How To Build A Real Estate Portfolio From Scratch

How to Build a Real Estate Portfolio from Scratch is an essential guide for aspiring investors looking to make their mark in the real estate market. With the right knowledge, strategies, and dedication, anyone can start to build a robust portfolio that stands the test of time. This overview will walk you through key concepts from understanding real estate portfolios to expanding your investments.

Throughout this journey, we will explore vital components like setting clear investment goals, financing options, and the types of real estate investments available. By diving into practical tips on market research, property management, and networking, you’ll be well-equipped to turn your real estate dreams into reality.

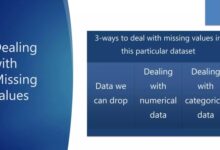

Understanding Real Estate Portfolios

A real estate portfolio represents a collection of investment properties owned by an individual or entity, strategically assembled to generate income and build wealth over time. Understanding the significance of a real estate portfolio is crucial for anyone looking to achieve long-term financial success through property investment. A well-structured portfolio can provide not only financial returns but also diversification, risk management, and potential tax advantages.The components of a diversified real estate portfolio include various types of properties, geographical locations, and investment strategies.

This diversification helps mitigate risks associated with market fluctuations, economic downturns, and location-specific challenges. The core components typically consist of residential properties, commercial properties, industrial real estate, and real estate investment trusts (REITs), each serving a distinct purpose within the portfolio.

Components of a Diversified Real Estate Portfolio

To build a robust real estate portfolio, it is essential to understand the different components and their roles. A diversified portfolio can include:

- Residential Properties: These include single-family homes, multi-family units, and vacation rentals. They often provide steady cash flow and appreciation potential.

- Commercial Properties: Office buildings, retail spaces, and warehouses fall into this category. They typically offer longer lease terms and higher returns but come with increased management responsibilities.

- Industrial Real Estate: Properties such as manufacturing plants and distribution centers are essential for businesses and can yield attractive returns, especially in growing markets.

- Real Estate Investment Trusts (REITs): Investing in REITs allows individuals to gain exposure to real estate without direct ownership, providing liquidity and diversification across many properties.

Active and Passive Real Estate Investing

Active and passive investing in real estate represents two distinct strategies. Active investing involves direct management and decision-making concerning properties, often requiring significant time and expertise. Investors may engage in house flipping, rental property management, or real estate development, all of which demand hands-on involvement.In contrast, passive investing allows individuals to invest in real estate without the day-to-day management responsibilities.

This method includes investing in REITs or real estate crowdfunding platforms, where investors can benefit from property income and appreciation while relying on professionals to manage the investments.

“Active investors often enjoy greater control over their investments, while passive investors benefit from reduced involvement and diversified risk.”

Setting Investment Goals

Establishing clear investment goals is a crucial step when building a real estate portfolio from scratch. It provides direction and helps in measuring progress over time. By defining what you want to achieve, you can create a roadmap that aligns your real estate investments with your overall financial aspirations.

Understanding the distinction between short-term and long-term investment goals is essential for structuring your portfolio effectively. Short-term goals are typically more focused on immediate cash flow or quick returns, while long-term goals involve broader objectives such as wealth accumulation and retirement planning. To ensure that your real estate investments align with your financial aspirations, it’s important to have a comprehensive strategy that accommodates both types of goals.

Identifying Short-term and Long-term Investment Goals

When setting investment goals, consider both immediate returns and future aspirations. Here are key aspects to evaluate:

- Short-term Goals: These may include generating cash flow from rental properties, flipping houses for quick profits, or building equity in your current holdings. For instance, aiming for a specific monthly income from rental properties can provide an immediate financial boost.

- Long-term Goals: Focus on building overall wealth, preparing for retirement, or creating a legacy for future generations. An example is targeting a net worth milestone through property appreciation and capital gains over 10-20 years.

Establishing SMART goals—Specific, Measurable, Achievable, Relevant, and Time-Bound—can help in formulating clear objectives that are easy to follow. For example, instead of saying “I want to invest in real estate,” a SMART goal would be “I aim to acquire three rental properties over the next five years that generate a combined monthly income of $3,000.”

