Car Insurance What Coverage Do You Really Need?

Car Insurance: What Coverage Do You Really Need? Understanding car insurance is essential for every driver, as it not only safeguards your financial investments but also ensures peace of mind on the road. With various types of coverage options available, it’s important to navigate through what’s mandatory and what’s optional, helping you make informed choices that align with your personal circumstances.

From liability to comprehensive coverage, this discussion will delve into the specifics of each type, the factors influencing your coverage needs, and how to assess what’s best for your individual situation. Let’s simplify these concepts and demystify the complexities surrounding car insurance.

Understanding Car Insurance Basics

Car insurance is a crucial aspect of responsible vehicle ownership, designed to protect drivers from financial loss in the event of accidents, theft, or damage. It acts as a safety net, ensuring that both the driver and other parties are covered in unfortunate incidents. Navigating the world of car insurance can be overwhelming due to various options and requirements, but understanding these basics can empower drivers to make informed decisions regarding their coverage needs.

Different types of car insurance are available in the market, each serving specific purposes and covering various risks. These typically include liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage. It’s essential to recognize what each type entails to select the most suitable options for individual circumstances.

Types of Car Insurance Coverage

When considering car insurance, it’s important to differentiate between mandatory and optional coverage, as requirements can vary significantly by region. Below are the primary types of coverage you may encounter:

- Liability Coverage: This is often required by law and covers damages to others if you’re responsible for an accident. It usually includes bodily injury liability and property damage liability.

- Collision Coverage: This optional coverage pays for damages to your own vehicle resulting from a collision, regardless of who is at fault.

- Comprehensive Coverage: Also optional, this protects against non-collision-related incidents, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): In some regions, this coverage is mandatory and pays for medical expenses for you and your passengers after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This optional coverage provides protection if you’re involved in an accident with a driver who lacks sufficient insurance.

Understanding mandatory and optional coverage helps drivers evaluate their needs against legal requirements. For instance, states like California require minimum liability coverage, while states like New Hampshire offer more flexibility, allowing drivers to choose whether to carry insurance. Each state’s specific regulations should be reviewed to ensure compliance while considering personal circumstances and financial implications.

It is crucial to evaluate your driving habits, the value of your vehicle, and your financial situation when choosing car insurance coverage.

Types of Coverage Explained

Understanding the various types of car insurance coverage is essential for every driver. Each type serves a unique purpose and can provide protection in different scenarios. By knowing the specifics of each coverage type, you can make informed decisions that best suit your needs and financial situation.

Liability Coverage

Liability coverage is a fundamental component of car insurance that protects you financially if you are found at fault for an accident. This coverage pays for the damages to another person’s property and any medical expenses incurred by others due to the accident. In many states, carrying a minimum amount of liability insurance is mandatory. The significance of liability coverage cannot be overstated, as it safeguards your assets and future earnings from potential lawsuits stemming from accidents.

“Liability coverage ensures that you are financially protected in the event you cause harm to others while driving.”

Collision and Comprehensive Coverage

Collision and comprehensive coverages are optional types of insurance that protect your own vehicle in different situations. Collision coverage pays for damages to your car resulting from a collision with another vehicle or object, regardless of who is at fault. This coverage is especially beneficial for newer or more valuable cars, where repair costs can be significant. On the other hand, comprehensive coverage protects against damages to your vehicle that are not the result of a collision.

This includes incidents like theft, vandalism, natural disasters, or hitting an animal. For instance, if a tree falls on your parked car during a storm, comprehensive coverage would cover the repair costs.

“Choosing between collision and comprehensive coverage depends on your car’s value and your personal risk tolerance.”

Uninsured and Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage is designed to protect you if you’re involved in an accident with a driver who lacks insurance or does not have enough coverage to pay for your damages. This type of coverage is especially crucial as many drivers may not carry adequate insurance. For example, if you suffer $15,000 in damages and the at-fault driver has only $10,000 in liability coverage, underinsured motorist coverage will help cover the remaining costs.

Similarly, if you’re hit by a driver who has no insurance, this coverage ensures that you are not left with financial burdens due to another’s negligence.

“Uninsured and underinsured motorist coverage acts as a safety net when the other party cannot compensate you adequately.”

