How To Finance A Real Estate Deal Without A Bank

How to Finance a Real Estate Deal Without a Bank invites you to explore alternative pathways that empower real estate investors to seize opportunities without relying on traditional banking methods. This approach not only broadens the horizon for financing options but also highlights innovative strategies such as seller financing, crowdfunding, and partnerships that can be game-changers in the real estate market.

In today’s dynamic landscape, understanding these alternative financing methods can open doors to lucrative investments that might otherwise be inaccessible. With a strategic mindset and the right tools, you can effectively navigate the diverse avenues available, whether through private investors, creative financing techniques, or government-backed programs. Each option has its unique advantages and potential challenges, making it essential to equip yourself with knowledge for informed decision-making.

Alternative Financing Methods

Source: geniedollars.com

When traditional bank financing isn’t an option or doesn’t meet your needs, alternative financing methods can provide viable pathways to secure funding for real estate deals. Understanding these methods can open doors to investment opportunities that you might not have considered before. This section explores various alternative financing options, providing insights into how they work and their implications.

Seller Financing

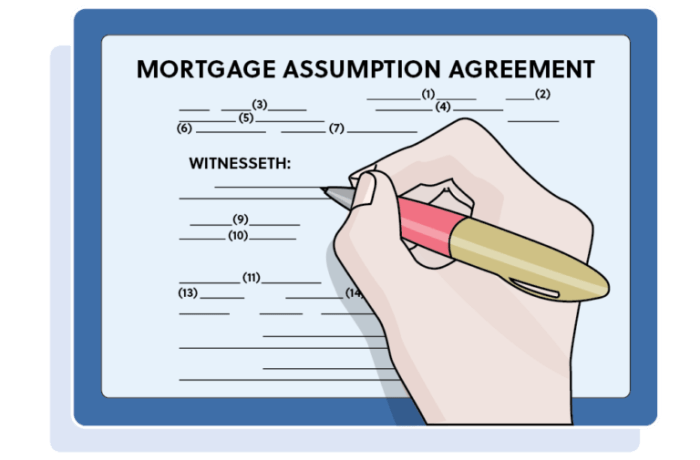

Seller financing occurs when the property seller provides financing to the buyer directly instead of the buyer obtaining a loan from a bank or mortgage lender. This method can be beneficial for both parties. For sellers, it can expedite the sale process and attract a broader pool of potential buyers. For buyers, it can offer more flexible terms and lower closing costs.

In a typical seller financing agreement, the buyer makes payments directly to the seller over an agreed period, often at a negotiated interest rate. A common structure includes a promissory note outlining the repayment terms. This method is particularly advantageous in markets with tighter lending standards, where buyers may struggle to secure traditional financing.

“Seller financing can serve as a bridge for buyers unable to access traditional loans.”

Lease Options

A lease option allows a tenant to lease a property with the option to purchase it after a specified period. This arrangement can be particularly appealing for individuals who want to buy a home but may not yet qualify for a mortgage. With a lease option, a portion of the rent paid may contribute toward the future purchase price, which can help tenants build equity while they save for a down payment.

This method also benefits sellers by providing a steady income stream while keeping their property off the market.

“Lease options provide a unique opportunity to build equity while living in the property.”

Hard Money Lending

Hard money lending involves short-term loans secured by real estate, typically provided by private investors or companies rather than traditional banks. This financing method is often used by real estate investors looking to quickly close deals, flip properties, or secure cash for renovations.Hard money loans usually come with higher interest rates compared to traditional loans due to the increased risk for lenders.

They are based more on the property’s value than on the borrower’s creditworthiness. Borrowers should understand the implications of hard money lending, including the potential for high fees and short repayment terms, usually ranging from one to three years.

“Hard money loans can provide quick capital but come at a higher cost.”

Crowdfunding in Real Estate

Real estate crowdfunding has emerged as a dynamic alternative financing method, enabling investors to pool their resources and participate in property ventures that were once accessible only to affluent individuals. This innovative approach democratizes real estate investment by allowing individuals to contribute smaller amounts towards larger projects, fostering a collaborative investment environment.Crowdfunding in real estate works by creating a platform where multiple investors can contribute funds towards a specific real estate project.

