How To File An Insurance Claim Successfully

How to File an Insurance Claim Successfully sets the stage for navigating the often overwhelming world of insurance claims. Whether it’s for a car accident, home damage, or health-related issues, understanding the claims process can make a significant difference in the outcome. This guide will walk you through the essential steps to ensure your claim is handled efficiently and effectively, turning a potentially stressful experience into a manageable one.

From gathering necessary documents to communicating with insurance adjusters, we cover everything you need to know. By being well-prepared and informed, you can maximize the chances of a successful claim and receive the compensation you deserve.

Understanding Insurance Claims Process

Source: insuranceclaimfiling.com

Filing an insurance claim can often seem daunting, but understanding the process can simplify what might otherwise be a confusing experience. This knowledge not only facilitates a smoother submission but also enhances your ability to secure the compensation you deserve. Familiarity with your policy and the underlying claims process is crucial for effective claim management.The general process of filing an insurance claim typically involves a series of steps that start with notifying your insurance provider of the incident.

Following this, you’ll need to provide necessary documentation and evidence to support your claim. The insurance company then reviews your information, assesses the claim, and ultimately determines the amount of compensation you may receive. Each step is essential to ensure that claims are processed efficiently and fairly.

Types of Insurance Claims

Understanding the various types of insurance claims can help individuals navigate their policies more effectively. Here are some common types of claims one might encounter:

- Auto Insurance Claims: These involve accidents or damage to vehicles, including liability claims for damage caused to another party.

- Homeowners Insurance Claims: These cover damages to a home and its contents due to incidents like fire, theft, or natural disasters.

- Health Insurance Claims: These are submitted for medical services or treatments received, often requiring documentation from healthcare providers.

- Life Insurance Claims: These claims are made by beneficiaries after the policyholder’s death, providing financial support to loved ones.

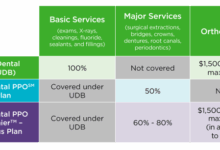

Understanding Policy Limits and Coverage

Knowledge of your policy limits and coverage specifics is vital for successful claims. Policy limits refer to the maximum amount an insurer will pay for a covered loss. Understanding these limits ensures that you are aware of your financial responsibilities in the event of a claim. Additionally, each policy may have different coverage specifics, dictating what is covered and what isn’t.

“Being informed about your policy limits can prevent unexpected out-of-pocket expenses during the claims process.”

It is crucial to regularly review your insurance policies to ensure that coverage aligns with your current needs. For example, if you recently renovated your home, you might need to adjust your homeowners insurance to reflect increased property value. Understanding the nuances of your coverage can significantly impact the outcome of any claim you may file.

Preparing to File a Claim

When it comes to filing an insurance claim, preparation is key to ensuring a smooth process. Being organized not only helps you present your case effectively but also minimizes any potential delays that could arise from missing information. This section Artikels the essential documents needed, how to gather supporting evidence, and stresses the importance of acting quickly.

Checklist of Required Documents

Having the right documents prepared before filing your claim is crucial. A well-organized submission can expedite the processing of your claim significantly. Here’s a checklist of the essential documents typically required when filing an insurance claim:

- Insurance policy number and details

- Claim form (provided by the insurance company)

- Proof of loss or damage (receipts, invoices, etc.)

- Photographic evidence of the incident or damage

- Witness statements, if applicable

- Any police reports or incident reports related to the claim

- Medical records (for health-related claims)

- Correspondence with the insurance company

Gathering Evidence to Support Your Claim

To strengthen your claim, it’s essential to gather evidence that clearly demonstrates the circumstances surrounding your case. This evidence can play a pivotal role in the decision-making process of your insurance provider. Here’s how to effectively collect supporting evidence:

Photographs

Capture clear, detailed images of the damage or incident scene. Ensure to take photos from various angles, highlighting any critical elements, such as the extent of damage or location specifics. If it’s an accident, photograph all vehicles involved and relevant road signs.

Witness Statements

Collect statements from individuals who witnessed the incident. Their accounts can provide additional validation. Documenting their contact details and having them write down their observations can be particularly beneficial.

Documentation of Communications

Keep records of all communications with your insurance provider. Emails, notes from phone conversations, and copies of letters should all be saved as they may be required later.

Having comprehensive evidence can significantly improve the chances of a successful claim.

Importance of Timeliness in Filing a Claim

Timeliness is a critical factor when it comes to filing an insurance claim. Most insurance policies have specific time limits for reporting a claim after an incident has occurred. Failing to file your claim promptly can lead to complications or even denial. Here are a few reasons why acting quickly is essential:

Adhering to Policy Deadlines

Insurance companies often stipulate a time frame within which claims must be filed. If you miss this deadline, you may forfeit your right to compensation.

