Health Insurance For Expats What To Know

Health Insurance for Expats: What to Know sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As an expatriate navigating life in a new country, the importance of understanding health insurance cannot be overstated. It’s not just a legal requirement in many places; it’s a vital safety net that protects against unexpected medical expenses. Different countries have varied healthcare systems, and expats frequently encounter unique health risks that they may not be accustomed to in their home countries.

This guide aims to clarify the types of health insurance plans available, essential factors to consider when selecting a plan, and navigating the complex landscape of healthcare access, all tailored specifically for expatriates.

Types of Health Insurance Plans Available to Expats

When considering health insurance as an expatriate, it’s essential to understand the various types of plans that cater specifically to this demographic. Expatriates often face unique health needs, as they may not have access to their home country’s healthcare system. Thus, selecting the right insurance plan can significantly impact their overall well-being and financial stability.Health insurance plans for expats generally fall into two main categories: comprehensive coverage and basic coverage.

Each type offers distinct levels of protection and service, catering to different lifestyle needs and budgets.

Comprehensive Coverage Versus Basic Coverage Options

Comprehensive coverage provides extensive protection, often including a wide range of medical services such as hospital stays, outpatient care, maternity benefits, preventive care, and sometimes even mental health services. This type of plan is ideal for expats looking for peace of mind as it covers a variety of health needs.Conversely, basic coverage typically includes essential health services like emergency care and a limited set of outpatient services.

While more affordable, basic plans may leave expats vulnerable to high out-of-pocket costs for more extensive medical needs.A comparison of these two coverage types highlights their respective advantages and drawbacks:

- Comprehensive Coverage:

- Pros:

Offers extensive medical coverage, reducing out-of-pocket expenses and providing access to a wider range of healthcare services.

- Cons:

Generally more expensive, which may strain the budget of some expatriates.

- Pros:

- Basic Coverage:

- Pros:

More affordable premiums make it easier for expats to manage their healthcare expenses.

- Cons:

Limited coverage may lead to substantial out-of-pocket costs in case of unexpected health issues.

- Pros:

Public Versus Private Health Insurance for Expats

When expatriates select health insurance, they often grapple with the choice between public and private health insurance options. Each has its own set of characteristics, benefits, and constraints that can influence an expat’s decision.Public health insurance is typically government-provided, necessitating the payment of taxes or contributions. It can be beneficial due to its lower cost and accessibility. However, waiting times for treatment and limited choices in healthcare providers can be drawbacks.Private health insurance, on the other hand, offers more flexibility and faster access to healthcare services.

It allows expatriates to choose their preferred doctors and facilities. However, it often comes with higher premiums and may not cover all expenses.To better understand their characteristics, here’s a comparison:

- Public Health Insurance:

- Pros:

Lower costs for basic medical services, ensuring that essential healthcare is accessible to everyone.

- Cons:

Longer wait times for non-emergency procedures, potentially leading to delayed healthcare.

- Pros:

- Private Health Insurance:

- Pros:

Quick access to healthcare services and a broader choice of healthcare providers.

- Cons:

Can be significantly more expensive, especially for families or those with pre-existing conditions.

- Pros:

Understanding these options equips expatriates with the knowledge necessary to choose the most appropriate health insurance plan tailored to their unique needs and circumstances.

Factors to Consider When Choosing a Plan

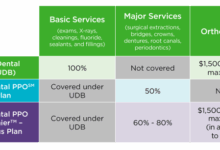

Source: website-files.com

Selecting a health insurance plan is a critical decision for expats, as it directly impacts access to medical care while living abroad. With various options available, understanding the key factors can help in making an informed choice that meets individual needs and circumstances.Before diving into the specifics of different plans, expats should assess several essential factors that could significantly affect their health coverage and overall well-being.

Evaluating these elements can prevent unexpected expenses and ensure comprehensive protection in case of medical emergencies.

Essential Coverage Features for Expats

When choosing a health insurance plan, expats must ensure that it includes essential features tailored to their unique needs. The following checklist Artikels key coverage aspects to consider:

- Emergency Medical Coverage: This should provide extensive coverage for emergencies, including hospitalization, surgeries, and ambulance services.

- International Coverage: Ensure that the plan offers worldwide coverage, especially if traveling frequently to other countries.

- Pre-existing Condition Coverage: Look for plans that cover pre-existing medical conditions, as this can be crucial for those with ongoing health issues.

- Repatriation of Remains: This is important for expats who may wish to return home in the event of a serious medical incident or death.

- Access to a Network of Hospitals and Doctors: A robust network ensures that quality care is available nearby and reduces out-of-pocket expenses.

- Prescription Medication Coverage: This should cover necessary medications, which can be particularly important for those managing chronic illnesses.

- Maternity and Newborn Care: If applicable, check for maternity coverage and newborn care provisions.

