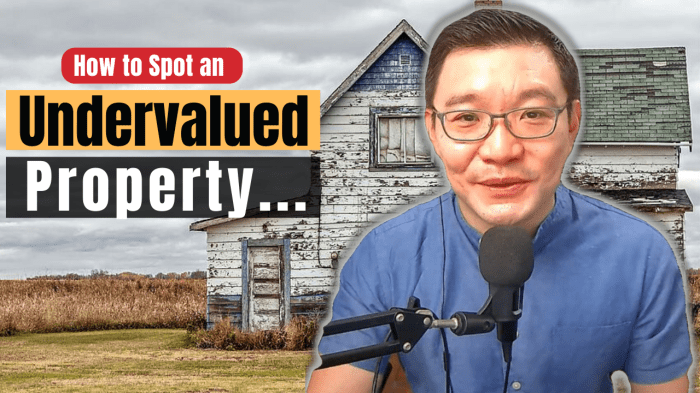

How To Spot An Undervalued Property Before Anyone Else

How to Spot an Undervalued Property Before Anyone Else is a crucial skill for anyone looking to make a smart investment in real estate. In a market filled with fluctuating prices and hidden gems, understanding how to identify undervalued properties can set you apart from the competition. This guide will take you through the essential aspects of property valuation, the indicators to look for, and the tools that can help you uncover opportunities before they become mainstream.

From analyzing market trends to conducting thorough inspections, you’ll learn how to navigate the complexities of real estate investment with confidence. Whether you’re a seasoned investor or a first-time buyer, mastering these techniques will empower you to make informed decisions and potentially secure properties at below-market prices.

Understanding Property Valuation

Property valuation is a critical aspect of real estate that helps investors and homeowners alike determine the worth of a property. Understanding the factors that influence property values can significantly aid in making informed decisions, especially when looking for undervalued properties. Numerous elements contribute to property valuation, and being aware of them can give you an edge in the competitive real estate market.

Several key factors influence property value, including location, property condition, and market trends. The location of a property is often considered the most significant factor; properties in desirable neighborhoods with good schools, amenities, and low crime rates tend to have higher values. The condition of the property itself also plays a vital role; well-maintained homes are valued higher than those in disrepair.

Additionally, market trends, such as supply and demand dynamics, interest rates, and economic indicators, can heavily impact valuations.

Factors Influencing Property Value

When assessing property value, various elements come into play. Understanding these elements is essential for identifying undervalued properties. The following are some primary factors that influence property value:

- Location: Proximity to schools, parks, public transport, and employment opportunities greatly affects desirability.

- Size and Layout: The total square footage and the efficiency of the property layout can impact its utility and appeal.

- Condition: Properties that are well-maintained or recently renovated usually command higher prices.

- Comparative Sales: Recent sales of similar properties in the area provide a benchmark for valuation.

- Market Conditions: Economic factors, such as interest rates and employment levels, influence buyer demand and property prices.

Common Valuation Methods in Real Estate

Multiple methods are used in real estate to assess property values. Recognizing these approaches can enhance your ability to spot undervalued properties effectively. Here are some common valuation methods:

- Sales Comparison Approach: This method evaluates the property by comparing it to similar properties that have recently sold in the same area.

- Cost Approach: This technique estimates the value based on the cost to replace or reproduce the property, minus depreciation.

- Income Approach: Commonly used for rental properties, this method calculates the potential income the property can generate, factoring in expenses.

Impact of Market Trends on Property Valuations

Market trends significantly influence property valuations, and being aware of these trends can provide crucial insights when searching for undervalued properties. Changes in the economy, housing supply, and buyer demand can create fluctuations in property values. For instance, a surge in new job opportunities in a region can lead to increased demand for housing, pushing property values upward. Conversely, economic downturns may decrease demand, resulting in lower property valuations.

Analyzing historical trends and current market conditions allows investors to identify properties that may currently be undervalued but will appreciate as market conditions improve.

