Hidden Costs Of Buying A New Home You Should Prepare For

Hidden Costs of Buying a New Home You Should Prepare For unveils the intricate layers of expenses often overlooked by first-time buyers. Homeownership is an exciting journey, yet it comes with financial surprises that can catch you off guard if you’re not prepared. Understanding these hidden costs is crucial as they play a significant role in the overall affordability and sustainability of your new living situation.

This article will guide you through the most common hidden costs associated with purchasing a new home, ensuring you are armed with knowledge and ready to navigate the complexities of home buying. From closing costs to maintenance fees, we will highlight the essential factors to consider before making this significant investment.

Introduction to Hidden Costs

Source: com.au

When it comes to buying a new home, many potential homeowners often focus on the sticker price, overlooking various additional expenses that can arise. These hidden costs can significantly impact the overall financial picture of homeownership. Being aware of these expenses is essential to avoid any unwelcome surprises down the road and to ensure that you’re fully prepared for the financial commitment involved in purchasing a home.Understanding hidden costs is crucial because they often accumulate and can affect your budget in ways that aren’t immediately apparent.

Many first-time buyers underestimate these expenses, which can range from minor to substantial. By recognizing these costs upfront, buyers can make more informed decisions and avoid potential financial strain. Common hidden costs associated with purchasing a new home can include, but are not limited to, closing costs, property taxes, insurance, and maintenance.

Common Hidden Costs in Home Buying

Navigating the financial landscape of home buying requires a thorough understanding of potential hidden costs that can impact your budget. It’s important to examine these common expenses to prepare adequately for your new investment.

- Closing Costs: These fees typically range from 2% to 5% of the home’s purchase price and can include loan origination fees, appraisal fees, and title insurance. For example, on a $300,000 home, closing costs could be between $6,000 and $15,000.

- Property Taxes: Homeowners must pay property taxes annually, which can vary significantly based on location. For instance, cities with higher public service needs often impose higher tax rates.

- Homeowners Insurance: This insurance protects against damages and liabilities. On average, homeowners pay around $1,200 annually, but costs can escalate based on home value and location risks, such as flooding or earthquakes.

- Maintenance and Repairs: Owning a home requires ongoing maintenance. A good rule of thumb is to budget 1% to 3% of the home’s value each year for repairs. For a $300,000 home, this equates to $3,000 annually.

- Utilities: Utility costs can increase significantly once you move in. It’s essential to factor in water, gas, electricity, and trash services, which can be more than expected.

- Homeowners Association (HOA) Fees: If your new home is within a community governed by an HOA, be prepared for monthly or annual fees that cover maintenance of common areas and amenities.

“By understanding and preparing for hidden costs, homebuyers can safeguard their finances and make more informed purchasing decisions.”

Closing Costs

Buying a new home comes with a range of expenses that extend beyond the purchase price, and one of the most significant categories of these expenses is closing costs. Often overlooked by prospective buyers, closing costs can add thousands of dollars to your home purchase. Understanding these costs is crucial for effective budget planning and financial preparedness when entering the real estate market.Closing costs encompass various fees incurred during the transaction, and they can vary significantly based on location, type of loan, and other factors.

These costs typically include several components, such as title insurance, appraisal fees, and attorney fees. Being aware of these expenses and their breakdown can help buyers avoid unpleasant surprises at the closing table.

Typical Closing Costs

A variety of fees contribute to the total closing costs, and it’s essential to comprehend each component. Here are some common closing costs that buyers might overlook:

- Title Insurance: Protects against losses from disputes over property ownership.

- Appraisal Fees: Required to establish the home’s market value, ensuring the lender is not over-lending on the property.

- Attorney Fees: Costs associated with hiring a lawyer to review documents and facilitate the closing process.

- Inspection Fees: Charged for home inspections to identify potential issues before purchase.

- Recording Fees: Fees charged by the local government to officially record the new ownership.

Understanding these costs can help buyers anticipate the total outlay needed at closing and avoid financial strain.

Breakdown of Closing Costs

To give you a clearer picture of how closing costs add up, here’s a detailed breakdown with average ranges for each type of cost involved:

| Closing Cost Item | Average Range ($) |

|---|---|

| Title Insurance | 1,000 – 2,500 |

| Appraisal Fees | 300 – 600 |

| Attorney Fees | 500 – 1,500 |

| Inspection Fees | 300 – 500 |

| Recording Fees | 50 – 150 |

This table provides a comprehensive view of the typical closing costs buyers should expect to encounter. By preparing for these expenses, buyers can ensure a smoother closing process and avoid any last-minute financial hurdles.