Accurate Recall of Events

The sooner you file your claim, the fresher the details will be in your memory. This accuracy can be vital when recalling specifics that support your claim.

Preservation of Evidence

Delays can lead to the loss of evidence. Photographic documentation can fade or become inaccessible, witness availability can diminish, and physical evidence can be altered.

Acting swiftly not only strengthens your claim but also demonstrates your commitment and seriousness to the insurance process.

Steps to File an Insurance Claim

Filing an insurance claim can seem daunting, but understanding the process makes it manageable. By knowing the steps involved, you can ensure that your claim is submitted correctly and efficiently, leading to a quicker resolution. Let’s explore the essential steps to take when filing a claim with your insurance provider.

Step-by-Step Procedure for Filing a Claim

The following steps Artikel the general procedure for filing an insurance claim. Each insurance company may have specific requirements, so it’s crucial to review your policy and the provider’s guidelines.

- Review Your Policy: Understand your coverage details, including what is covered and the claims process.

- Document the Incident: Gather all relevant information and evidence related to the claim, such as photographs, invoices, police reports, or witness statements.

- Contact Your Insurance Company: Notify your insurer as soon as possible after the incident. Most companies have a dedicated claims department available 24/7.

- Complete the Claim Form: Fill out the claim form accurately, providing all necessary information. Be honest and thorough in your responses.

- Submit Your Claim: Send the completed claim form along with any supporting documents to your insurance provider through their preferred method (online, by mail, or via phone).

- Follow Up: After submission, keep track of your claim status and respond promptly to any inquiries from your insurance company.

- Receive Claim Decision: Wait for your insurer to review your claim and provide a decision. If approved, they will Artikel the compensation details.

Claim Filing Processes of Various Insurance Companies

Different insurance companies have unique processes for filing claims. Understanding these specific procedures can save you time and frustration. Here’s a comparison of some well-known insurance providers:

| Insurance Company | Claim Filing Process |

|---|---|

| State Farm | File online via their website or mobile app, call their claims hotline, or visit a local agent. |

| Allstate | Submit claims through their website, mobile app, or by contacting an agent directly. |

| Geico | Use their mobile app or website to file a claim, or call their claims department for assistance. |

| Progressive | Claims can be filed online, through the mobile app, or by calling customer service. |

Common Mistakes to Avoid When Submitting a Claim

Filing a claim accurately is crucial for a timely and successful resolution. Avoiding common pitfalls can help ensure your claim is processed smoothly.

Providing incomplete or incorrect information can lead to delays or denial of your claim.

Failing to document the incident properly may weaken your case.

Ignoring deadlines for filing a claim can result in losing your right to compensation.

It’s essential to pay close attention to the details when submitting your claim. By ensuring thorough documentation, accurate information, and timely submission, you increase your chances of a positive outcome. Remember to keep copies of all documents submitted and maintain communication with your insurance provider throughout the process.

Communicating with Insurance Adjusters

Source: cloudfront.net

Effective communication with insurance adjusters is crucial in ensuring a smooth claims process. These professionals are responsible for assessing claims and determining the amount of compensation you are eligible for. By adopting effective communication strategies, you can facilitate a better understanding of your situation and promote a more favorable outcome for your claim.

Clear and concise communication is essential when interacting with insurance adjusters. Providing key information during conversations and written correspondence can significantly impact the efficiency of your claim. It’s important to be well-prepared and organized, which can save you time and potential frustration during the claims process.

Strategies for Effective Communication

Maintaining a professional yet friendly tone is vital when communicating with insurance adjusters. Here are some effective strategies to consider:

- Be Prepared: Before you start communicating, gather all relevant documents, including your policy, any correspondence, and evidence related to the claim. This preparation will allow you to answer questions confidently.

- Use Clear Language: Avoid jargon and technical terms. Speak plainly to ensure that your points are understood without confusion.

- Keep Detailed Records: Document every interaction, including dates, times, names, and topics discussed. This will help you track the progress of your claims and provide a reference if needed later.

- Stay Calm and Polite: Even if the process becomes frustrating, maintaining a calm demeanor will facilitate better conversations and increase the likelihood of a cooperative relationship.

Essential Information to Provide

When communicating with adjusters, it’s important to share specific details that can help your case. Consider including the following information:

- Claim Number: Always reference your claim number when communicating to help the adjuster quickly locate your file.

- Incident Details: Provide a clear and concise overview of the incident that led to the claim, including dates, times, and locations.

- Impact on You: Explain how the incident has affected you, whether financially, physically, or emotionally. This adds a personal touch to your claim.

- Supporting Documentation: Mention any documents you are sending or have already sent, such as photos, police reports, and repair estimates.