These platforms typically vet projects based on their potential for returns and risk profiles, allowing investors to select opportunities that align with their investment goals. Once the funding target is met, the project is funded, and investors earn returns based on the performance of the property. This method not only opens the door to new investment opportunities but also mitigates the risks associated with traditional financing methods.

Successful Case Studies of Real Estate Crowdfunding Ventures

To illustrate the effectiveness of real estate crowdfunding, several success stories stand out, reflecting the potential and viability of this financing method. A notable example is the case of EquityMultiple, which helped fund a $10 million acquisition of a multi-family property in Atlanta. Over 200 investors participated, providing a range of $5,000 to $50,000 each. Within a few years, the project yielded a return of 15% to its investors, showcasing how collective funding can lead to profitable outcomes.Another successful project comes from Fundrise, which funded a $1.5 million mixed-use property in Washington, D.C.

Investors enjoyed an annualized return of around 11%, demonstrating the lucrative potential of crowdfunding in real estate. Such examples highlight how crowdfunding can not only facilitate property acquisitions but also promote community involvement in real estate development.

Benefits and Drawbacks of Using Crowdfunding for Property Investment

Understanding the advantages and challenges of crowdfunding as an investment strategy is crucial for potential investors. Here are the notable benefits and drawbacks associated with this method:The benefits include:

- Accessibility: Crowdfunding platforms have low minimum investment thresholds, making it easier for novice investors to participate.

- Diversification: Investors can spread their capital across multiple projects, reducing risk exposure.

- Transparency: Most platforms provide in-depth information about the projects, allowing investors to make informed decisions.

Conversely, there are some drawbacks to consider:

- Liquidity: Crowdfunding investments may have long holding periods, making them less liquid compared to traditional assets.

- Market Risk: Real estate markets can fluctuate, impacting the performance of investments.

- Platform Risk: Investors depend on the integrity and reliability of the crowdfunding platform, which may vary.

In summary, while real estate crowdfunding presents exciting opportunities for diverse investors, it also comes with inherent risks that must be carefully evaluated.

Building Partnerships

Forming partnerships is a pivotal strategy in the realm of real estate financing. It allows investors to pool resources, share risks, and leverage each other’s strengths. In a landscape where funding can be challenging, partnership offers a viable alternative, facilitating access to opportunities that might be otherwise unattainable. The strength of such alliances lies not just in financial contributions, but also in the diverse expertise and networks each partner brings to the table.

Strategies for Forming Partnerships

Establishing successful partnerships in real estate necessitates a well-thought-out approach. Key strategies include:

- Networking: Engage in local real estate events, join investment clubs, and leverage social media platforms to connect with potential partners. Building relationships takes time, but consistent networking can yield beneficial partnerships.

- Identifying Complementary Skills: Look for partners whose skills and experiences complement your own. For instance, if you excel in property management, partnering with someone who has strong financial acumen can create a balanced team.

- Creating a Value Proposition: Clearly articulate what you bring to the partnership. Define your strengths and explain how they add value to potential deals, which helps in attracting the right partners.

- Drafting Clear Agreements: Ensure that all terms of the partnership are agreed upon and documented. This sets a professional tone and helps mitigate misunderstandings down the line.

Importance of Joint Ventures

Joint ventures are essential in real estate as they facilitate the pooling of resources, thereby increasing purchasing power and risk mitigation. By collaborating, partners can tackle larger projects or investments that would be challenging to manage independently.

- Resource Sharing: Joint ventures allow for sharing not just capital, but also expertise, local market knowledge, and operational capabilities. This diversified approach often leads to more efficient project execution.

- Risk Mitigation: By sharing the financial burden, partners can reduce individual liability. In the event of a property downturn, this can protect personal assets and ensure business continuity.

- Access to Better Opportunities: Larger capital pools enable partners to bid on more lucrative properties. Such opportunities frequently yield higher returns, enhancing overall investment success.