Evaluating these coverage features ensures that expats are not only covered for routine check-ups but also for serious health issues that may arise unexpectedly.

Reputation of the Insurance Provider and Customer Service

The insurance provider’s reputation plays a significant role in the decision-making process. A reliable insurer with a strong track record can provide peace of mind, while a poor reputation can lead to complications during claims handling. It’s essential to research the provider’s history, including their financial stability, customer reviews, and how they handle claims. Additionally, exceptional customer service is vital for addressing any concerns or questions that may arise during the policy’s life.

Consider the following when evaluating insurance providers:

- Claim Settlement Ratio: A high ratio indicates that the insurer successfully settles most claims, which is a good sign of reliability.

- Customer Support Availability: Check if support is available in your preferred language and through multiple channels like phone, chat, or email.

- Online Reviews and Testimonials: Look for feedback from other expats regarding their experiences, as this can provide insight into the provider’s service quality.

- Accessibility of Information: The provider should have easy-to-understand policy documents and an informative website.

By prioritizing these aspects, expats can secure a health insurance plan that not only meets their medical needs but also ensures support and service when they need it most.

Legal Requirements and Regulations

Source: vietnaminsiders.com

When relocating as an expatriate, understanding the legal requirements surrounding health insurance in your new country is crucial. Different nations have varying laws that dictate whether expats must have health insurance and what type of coverage is acceptable. This can significantly influence your overall living experience and financial planning while abroad.The legal landscape for health insurance can differ dramatically between countries.

In some regions, such as Germany and Australia, having health insurance is mandatory for all residents, including expats. Conversely, countries like Thailand and Mexico have more lenient regulations, where health insurance is not required by law, although strongly recommended. Understanding these differences is essential for expats as it can affect access to healthcare services and financial liabilities in case of medical emergencies.

Mandatory Health Insurance in Popular Expat Destinations

In many popular expatriate destinations, there are specific legal stipulations regarding health insurance. Below are key examples highlighting how regulations vary:

- Germany: Health insurance is mandatory for all residents. Expats must enroll in a public or private health insurance plan upon arrival. Failure to do so can result in significant fines and back payment requirements.

- Australia: While it’s not a requirement for expats to have health insurance, those on certain visas might need to show adequate health coverage to avoid penalties.

- United Arab Emirates: Health insurance is mandatory for all residents in Dubai and Abu Dhabi. Employers are responsible for providing health insurance, but expats not under employer plans must obtain their own, with penalties for non-compliance.

- Thailand: No legal requirement exists for health insurance, but it is highly recommended to avoid high out-of-pocket expenses in case of illness or injury.

- Spain: Expats are encouraged to have private health insurance, particularly if they are not eligible for the public system. Not having coverage can lead to high costs for medical services.

Understanding and complying with local health insurance regulations is not just a legal obligation, but a crucial step in ensuring your well-being while living abroad.

Penalties for Non-Compliance

Lack of health insurance can lead to various consequences depending on the destination. Many countries impose strict penalties on those who do not comply with health insurance regulations. Here are examples of what can occur if expats neglect this important aspect:

- Germany: Expats who do not secure health insurance within a specified timeframe may face exorbitant fines and be required to retroactively pay for the time they were uninsured.

- United Arab Emirates: Fines can be imposed for not having valid health insurance, which may accumulate monthly until coverage is obtained.

- Australia: While penalties are less stringent, expats might face additional costs during medical treatment without coverage, reflecting the importance of having insurance.

It’s essential to be aware of the local regulations and potential penalties to avoid financial strain and ensure access to necessary healthcare services.

Claims Process and Procedures

Filing a health insurance claim can seem daunting, especially for expatriates navigating a system that may differ significantly from their home country. Understanding the steps involved and preparing the necessary documentation can help streamline the process and ensure timely reimbursement of medical expenses. The claims process typically involves several key steps that expats need to follow closely. Each insurance provider may have specific requirements, but the general procedure remains relatively consistent across different companies.

Step-by-step Process for Filing a Claim

To effectively file a health insurance claim, expatriates should adhere to the following steps:

1. Seek Medical Attention

Ensure you receive the necessary medical care. Keep all invoices and receipts provided by the healthcare provider.

2. Notify Your Insurer

Contact your insurance provider as soon as possible after receiving treatment. This may involve filling out a claim form, which can usually be found on their website or obtained through customer service.

3. Gather Required Documentation

Collect all necessary documents, which typically include:

Original invoices from the healthcare provider

Receipts for any out-of-pocket expenses

Medical reports or notes from the treating physician

Completed claim form provided by the insurer

4. Submit Your Claim

Send all collected documents to your insurance company via their preferred method, often through online submission, email, or postal mail.