Home Inspections

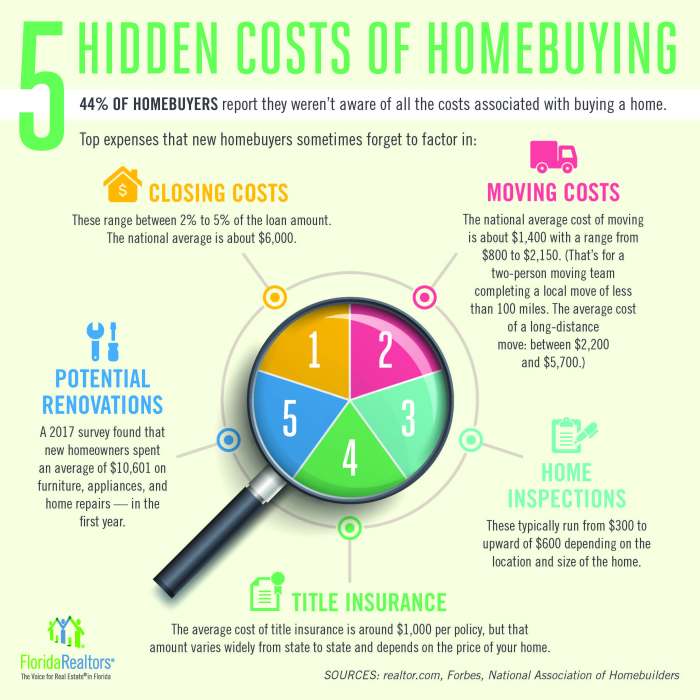

Source: floridarealtors.org

A thorough home inspection is a vital step in the home-buying process that can save you from unexpected costs and significant headaches down the road. This process involves a detailed examination of the property by a qualified inspector, ensuring that any hidden issues are identified before you finalize your purchase. Investing in a home inspection not only provides peace of mind but can also be a powerful negotiating tool when it comes to settling on the final price.Conducting a proper home inspection can unveil potential problems that may not be immediately visible, making it essential to consider various types of inspections.

Different aspects of the home, such as its structural integrity, electrical systems, and pest infestations, may require specialized inspections. The costs associated with these inspections can vary significantly based on the type and complexity of the assessment needed. For instance, a general home inspection may cost between $300 and $500, while a specialized inspection, such as for pests or roofing, could range from $100 to $1,000 or more depending on the specifics involved.

Types of Home Inspections and Associated Costs

Understanding the common types of inspections and their typical costs can help you allocate your budget effectively. Each inspection serves a distinct purpose and can uncover unique issues that require attention.

- General Home Inspection: This comprehensive inspection checks the overall condition of the home, including the roof, plumbing, electrical systems, and appliances. Expect to pay around $300 to $500.

- Pest Inspection: Conducted to identify any current or potential pest infestations, particularly termites. This inspection typically costs between $100 and $300.

- Roof Inspection: Focuses on the condition of the roofing materials, structures, and drainage systems. Costs can range from $200 to $400, depending on roof size and complexity.

- Foundation Inspection: A critical assessment of the home’s foundation, which can reveal serious structural issues. This inspection often costs $300 to $1,000 based on the home’s size and complexity.

- Radon Testing: Important for homes in areas where radon gas is a concern. This test usually costs between $100 and $250.

A home inspection checklist is crucial to ensure a thorough evaluation. Here are the key areas to focus on:

“A comprehensive checklist can guide you in identifying potential problems before finalizing your purchase.”

Home Inspection Checklist

Here’s a detailed checklist to keep in mind during a home inspection, which can help ensure nothing is overlooked:

- Exterior: Check for cracks in the foundation, condition of the siding, gutters, and grading around the house.

- Roof: Look for missing or damaged shingles, signs of leaks, and the condition of flashing and chimney.

- Interior: Examine walls, floors, and ceilings for stains or cracks that indicate water damage or structural issues.

- Plumbing: Inspect pipes for leaks, check the water pressure, and test the water heater for functionality.

- Electrical Systems: Ensure all outlets work, check for exposed wires, and verify the condition of the electrical panel.

- HVAC Systems: Evaluate the heating and cooling systems, including age, maintenance history, and functionality.

- Basement and Crawl Space: Look for signs of moisture or pests, and assess the overall condition of the foundation.

- Appliances: Test the functionality of included appliances such as stoves, refrigerators, and dishwashers.