Key Roles and Responsibilities in a Partnership Agreement

A well-defined partnership agreement stipulates the roles and responsibilities of each partner, which is crucial for operational effectiveness and accountability.

- Financier: The partner responsible for providing the majority of the capital. This role often involves overseeing financial transactions and ensuring that funds are allocated effectively.

- Project Manager: A partner designated to manage the day-to-day operations of the real estate project, including renovations, tenant relations, and logistics.

- Market Analyst: An individual focusing on market research and property assessment to ensure that investments align with market trends and investor goals.

- Legal Advisor: While not a regular partner, having access to a legal expert to navigate contracts and compliance is essential for protecting the partnership’s interests.

“The best partnerships are built on trust and transparency, ensuring that each partner feels valued and understood.”

Utilizing Private Investors

Source: eloquens.com

Securing funding from private investors can be a game-changer in real estate ventures. Unlike traditional bank financing, which often comes with strict requirements and lengthy approval processes, private investors can provide the necessary capital with more flexibility. This approach enables real estate investors to tap into a network of individuals who are eager to earn a return on their investment while contributing to meaningful projects in the property market.When approaching private investors, it’s essential to be prepared and strategic.

Building relationships with potential investors often starts with networking, attending real estate investment groups, and participating in community events. Once you’ve identified potential investors, crafting a compelling pitch presentation is crucial to effectively communicate your investment opportunities. A well-structured pitch should include clear information about the real estate project, expected returns, market analysis, and risk assessments.

Crafting an Effective Pitch Presentation

An effective pitch presentation should clearly articulate the investment opportunity while addressing the potential concerns of investors. Here are key elements to include in your presentation:

- Project Overview: Begin with a brief description of the property, including its location, size, and current condition. Highlight any unique features that make the property attractive.

- Market Analysis: Provide data on the local real estate market, including trends in property values, rental rates, and demand. Use graphs and charts to visualize this information.

- Financial Projections: Artikel expected returns, including cash flow analyses, potential appreciation, and exit strategies. This helps investors understand the financial upside of the project.

- Risk Assessment: Transparently address potential risks and your plans to mitigate them. This builds trust and shows that you are realistic about the investment.

- Investment Structure: Clearly explain how you intend to structure the investment, including the amount needed, equity share, and timeline for returns.

A well-crafted presentation not only informs but also engages the investor, making them feel confident in their potential partnership with you.

Potential Risks and Rewards of Private Investment

Investing in real estate with private investors comes with its share of risks and rewards. Understanding these factors is crucial for both parties involved. The potential rewards include:

- High Returns: Private investments can yield higher returns compared to traditional investments, especially in well-chosen real estate ventures.

- Flexibility: Investors may be more willing to negotiate terms that align with both parties’ interests compared to banks.

- Diverse Opportunities: Working with private investors can open doors to various real estate projects that may not receive bank financing.

However, certain risks are associated with private investments:

- Market Fluctuations: Real estate markets can be unpredictable, leading to potential losses if property values decline.

- Liquidity Risk: Real estate is generally not a liquid asset, meaning it can take time to sell or refinance, which affects investor returns.

- Investor Expectations: Misalignment of investor expectations regarding returns or timelines can lead to conflicts.

Overall, navigating private investments requires careful consideration and clear communication. With the right approach, leveraging private investors can significantly enhance your real estate ventures and provide substantial financial opportunities for all involved.

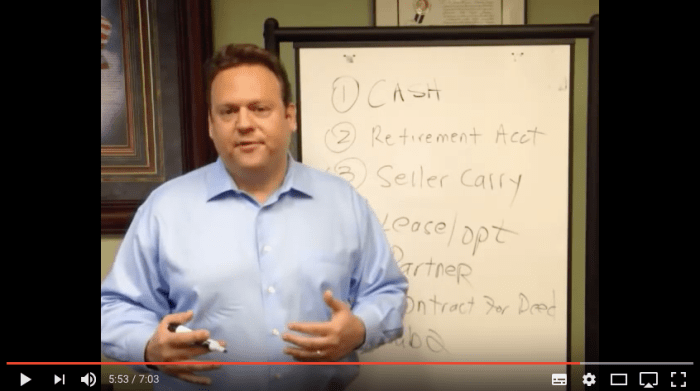

Creative Financing Techniques

Creative financing techniques offer innovative solutions for securing real estate deals without traditional banking methods. These approaches can open doors for investors who may have limited access to conventional funding, allowing for more flexibility and creativity in transactions. Among these methods, option contracts and subject-to financing stand out as effective strategies for acquiring properties with minimal upfront costs.