5. Follow Up

Keep track of your claim status by following up with your insurer if you haven’t received confirmation within a reasonable timeframe.

Common Documentation Required for Claims

Having the right documentation ready can expedite the claims process. The following is a list of common documents required when filing a health insurance claim:

Medical bills

Detailed invoices that break down services provided.

Claim form

A form specific to the insurer that captures details of the treatment received.

Proof of payment

Receipts or transaction records that show payment has been made for services rendered.

Medical reports

Documentation from the healthcare provider outlining the diagnosis and treatment given.

Challenges and Solutions During the Claims Process

Expatriates may encounter various challenges when filing health insurance claims. Some common issues include:

Language Barriers

Communication problems can arise if the documentation is in a language different from that of the insurance provider. To address this, consider having documents translated by a certified translator.

Lack of Familiarity with Local Procedures

Each country may have its own insurance processing protocols. Researching the specific regulations and practices in your host country can alleviate confusion.

Delayed Reimbursement

Claims may take longer to process than expected. To mitigate delays, ensure that all documents are submitted correctly and promptly. If the claim is taking too long, don’t hesitate to reach out to your insurer for updates.

“Being proactive and organized with your claim file can make all the difference during the claims process.”

By understanding these steps and being prepared with the necessary documentation, expatriates can navigate the claims process more effectively, ensuring they receive the benefits they are entitled to without unnecessary stress.

Tips for Managing Health Care Costs

Source: tedieka.com

Managing health care costs as an expat can be challenging, but with the right strategies in place, it’s entirely achievable. Understanding how to navigate the complexities of health insurance and health care systems in a new country can significantly reduce your financial burden. Here are some effective tips and preventative measures to keep your health care expenses manageable while living abroad.

Strategies for Cost Management

A proactive approach to managing health care costs is essential for expats. Keeping track of expenses, seeking preventive care, and understanding your insurance plan can save you money in the long run. Here are some strategies expats can employ to minimize their health care costs:

- Regular Health Check-ups: Schedule routine check-ups to catch potential health issues early, which can lead to lower treatment costs.

- Utilize Preventive Services: Take advantage of preventive services covered by your health insurance, such as vaccinations and screenings.

- Compare Prices: Different providers may charge varying amounts for the same services. Always compare prices before proceeding with treatments.

- Seek Local Care: Familiarize yourself with local health care options, which can often be more affordable than international facilities.

- Maintain a Healthy Lifestyle: Engage in regular exercise and eat a balanced diet to reduce the risk of chronic diseases, which can lead to expensive treatments.

Preventative Care Measures

Investing in preventative care is key to reducing long-term health care expenses. Here’s a list of important measures that expats can take to maintain their health and avoid costly medical bills:

- Annual Physical Exams: These help monitor your overall health and preemptively identify any issues.

- Regular Dental Check-ups: Dental problems can escalate if not treated early, leading to higher costs down the line.

- Routine Eye Exams: Vision problems can be addressed more effectively with regular assessments.

- Vaccinations: Stay updated with the necessary vaccinations to protect against diseases prevalent in your host country.

- Mental Health Checks: Mental well-being is crucial; regular counseling or therapy can prevent severe conditions that are costly to treat.

Understanding Out-of-Pocket Expenses and Deductibles

Being informed about out-of-pocket expenses and deductibles is vital for budgeting health care costs effectively. Out-of-pocket expenses include any costs not covered by your insurance plan, such as copayments and coinsurance. Deductibles are the amounts you must pay before your insurance begins to cover costs.

“Understanding your insurance plan’s specifics can help you strategize your health care spending and avoid unexpected costs.”

Expats should familiarize themselves with the terms and conditions of their health insurance policies, including what is covered and what is not. This knowledge can help in planning for potential medical expenses and deciding when to seek care. Being aware of your plan’s coverage limits can prevent surprises during a health crisis.

Access to Healthcare Services

Access to healthcare services is a critical aspect of life for expatriates. The experience can greatly vary depending on the country of residence, impacting not only the quality of care but also the convenience and speed of obtaining medical assistance. Understanding the nuances of local healthcare systems before relocating can significantly enhance the expatriate experience and ensure adequate health management.The variation in access to healthcare services for expats often hinges on multiple factors, including the country’s healthcare infrastructure, governmental regulations, and cultural attitudes towards medicine.

In some countries, such as Germany and Sweden, healthcare systems are robust, offering a wide array of services with well-trained professionals. In contrast, other nations may have limited facilities or a shortage of specialists, making it challenging for expats to receive timely care.

Understanding Local Healthcare Systems

Before moving, it’s essential for expats to familiarize themselves with the healthcare landscape of their destination. This knowledge can help them navigate potential challenges and utilize available services effectively. Consider the following aspects:

- Healthcare Infrastructure: Assess the quality of hospitals, clinics, and healthcare providers available in the area. Regions with modern facilities, such as Singapore and Japan, generally provide superior care compared to areas with underfunded systems.