“Being attuned to market trends is essential for discovering properties that may be undervalued today but are poised for future appreciation.”

Identifying Indicators of Undervalued Properties

Spotting undervalued properties hinges on understanding a few key characteristics that set these gems apart from the market norm. These indicators can lead savvy investors to opportunities that others may overlook, ultimately resulting in profitable real estate investments. From analyzing market trends to assessing property conditions, identifying these indicators requires a keen eye and a strategic approach.

One of the first signs that a property might be undervalued is its location. While some neighborhoods may have a historic reputation for being less desirable, emerging trends can reveal underlying potential. Additionally, analyzing properties that have been on the market for an extended period might signal an undervaluation, especially if they possess fundamentals like good structure or location that are usually in demand.

Understanding these factors can guide you in pinpointing undervalued properties.

Key Characteristics of Undervalued Properties

Recognizing specific characteristics can significantly aid in identifying undervalued properties. Below is a checklist that Artikels these signs, helping investors filter potential investments effectively.

- Comparative Market Analysis (CMA): If a property’s listing price is significantly lower than similar properties in the area, it may indicate undervaluation.

- Time on Market: Properties that have lingered on the market longer than average may be undervalued, especially if they possess appealing features that are not reflected in the asking price.

- Condition of the Property: Homes requiring minor cosmetic upgrades or repairs might be selling below market value, despite their potential after renovations.

- Foreclosure Properties: Bank-owned or distressed properties often present excellent buying opportunities due to their significantly reduced prices.

- Neighborhood Developments: Areas undergoing redevelopment or new infrastructure projects can suggest upcoming increases in property values.

- Seller Motivation: Sellers who are under duress (e.g., financial difficulties or rapid relocation) may price their properties lower to sell quickly.

Examples of Neighborhoods with Potential Undervaluation

Several neighborhoods across the country have shown signs of undervaluation, often overlooked by mainstream investors. For instance, areas that were historically less desirable may suddenly become hot spots due to urban revitalization or new amenities being introduced. Examples include:

- East Nashville, Tennessee: Once considered a rough area, it has transformed into a vibrant community with arts, restaurants, and parks, yet many property prices remain reasonable.

- West Philadelphia, Pennsylvania: This neighborhood offers affordable housing options while being adjacent to more expensive areas, making it a potential goldmine for savvy buyers.

- Detroit, Michigan: Following a significant economic downturn, various parts of Detroit are bouncing back, and undervalued properties can still be found at attractive prices.

Investors looking to capitalize on real estate opportunities should closely monitor these neighborhoods for signs of undervaluation and potential growth. When evaluating properties, employing the checklist of indicators can aid in making informed and strategic investment decisions, maximizing the chances of finding those hidden gems in the real estate market.

Utilizing Market Data and Analytics

Source: southslopenews.com

Accessing and interpreting real estate market data is crucial for discerning undervalued properties. With the right approach to data analytics, investors can make informed decisions based on historical trends and current market conditions. This segment will help you navigate the essential tools and resources available to assess property values effectively.

Accessing and Interpreting Real Estate Market Data

Understanding where to find reliable market data is the first step towards making informed decisions in real estate investment. There are several key resources and platforms that provide comprehensive data analysis for the housing market.

Multiple Listing Service (MLS)

This is a database used by real estate professionals to access property listings and sales data. It provides detailed information on property features, pricing history, and market trends.

Zillow and Redfin

These popular online platforms offer rich datasets, including estimates of property values (Zestimates), sales history, and neighborhood statistics. They also provide user-friendly charts for visualizing market trends over time.

Local Government Websites

Many counties offer access to property tax records, sales history, and zoning laws. These records can reveal undervalued properties due to delinquent taxes or potential zoning changes.

Real Estate Investment Software

Tools like PropStream or Real Data can provide analytical insights into cash flow potentials and property performance metrics. These platforms cater specifically to real estate investors, translating raw data into actionable intelligence.

