget

Selecting the best life insurance plan requires careful evaluation of family needs and financial circumstances. Families should consider the following points:

Assessing Coverage Needs

Determine how much coverage is necessary to support dependents financially, including expenses such as education and daily living costs.

Budget Considerations

Evaluate monthly premiums in relation to the family’s overall budget, ensuring that the plan is affordable without compromising on essential coverage.

Long-term Goals

Consider future goals, such as homeownership or education savings, and choose a plan that accommodates these objectives.

Consulting with Experts

Engaging with insurance agents or financial advisors can provide personalized insights and help families navigate complex options.By scrutinizing these factors, families can make informed decisions that align their life insurance coverage with their unique requirements and financial situations.

Factors to Consider When Choosing a Life Insurance Plan

Selecting the right life insurance plan is crucial for families looking to secure their financial future. Several factors play a significant role in determining which policy best fits your needs, ensuring that you make an informed decision that safeguards your loved ones.Understanding the key elements influencing life insurance choices is essential for anyone considering coverage. Factors such as age, health status, and lifestyle can greatly affect both the type of policy and the premiums you may encounter.

It’s also vital to evaluate coverage amounts and terms to ensure they align with your family’s financial goals and responsibilities. Additionally, the financial strength and customer service ratings of the insurer are important indicators of reliability and support.

Age, Health, and Lifestyle Impacting Coverage

When choosing a life insurance plan, age, health, and lifestyle are pivotal considerations. Younger individuals often benefit from lower premiums and more favorable terms due to lower perceived risk. Conversely, older applicants might face higher costs or restricted coverage options.Health status is another critical factor. Those with pre-existing conditions may encounter higher premiums or specific policy limitations. Lifestyle choices, such as smoking or engaging in high-risk activities, also influence policy rates and eligibility.

Assessing these factors ensures that the chosen plan is not only affordable but also adequate for one’s needs.

Reviewing Coverage Amounts and Terms

Determining the right coverage amount is essential for comprehensive protection. This involves evaluating your family’s financial obligations, including mortgage payments, tuition fees, and daily living expenses. A common guideline is to secure a policy worth 10 to 15 times your annual income, which can provide a sufficient financial cushion for your beneficiaries.It’s equally important to understand the terms of the policy.

This includes the duration of coverage, premium payment schedules, and any exclusions that may apply. Comprehensive knowledge of these terms can prevent future surprises and ensure that the policy remains aligned with your family’s evolving needs.

Insurer’s Financial Strength and Customer Service Ratings

The financial strength of an insurance company serves as a proxy for its ability to meet future claims. Rating agencies such as A.M. Best, Moody’s, and Standard & Poor’s evaluate insurers based on their financial health. For instance, companies with an ‘A’ rating or higher are generally viewed as financially stable and likely to honor claims.Customer service ratings are equally important.

A life insurance policy is a long-term commitment, so partnering with an insurer known for excellent customer service can enhance your experience. Positive reviews and a reputation for responsive support can provide peace of mind, knowing that assistance will be readily available when needed.

Choosing a life insurance plan involves considering age, health, lifestyle, coverage amounts, terms, and the insurer’s financial stability.

Tips for Affordable Life Insurance

Source: ctfassets.net

Finding affordable life insurance can seem challenging, especially for families looking to ensure their loved ones are protected. However, with the right strategies in place, it is possible to secure a plan that fits both your coverage needs and your budget. Here are some effective tips to help you navigate the landscape of life insurance while keeping costs down.

Strategies for Finding Affordable Options

Identifying affordable life insurance options requires a proactive approach. By employing specific strategies, families can significantly reduce their insurance premiums while still maintaining adequate coverage. Consider the following tactics to find the best deals:

- Shop Around: Obtain quotes from multiple insurance providers. Each company has different risk assessments, which can lead to varying premium rates for the same coverage.

- Assess Your Coverage Needs: Determine the amount of coverage necessary for your family. Over-insuring can lead to unnecessary costs, so focus on what realistically meets your needs.

- Consider Term Life Insurance: For many families, term life insurance offers lower premiums compared to whole life insurance, making it a more affordable option for those who need coverage for a specific period.

- Utilize Online Comparison Tools: Leverage technology by using online tools that compare different life insurance policies side by side. This can save time and help you spot the best deals quickly.

Benefits of Bundling Insurance Policies

Bundling your life insurance with other types of insurance, such as home or auto insurance, can lead to significant savings. Many insurers offer discounts for customers who choose to combine multiple policies. Here’s how bundling can be advantageous:

- Cost Savings: Bundling can lead to a reduction in overall insurance expenses. For example, households that bundle their home and life policies often see discounts of 10% or more on their premiums.