Aligning Personal Financial Goals with Real Estate Investments

Aligning your real estate investment goals with your personal financial objectives maximizes the effectiveness of your portfolio. Here are strategies to ensure this alignment:

- Assess Your Financial Situation: Start by evaluating your current income, expenses, assets, and liabilities. This will help you understand how much you can invest and what level of risk you can tolerate.

- Establish a Budget: Create a detailed budget that includes your investment goals. Ensure that you allocate funds for investments without jeopardizing your personal financial stability.

- Consider Tax Implications: Understand how real estate investments affect your taxes. This knowledge can guide you in choosing properties that offer tax advantages, such as depreciation and mortgage interest deductions.

Consulting with a financial advisor or a real estate expert can provide insights into how best to align your investments with your broader financial objectives.

Understanding Risk Tolerance and Its Impact on Investment Decisions

Risk tolerance plays a pivotal role in shaping your investment strategy. It reflects your ability and willingness to withstand fluctuations in the market. Understanding your risk tolerance is essential, as it informs the types of properties to invest in and the strategies to employ.

To evaluate your risk tolerance, consider the following factors:

- Investment Timeline: A longer investment horizon may allow you to take on more risk, as you have time to recover from potential downturns.

- Financial Stability: If you have a stable income and emergency savings, you may be more comfortable taking risks compared to someone with limited financial flexibility.

- Market Knowledge: A deep understanding of the real estate market can reduce perceived risks. The more informed you are, the more confident you will feel in making investment decisions.

“Understanding your risk tolerance is crucial; it not only influences your investment choices but also impacts your peace of mind as you navigate the real estate landscape.”

By being introspective about your financial goals and risk appetite, you can set a solid foundation for your real estate portfolio, ensuring it grows in alignment with your aspirations and needs.

Financing Your Real Estate Investments

Navigating the world of real estate investment requires a firm grasp of financing options. Understanding how to fund your property purchases can significantly impact your portfolio’s growth and sustainability. This section explores various financing methods available to investors, each with its unique advantages and disadvantages, helping you make informed decisions.

Financing Options for Real Estate Investments

Investors can choose from several financing methods to fund their real estate investments. Each option comes with its own set of characteristics that can influence your overall investment strategy. Here’s an overview of the most common options:

- Traditional Loans: Conventional mortgages offered by banks or credit unions are the most common choice. These loans usually require a good credit score and a substantial down payment, often around 20% of the purchase price.

- Hard Money Loans: These are short-term loans secured by real estate, typically provided by private investors or companies. Hard money loans often require minimal documentation but come with higher interest rates.

- Private Financing: This involves borrowing money from private individuals or organizations, often based on personal relationships. Terms can be flexible, but interest rates may vary significantly.

Pros and Cons of Using Leverage in Real Estate

Leverage refers to using borrowed capital to increase the potential return on investment. While leveraging can amplify gains, it also introduces risks that investors must consider.

Using leverage allows investors to control more assets with less capital, potentially leading to higher returns.

The benefits of leveraging your investments include the ability to purchase more properties than you could with cash alone, tax deductions on interest payments, and increased cash flow from rental income. However, the drawbacks include the risk of losing your investment if the market declines, the obligation to meet monthly payments regardless of rental income fluctuations, and potential foreclosure if you default.

Comparison of Financing Options

To illustrate the differences among financing types, the following table provides a clear comparison of traditional loans, hard money loans, and private financing options:

| Financing Type | Interest Rates | Loan Terms | Approval Process | Best For |

|---|---|---|---|---|

| Traditional Loans | 3-7% | 15-30 years | Lengthy (30-60 days) | Long-term investments with good credit |

| Hard Money Loans | 8-15% | 6 months to 3 years | Quick (1-2 weeks) | Flipping properties or short-term investments |

| Private Financing | Varies widely (5-12%) | Flexible | Variable (can be quick) | Investors with personal connections |

Researching Real Estate Markets

Identifying promising real estate markets is a crucial step in building a successful portfolio. This process involves understanding various market dynamics, evaluating property values, and using available tools for comprehensive analysis. Effective market research lays the groundwork for informed investment decisions and maximizes the potential for returns.Understanding how to analyze market trends and property values can significantly impact investment choices.