Taking the time to conduct thorough home inspections, considering the associated costs, and using an effective checklist can significantly enhance your home-buying experience. Being proactive in identifying potential issues not only protects your investment but also empowers you to make informed decisions throughout the purchasing process.

Maintenance and Repairs

Owning a new home comes with various responsibilities, particularly in the realm of maintenance and repairs. While many first-time homeowners may focus solely on the purchase price and financing, it’s crucial to budget for ongoing expenses that can arise after closing. Understanding these costs can help you manage your finances more effectively and ensure your home remains in good condition.Regular maintenance is vital for preserving your property and can vary depending on the age and condition of your home.

Homeowners should anticipate costs related to routine upkeep as well as potential repairs that may be needed shortly after taking possession. It’s essential to be proactive in addressing maintenance issues to avoid larger, more expensive repairs down the line.

Ongoing Maintenance Costs

The following are some common maintenance tasks that homeowners should budget for annually. These costs can add up, but they are necessary for ensuring your home remains a safe and comfortable environment.

- HVAC system maintenance: $150 – $500 per year

- Landscaping and yard maintenance: $300 – $1,000 per year

- Gutter cleaning and maintenance: $100 – $300 per year

- Roof inspection and maintenance: $200 – $400 every few years

- Pest control: $300 – $600 per year

- Painting and exterior maintenance: $300 – $800 every few years

Potential Repair Expenses

Soon after moving into a new home, homeowners may face unexpected repair expenses. It’s wise to set aside funds for these potential issues, as they can arise from normal wear and tear or even from the previous homeowner’s neglect.A variety of common repairs may be needed shortly after purchasing, including plumbing issues, electrical repairs, or even structural fixes. Being prepared for these eventualities can mitigate financial strain.

Common Repairs and Estimated Costs

It’s important to know what repairs you may need to address and their associated costs. Below is a list of typical repairs new homeowners may encounter:

- Plumbing repairs (leaky faucets, pipe repairs): $150 – $600

- Electrical repairs (outdated wiring, fixture replacements): $150 – $1,000

- Water heater replacement: $800 – $1,500

- Foundation repairs: $2,000 – $7,000

- Roof replacement: $5,000 – $15,000

- Appliance repairs or replacements (stove, refrigerator, etc.): $100 – $3,000

Understanding these ongoing maintenance and repair costs can help you budget effectively and ensure your new home remains a place of comfort and security. Being prepared for these expenses allows you to enjoy your new living space without the stress of unexpected financial burdens.

Property Taxes and Insurance

When buying a new home, understanding the implications of property taxes and insurance is crucial to your overall financial planning. These costs can vary significantly based on location, property value, and individual circumstances, and it’s essential to prepare for them to avoid any unpleasant surprises down the road.Property taxes are levied by local governments and can fluctuate after your home purchase.

They are usually based on the assessed value of your property, which can increase due to renovations or market shifts. As a homeowner, you might initially face a lower tax rate, but reassessments can lead to higher taxes over time. Knowing how your local tax authority calculates these taxes will help you budget effectively for future changes.

Types of Homeowners Insurance and Their Costs

Homeowners insurance is a necessary expense that protects your investment and personal belongings. Various types of policies are available, each offering different levels of coverage. It’s important to understand these types and their associated costs to ensure adequate protection for your home.The following are common types of homeowners insurance policies:

- HO-1: Basic Form

-This is the most limited coverage, covering only specific perils like fire or theft. - HO-2: Broad Form

-This policy covers more perils than HO-1 and includes damages from things like falling objects or the weight of snow. - HO-3: Special Form

-This is the most common type, covering your house against all risks except those specifically excluded, and providing personal property coverage for named perils. - HO-4: Renters Insurance

-This insurance is for tenants, covering personal property and liability but not the structure itself. - HO-5: Comprehensive Form

-This policy offers the most extensive coverage for both the home and personal property on an open-perils basis. - HO-6: Condominium Insurance

-This covers personal property and any improvements you make to your condo. - HO-7: Mobile Home Insurance

-This is designed specifically for mobile or manufactured homes.

The costs associated with homeowners insurance can vary significantly based on the amount of coverage, the deductible you choose, and your property’s location. On average, homeowners can expect to pay between $500 and $2,000 annually, depending on these factors.