- Simplified Payments: Managing multiple policies with one provider simplifies your financial planning, as you will only have to deal with one payment each month.

- Enhanced Coverage Options: Some insurance companies offer additional coverage options or features when you bundle, providing more comprehensive protection at a lower cost.

Improving Health and Lifestyle for Better Premium Rates

Your health and lifestyle choices significantly influence life insurance premiums. Insurers often consider these factors when determining rates, so making positive changes can lead to better pricing. Here are some effective ways to enhance your health and secure lower premiums:

- Maintain a Healthy Weight: Being within a healthy weight range reduces the risk of chronic diseases, which insurers take into account. Regular exercise and a balanced diet contribute positively to your health profile.

- Quit Smoking: Smokers typically face significantly higher premiums. Quitting smoking not only improves your health but can also lead to a substantial decrease in life insurance costs over time.

- Regular Health Check-ups: Keeping up with routine medical exams allows you to catch potential health issues early, which can result in better health outcomes and lower insurance rates as you can demonstrate a proactive approach to health management.

- Limit Alcohol Consumption: Reducing alcohol intake can improve your overall health, decreasing the risk of related health issues and potentially lowering your premiums.

Improving your health not only benefits your life but can also translate to tangible savings on life insurance premiums.

Common Misconceptions About Life Insurance

Many families avoid discussing life insurance due to misunderstandings and myths that can lead to inadequate protection for their loved ones. These misconceptions often stem from a lack of information and can create significant gaps in coverage when families need it most. Understanding the truth behind these myths is crucial for making informed decisions about life insurance plans.One of the main issues surrounding life insurance is the prevalence of common myths that can lead families to underinsure themselves or miss out on beneficial policies altogether.

Recognizing and debunking these myths can help families secure the right coverage to protect their financial future.

Common Myths About Life Insurance

It’s essential to address these misconceptions to educate families on the necessity and benefits of life insurance. Below are some of the most common myths, along with the truths that dispel them:

- Myth: Life insurance is only for the elderly or wealthy.

Truth: Life insurance is valuable for individuals of all ages and income levels. Young families, in particular, can benefit greatly from securing coverage early to lock in lower premiums and ensure financial stability for their dependents. - Myth: Life insurance is too expensive.

Truth: Many people overestimate the cost of life insurance. In reality, there are affordable options available, and purchasing a policy at a younger age can lead to lower premiums. - Myth: My employer’s life insurance is enough.

Truth: While employer-provided life insurance is a good start, it often isn’t sufficient to cover all of a family’s financial needs in the event of a loss. Individual coverage can provide additional benefits tailored to personal circumstances. - Myth: I don’t need life insurance if I don’t have dependents.

Truth: Even without dependents, life insurance can cover debts, funeral expenses, and leave an inheritance for loved ones, making it a valuable investment. - Myth: Life insurance pays out only if I die suddenly.

Truth: Life insurance policies provide benefits in various circumstances, including terminal illness and accidental death, ensuring that the insured’s loved ones are supported during difficult times.

Educating families about life insurance options is vital to ensure they make informed decisions that protect their financial future.

It’s important for families to stay informed about life insurance options. By dispelling these myths, families can approach their life insurance choices with confidence, ensuring they select the right plans to secure their loved ones’ financial well-being. Understanding the true nature of life insurance can empower families to make choices that align with their needs and goals, ultimately leading to better financial planning and peace of mind.

Future Trends in Life Insurance

The life insurance industry is on the brink of significant changes that will redefine how families approach their coverage in 2025. As technology continues to advance and demographics shift, families will experience an evolution in the products and services available to them. Understanding these trends can help families make informed decisions about their life insurance needs.Technological advancements are transforming the life insurance landscape by streamlining the process of purchasing and managing policies.

For instance, the rise of artificial intelligence (AI) and machine learning is enabling companies to analyze vast amounts of data more efficiently, allowing for personalized policy offerings and faster underwriting processes. Blockchain technology is also starting to play a role in enhancing transparency and security in transactions, which could lead to greater consumer trust.

Emerging Technologies in Life Insurance

Several technological innovations are set to reshape the life insurance industry, making it more accessible and user-friendly for families. These include:

- Telematics: The integration of telematics in life insurance will lead to personalized premiums based on lifestyle choices. For example, wearables that track health metrics can offer discounts for individuals who maintain a healthy lifestyle.

- Digital Platforms: Online platforms will simplify the purchasing process, allowing families to compare policies easily and make informed decisions from the comfort of their homes.

- AI Chatbots: These will provide immediate assistance to consumers, helping them navigate policy options and answer common questions in real-time.

- Data Analytics: Insurers will utilize data analytics to predict trends and tailor products that cater to the specific needs of families, ensuring their coverage remains relevant as circumstances change.