Importance of Historical Sales Data

Historical sales data plays a significant role in identifying undervalued properties. By analyzing past market performance, investors can recognize patterns and anomalies that highlight potential opportunities.

Identifying Trends

Understanding how similar properties have appreciated or depreciated over time can provide insights into future value trajectories. For instance, if a neighborhood has consistently seen a 5% annual increase, a property currently priced lower than its historical average may present a strong investment opportunity.

Market Cycles

Real estate operates in cycles. Historical data helps determine whether the market is in a buyer’s or seller’s phase, which influences pricing strategies. A property might be undervalued if it’s being sold during a downturn when the typical value is higher.

Comparative Market Analysis (CMA)

By conducting a CMA, investors can compare a property’s current price against similar properties’ sale prices over the last few years. This comparison highlights discrepancies and can lead to identifying undervalued properties.

“Historical sales data is a vital tool; it not only demonstrates past performance but also acts as a predictor of future value.”

Using Online Tools and Resources for Property Analysis

There are numerous online tools that can streamline the property analysis process. Leveraging technology allows investors to efficiently filter through data to uncover undervalued opportunities.

Property Analysis Tools

Websites like Mashvisor and RealtyMogul offer analytical tools that help investors assess rental income potential, flip profitability, and market trends.

Data Visualization Software

Tools such as Tableau or Google Data Studio can be used to create visual representations of market data, making it easier to spot trends and make comparisons.

Real Estate Blogs and Market Reports

Staying informed through reputable real estate blogs and publications can provide additional insights into market changes, emerging neighborhoods, and expert opinions.

Social Media and Networking Groups

Engaging in online forums or social media groups for real estate investors can lead to valuable information sharing. Members often discuss recent deals, market shifts, and analytical techniques that could reveal undervalued properties.By utilizing these resources, investors can enhance their property analysis capabilities, significantly improving their chances of spotting undervalued properties before anyone else.

Conducting Comparative Market Analysis (CMA)

Source: dividendstocks.cash

To effectively spot an undervalued property, conducting a Comparative Market Analysis (CMA) is essential. This analytical process helps investors and homebuyers determine the fair market value of a property by comparing it with similar properties in the area. A well-executed CMA can reveal hidden opportunities that are not immediately apparent, allowing savvy investors to make informed decisions.The CMA involves several steps that can guide you through the process of evaluating a property’s value.

Here’s a structured approach to conducting a CMA:

Step-by-Step Process of Conducting a CMA

The following steps Artikel the necessary actions to perform a thorough CMA. Each step is crucial for ensuring an accurate assessment of the property in question.

- Define the Subject Property: Start by clearly defining the property you want to analyze. Detail its characteristics, including the type (single-family home, condo, etc.), square footage, number of bedrooms and bathrooms, and any unique features.

- Research Comparable Properties: Identify similar properties (comps) that have recently sold in the same neighborhood. Look for properties with similar characteristics and within a close proximity, ideally within a mile radius.

- Gather Sales Data: Collect data on the sale prices of the comps, focusing on the last 3 to 6 months. Use local MLS databases or real estate websites to obtain accurate and up-to-date information.

- Adjust for Differences: Make necessary adjustments to the prices of the comps based on differences in features, condition, and location. For example, if a comp has a finished basement and your subject property does not, decrease the comp’s value accordingly.

- Calculate the Average Price per Square Foot: Divide the adjusted sale prices of the comps by their total square footage to find the price per square foot. This figure will help you compare values more effectively.

- Determine a Price Range: Use the average price per square foot to establish a price range for the subject property. Multiply the price per square foot by the subject property’s total square footage.

- Compile and Analyze Results: Present your findings in a clear format, highlighting the key points and adjustments made. This analysis should guide you in making a well-informed decision regarding the property’s value.

