How To Use Real Estate To Build Long-Term Wealth

How to Use Real Estate to Build Long-Term Wealth invites you to explore the intricate world of real estate investment, a powerful avenue for financial growth and stability. With the right knowledge and strategies, real estate can transform from mere property to a significant wealth-building tool, offering both tangible rewards and unique opportunities.

This guide will take you through the essential facets of real estate investing, including understanding types of investments, financing options, market analysis, and property management techniques. By delving into proven strategies for long-term wealth, tax benefits, and emerging trends, you’ll be well-equipped to navigate the complexities of the real estate landscape.

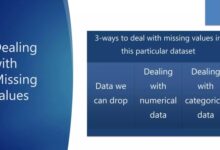

Understanding Real Estate Investment

Source: lifereg.ca

Real estate investment refers to the purchase, ownership, management, rental, or sale of real estate for profit. This investment strategy is recognized for its potential to build long-term wealth, serving as a valuable component of many individuals’ financial portfolios. Investing in real estate can provide both passive income opportunities and appreciation in property value over time, making it an attractive avenue for wealth accumulation.Real estate investments can be categorized into various types, each offering unique opportunities and challenges.

The primary types of real estate investments include residential, commercial, and industrial properties. Understanding these categories is crucial for investors to align their strategies with their financial goals and risk tolerance.

Types of Real Estate Investments

Different types of real estate investments have distinct characteristics and potential returns. Here are the primary categories:

- Residential Properties: These include single-family homes, multi-family units, and vacation rentals. Residential real estate often provides steady cash flow through rent, making it a popular choice for new investors.

- Commercial Properties: This category comprises office buildings, retail spaces, and warehouses. Commercial properties generally offer longer lease terms and can yield higher returns but may also come with more complex management needs.

- Industrial Properties: These include manufacturing facilities, distribution centers, and storage units. Industrial real estate can be lucrative due to high demand for logistics spaces, especially with the rise of e-commerce.

- Raw Land: Investing in undeveloped land can be a speculative strategy. Investors may purchase land to hold for future appreciation or to develop residential or commercial projects.

- Real Estate Investment Trusts (REITs): These are companies that own and manage income-producing real estate. Investing in REITs provides exposure to real estate markets without the need to directly own properties.

Investing in real estate comes with its own set of risks and rewards. It is essential for investors to balance these factors when making decisions.

Risks and Rewards of Real Estate Investing

The potential rewards of real estate investing can be substantial, but they must be weighed against inherent risks.

- Rewards:

- Appreciation: Over time, real estate values generally increase, leading to profits upon resale.

- Cash Flow: Rental properties can provide a consistent income stream, enhancing overall financial stability.

- Tax Benefits: Investors can take advantage of tax deductions on mortgage interest, property taxes, and depreciation.

- Risks:

- Market Fluctuations: Real estate values can decline due to economic downturns or changing market conditions.

- Vacancy Risks: Properties may remain unoccupied, leading to lost rental income and increased costs.

- Maintenance Costs: Property upkeep and unexpected repairs can erode profit margins.

Investors need to conduct thorough research and due diligence to navigate these risks and maximize rewards effectively.

Financing Real Estate Investments

Investing in real estate requires not just a good strategy, but also a solid understanding of how to finance those investments. The ability to secure adequate funding can make a significant difference in the success of your real estate ventures. Here, we will delve into the various financing options available for real estate purchases, the importance of budgeting for these investments, and how credit scores play a crucial role in the financing process.

Financing Options for Real Estate Purchases

Several financing options are available, catering to different needs and investment strategies. Understanding these options is crucial for making informed decisions.

- Conventional Loans: Offered by banks and credit unions, these loans typically require a good credit score and a down payment of 20%. They are suitable for traditional home purchases and investment properties.

- FHA Loans: Insured by the Federal Housing Administration, these loans allow for lower down payments, making them accessible for first-time investors. A credit score of at least 580 is often required for the minimum down payment of 3.5%.

- VA Loans: Available for veterans and active-duty service members, these loans offer favorable terms, including no down payment and no private mortgage insurance (PMI), making them an attractive option for eligible buyers.

- Hard Money Loans: These are short-term loans provided by private investors or companies, typically at higher interest rates. They are often used for fix-and-flip investments where quick access to capital is essential.

- Home Equity Loans: Utilizing the equity built up in a primary residence can provide funds for purchasing additional properties. These loans often have lower interest rates compared to other borrowing options.

Creating a Budget for Real Estate Investments

Establishing a comprehensive budget is a key step in the real estate investment process. A well-structured budget helps investors understand their financial limits and guides them in making strategic decisions.When creating a budget, consider the following components:

- Purchase Price: Determine the maximum price you are willing to pay for a property based on your financial situation and investment goals.