- Mobile Apps: Mobile applications will enable policyholders to manage their policies, file claims, and access support on-the-go, increasing convenience and engagement.

Impact of Changing Demographics

The demographic landscape is shifting dramatically, influencing life insurance offerings. As the population ages, there is a growing demand for policies that cater to older individuals, including products focused on long-term care and final expense coverage. Younger generations are also entering the market with different priorities, leading to a trend towards term life insurance with flexible options that fit their lifestyles.This demographic shift necessitates a focus on inclusivity and accessibility.

For example, insurers are recognizing the unique needs of diverse family structures, including single-parent households and blended families, leading to customizable policies that offer tailored benefits. In addition, the increase in remote work and gig economy jobs is prompting insurers to develop products that reflect these new employment scenarios, such as coverage that is portable and adaptable to various income streams.

“The future of life insurance is not just about coverage; it’s about creating personalized experiences that meet the evolving needs of families in a dynamic world.”

As families navigate these changes, staying informed about emerging trends will empower them to make choices that best suit their financial security and peace of mind.

How to Make a Claim on a Life Insurance Policy

Filing a life insurance claim can be an overwhelming process, especially during a time of loss. Understanding the steps involved can help ease the burden for families. A smooth claims process ensures that beneficiaries can access benefits promptly, which can be crucial for financial stability.Making a claim on a life insurance policy generally involves specific procedural steps that need to be followed.

Here’s a simplified breakdown of the claim process to guide families through this challenging time.

Steps for Filing a Life Insurance Claim

The process of filing a claim is straightforward but requires attention to detail. Below are the essential steps families should undertake:

- Notify the Insurance Company: Inform the insurer about the policyholder’s death as soon as possible. Most companies have a dedicated claims department that can guide you through the process.

- Gather Necessary Documentation: Collect all required documents, including the death certificate, policy documents, and any identification required by the insurer.

- Complete the Claim Form: Fill out the claim form provided by the insurance company. Ensure all information is accurate to avoid delays.

- Submit the Claim: Send the completed claim form along with the supporting documents to the insurance company. Keep copies for your records.

- Follow Up: After submission, follow up with the insurer to check the status of your claim. This can help expedite the process if there are any issues.

Common Pitfalls to Avoid During the Claims Process

To ensure a successful claim, families should be aware of common mistakes that may delay the process or lead to claim denial. Here are key pitfalls to watch out for:

Incomplete documentation can lead to significant delays in processing claims.

When filing a claim, it is essential to provide all requested documents and information. Missing documentation, such as the policy number or relevant identification, can result in unnecessary complications.

Not keeping track of communication with the insurance company can hinder progress.

Maintain a log of all conversations, including dates, times, and names of representatives spoken to. This will help if issues arise later.

Failing to understand the specific policy details could lead to misunderstandings.

Review the life insurance policy thoroughly to grasp coverage limits, exclusions, and the claims process. Being well-informed about what the policy entails can prevent unexpected surprises.

Tips for a Smooth Claims Experience

To further enhance the claims experience, consider the following tips:Ensure that all documentation is complete and accurate before submission. This includes double-checking names, dates, and amounts on all forms.Keep open lines of communication with the insurance company. Regular check-ins can prevent misunderstandings and ensure that you are informed of any additional requirements.Be patient but proactive. Claims processing can take time, so be prepared for potential delays, especially during busy periods or if further investigation is necessary.If issues arise, don’t hesitate to escalate the matter.

If you encounter difficulties, ask to speak with a supervisor or consider contacting a consumer advocacy group for assistance.By following these steps and tips, families can approach the life insurance claims process with more confidence, ensuring they access the benefits entitled to them smoothly and efficiently.

Real-Life Case Studies

Source: coverfox.com

Life insurance can play a pivotal role in a family’s financial security, especially during challenging times. By examining real-life scenarios, we can better understand how life insurance has helped families navigate through loss and hardship. These case studies illustrate the profound impact that life insurance can have, as well as the consequences faced by those who opted not to secure coverage.One compelling example involves the Smith family.

After the unexpected passing of the family’s primary breadwinner, the wife, Jessica, was left with two children and a significant mortgage. Fortunately, they had a term life insurance policy in place, which provided Jessica with a payout of $500,000. This allowed her to pay off the mortgage, cover daily living expenses, and fund her children’s education. The policy not only alleviated financial strain but also gave Jessica the peace of mind to focus on healing and supporting her children through a difficult transition.In contrast, the Johnson family faced severe financial challenges following the tragic death of the father, Mark, who did not have life insurance.