Template for Comparing Similar Properties

To streamline the comparative analysis, utilize the following template that organizes key data points. This will help you visualize the differences and similarities among the properties.

| Property Address | Sale Price | Square Footage | Bedrooms | Bathrooms | Unique Features | Adjustments |

|---|---|---|---|---|---|---|

| 123 Main St | $350,000 | 1,800 | 3 | 2 | Finished Basement | + $15,000 |

| 456 Elm St | $340,000 | 1,750 | 3 | 2 | New Roof | + $5,000 |

| 789 Oak St | $300,000 | 1,600 | 2 | 1 | No Garage | – $20,000 |

Criteria for Selecting Comparable Properties

Choosing the right comparable properties is key to achieving an accurate CMA. The following criteria help ensure that your comparisons are relevant and reliable.When selecting comparables, consider the following factors:

- Location: Properties should be located in the same neighborhood or area to account for local market conditions.

- Property Type: Ensure that the comps are of the same property type as the subject property (e.g., single-family homes vs. condos).

- Recent Sales: Focus on properties that have sold within the last 3 to 6 months to reflect current market trends.

- Size and Layout: Look for properties with similar square footage and floor plans to provide a more accurate comparison.

- Age and Condition: Take note of the age and condition of the properties, as this can significantly impact value.

- Unique Features: Consider special features like pools, garages, or renovations that may affect property values.

Networking and Local Insights

Source: homeseller.sg

Building relationships with local real estate professionals is crucial in spotting undervalued properties before they hit the mainstream market. Establishing a network in your local area can provide you with insider knowledge and opportunities that you might not find through traditional channels. Engaging with real estate agents, property managers, and investors helps you to tap into their expertise, experiences, and valuable insights about the market dynamics.By attending local property auctions and real estate events, you not only expose yourself to various properties but also meet like-minded individuals who are passionate about real estate.

These gatherings can serve as a goldmine for networking, allowing you to exchange ideas and strategies that could lead to discovering hidden gems in the property market.

Building Relationships with Local Real Estate Professionals

Establishing strong connections with local real estate professionals can significantly enhance your ability to find undervalued properties. Consider the following approaches to foster these relationships:

- Join local real estate investment groups or associations to meet industry insiders and gain insights into market trends.

- Offer to assist real estate agents with open houses or property viewings, which can provide you with a behind-the-scenes look at the market.

- Engage with property managers who can give you information about rental markets and potential undervalued investment opportunities.

- Maintain communication with local mortgage brokers, as they often possess knowledge about properties that may be financially accessible to buyers.

Benefits of Attending Local Property Auctions and Real Estate Events

Participating in local property auctions and real estate events offers several advantages that can aid in identifying undervalued properties. These benefits include:

- Access to off-market deals that are not widely advertised.

- Real-time insights into bidding behavior and market demand, which can help you gauge property values.

- The opportunity to interact with sellers directly, allowing you to negotiate better deals.

- Networking opportunities that facilitate connections with other investors and industry professionals.

Community Sources for Insider Information on Undervalued Properties

Utilizing community resources for insider information can be invaluable in your quest to find undervalued properties. Here are some effective sources to consider:

- Local community bulletin boards or online forums where residents share information about properties that might be on the market soon.

- Social media groups focused on real estate investment in your area, which can provide real-time discussions and tips.

- Networking with neighborhood associations that may have insights into homes that are not actively listed but are on the verge of being sold.

- Engaging with local civic organizations that may have data on upcoming developments or revitalization projects that could drive property values up.

“The best deals often come from those who know the market inside and out—your network is your net worth.”

Financial Considerations and Investment Strategies

When it comes to acquiring undervalued properties, financial considerations and effective investment strategies play a crucial role in ensuring success. A well-planned budget and a clear understanding of financing options can make a significant difference in your investment journey. This section will delve into budget planning, various financing options available for acquiring undervalued properties, and investment strategies that can help maximize returns.