Option Contracts

An option contract is a unique agreement that gives a buyer the right, but not the obligation, to purchase a property at a predetermined price within a specified timeframe. This technique is particularly advantageous for investors looking to control a property without immediately purchasing it. Here’s how you can effectively utilize option contracts:

1. Identify a Property

Find a property that fits your investment criteria.

2. Negotiate the Terms

Approach the property owner and negotiate an option to purchase agreement. This typically includes the purchase price and the duration of the option (e.g., 1 year).

3. Pay an Option Fee

Make a small upfront payment to the seller, securing your right to purchase the property within the specified timeframe.

4. Market the Property

Use the time under the option to market the property or secure financing.

5. Exercise the Option

If you find a buyer or secure financing, you can exercise your option to purchase the property, or you can choose to sell the option to another investor for a profit.Option contracts can be a low-risk way to control real estate assets while figuring out your financing options.

Subject-To Financing

Subject-to financing involves acquiring a property “subject to” the existing mortgage. This means you take over the mortgage payments while the loan remains in the seller’s name. This can be an excellent way to purchase properties without needing to qualify for a new loan. Here’s a step-by-step guide:

1. Find Motivated Sellers

Look for homeowners who are eager to sell, often due to financial distress or relocation.

2. Evaluate the Existing Mortgage

Ensure that the current mortgage terms are favorable and that the seller has sufficient equity.

3. Negotiate the Sale

Discuss taking over the mortgage payments with the seller. Ensure all terms are clear and agreeable.

4. Draft a Purchase Agreement

Create a legally binding agreement that Artikels the purchase terms and your responsibility for the mortgage payments.

5. Finalize the Deal

Close the transaction, ensuring the original mortgage remains in the seller’s name while you take over payments.This method allows investors to acquire properties with little to no money down and can be a win-win for both buyers and sellers.

Wraparound Mortgages

A wraparound mortgage is a creative financing technique where the buyer takes a new loan that “wraps around” the existing mortgage. This method can be beneficial for both buyers and sellers. Here’s how to execute a wraparound mortgage:

1. Understand the Existing Mortgage

Determine the terms of the seller’s current mortgage, including interest rate and remaining balance.

2. Negotiate Terms with the Seller

Agree on a purchase price and the interest rate for the wraparound mortgage. The new mortgage should be higher than the existing one.

3. Create a Written Agreement

Draft a wraparound mortgage agreement outlining the terms, including the payments and duration.

4. Make Payments

The buyer makes monthly payments to the seller, who continues to pay the original mortgage. The seller benefits from the difference in payments.

5. Record the Agreement

Ensure that the agreement is recorded at the local government office to protect both parties’ interests.This creative financing method allows buyers to acquire properties while providing sellers with consistent income.

Success Stories

Many individuals have successfully utilized creative financing techniques to achieve their real estate investment goals. For instance, one investor purchased a distressed property using a subject-to financing strategy, enabling them to avoid significant upfront costs. They were able to renovate and resell the property for a substantial profit, showcasing the power of innovative financing methods.Another investor’s successful wraparound mortgage involved acquiring a property with little cash down, allowing them to leverage existing equity effectively.

Their experience illustrates how these creative strategies can lead to profitable transactions.These testimonials highlight the effectiveness and potential of creative financing, encouraging others to consider these methods for their real estate endeavors.