Remaining Assertive and Cooperative

Striking a balance between being assertive and cooperative is key to navigating the insurance claims process effectively. Here are some tips to help you achieve that balance:

- Know Your Rights: Familiarize yourself with your insurance policy and the claims process. Understanding your rights empowers you to advocate for yourself.

- Ask Questions: If something is unclear, don’t hesitate to ask. It’s important to fully understand the process and what is expected from you.

- Be Firm, Yet Respectful: Stand your ground on valid claims and concerns, but always approach discussions respectfully. This approach encourages a more positive dialogue.

- Follow Up: Regularly check in on the progress of your claim. Persistence shows that you are serious about resolving your claim while maintaining an open line of communication.

Effective communication can significantly affect the outcome of your insurance claim. Approach the conversation strategically, and remember that you are your best advocate.

Following Up on Your Claim

Tracking the status of your insurance claim is crucial for ensuring that the process moves along smoothly. Once you’ve filed a claim, staying engaged and informed can help expedite resolution, prevent delays, and provide clarity about what to expect next. A proactive approach to follow-up can also signal to your insurance provider that you are serious and organized, which may lead to more efficient handling of your case.Effective tracking of your claim’s status can be accomplished through various methods.

Utilize the online portal provided by your insurance company if available, or keep a detailed log of all communications via email or phone calls. Make sure to record the date, time, and name of the representative you spoke with, as well as any reference numbers related to your claim. This documentation will serve as a helpful resource in any future correspondence.

Timeline for Following Up with an Insurance Company

Establishing a timeline for follow-up actions can provide clarity and direction as you navigate the claims process. Below is a structured timeline highlighting key milestones to consider:

- Day 1: Claim Submission

-After submitting your claim, make a note of your submission date and any reference numbers. - Day 3: Confirm Receipt

-Contact the insurance company to confirm that your claim has been received and is under review. - Day 7: First Follow-Up

-Reach out to check on the status of your claim. This is a good time to inquire if any additional documentation is needed. - Day 14: Second Follow-Up

-If you haven’t received any updates, follow up again. Be polite but firm in your inquiry. - Day 30: Escalation Point

-If there is still no progress, consider asking to speak with a supervisor or claims manager, emphasizing the length of time that has passed. - Day 45: Final Follow-Up

-If necessary, you may escalate further by submitting a written complaint or contacting your state’s insurance commissioner for assistance.

Timely follow-ups are essential for keeping your claim on track, and adhering to this timeline can help ensure that you remain informed and engaged throughout the process.

Escalation of Issues

When claims are not processed in a timely manner, it’s important to know how to escalate the issue effectively. Here are some strategies to consider:

- Document Everything: Maintain a detailed log of all interactions regarding your claim, including dates, names, and summaries of discussions.

- Contact a Supervisor: If initial representatives are unhelpful, politely ask to speak with a supervisor. They may have more authority to resolve your issue.

- File a Formal Complaint: If you’re still not seeing progress, consider submitting a formal complaint through the insurance company’s official channels.

- State Insurance Department: If all else fails, contact your state’s insurance department. They can provide assistance and potentially intervene on your behalf.

“Documentation is your best friend in navigating insurance claims. Keep everything organized for a smoother follow-up process.”

Taking these steps will help ensure that your concerns are addressed promptly and that your claim receives the attention it deserves.

Handling Denials and Appeals

Filing an insurance claim can sometimes lead to unexpected challenges, particularly when a claim is denied. Understanding how to navigate this situation is crucial for policyholders. Being prepared for potential denials and knowing the appeals process can significantly increase your chances of a successful outcome. Common reasons for denial include insufficient documentation, coverage limits, or policy exclusions. It’s essential to recognize these potential pitfalls early on.

Preparing for the possibility of a denial involves thorough research and gathering all necessary information to support your claim from the beginning.

Reasons for Claim Denials

Understanding the most prevalent reasons why insurance claims are denied can help policyholders better prepare their submissions. Here are some common issues that lead to denials:

- Insufficient Documentation: Claims lacking adequate evidence or proper forms are often rejected.

- Policy Exclusions: Certain events may not be covered under a policy, leading to denial.

- Missed Deadlines: Not filing within the specified time frame can result in automatic denial.

- Pre-existing Conditions: For health insurance claims, existing conditions not covered by the policy may lead to denials.

- Incorrect Information: Providing false or misleading details can void a claim.

Appeals Process for Denied Claims

When faced with a denied claim, understanding the appeals process can be a game changer. The steps to challenge a denial typically include the following:

1. Review the Denial Letter

Examine the reasons cited for the denial to understand the insurer’s position.

2. Gather Supporting Documents

Collect all necessary documentation, including previous correspondence, photographs, and witness statements, to strengthen your case.