Assessing Your Coverage Needs

Determining the right amount of car insurance coverage can feel overwhelming, especially with so many factors at play. Understanding your personal situation and driving habits is essential to make informed decisions that suit your specific needs. This segment will help you identify what influences your coverage necessities, ensuring you’re adequately protected on the road.A variety of factors can influence the amount of coverage a driver should have, including the type of vehicle, driving habits, and personal financial circumstances.

For instance, a new luxury vehicle may require comprehensive coverage, while an older car might only need liability coverage. Additionally, if you frequently commute long distances in heavy traffic, you may want more coverage to safeguard against potential accidents. Personal circumstances, such as your credit score and claims history, also play a vital role in determining premium rates and coverage levels.

Factors Influencing Coverage Choices

Several key factors can help you assess your individual needs for car insurance coverage. The following points are crucial to consider when evaluating your situation:

- Vehicle Value: The worth of your car greatly impacts coverage. Higher-value cars typically warrant more comprehensive coverage due to the potential repair costs.

- Driving Habits: Frequent drivers or those who travel long distances may require additional coverage to protect against higher accident risks.

- State Requirements: Each state has different minimum insurance requirements, which can influence how much coverage you need to maintain legal driving status.

- Personal Finances: Your financial situation can dictate whether you opt for higher deductibles or more extensive coverage options.

- Claims History: A history of accidents or claims may lead insurers to recommend or require higher coverage limits.

It’s also beneficial to create a checklist that evaluates your individual needs for car insurance coverage. This can serve as a guiding tool to ensure nothing important is overlooked when selecting your policy.

By understanding what influences your coverage, you can make more informed choices that align with your lifestyle and financial situation.

Here’s a simple checklist to help you assess your needs:

- What is the current market value of my vehicle?

- How often do I drive, and in what conditions?

- What are the minimum insurance requirements in my state?

- What is my budget for insurance premiums and deductibles?

- Do I have a history of accidents or claims that may affect coverage options?

Taking these factors into account will empower you to select a car insurance policy that best suits your unique needs, helping to ensure peace of mind every time you hit the road.

Cost Considerations in Car Insurance

When it comes to car insurance, understanding the cost implications is essential for making informed decisions. Different factors, including your deductible, coverage options, and potential discounts, can significantly affect your overall expenses. This section delves into these cost considerations to help you navigate your insurance choices effectively.

Deductibles: Higher vs. Lower

The deductible is the amount you’ll pay out of pocket before your insurance kicks in when you file a claim. Choosing a higher deductible typically results in lower premium rates, which can save you money in the long term. Conversely, a lower deductible means higher premiums but less out-of-pocket expense during a claim. For example, if you opt for a deductible of $1,000, your monthly premium might be $100.

However, if you lower your deductible to $500, your premium could rise to $150. It’s crucial to assess your financial situation and risk tolerance when considering deductibles.

“Selecting a deductible is a balance between potential savings on premiums and financial readiness for unexpected costs.”

Coverage Options and Premium Rates

The type and extent of coverage you choose can directly impact your premium rates. Comprehensive insurance, which covers damages from non-collision incidents, will typically cost more than basic liability coverage. Each coverage option comes with its own implications for both monthly premiums and overall expenses.For instance, adding roadside assistance or rental car reimbursement to your policy can enhance protection but will also increase your premium.

Here’s how different coverage types can affect your costs:

- Liability Coverage: Mandatory in most states, this is often the most affordable option.

- Collision Coverage: Protects your vehicle in an accident, generally raising premium costs.

- Comprehensive Coverage: Covers non-accident-related damages; it typically leads to higher premiums.

- Additional Coverage: Options like uninsured motorist coverage and personal injury protection can further increase costs.

Understanding these premium impacts can help you tailor your policy to fit your budget and coverage needs.

Discounts Available for Coverage Types

Insurance companies often provide various discounts that can help reduce your premium rates, making coverage more affordable. Eligibility for these discounts varies by provider and coverage type, so it’s worth inquiring about them when shopping for insurance.Here’s a list of common discounts you might be eligible for:

- Safe Driver Discount: For maintaining a clean driving record without accidents or violations.

- Multi-Policy Discount: Bundling car insurance with other types of insurance, such as homeowners or renters insurance.