A strong real estate market is characterized by factors such as population growth, job opportunities, and economic stability. Evaluating these elements can help pinpoint areas that are likely to appreciate in value. Additionally, keeping an eye on local regulations, zoning laws, and infrastructure developments can provide insights into future market potential.

Identifying Promising Markets

Several key indicators can help investors identify promising real estate markets. These indicators can be effectively analyzed through various methods:

- Population Growth: Markets experiencing population growth often see increased demand for housing. Tracking census data and demographic trends can provide essential insights into potential markets.

- Employment Opportunities: Areas with a strong job market attract residents. Investigate local employment statistics and major employers in the region to gauge economic stability.

- Real Estate Trends: Analyzing trends such as median home prices and rental rates can help determine if a market is appreciating or depreciating. Historical data can be found through local real estate boards or national databases.

- Infrastructure Developments: Upcoming infrastructure projects, like highways or public transport systems, can increase property values in the vicinity. Research local government announcements and planning departments for information on proposed developments.

- School District Ratings: Properties located in high-rated school districts tend to have higher values and attract families. Utilize school district rankings available from educational resources to assess this factor.

Analyzing Market Trends

To analyze market trends and property values comprehensively, investors should focus on a combination of quantitative and qualitative data. Understanding both aspects provides a more rounded view of the market landscape.

“Market analysis is not just about numbers; it’s about understanding the story those numbers tell.”

Start with quantitative analysis by utilizing tools such as:

- Multiple Listing Service (MLS): Access current listings, sales data, and historical trends to evaluate property values accurately.

- Real Estate Analytics Platforms: Websites like Zillow, Redfin, and Realtor.com provide extensive data on market trends, prices, and forecasts.

- Local Government Resources: Municipal websites often publish property tax assessments, zoning changes, and economic reports that can inform investment decisions.

Complement quantitative data with qualitative insights by:

- Networking with Local Experts: Connect with real estate agents, property managers, and local investors to gain insider knowledge about the market.

- Community Engagement: Attend local community meetings or forums to understand the concerns and aspirations of residents, which can impact property values.

- Market Sentiment Surveys: Conduct surveys or utilize research reports that gauge buyer and seller sentiment within the market.

Utilizing Online Tools and Resources

The internet is an invaluable resource for conducting thorough market research. Several online tools and platforms can assist investors in gathering and analyzing market data effectively.Some essential online resources include:

- Real Estate Websites: Utilize platforms like Zillow, Realtor.com, and Trulia to access listings, historical data, and neighborhood information.

- Data Analytics Tools: Tools like Mashvisor and PropStream provide in-depth analysis and comparative market analysis to help investors make informed decisions.

- Social Media Groups and Forums: Engage with community groups on platforms like Facebook and Reddit that focus on real estate investing to gather insights and experiences from fellow investors.

- Government and Economic Reports: Websites like the Bureau of Labor Statistics and local economic development agencies offer reports on economic indicators that affect real estate markets.

By combining these resources, investors can create a robust framework for researching real estate markets, ensuring they make well-informed decisions in their investment journey.

Types of Real Estate Investments

Source: flexclip.com

Investing in real estate can be a lucrative venture, but understanding the different types of real estate investments is crucial for making informed decisions. Each type comes with its own set of characteristics, potential returns, and risks, making it important for investors to align their choices with their investment goals and risk tolerance.Real estate investments can be broadly categorized into three types: residential, commercial, and industrial properties.

Each type serves a different market segment and presents unique opportunities and challenges for investors.

Residential Properties

Residential properties primarily include single-family homes, condominiums, townhouses, and multi-family units. These properties are generally purchased for rental income or resale. Examples include:

- Single-family homes in suburban neighborhoods.

- Apartment complexes in urban areas.