Comparison of Homeowners Insurance Policies

To help you navigate the various options available, here’s a comparison table outlining the coverage options for different types of homeowners insurance policies:

| Policy Type | Dwelling Coverage | Personal Property Coverage | Liability Coverage | Natural Disaster Coverage |

|---|---|---|---|---|

| HO-1 | Limited (specific perils) | No | Basic | No |

| HO-2 | Broad (more perils) | Limited | Basic | No |

| HO-3 | All-risks (except exclusions) | Named perils | Moderate | Limited |

| HO-4 | No | Personal property | Moderate | No |

| HO-5 | All-risks | All-risks | Comprehensive | More comprehensive |

| HO-6 | Improvements only | Personal property | Moderate | No |

| HO-7 | Limited (specific perils) | Limited | Basic | No |

In conclusion, it’s pivotal to understand the implications of property taxes and homeowners insurance when purchasing a new home. This knowledge will empower you to make informed financial decisions, ensuring long-term security for your investment.

Utilities and Home Services

When moving into a new home, understanding the costs associated with utilities and home services is essential. These expenses can vary significantly based on location, the size of the home, and individual consumption habits. Being prepared for these costs can help you avoid surprises in your monthly budget.Setting up essential services like electricity, water, and internet involves initial setup fees as well as ongoing monthly costs.

Many homeowners underestimate these expenses, which can lead to financial strain if not accurately accounted for. It’s important to consider both the fixed and variable costs associated with utilities to get a clear picture of what to expect.

Setup Costs and Monthly Expenses

Establishing utilities and home services often comes with initial setup costs that need to be factored into your budget. These costs can include installation fees, deposits, and activation charges. Here are some of the typical services and their associated costs:

- Electricity: Setup fees can range from $50 to $200, depending on the provider and region.

- Water: Typically, the connection fee varies from $20 to $100, plus a possible deposit.

- Internet: Installation fees can be $50 to $150, plus equipment rental charges around $10 to $15 monthly.

Monthly utility expenses can fluctuate greatly based on factors such as your home’s size, the number of occupants, and local climate conditions. For example, air conditioning needs in hot climates can significantly increase electricity bills during summer months.To give you a clearer picture, here’s an overview of average monthly utility costs across different regions and home sizes:

| Region | 1-Bedroom Apartment | 3-Bedroom House |

|---|---|---|

| Urban Area | $150 | $300 |

| Suburban Area | $120 | $250 |

| Rural Area | $100 | $200 |

“Understanding your utility costs is crucial for successful homeownership and financial planning.”

Considering these expenses in your budget will provide a more accurate depiction of your financial responsibilities as a homeowner. Always remember to check with local providers for the most accurate and up-to-date cost information.

Homeowners Association (HOA) Fees

Homeowners Associations (HOAs) play a significant role in maintaining the standards and values of residential communities. These organizations are typically formed in planned neighborhoods, condominiums, or townhome developments, and they often manage shared amenities and services. While living in an HOA community can offer various benefits, it also comes with fees that homeowners must be prepared for.HOA fees can vary widely depending on the community and the amenities offered.

In some neighborhoods, fees might be minimal, covering only basic services, while in others, they can be substantial, reflecting a comprehensive array of facilities and services. Homeowners should understand what their fees contribute to, as these costs can impact monthly budgets significantly.

Services and Benefits Covered by HOA Fees

HOA fees typically cover a range of services that enhance the living experience within the community. Understanding what these fees entail is crucial for homeowners. Here are some common services and benefits that are generally included:

- Maintenance of common areas: This includes landscaping, lawn care, and the upkeep of amenities such as parks, pools, and clubhouses.

- Security services: Many HOAs provide security patrols or gated access to enhance safety within the community.

- Community amenities: Access to facilities such as gyms, sports courts, playgrounds, and event rooms are often available to residents.

- Trash and recycling services: Some HOAs include waste management in their fees, providing residents with a convenient solution for garbage disposal.

- Insurance for common areas: HOAs often carry insurance that protects shared property and facilities, helping to mitigate financial risks for homeowners.

- Community events: Fees may also fund social gatherings, holiday celebrations, and other community-building activities.

- Utilities for common areas: This can include water and electricity for pools, street lighting, and other shared facilities.

“Understanding the full scope of HOA fees can prevent surprises and ensure that homeowners are fully informed about their community’s financial responsibilities.”

Moving Costs

When you purchase a new home, one of the significant hidden costs you need to prepare for is the expense of moving. It’s not just about transporting your belongings; moving can encompass a variety of expenses that add up quickly. Understanding these costs ahead of time helps you budget effectively and ensures a smoother transition to your new home.Moving costs can include a range of expenses such as truck rentals, fuel, packing supplies, and even the expenses associated with hiring professional movers.

Each of these components plays a role in the overall cost of relocating, making it crucial to map out a comprehensive budget. Before you start packing, it’s wise to develop a financial plan that accounts for all potential moving-related expenses.