- Closing Costs: Include expenses such as title insurance, appraisal fees, and attorney fees, which typically amount to 2-5% of the purchase price.

- Repairs and Renovations: Allocate funds for any necessary improvements to increase the property’s value and rental appeal.

- Ongoing Expenses: Factor in property taxes, insurance, maintenance, and management fees to understand the total cost of ownership.

Impact of Credit Scores on Financing

Credit scores play a pivotal role in determining the financing options available to an investor. A higher credit score can unlock better loan terms and lower interest rates, which can significantly affect overall investment profitability.The following aspects highlight the importance of maintaining a good credit score:

- Loan Approval: Lenders assess credit scores to decide whether to approve a loan application. A score above 740 is generally considered excellent and can lead to more favorable borrowing conditions.

- Interest Rates: A strong credit score often results in lower interest rates, which can save thousands over the life of a loan.

- Down Payment Requirements: Higher credit scores may reduce the amount of down payment required, making it easier to invest.

The general rule of thumb is to keep your credit score above 700 to access the best financing options for real estate investments.

Real Estate Market Analysis

Understanding the real estate market is crucial for any investor looking to build long-term wealth. A thorough market analysis allows you to make informed decisions about where and when to invest. In this section, we’ll explore effective methods for conducting market research, criteria for evaluating investment locations, and the importance of grasping market trends and indicators.

Methods for Conducting Market Research

Before diving into real estate investments, conducting comprehensive market research is essential. This involves gathering data from various sources and analyzing it to inform your investment decisions. Effective research methods include:

- Utilizing online real estate platforms, such as Zillow and Realtor.com, to analyze property values and market trends.

- Reviewing local economic reports, which provide insights into job growth, population demographics, and housing demand.

- Engaging with local real estate agents who have firsthand experience and knowledge of the area’s market conditions.

- Attending real estate networking events and seminars to gain insights from other investors and professionals.

Each of these methods contributes to a holistic view of the market, enabling you to make educated choices regarding potential investments.

Criteria for Evaluating Potential Investment Locations

Selecting the right location is a cornerstone of successful real estate investment. To evaluate potential areas for investment, consider the following criteria:

- Economic Stability: Research the local economy’s health, focusing on employment rates and major industries.

- Neighborhood Trends: Investigate neighborhood development plans and the rate of property value appreciation over the past years.

- Accessibility: Assess transportation options, including proximity to public transit, highways, and airports.

- Quality of Life: Analyze local schools, parks, and amenities that contribute to the desirability of the area for potential tenants or buyers.

These criteria will help you identify locations with strong growth potential, allowing for better investment outcomes.

Significance of Understanding Market Trends and Indicators

Staying attuned to market trends and indicators is vital for making timely investment decisions. Key trends to watch include:

- Housing Inventory: A low inventory often signals a seller’s market, which could drive prices higher, while a high inventory might indicate a buyer’s market.

- Interest Rates: Monitoring changes in interest rates can impact your financing costs and overall investment profitability.

- Rental Demand: Understanding shifts in rental demand, especially in urban versus suburban areas, can guide your investment focus.

- Local Government Policies: Be aware of zoning laws and regulations that may affect property values and development opportunities.

By keeping an eye on these indicators, you can anticipate market changes and adjust your strategies accordingly, enhancing your potential for long-term wealth accumulation through real estate.

Strategies for Long-Term Wealth Building

In the realm of real estate investment, developing effective strategies is crucial for building long-term wealth. By understanding the approaches that work best, investors can maximize their returns and cultivate a stable financial future. Here, we explore several proven strategies that can enhance the profitability of real estate investments.

Maximizing Returns on Real Estate Investments

To optimize the returns from real estate investments, several strategies can be employed. These strategies are essential for navigating the complexities of the real estate market effectively.

- Buy-and-Hold Strategy: This approach involves purchasing properties and holding onto them for an extended period. The idea is to benefit from appreciation in property value over time and to generate consistent rental income. Successful investors often look for properties in high-demand areas where prices are expected to rise.

- Value-Add Strategy: This involves acquiring properties that require renovations or improvements. By upgrading the property, investors can increase its value and generate higher rental income. Examples include converting multi-family units into condos or modernizing outdated facilities.

- Leverage Financing: Utilizing financing options allows investors to purchase more properties without needing vast amounts of capital upfront. By using mortgages or other financing methods, investors can control larger assets while only putting down a fraction of their value.

- Diversification: Investing in various types of properties (residential, commercial, or mixed-use) spreads risk and can enhance overall returns. Each property type reacts differently to market conditions, providing a safety net in down markets.