- Government Regulations: Understand the legalities surrounding healthcare access, including any residency requirements or eligibility criteria for public health services. Countries like Canada offer universal health coverage, while others might require private insurance for expats.

- Cultural Attitudes: The approach to healthcare can differ greatly. In some cultures, preventive care is prioritized, while in others, treatment is sought only after symptoms arise. This can affect how expats interact with local healthcare services.

Availability of Specialists and Emergency Services

The availability of specialists and emergency services also varies dramatically by region. In urban centers across Europe and North America, expats often find a wide range of specialists available, equipped with the latest technology. However, in rural areas or developing countries, such services could be sparse or require long travel distances. Key points to consider include:

“A well-functioning emergency service is crucial for expats, particularly in the case of sudden health issues or accidents.”

- Emergency Response Times: In countries like Australia and the UK, emergency services are swift and efficient, often arriving within minutes. In contrast, response times in less developed countries can be significantly longer, which could pose risks during critical situations.

- Specialist Availability: Finding a cardiologist or orthopedic surgeon may be straightforward in cities with developed healthcare systems, but in other regions, access may be limited, necessitating travel to larger urban areas.

- Language Barriers: Communication is key in healthcare. Countries with a high population of English speakers, such as the Netherlands, often provide easier access to specialists who can communicate effectively with expats. Language barriers in other regions may complicate consultations and treatment plans.

By understanding these factors and their implications, expats can better prepare for their healthcare needs and ensure a smoother transition into their new environment.

Resources for Expats

Finding the right resources for health insurance can be crucial for expatriates living abroad. With the complexities involved in navigating different healthcare systems, having access to reliable information and support networks is invaluable. By tapping into online resources and communities, expats can gain insights that help simplify the process of securing adequate health insurance.There are numerous online resources and organizations dedicated to supporting expatriates with health insurance questions and concerns.

These platforms not only provide information but also create a community where expats can share their experiences and advice regarding healthcare options abroad.

Online Resources and Communities

Many websites and online platforms cater specifically to expatriates, offering guidance on health insurance and other essential services. Engaging with these resources can help expats make informed choices about their health coverage. Below are some noteworthy online platforms:

- Expat.com: A global community that connects expatriates and provides forums for discussing health insurance and other expatriate concerns.

- International Insurance: This site offers comprehensive comparisons of health insurance plans tailored for expats, along with detailed guides and articles.

- Expatriate Health Insurance: A resource aimed at helping expats understand their health insurance options and navigate the local healthcare systems.

- Facebook Groups: Numerous groups on Facebook offer space for expats to share their experiences and recommendations about health insurance providers and plans.

Organizations Assisting Expats

In addition to online resources, several organizations provide direct support for expatriates facing health insurance challenges. These organizations can offer personalized assistance and answer specific queries about health coverage abroad. Key organizations include:

- International Organization for Migration (IOM): Provides resources and guidance for expatriates regarding health and insurance matters.

- Consular Services: Many governments have consulates that provide information on health insurance requirements and options for their citizens living abroad.

- Health Insurance Brokers: Local brokers specializing in international health insurance can help expats find suitable plans and clarify policy details.

Networking with Other Expats

Networking with fellow expatriates can be an excellent way to gather firsthand insights and recommendations regarding health insurance. By discussing shared experiences, expats can discover valuable tips and tricks that might not be available through formal channels. Engaging with local expat communities, attending meetups, or participating in online forums can facilitate these connections.

“Connecting with other expats can significantly enhance your understanding of navigating health insurance options in a foreign country.”

Conclusive Thoughts

In summary, navigating health insurance as an expat can be a daunting task, but with the right information and resources, it becomes manageable. Understanding the different types of plans, assessing personal needs, and knowing legal requirements are crucial steps in this journey. Ultimately, investing time in researching and selecting an appropriate health insurance plan can lead to a safer, healthier, and more enjoyable experience living abroad.

Q&A

Do I need health insurance as an expat?

Yes, having health insurance is essential for expatriates to cover medical expenses and comply with local regulations in many countries.

What is the difference between public and private health insurance for expats?

Public health insurance is typically government-sponsored and may have lower costs, while private health insurance offers more comprehensive coverage and quicker access to services.

Can I use my home country insurance while abroad?

It depends on your policy; some home country plans provide limited coverage overseas, while others may not cover international services at all.

What are the common health risks for expats?

Common health risks include exposure to different diseases, lack of access to familiar healthcare systems, and challenges in obtaining necessary medications.

How can I lower my health insurance costs as an expat?

You can lower costs by opting for a plan with higher deductibles, using preventive care services, and comparing multiple insurance providers.