Budgeting for Moving Costs

Creating a budget for moving expenses requires a clear understanding of what you will need. Below are some essential considerations to help you estimate costs effectively:

- Truck Rental: If you plan to move your belongings yourself, you’ll need to consider the cost of renting a moving truck. Prices can vary based on the size of the truck and the distance of your move.

- Fuel Expenses: Don’t forget to factor in fuel costs, especially if you’re traveling a long distance. This can significantly increase your overall moving expenses.

- Packing Supplies: Budget for boxes, tape, bubble wrap, and other packing materials. Estimated costs for these supplies can range from $50 to several hundred dollars.

- Professional Movers: If hiring movers, get quotes from multiple companies. Prices can vary widely based on services provided and distance.

- Insurance: Consider purchasing moving insurance if you’re hiring professional movers, to protect your belongings during the move.

A checklist can also be an effective tool for estimating your moving expenses. Here’s a useful checklist to help you keep track of all potential costs:

Moving Expenses Checklist

This checklist will guide you through estimating your moving expenses, ensuring you don’t overlook any critical costs:

- Truck rental fee

- Fuel costs

- Packing materials (boxes, tape, bubble wrap)

- Professional mover’s fees

- Insurance for your belongings

- Costs associated with disconnecting and reconnecting utilities

- Storage fees (if needed)

- Cleaning supplies for your old and new homes

- Cost of meals during the moving process

- Childcare or pet care services during the move

By evaluating each item on this checklist, you can create a comprehensive budget that reflects your unique moving situation. Remember, the key to managing moving costs lies in careful planning and preparation, so take the time to calculate these estimates well in advance.

Future Resale and Market Changes

Source: co.uk

When buying a home, it’s essential to look beyond immediate comfort and aesthetics to consider the potential for future resale value. A property is not only a place to live but also a significant financial investment. Understanding how market trends and neighborhood dynamics could affect your home’s depreciation or appreciation is crucial for making a wise purchase decision.Market fluctuations can have a considerable impact on the resale value of a home.

Economic conditions, interest rates, and local demand all play a role in determining how much a property will sell for in the future. If you plan to renovate before selling, it’s also important to evaluate whether the costs of improvements will be recouped in the overall sale price. Certain renovations may add value, while others could be considered poor investments.

Neighborhood Value Trends

Assessing neighborhood trends can provide insight into potential resale values. Over time, some areas may experience significant appreciation, while others could decline. It’s helpful to compare historical home values in various neighborhoods. The following table illustrates how home values have changed in three neighborhoods over the last decade, highlighting the importance of location in real estate investments.

| Neighborhood | 2013 Average Home Value | 2023 Average Home Value | Percentage Change |

|---|---|---|---|

| Greenwood | $250,000 | $350,000 | 40% |

| Oakwood | $300,000 | $280,000 | -7% |

| Maplewood | $200,000 | $400,000 | 100% |

Understanding these trends can guide potential buyers in making informed decisions. For example, Maplewood has shown remarkable growth, suggesting a strong investment, while Oakwood may not be the best choice if future appreciation is a priority.

“Investing in a property is not just about finding a place to live but also about making a sound financial decision for the future.”

Whether contemplating renovations or selecting a neighborhood, being aware of the market landscape is vital. Future resale value is not merely a consideration; it’s a key component of a successful home-buying strategy.

Final Thoughts

In summary, being aware of the Hidden Costs of Buying a New Home You Should Prepare For is vital for any prospective homeowner. By understanding the various expenses beyond the purchase price, you can make informed decisions and avoid financial strain down the road. This preparation not only helps you budget effectively but also ensures a smoother transition into your new abode, allowing you to focus on creating lasting memories in your dream home.

FAQ Compilation

What are closing costs?

Closing costs are fees associated with finalizing a real estate transaction, including title insurance, appraisal fees, and legal fees.

How can I budget for moving costs?

To budget for moving costs, consider expenses for packing materials, transportation, and professional movers. Create a checklist to estimate these costs accurately.

What should I look for in a home inspection?

During a home inspection, check for issues with plumbing, electrical systems, roofing, and structural integrity. A detailed checklist can help ensure you cover all critical areas.

How often should I expect maintenance costs?

Maintenance costs can vary, but budgeting around 1% of your home’s value annually for ongoing maintenance is a good rule of thumb.

What are HOA fees, and what do they cover?

HOA fees are charges associated with living in a community governed by a homeowners association, covering services such as landscaping, maintenance of common areas, and sometimes utilities.