Potential returns on residential properties can range from 6% to 12% per year, depending on location and demand. However, risks include property management issues, tenant turnover, and market fluctuations.The following points highlight the pros and cons of investing in residential properties:

- Pros:

- Steady demand in most markets.

- Potential for long-term appreciation.

- Tax benefits from mortgage interest deductions.

- Cons:

- High maintenance and management costs.

- Vacancy risks leading to loss of income.

- Market downturns can affect property values.

Commercial Properties

Commercial properties can include office buildings, retail spaces, warehouses, and shopping centers. These types of properties are typically leased to businesses and can provide higher returns compared to residential properties.Examples include:

- Office buildings in downtown areas.

- Retail shops in popular shopping districts.

Potential returns on commercial properties can be as high as 15% or more, but they often require larger capital investments. Risks include economic downturns that can affect tenant stability and longer vacancy periods.Assessing the pros and cons of commercial property investment is essential:

- Pros:

- Longer lease terms providing stable income.

- Higher rental yields compared to residential properties.

- Less management intensity if leased to established businesses.

- Cons:

- Significant initial investment required.

- More complex zoning and regulatory requirements.

- Higher market sensitivity during economic downturns.

Industrial Properties

Industrial properties include warehouses, manufacturing facilities, and distribution centers. These investments are often linked to the supply chain and can benefit from e-commerce growth.Examples include:

- Distribution centers for online retail companies.

- Manufacturing plants for various industries.

Potential returns on industrial properties typically range from 8% to 12%. However, they carry risks related to economic cycles and the need for specialized knowledge regarding tenants.Understanding the pros and cons of investing in industrial properties contributes to more strategic decision-making:

- Pros:

- Stable demand, especially in logistics sectors.

- Long-term leases with creditworthy tenants.

- Less tenant turnover compared to residential properties.

- Cons:

- High maintenance costs for specialized facilities.

- Potentially lengthy lease negotiations.

- Market fluctuations affecting logistics and manufacturing demand.

Building Your First Property

Purchasing your first investment property can be both exciting and overwhelming. It involves several steps that range from locating the right property to closing the deal. Understanding this process is crucial in building your real estate portfolio successfully. Here’s a comprehensive guide to help you navigate through the essential stages of buying your first property.

Process of Purchasing Your First Investment Property

The journey of buying an investment property can be summarized in a series of steps that ensure you make informed decisions. The following steps Artikel the process from start to finish:

1. Define Your Criteria

Identify what type of property you want, such as single-family homes, multi-family units, or commercial properties. Consider location, size, and your budget.

2. Get Pre-Approved for Financing

Approach lenders to understand your borrowing capacity and secure financing options. This will help you set a realistic budget.

3. Search for Properties

Utilize online platforms, real estate agents, and local listings to find properties that meet your criteria.

4. Conduct Property Inspections

Once you’ve shortlisted properties, schedule inspections to assess their condition. This is essential to uncover any hidden issues.

5. Evaluate Repair Costs

After inspections, estimate the costs of necessary repairs. This will help you in negotiations and budgeting.

6. Make an Offer

Present a competitive but fair offer based on market analysis and property condition.

7. Negotiate the Deal

Be prepared for counteroffers and aim for a mutually beneficial agreement.

8. Close the Purchase

After settling on a price, finalize the paperwork, pay closing costs, and officially take ownership of the property.

Conducting Property Inspections and Assessing Repair Costs

Performing thorough property inspections is vital to understanding the true condition of a property and anticipating future expenses. Here’s how to effectively conduct inspections and evaluate repair costs:

Hire a Professional Inspector

Engage a certified home inspector who can identify issues that may not be visible to the untrained eye.

Inspect Major Systems

Focus on the roof, plumbing, electrical systems, and HVAC. Understanding the age and condition of these systems can reveal potential future expenses.

Check for Structural Issues

Look for cracks in the foundation, walls, and ceilings. Structural problems can be costly to repair.

Evaluate Cosmetic Repairs

Assess the need for painting, flooring, and landscaping. While these may be less critical, they can impact the property’s rental appeal or resale value.