- Good Student Discount: For students who maintain a certain GPA, reflecting responsible behavior.

- Low Mileage Discount: For those who drive fewer miles than average, suggesting a lower risk for insurers.

Utilizing available discounts can significantly lower your insurance costs while ensuring you have the necessary coverage.

Common Misconceptions About Car Insurance

Source: tgsinsurance.com

Many drivers harbor misunderstandings about car insurance that can lead to inadequate coverage or unexpected costs. Dispelling these myths is crucial not only for financial protection but also for peace of mind on the road. Let’s clear up some of the most common misconceptions surrounding car insurance coverage and claims processes.

Myths About Car Insurance Coverage

There are several widespread myths regarding car insurance that can mislead consumers. Understanding the truths behind these beliefs can safeguard drivers from making uninformed decisions about their coverage.

- Comprehensive coverage includes everything: Many believe that comprehensive insurance covers all damages to a vehicle. In reality, it primarily protects against non-collision incidents such as theft, vandalism, and natural disasters.

- Higher premiums ensure better coverage: A common misconception is that paying higher premiums always equates to better coverage. However, it’s essential to understand the specifics of what each policy covers as premium costs vary based on multiple factors.

- Car insurance is unnecessary for older vehicles: Some drivers think they don’t need insurance for older cars. While they might not have high market value, legal requirements and potential liability still necessitate coverage.

Understanding State Minimum Coverage Requirements

Misunderstandings about state minimum coverage can lead to significant gaps in protection. Each state has its own requirements, and assuming that meeting these minimums provides adequate coverage can be misleading.

- Minimum coverage is enough for all drivers: Statutory minimums often cover only basic liability and may not protect you adequately in an accident, especially if you are at fault.

- All states have the same requirements: Each state varies in its minimum insurance requirements, ranging from liability only to including uninsured motorist coverage. Drivers must research their specific state’s laws.

- Once you have minimum coverage, you’re set: Minimum coverage does not account for personal damages or injuries; as such, additional coverage may be wise to cover potential out-of-pocket expenses.

Beliefs About Claims Processes and Payouts

Many drivers are uncertain about how claims processes work, leading to exaggerated beliefs about the ease and reliability of payouts. Understanding the realities of claims can reduce frustration and confusion when accidents occur.

- All claims are automatically approved: Contrary to popular belief, insurance companies investigate claims thoroughly. Factors such as policy limits and the circumstances of the accident can affect claim approval.

- You will always get full payout for damages: Payouts depend on coverage limits and the assessment of damages. If the costs exceed the coverage limits, the driver is responsible for the difference.

- Filing a claim will always raise your premiums: While some claims may lead to increased premiums, others might not affect rates, especially if you have a good driving record or the accident was not your fault.

Adjusting Your Coverage Over Time

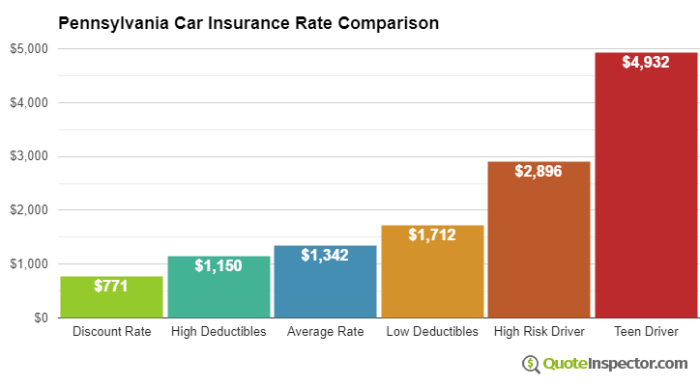

Source: quoteinspector.com

Life is constantly changing, and with those changes can come new needs for car insurance coverage. Whether you’re moving to a new city, buying a new car, or experiencing changes in your family structure, it’s important to periodically review your policy to ensure it still meets your requirements. Adapting your coverage can provide peace of mind and financial protection tailored to your current situation.Several life events can signify the need to reassess your car insurance coverage.