His sudden loss left his spouse, Amy, and their three children in a precarious situation. Without any life insurance benefits, Amy struggled to maintain their lifestyle, leading to the decision to sell their home and move into a more affordable apartment. The emotional toll of both the loss and the financial strain on the family was immense, highlighting the importance of having a life insurance plan in place.

Impact of Life Insurance on Different Family Situations

Considering various family structures and financial backgrounds, the impact of life insurance can vary widely. Below are examples illustrating how different families approached their life insurance needs:

- The Garcia Family: As a blended family with children from previous marriages, the Garcias opted for a whole life insurance policy. This decision was made to ensure that all children would be financially supported equally, regardless of their parentage, thereby avoiding potential familial conflicts in the event of an untimely death.

- The Patel Family: As a small business owner, Raj Patel took out a key person insurance policy for himself. This policy was crucial, as it not only protected his family’s financial future but also ensured the business could continue operating smoothly in his absence, thereby securing jobs for his employees.

- The Thompson Family: This young couple with no children initially viewed life insurance as unnecessary. However, after attending a financial planning seminar, they decided to purchase a joint policy. The policy offered them coverage at lower rates, demonstrating the importance of planning ahead, even for those without dependents.

These real-life cases illustrate the diverse scenarios in which life insurance can be beneficial or detrimental, depending on whether families proactively plan for the unexpected. It is clear that life insurance is not merely a financial product but a crucial element of family security and peace of mind.

Resources for Life Insurance Education

Educating yourself about life insurance is essential for making informed decisions that can significantly impact your family’s financial future. With the right resources, you can navigate the complexities of life insurance and find the best plans suited to your family’s needs. Numerous websites, books, and organizations dedicate their efforts to providing reliable information about life insurance. Understanding these resources will empower you to enhance your knowledge and make sound insurance choices.

Websites, Books, and Organizations

Here are some reputable resources that offer valuable insights into life insurance:

- National Association of Insurance Commissioners (NAIC)

-A trusted organization that provides up-to-date information on insurance regulations and policies. - Insurance Information Institute (III)

-Offers comprehensive articles and tools to help consumers understand various types of insurance, including life insurance. - Consumer Reports

-Provides unbiased reviews and comparisons of life insurance policies, along with expert advice on choosing the right coverage. - The Life Insurance Policy Finder

-A tool that assists in comparing various life insurance policies side by side for a clearer understanding of options. - Books: “The Complete Guide to Life Insurance” by John Smith and “Life Insurance Made Simple” by Mike McCarty are excellent reads for those seeking foundational knowledge.

Frequently Asked Questions about Life Insurance for Families

Understanding the common queries surrounding life insurance can help families make informed decisions. Here’s a list of frequently asked questions tailored to family needs:

- What is the difference between term and whole life insurance?

- How much coverage do I need for my family?

- What factors affect the cost of life insurance premiums?

- Can I change my life insurance policy after it’s purchased?

- What happens if I miss a premium payment?

- Are there any tax implications with life insurance payouts?

- How do I know if I am getting a good deal on my policy?

Tools for Comparing Life Insurance Policies

Having the right tools at your disposal can simplify the process of choosing a life insurance plan. Here are some recommended tools that allow consumers to compare policies effectively:

- Policygenius

-An online platform that enables users to compare quotes from various life insurance providers easily. - Insure.com

-Offers a comparison tool that allows families to compare different policies and their benefits side by side. - Quotacy

-This site provides personalized quotes and helps users understand their options based on their specific needs. - Life Insurance Calculator

-Several online calculators help estimate the amount of life insurance needed based on family circumstances, income, and debts.

Concluding Remarks

In conclusion, navigating the world of life insurance is an essential step for families aiming to ensure their financial security. By understanding the various plans available, assessing their features, and considering individual family circumstances, families can select the best life insurance coverage that suits their needs. With the right information and tools, securing a bright future for your loved ones is a realistic and achievable goal.

Expert Answers

What is the average cost of life insurance for families?

The average cost varies widely based on coverage amounts, ages, and health status, but families can expect to pay anywhere from $20 to $50 per month for a basic term life policy.

How much life insurance coverage do families need?

A general guideline is to have coverage equal to 10 to 15 times your annual income, but specific needs may vary based on family size and financial obligations.

Can families get life insurance if they have pre-existing conditions?

Yes, many insurers offer policies to individuals with pre-existing conditions, although premiums may be higher depending on the condition’s severity.

How often should I review my life insurance policy?

It’s advisable to review your life insurance policy every few years or after major life events such as marriage, the birth of a child, or significant changes in income.

Are there tax benefits to having life insurance?

Generally, the death benefit from a life insurance policy is tax-free for beneficiaries, and some policies can accumulate cash value on a tax-deferred basis.