Understanding Real Estate Syndication

Real estate syndication is a powerful tool for investors looking to pool resources and access larger deals that might be out of reach individually. By coming together, investors can share both the risks and the rewards of a property investment. This approach not only broadens the potential for substantial profits but also creates opportunities to diversify investment portfolios.Real estate syndication involves a group of investors who join forces to purchase and manage a property.

This method allows individuals to invest in larger real estate deals, such as apartment complexes or commercial properties, that they may not be able to afford alone. The investors typically form a legal entity, such as an LLC or a limited partnership, which holds the property and manages its operations. The funds raised from the investors are then used to cover the down payment, closing costs, and other expenses associated with the property acquisition.

Legal Structures and Compliance Requirements

When engaging in real estate syndication, understanding the legal structures and compliance is paramount to ensure that all parties are protected and that the syndication operates within the law. Syndications usually take the form of a limited liability company (LLC) or a limited partnership (LP), which dictates the roles and responsibilities of the participants.A limited liability company (LLC) provides flexibility and protection from personal liability for the investors involved.

In contrast, a limited partnership typically consists of general partners who manage the investment and limited partners who contribute capital but do not participate in day-to-day operations. Each structure comes with its compliance requirements, which include registering with the appropriate state authorities and adhering to securities laws. It’s essential for syndicators to comply with the Securities and Exchange Commission (SEC) regulations since they are offering securities when raising funds from investors.

This entails preparing comprehensive disclosure documents that detail the investment, risks, and the business plan.

Roles of General and Limited Partners

In a real estate syndication, the roles of general and limited partners are distinctly Artikeld, affecting both decision-making and financial returns. The general partners (GPs) are responsible for the management of the investment, making strategic decisions, and handling operations. They typically take on the most risk as they ensure the property is maintained and profitable.Limited partners (LPs), on the other hand, are essentially passive investors.

They provide capital contributions while relinquishing control over day-to-day management. Their involvement is crucial, as it allows the syndication to pool a significant amount of resources without the need for each investor to manage the property directly. The relationship between GPs and LPs often involves a profit-sharing arrangement, where the GPs receive a management fee and a percentage of profits, whereas LPs earn returns based on their investment.

This structure aligns the interests of both parties, fostering a collaborative environment to achieve the best outcomes from the investment.

Real estate syndication allows investors to leverage collective resources for larger, more lucrative deals while benefiting from the expertise of seasoned professionals.

Government Programs and Incentives

Government-backed programs play a crucial role in making real estate financing more accessible to a wider range of investors and homebuyers. These programs can provide significant financial support and open doors that might otherwise remain closed, especially for those who may struggle to secure traditional bank loans. Understanding these programs and the incentives they offer can be beneficial for anyone looking to finance a real estate deal without relying solely on conventional banking methods.Several government programs exist that cater specifically to real estate financing.

These can include low-interest loans, grants, and tax credits aimed at supporting both residential and commercial real estate investments. By leveraging these programs, investors can reduce their overall costs and increase their potential returns on investment. Below are some key government-backed programs and incentives.

Federal Housing Administration (FHA) Loans

FHA loans are designed to help low to moderate-income individuals or families purchase homes. These loans are particularly advantageous due to their lower down payment requirements and more lenient credit score criteria. The following points Artikel the key features of FHA loans:

- Minimum down payment as low as 3.5% of the purchase price.

- Credit scores can be as low as 580 for maximum financing.

- Mortgage insurance premiums (MIP) are required, adding to the overall cost.

- Available for both first-time homebuyers and those looking to refinance.

U.S. Department of Agriculture (USDA) Loans

USDA loans are another valuable program aimed at promoting homeownership in rural areas. These loans are backed by the government and offer unique benefits for eligible borrowers. The main features of USDA loans include:

- No down payment requirement for qualified properties.

- Competitive interest rates that can be lower than conventional loans.

- Income eligibility requirements that vary by location and family size.

Tax Incentives and Grants

Various tax incentives and grant programs are available to real estate investors that can significantly enhance cash flow and reduce tax liabilities. Understanding these benefits is essential for maximizing investment potential. Some notable options include:

- Low-Income Housing Tax Credit (LIHTC) provides tax incentives for developers to build affordable housing.