3. Write an Appeal Letter

Clearly articulate why you believe the claim should be reconsidered. Include all supporting evidence and be concise.

4. Submit the Appeal

Send the appeal letter and documentation to the appropriate claims department, ensuring to follow the insurer’s specified process for appeals.

5. Keep Records

Document all correspondence and keep copies of everything sent and received during the appeal process.

Strategies for Negotiating with Insurance Companies

Negotiating with insurance companies to overturn claim denials requires a mix of strategy and persistence. Here are effective approaches:

- Stay Calm and Professional: Maintaining a composed demeanor can lead to more productive conversations.

- Know Your Policy: Familiarize yourself with the terms of your policy to argue your case effectively.

- Use Evidence Wisely: Present clear, organized documentation that supports your position. Include any relevant laws or regulations that support your claim.

- Request a Meeting: Sometimes, a direct conversation can expedite the resolution. Request a meeting with an adjuster or supervisor if necessary.

- Be Persistent: If your initial appeal is denied, don’t hesitate to follow up regularly. Persistence can sometimes lead to a reconsideration.

Tips for a Successful Claim

Source: com.ph

Filing an insurance claim can sometimes feel overwhelming, but following a few best practices can greatly enhance your chances of a smooth and successful experience. Understanding the intricacies of the claims process and being organized can make all the difference. Here’s a guide to help you navigate your claim effectively.Maintaining thorough records throughout the claims process is crucial. Documentation not only supports your claim but also provides a clear timeline should any disputes arise.

It’s essential to keep all correspondence, receipts, and records in a well-organized manner.

Best Practices for Claim Filing

Implementing best practices can significantly improve your experience with filing an insurance claim. Below are key tips that can help you navigate the process with ease:

- Document Everything: Keep a detailed record of all interactions with your insurance provider, including dates, times, and names of representatives you speak with.

- Gather Evidence: Collect and store evidence related to your claim, such as photographs of damages, police reports, and repair estimates.

- Understand Your Policy: Familiarize yourself with your insurance policy’s terms and coverage limits to know what to expect and ensure you’re claiming for everything you’re entitled to.

- Be Honest and Accurate: Always provide truthful information when filing your claim. Misrepresentations can lead to claim denials or even legal issues.

- Follow Up: After filing your claim, regularly check in with your insurance adjuster to stay updated on the status and ensure your claim is processed in a timely manner.

Significance of Keeping Thorough Records

Thorough record-keeping is fundamental during the insurance claims process. Having organized documentation not only helps in tracking the progress of your claim but also serves as invaluable evidence if disputes arise.

“A well-documented claim is often a successful claim.”

Keep all relevant documents, including:

- Claim forms and correspondence with the insurance company.

- Invoices and receipts related to the incident.

- Photos and videos documenting damages or losses.

- Notes from conversations with your insurance adjuster.

Resources and Support Services for Claims Filing

Several resources and support services can assist you in filing your claim and managing disputes. Utilizing these resources can provide additional guidance and reassurance throughout the process.Consider reaching out to:

- Insurance Agents: Your agent can clarify policy details and assist with the claims process.

- Consumer Advocacy Groups: Organizations such as the National Association of Insurance Commissioners (NAIC) provide resources and guidance for consumers facing claims issues.

- Legal Advisors: If you’re encountering difficulties with your claim, consulting an attorney who specializes in insurance law can provide insight and representation.

- Online Forums and Communities: Platforms like Reddit or specialized Facebook groups allow you to connect with others who have undergone similar experiences, offering a wealth of shared knowledge.

Summary

In conclusion, mastering the art of filing an insurance claim successfully can empower you during challenging times. By following the steps Artikeld in this guide, staying organized, and effectively communicating with your insurer, you can navigate the claims process with confidence. Remember, preparedness is key, and understanding your rights as a policyholder can lead to a smoother resolution, allowing you to focus on what truly matters.

Frequently Asked Questions

What is the typical timeline for processing a claim?

Most claims are processed within a few weeks, but timelines can vary depending on the complexity of the claim and the insurance company.

Can I file a claim for damages I didn’t notice immediately?

Yes, you can file a claim for damages discovered later, but it’s crucial to do so as soon as possible to avoid complications.

What should I do if my claim is denied?

If your claim is denied, review the denial letter carefully, and consider appealing the decision by providing additional evidence or documentation.

Are there any fees associated with filing a claim?

Generally, there are no fees to file a claim, but certain policies might have specific conditions; check your insurance policy for details.

How can I ensure I’m getting a fair settlement?

To ensure a fair settlement, document all damages thoroughly, gather evidence, and consider consulting with an insurance expert if needed.