Estimate Repair Costs

Gather estimates from contractors or use online calculators to gauge potential repair costs. Consider budgeting 10-20% more than the estimates to account for unexpected expenses.

“Understanding the condition of a property can save you thousands in repair costs down the line.”

Negotiating the Best Deal When Buying a Property

Negotiation is a critical skill when purchasing property. The following tips can help you secure the best deal:

Research Comparable Sales

Analyze recent sales of similar properties in the area to understand the market value. This data can empower your negotiations.

Be Prepared to Walk Away

Show your willingness to walk away if the terms aren’t favorable. This can motivate sellers to reconsider your offer.

Understand the Seller’s Motivation

Gauge why the seller is selling. If they are eager to sell quickly, you may have more leverage in negotiations.

Start Below Your Maximum Budget

Begin negotiations with an offer lower than your maximum budget to give yourself room to maneuver.

Use Contingencies Wisely

Incorporate contingencies that allow you to back out if inspections reveal significant issues. This can strengthen your negotiating position.

“Effective negotiation can turn a good deal into a great one.”

Managing Your Real Estate Investments

Source: flexclip.com

Managing your real estate investments effectively is crucial to maximizing returns and maintaining property value. A well-managed property can provide a consistent revenue stream, minimize expenses, and ensure tenant satisfaction, which is essential for long-term success in real estate investing.

Effective Property Management Strategies for Rental Properties

Establishing efficient property management strategies is key to ensuring your rental properties operate smoothly. This includes regular communication with tenants, prompt response to maintenance requests, and understanding local landlord-tenant laws to ensure compliance. One effective approach is to utilize property management software, which can help streamline operations such as rent collection, maintenance tracking, and tenant communication. This technology minimizes administrative burdens and allows for better tracking of financial performance.

Regularly scheduled property inspections can also help identify potential issues before they escalate. These inspections should focus on both the interior and exterior of the property to ensure that everything is well-maintained and up to code.

Importance of Tenant Screening and Lease Agreements

Tenant screening is an essential step in ensuring that you select reliable occupants for your rental properties. A thorough screening process includes checking credit history, rental history, and conducting background checks. This diligence helps minimize the risk of late payments, property damage, or eviction processes further down the line. Lease agreements play a pivotal role in clarifying expectations between landlords and tenants.

A comprehensive lease should Artikel terms such as rent amount, due dates, maintenance responsibilities, and rules regarding pets or property alterations. Clear lease agreements help to mitigate disputes and establish a professional relationship from the outset.

Checklist for Regular Property Maintenance and Inspections

Regular maintenance and inspections are fundamental to preserving your property’s value and ensuring tenant satisfaction. Below is a checklist that Artikels key maintenance tasks and inspection points to consider throughout the year:

Monthly Tasks

Check and replace HVAC filters.

Test smoke and carbon monoxide detectors.

- Inspect fire extinguishers for proper service dates.

- Quarterly Tasks

Service HVAC systems to ensure efficient operation.

Clean gutters and downspouts to prevent water damage.

- Inspect plumbing for leaks or signs of wear.

- Biannual Tasks

Conduct a thorough inspection of the roof for damage.

Review the exterior for peeling paint, cracks, or other issues.

- Inspect and clean appliances provided in the rental unit.

- Annual Tasks

Schedule a professional pest control treatment.

Review safety features such as outdoor lighting and secure locks.

Evaluate landscaping and irrigation systems for upkeep.

Implementing this checklist can help preemptively address maintenance needs and extend the life of your property, ensuring a safe and comfortable living environment for your tenants.

Expanding Your Portfolio

As you successfully build your real estate portfolio, the next step is to think about expansion. Scaling your portfolio can lead to increased cash flow, greater equity accumulation, and enhanced wealth creation. It involves strategic planning, smart reinvestment, and diversification into various types of real estate investments to mitigate risk and capitalize on market opportunities.To effectively expand your real estate portfolio over time, it’s essential to adopt well-defined strategies.

These strategies may include reinvesting your profits into additional properties, leveraging existing equity, and identifying emerging markets for potential investment. Each of these approaches contributes to the sustainable growth of your real estate assets.