Major milestones such as marriage, the birth of a child, or even retirement can affect how much coverage you need, as well as what types of coverage are most relevant. It’s crucial to recognize these moments and adjust your policy accordingly to avoid lapses in protection or overpaying for unnecessary coverage.

Life Events That Necessitate a Review

Understanding the key life events that should prompt a policy review can help ensure you maintain the appropriate coverage. These events include:

- Marriage or Cohabitation: Combining households can affect your insurance needs and may qualify you for discounts.

- New Vehicle Purchase: Upgrading to a newer or more expensive vehicle may require higher coverage limits.

- Change in Employment: A new job may entail a longer commute, affecting your risk profile.

- Addition of a Teen Driver: Adding a young driver to your policy can significantly impact premium costs and coverage needs.

- Relocation: Moving to a different state or city often entails different insurance requirements and rates.

- Significant Changes in Financial Status: Changes in income or net worth might necessitate a reassessment of liability coverage levels.

Reviewing your policy regularly, especially after these major life events, can help ensure that you have the right coverage to protect yourself and your assets.

Guidelines for Updating Your Policy

To effectively update your car insurance policy, follow these key guidelines:

- Schedule Regular Reviews: Aim to review your coverage at least once a year or after any significant life change.

- Contact Your Insurance Agent: Discuss your current situation and any changes that might warrant a policy adjustment.

- Compare Quotes: Regularly compare rates and coverage options from different providers to ensure you’re getting the best deal.

- Understand Your Coverage Needs: Evaluate your current and future needs based on life changes to determine if you require more or less coverage.

- Keep Documentation Organized: Maintain records of your policy changes, claims, and communications with your insurer for easy reference.

By adhering to these guidelines, you can ensure that your car insurance coverage keeps pace with your life circumstances, providing you with the necessary protection.

Real-Life Testimonials

Hearing firsthand experiences can provide valuable insights into the importance of adjusting coverage.

“I never thought twice about my car insurance until I got married. When my partner and I combined our policies, we ended up saving a significant amount on premiums while increasing our coverage. It was a win-win!”

Sarah M.

“After my son got his driver’s license, I was worried about how much my premiums would rise. I spoke with my insurance agent, who helped me adjust my coverage and find discounts for good students. Not only did we keep our costs down, but we also got the coverage we needed.”

Tom R.

These testimonials highlight the importance of regularly evaluating car insurance coverage in light of life changes. By doing so, individuals can achieve better financial outcomes and ensure sufficient protection.

The Role of Insurance Agents

Insurance agents play a crucial role in helping you navigate the complex world of car insurance. With their expertise and knowledge of the insurance market, they can guide you in selecting the right coverage that fits your individual needs and financial situation. Whether you’re a first-time buyer or looking to reassess your policy, consulting with an agent can provide valuable insights and personalized solutions.The process of consulting with an insurance agent typically begins with an initial assessment of your circumstances.

The agent will gather information about your driving habits, vehicle type, and any specific coverage concerns you may have. This consultation often leads to recommendations tailored to your situation, allowing you to make informed decisions. Agents not only help you understand the different types of coverage available but also clarify any jargon that may be confusing.

Benefits of Using an Insurance Agent

Utilizing an insurance agent comes with several advantages that enhance your experience in choosing car insurance.

- Personalized Service: Agents provide individualized attention, ensuring you understand your options and find the best fit for your needs.

- Expert Knowledge: They are well-versed in the intricacies of insurance policies and can offer insights that help you make educated choices.

- Claims Assistance: In the event of an accident, agents can assist with the claims process, providing support and guidance to ensure a smooth experience.

- Access to Multiple Insurers: Agents often represent multiple insurance companies, giving you more options to choose from and potentially better rates.

Drawbacks of Using an Insurance Agent

While there are many benefits to working with an insurance agent, there are also some downsides to consider.

- Cost Implications: Some agents may charge fees for their services, potentially increasing your overall insurance costs.

- Availability Limitations: Depending on the agent’s schedule, you may experience delays in communication or assistance, especially during peak times.

- Pressure to Purchase: In some cases, agents may push certain policies or coverages that may not be necessary for your situation.

Comparing Agents to Online Platforms

As technology evolves, many consumers are turning to online platforms for their insurance needs. Comparing the use of insurance agents with online platforms highlights key differences in service and accessibility.