Budget Planning for Property Purchases

Establishing a solid budget is the foundation of any successful property investment. It’s essential to assess your financial situation thoroughly to determine how much you can comfortably invest without compromising your financial stability. Consider the following key elements while planning your budget:

- Initial Costs: Account for down payments, closing costs, and any necessary repairs or renovations. These upfront costs can significantly affect your total budget.

- Ongoing Expenses: Include property management fees, insurance, property taxes, and maintenance costs. Understanding these recurring expenses helps in evaluating cash flow.

- Contingency Fund: Set aside a percentage of your budget for unexpected expenses. A good rule of thumb is to reserve 10-20% of the total budget for contingencies.

Financing Options for Acquiring Undervalued Properties

Exploring various financing options is crucial for capitalizing on undervalued properties. Here are some of the most common financing avenues you might consider:

- Conventional Mortgages: Traditional loans that often require a significant down payment but offer competitive interest rates, making them suitable for long-term investments.

- FHA Loans: Federal Housing Administration loans allow lower down payments and are beneficial for first-time investors looking to purchase undervalued properties.

- Hard Money Loans: Short-term loans secured by the property itself, ideal for investors needing quick cash for renovations before refinancing with a conventional mortgage.

- Private Investors: Partnering with private investors can provide the capital needed without traditional bank hurdles, often resulting in more flexible terms.

- Home Equity Loans: Leveraging the equity in your current home can provide funds for purchasing another property, especially if it’s undervalued.

Investment Strategies for Maximizing Returns

Choosing the right investment strategy is essential for ensuring that your investment in undervalued properties yields the highest possible returns. Here are several strategies to consider:

- Value-Added Renovations: Making strategic improvements to the property, such as updating kitchens or bathrooms, can significantly increase the property’s market value and rental income.

- Buy and Hold: Acquiring properties with the intent of holding them long-term can be beneficial. This strategy allows you to take advantage of market appreciation over time, generating wealth through equity growth.

- Flipping Properties: For those looking for quicker returns, purchasing undervalued properties, renovating them, and selling at a higher price can yield substantial profits if done correctly.

- Rental Income: Investing in undervalued properties can provide a steady stream of rental income, which can help offset mortgage payments and other costs, ultimately increasing cash flow.

- Diversifying Investments: Consider spreading your investments across different types of properties or markets to mitigate risks associated with fluctuations in specific areas.

Conducting Physical Property Inspections

When evaluating potential investment properties, conducting a thorough physical inspection is essential. This process not only identifies any existing issues but also provides insight into the overall condition of the property. A keen eye during inspections can help investors spot undervalued properties that require minor adjustments to enhance their value significantly.Assessing the physical state of a property is crucial, as it can directly affect the overall investment return.

Small renovations might yield significant increases in property value, while major repairs can drastically influence potential profits. Therefore, understanding the condition of the property can help investors make informed decisions about their investments.

Property Condition Evaluation Checklist

A well-structured checklist can simplify the process of evaluating a property’s condition. Here are key areas to focus on during inspections:

- Exterior Inspection: Look for roof integrity, siding condition, foundation stability, and landscaping upkeep.

- Interior Inspection: Check for signs of water damage, mold, and the condition of floors, walls, and ceilings.

- Systems Check: Assess the functionality of HVAC systems, plumbing, and electrical wiring.

- Safety Features: Verify the presence of smoke detectors, fire extinguishers, and adequate egress in case of emergencies.

- Appliances and Fixtures: Determine the age and condition of kitchen appliances and plumbing fixtures.

Highlighting the significance of renovations and repairs is vital when determining property value. A property that shows signs of neglect may be priced lower, but with some strategic renovations, an investor can significantly increase its worth. For example, updating a dated kitchen or bathroom can lead to an increase in marketability and rental income potential.

Estimating Renovation Costs

Estimating renovation costs accurately can significantly affect your investment strategy. An effective way to approach this is by breaking down potential renovations into specific categories. Here’s a structured method to estimate costs:

- Cosmetic Updates: Minor improvements like painting, flooring, and landscaping often have lower costs, typically ranging from $1,500 to $5,000 depending on the size of the property.