Reinvesting Profits into Additional Properties

Reinvesting profits is a fundamental strategy for real estate expansion. By using the cash flow generated from your current properties, you can purchase additional investments, further compounding your wealth. The process of reinvestment allows you to avoid relying solely on external funding and reduces your overall risk.Key considerations for successful reinvestment include:

- Identifying high-yield properties that align with your investment strategy.

- Assessing market trends to determine the optimal timing for reinvestment.

- Taking advantage of tax benefits associated with real estate investments, such as depreciation deductions.

- Utilizing cash reserves strategically to capitalize on opportunities, especially in competitive markets.

“Reinvesting profits can accelerate your wealth accumulation in real estate, transforming cash flow into new opportunities.”

Diversifying into New Types of Real Estate Investments

Diversifying your portfolio not only spreads risk but also opens doors to new growth opportunities. As markets evolve, integrating different types of real estate investments can enhance your portfolio’s resilience. This includes exploring avenues such as commercial properties, multifamily units, vacation rentals, or real estate investment trusts (REITs).When considering diversification, focus on the following factors:

- Understanding the specific market dynamics of each real estate type you plan to enter.

- Assessing your risk tolerance and investment timeline for various asset classes.

- Researching potential locations that may offer higher rental yields or appreciation rates.

- Building relationships with knowledgeable professionals in different real estate sectors to gain insights and advice.

“A well-diversified real estate portfolio can withstand market fluctuations and provide consistent returns.”

By implementing these strategies and maintaining a proactive approach to reinvestment and diversification, you can effectively scale your real estate portfolio. The key is to remain informed, adaptable, and focused on long-term growth as you expand your investment horizons.

Legal and Tax Considerations

Building a real estate portfolio involves various legal and tax implications that can significantly impact your investment success. Understanding these elements is crucial for making informed decisions that comply with regulations while maximizing your financial benefits. Legal considerations ensure that your transactions are legitimate and protect your investments, while tax implications can influence your overall profitability and cash flow.

Legal Considerations in Real Estate Investing

When entering the real estate market, it is essential to be aware of the legal framework governing property transactions. Key legal elements include:

Property Rights

Understanding ownership rights, including title, zoning laws, and easements, is fundamental. Each property has unique rights that dictate how it can be used and developed.

Contracts and Agreements

Real estate transactions involve contracts that Artikel the terms of purchase or lease. It’s critical to ensure these documents are comprehensive and legally binding, often requiring the expertise of an attorney.

Landlord-Tenant Laws

If you plan to rent properties, familiarize yourself with the local landlord-tenant laws. These statutes govern rental agreements, security deposits, eviction procedures, and tenant rights, ensuring compliance and reducing the risk of legal disputes.

Licensing and Regulations

Depending on your location, you may need specific licenses or permits for real estate activities. This includes real estate agent licenses if you engage in buying or selling property on behalf of others.

Tax Implications of Real Estate Investing

Investing in real estate comes with various tax implications that can enhance or diminish your overall returns. Investors should be aware of the following aspects:

Capital Gains Tax

Profits from selling real estate are subject to capital gains tax. Long-term investments (held for more than a year) typically benefit from lower rates than short-term investments.

Depreciation

Investors can deduct depreciation on their properties, which reduces taxable income. For residential properties, this is calculated over 27.5 years, while commercial properties are depreciated over 39 years.

1031 Exchange

This IRS provision allows investors to defer capital gains taxes by reinvesting proceeds from a sold property into a similar property. This strategy is beneficial for building wealth without immediate tax burdens.The table below summarizes various tax strategies that can be utilized by real estate investors:

| Tax Strategy | Description |

|---|---|

| Depreciation Deduction | Allows investors to deduct a portion of the property’s value each year from their taxable income. |

| 1031 Exchange | Defers capital gains tax on the sale of an investment property when reinvested in a similar property. |

| Mortgage Interest Deduction | Permits homeowners to deduct interest paid on mortgage debt, reducing taxable income. |

| Real Estate Professional Status | Enables qualifying investors to deduct losses from investments against other income, thereby lowering overall taxes. |

Understanding and navigating the legal and tax landscape in real estate investing is essential for maximizing profits and minimizing risks. By being proactive and seeking professional advice when necessary, investors can position themselves favorably in the market.