- Convenience: Online platforms offer 24/7 access, allowing you to compare rates and policies at your convenience, without needing to schedule an appointment.

- Speed: The online process can be quicker, enabling you to receive quotes almost instantly and make decisions without delays.

- Research Capabilities: Online tools often provide resources that empower you to educate yourself about various coverages and insurance terms.

- Lack of Personal Touch: Online platforms may not provide the personalized service and tailored recommendations that an agent can offer.

Future Trends in Car Insurance

Source: tastingtable.com

As the landscape of transportation continues to evolve, so too does the realm of car insurance. Emerging technologies, shifts in consumer behavior, and potential regulatory changes are set to redefine how we think about and purchase car insurance. Understanding these trends is crucial for both consumers and insurance providers to adapt to the future of mobility.One of the most significant advancements influencing car insurance coverage decisions is the rise of telematics.

This technology enables insurers to monitor driving behavior through devices installed in vehicles or smartphone apps. By collecting data on speed, braking patterns, and driving habits, insurers can offer personalized premiums based on individual risk profiles. Consequently, safe drivers may benefit from lower rates, while those with riskier habits might face higher costs.

Impact of Autonomous Vehicles and Shared Mobility

The proliferation of autonomous vehicles and shared mobility services is poised to have a profound impact on car insurance needs. As self-driving cars become more mainstream, traditional insurance models will need to be reevaluated. Here’s how these innovations are shaping the future of car insurance:

- Shift in Liability: With autonomous vehicles, the question of liability may shift from drivers to manufacturers and software developers. This change will necessitate the creation of new insurance products tailored to cover these entities rather than individual drivers.

- Shared Mobility Services: As car-sharing and ride-hailing services become prevalent, traditional personal auto policies may not suffice. Insurers will need to develop specific coverage solutions for vehicles used in shared mobility contexts, ensuring both passengers and drivers are adequately protected.

- Data Sharing: With autonomous vehicles generating vast amounts of data, insurers can leverage this information to better assess risk and refine their pricing models. This data-driven approach could lead to more accurate premium calculations, benefitting both insurers and consumers.

Potential Regulatory Changes Affecting Car Insurance

As the insurance landscape adjusts to emerging technologies and new mobility solutions, regulatory frameworks will also evolve. Government agencies may introduce new regulations aimed at ensuring consumer protection while fostering innovation in the insurance sector. Key considerations include:

- Mandatory Coverage Requirements: Regulatory bodies may impose new requirements for insurance coverage related to autonomous vehicles, ensuring that all users, including those using shared mobility services, are adequately insured.

- Data Privacy Regulations: As telematics and data collection become integral to premium pricing, lawmakers may introduce stricter data privacy regulations to protect consumer information, impacting how insurers collect and utilize data.

- Incentives for Innovation: Future regulations could also include incentives for insurance companies that adopt new technologies aimed at improving road safety, such as discounts for customers who use telematics devices.

The future of car insurance is undoubtedly on the brink of major transformation, driven by technological advancements and changes in consumer behavior. Staying informed about these trends will be essential for individuals and insurers alike as they navigate the evolving landscape of mobility and protection.

Conclusion

In conclusion, understanding car insurance is not just about meeting legal requirements but ensuring that you have adequate protection tailored to your unique needs. By reviewing your coverage regularly and dispelling common myths, you can optimize your policy for both affordability and effectiveness. Remember, your car insurance should serve you well, both today and as your circumstances evolve over time.

FAQ Resource

What is the difference between collision and comprehensive coverage?

Collision coverage pays for damages to your vehicle after an accident, while comprehensive coverage covers non-collision incidents like theft or natural disasters.

How can I lower my car insurance premium?

Consider raising your deductible, bundling policies, maintaining a good credit score, and taking advantage of discounts offered by your insurer.

Do I need uninsured motorist coverage?

Yes, uninsured motorist coverage is important as it protects you if you’re in an accident with a driver who lacks insurance.

How often should I review my car insurance policy?

It’s advisable to review your policy annually or whenever significant life changes occur, such as moving or purchasing a new vehicle.

Are there specific discounts I should look for?

Look for discounts for safe driving, low mileage, good grades (for students), and memberships in certain organizations.