- Major Renovations: More intensive projects such as kitchen remodels or structural changes can cost upwards of $20,000 to $100,000, depending on scope and materials.

- Labor Costs: Factor in labor costs which can vary significantly based on local market rates and the complexity of the work involved.

- Permits and Overheads: Consider potential costs related to permits and unexpected expenses that may arise during the renovation process.

It’s important to gather multiple quotes from contractors and consider potential DIY options to better understand the overall project budget. By carefully evaluating the condition of the property and estimating repair costs accurately, investors can make informed decisions that enhance their profitability potential.

Timing and Market Cycles

Understanding the timing of market cycles is crucial for spotting undervalued properties before they attract mainstream attention. Economic conditions and market dynamics play a significant role in property valuation. By analyzing these cycles, investors can strategically position themselves to capitalize on opportunities that others may overlook.The impact of economic cycles on property prices is profound. During economic expansions, demand for properties typically increases, leading to rising prices.

Conversely, during downturns, prices may drop, creating potential opportunities for savvy investors. It’s essential to recognize the indicators of these cycles, such as employment rates, interest rates, and consumer confidence, as they can provide critical insights into when to enter the market.

Identifying Economic Conditions

Several key economic indicators can signal when to look for undervalued properties. Monitoring the following metrics can help investors make informed decisions:

- Interest Rates: Lower interest rates can increase affordability, leading to higher demand for properties. Conversely, high rates may suppress demand and create opportunities for buyers.

- Job Growth: A growing job market often correlates with increased demand for housing. Areas with robust job growth can indicate a stable or appreciating real estate market.

- Consumer Confidence Index: High consumer confidence can lead to increased spending on real estate, while low confidence can signify a decline in property values.

In addition to economic indicators, seasonal trends also influence property valuations. Recognizing the cyclical nature of real estate can help investors pinpoint the best times to search for undervalued opportunities. For instance, the spring and summer months often see more listings and heightened activity, while fall and winter may present lower competition and potential bargains.

Seasonal Trends in Real Estate

Understanding seasonal trends is essential for maximizing investment potential. The following aspects illustrate how seasons can affect property valuations:

- Spring Market Surge: Typically, spring heralds an influx of listings and buyers, leading to increased competition and higher prices.

- Summer Slowdown: As the summer progresses, activity may taper off as families focus on vacations and moving logistics, potentially leading to price reductions.

- Fall Opportunities: With the onset of fall, many sellers may become more motivated to sell, especially if they haven’t found buyers during the peak season, creating opportunities for negotiation.

- Winter Discounts: Winter often sees fewer transactions, but motivated sellers can provide excellent deals for investors willing to brave the cold.

By staying attuned to economic cycles and seasonal trends, investors can better position themselves to identify undervalued properties. Recognizing the interplay of these factors can lead to strategic acquisitions that yield significant returns as the market rebounds.

Ending Remarks

In conclusion, spotting undervalued properties takes a combination of research, intuition, and strategic planning. By understanding valuation methods, utilizing market data, and tapping into local insights, you can enhance your investment strategy significantly. Remember, the key to finding great deals often lies in being proactive and thorough in your approach. With these tools at your disposal, you’re well on your way to discovering undervalued properties before anyone else does.

User Queries

What are the main indicators of an undervalued property?

Key indicators include properties that have been on the market for a long time, those listed below market value, and homes in improving neighborhoods.

How can I access real estate market data?

You can access market data through online databases, real estate websites, and local property records.

What is the benefit of using a Comparative Market Analysis (CMA)?

A CMA helps you understand the fair market value of a property by comparing it to similar properties that have recently sold.

How important is networking in real estate?

Networking is crucial as it provides access to insider information and opportunities that may not be publicly available.

What should I consider for financing undervalued properties?

Options include traditional mortgages, private loans, and partnerships, depending on your financial situation and investment strategy.