- The Energy Efficient Home Credit allows for tax deductions for energy-efficient home modifications.

- Grants for first-time homebuyers can assist with down payments and closing costs.

Eligibility Requirements for Government Programs

Each government-backed financing program has specific eligibility criteria that applicants must meet. Understanding these requirements can help potential investors identify which programs are most accessible to them. The following summarizes the qualifications for various programs:

| Program | Eligibility Criteria |

|---|---|

| FHA Loans | Must have a valid Social Security number, be of legal age to sign a mortgage, and meet credit score requirements. |

| USDA Loans | Must reside in eligible rural areas and meet income limits based on household size and location. |

| LIHTC | Developers must meet specific income and rent restrictions for the properties involved. |

Risk Management in Non-Bank Financing

Navigating the world of non-bank financing can be exhilarating, but it’s important to understand that it comes with its own set of risks. Unlike traditional bank loans, alternative financing methods often involve varied stakeholders and less regulatory oversight, which can lead to potential challenges. This section will explore the risks involved in sourcing funds outside of traditional banks, strategies for mitigating these risks, and present case studies that illustrate effective risk management practices in real estate deals.Identifying potential risks in alternative financing is essential for maintaining the integrity and success of real estate investments.

Understanding these risks allows investors to make informed decisions and prepares them to handle unforeseen challenges. Common risks in non-bank financing include:

- Liquidity Risk: The potential difficulty of accessing cash when needed, which can hinder the ability to meet financial obligations.

- Credit Risk: The possibility that a borrower may default on their financing obligations, impacting the overall project.

- Market Risk: Fluctuations in market conditions can affect property values, leading to potential losses.

- Operational Risk: Challenges related to management and execution of the project, which can lead to unforeseen costs and delays.

Mitigating these risks can be achieved through proactive planning and strategic approaches. Implementing a robust risk management framework can help investors navigate these challenges effectively. Key strategies include:

- Diversification: Spreading investments across multiple projects or financing sources to reduce overall risk exposure.

- Thorough Due Diligence: Conducting comprehensive research on potential investors, partners, and market conditions to assess financial stability and risks.

- Structured Financing: Creating clear and structured financing agreements that Artikel terms, conditions, and responsibilities to avoid misunderstandings.

- Contingency Planning: Developing a plan for unexpected financial challenges, ensuring that there are reserves or alternative financing sources available.

Incorporating real-world examples can provide insight into effective risk management practices. One notable case is the successful financing of a mixed-use development in a rapidly growing urban area. The developers faced liquidity issues but mitigated risks by:

- Establishing a partnership with a private equity firm that provided flexible funding options.

- Implementing a phased development approach, allowing them to generate revenue from completed units before launching subsequent phases.

- Utilizing local government incentives designed to stimulate economic development, thus enhancing financial stability.

“Effective risk management in real estate is not about avoiding risk, but rather understanding and controlling it.”

By acknowledging potential risks and employing strategic mitigation measures, real estate investors can enhance their chances of success in the alternative financing landscape.

End of Discussion

Source: rehabfinancial.com

In summary, financing a real estate deal without a bank presents a wealth of possibilities for resourceful investors willing to think outside the box. By leveraging alternative financing methods, forming strategic partnerships, and understanding the nuances of private investments and crowdfunding, you position yourself for success in the competitive real estate arena. Embrace these alternative avenues and embark on your journey toward achieving your real estate dreams.

FAQ Insights

What are some common alternative financing options?

Common options include seller financing, lease options, hard money loans, and crowdfunding.

How does real estate crowdfunding work?

Real estate crowdfunding allows multiple investors to pool their resources online to finance a property, sharing the risks and returns.

What are the risks associated with private investors?

Risks may include disagreements on terms, potential loss of investment, and the need for clear communication and legal agreements.

Are there any government programs to help with financing?

Yes, there are various government-backed programs, tax incentives, and grants available for real estate investors.

What is the significance of risk management in non-bank financing?

Risk management is crucial to identify and mitigate potential financial pitfalls associated with alternative financing sources.