Networking and Resources

Source: infinityinvesting.com

Building a robust real estate portfolio isn’t just about finding the right properties—it’s also about connecting with the right people. Networking plays an essential role in the real estate industry, providing opportunities to share knowledge, resources, and support from others who have navigated similar paths.Engaging with industry professionals can significantly enhance your investment journey. Networking helps you stay informed about market trends, discover potential investment opportunities, and receive guidance from experienced investors.

Additionally, being part of a community allows for the exchange of valuable insights that can lead to better decision-making.

Importance of Networking

Networking in real estate is pivotal for several reasons. First and foremost, it opens doors to partnerships and collaborations that can accelerate your growth. The following points highlight why networking is critical in this industry:

- Access to Opportunities: Many real estate deals are not publicly advertised. Networking can lead to off-market opportunities that only insiders know about.

- Learning from Experience: Connecting with seasoned professionals allows newcomers to gain insights from their successes and mistakes, reducing the learning curve.

- Building a Support System: A strong network can offer emotional support and advice during challenging times, making the investment process less isolating.

- Referrals to Trusted Professionals: Networking often provides referrals to reliable agents, lenders, contractors, and property managers, which can be invaluable for your operations.

Resources for Networking

To enhance your networking efforts, various resources can help you connect with other real estate professionals. Here are some recommended platforms and groups:

- Local Real Estate Investing Groups: Many cities have local meetups or associations where investors gather to share experiences. Examples include the Real Estate Investment Association (REIA) and local chapters of the National Association of Realtors (NAR).

- Online Forums and Communities: Websites like BiggerPockets offer a platform for investors to discuss strategies, share experiences, and seek advice from each other.

- Social Media Groups: Platforms like Facebook and LinkedIn host numerous groups dedicated to real estate investing. Joining these groups can facilitate connections with like-minded individuals.

Key Industry Professionals

Establishing relationships with key industry professionals can be invaluable as you build your portfolio. Consider connecting with the following individuals:

- Real Estate Agents: They have insider knowledge about local markets and can help you find properties that fit your criteria.

- Mortgage Brokers: These professionals can provide insights into financing options, helping you secure the best rates and terms.

- Property Managers: If you’re investing in rental properties, a good property manager can handle day-to-day operations and tenant relations, allowing you to focus on scaling your portfolio.

- Real Estate Attorneys: Legal advice is crucial in real estate transactions. A knowledgeable attorney can help navigate contracts and ensure compliance with regulations.

Networking is an ongoing process that can yield significant rewards throughout your real estate investing journey. By actively engaging with the right resources and professionals, you can enhance your knowledge and uncover opportunities that lead to success.

Final Thoughts

In summary, building a real estate portfolio from scratch is both an exciting and rewarding venture that requires careful planning and informed decision-making. By understanding the basics and continuously adapting to market trends, you can create a diverse and profitable real estate portfolio. Remember, the journey may be challenging, but with perseverance and the right resources at your disposal, success is well within your reach.

Key Questions Answered

What is a real estate portfolio?

A real estate portfolio is a collection of real estate investments owned by an individual or entity, aimed at generating income and building wealth.

How much money do I need to start investing in real estate?

The amount varies depending on the type of investment, but it’s possible to start with a few thousand dollars, especially with options like house hacking or real estate crowdfunding.

How can I find the right property to invest in?

Researching market trends, analyzing property values, and using online real estate platforms can help identify promising properties that align with your investment goals.

What are the risks associated with real estate investing?

Common risks include market fluctuations, property maintenance costs, tenant issues, and changes in local regulations that can affect property value and rental income.

Is it better to invest in residential or commercial real estate?

It depends on your investment goals; residential properties typically offer stable income while commercial properties can provide higher returns but may come with more risks and management complexities.