Benefits of Buy-and-Hold vs. Flipping Properties

The buy-and-hold strategy and property flipping are two distinct approaches, each with its own merits and risks. Understanding these can help investors choose the method that aligns with their objectives.

- Stability of Buy-and-Hold: Investors who adopt the buy-and-hold strategy benefit from long-term appreciation and steady cash flow through rental income. This method allows for a more hands-off investment approach, where income is generated over time rather than requiring constant monitoring or intervention.

- Higher Potential Returns from Flipping: Flipping properties can yield substantial short-term profits if executed successfully. Investors purchase homes at a lower price, renovate them, and sell them for a profit, usually in a faster time frame. However, this strategy also involves higher risks and requires a keen understanding of market trends.

- Tax Benefits: Holding properties long-term can offer tax advantages, such as lower capital gains taxes. Investors can defer taxes through strategies like the 1031 exchange, which allows the deferral of taxes on the sale of a property if another property of equal or greater value is acquired.

- Market Resilience: Buy-and-hold investors are often less affected by short-term market fluctuations, while flippers must stay attuned to market conditions to ensure profitability. This stability can make buy-and-hold a more appealing option for risk-averse investors.

Leveraging Equity for Future Investments

Equity in real estate can serve as a powerful tool for financing future investments. As property values increase and mortgages are paid down, investors can tap into this equity to fund new acquisitions.

- Home Equity Loans: Investors can secure loans against the equity built up in their properties, which can then be reinvested into additional real estate. This allows for portfolio expansion without requiring large sums of cash out of pocket.

- Cash-Out Refinancing: This strategy involves refinancing an existing mortgage for more than what is owed, allowing investors to take out the difference in cash. The cash can be used for further property investments, paying off debt, or other financial goals.

- Using Equity to Increase Cash Flow: By leveraging equity, investors can acquire properties that generate positive cash flow. This not only increases wealth but also creates a cycle of reinvestment, further compounding returns.

- Risk Management: Leveraging equity should be done cautiously. Investors must ensure that the additional debt does not exceed their ability to manage and service, keeping an eye on market conditions to mitigate risks.

Property Management Techniques

Managing rental properties effectively is crucial for maximizing your investment returns and ensuring tenant satisfaction. A good property management strategy not only keeps your properties in top condition but also fosters positive relationships with tenants, which can lead to longer lease terms and lower vacancy rates. This section will explore best practices for managing rental properties, emphasizing the importance of tenant screening and property maintenance.

Best Practices for Managing Rental Properties

Implementing best practices in property management can significantly enhance the overall success of your real estate investments. Key strategies include consistent communication, thorough record-keeping, and proactive maintenance.

- Establish regular communication channels with tenants to address concerns promptly.

- Maintain accurate financial records of income and expenses to manage cash flow effectively.

- Conduct regular property inspections to identify maintenance needs early.

Importance of Tenant Screening and Property Maintenance

Tenant screening is a vital step in ensuring you attract responsible renters who will respect your property and pay rent on time. Alongside tenant screening, regular property maintenance is essential to preserve property value and prevent costly repairs in the future.

“Effective tenant screening can reduce turnover rates and improve rental income stability.”

- Implement background checks, including credit history and employment verification, to assess potential tenants.

- Create a maintenance schedule to routinely check essential systems, like plumbing and electrical work, to prevent emergencies.

- Respond to maintenance requests quickly to demonstrate commitment to tenant satisfaction.

Property Management Responsibilities Checklist

To ensure all aspects of property management are covered, it’s beneficial to have a comprehensive checklist of responsibilities. This will help in tracking important tasks and ensuring nothing is overlooked.

| Responsibility | Description |

|---|---|

| Tenant Screening | Conduct background checks and interviews to select qualified tenants. |

| Lease Agreements | Prepare and manage lease agreements clearly outlining tenant obligations. |

| Rent Collection | Establish a system for timely rent collection and manage late payments. |

| Maintenance Management | Schedule and oversee routine property maintenance and respond to repair requests. |

| Financial Reporting | Track income and expenses, providing regular financial reports to stakeholders. |

Tax Benefits of Real Estate Investing

Investing in real estate offers numerous tax benefits that can significantly enhance your overall financial position. Understanding these benefits is crucial for any investor looking to build long-term wealth through real estate. From deductions to depreciation, the tax landscape surrounding real estate investment is both complex and rewarding. One of the key advantages of real estate investing is the array of tax deductions available to investors.

These deductions not only reduce taxable income but also enhance cash flow, making real estate a preferred investment vehicle. The following deductions are commonly accessible to real estate investors:

Available Tax Deductions

Real estate investors can benefit from various tax deductions that can lower their overall tax burden substantially. Below are some essential deductions worth noting:

- Mortgage Interest Deduction: Investors can deduct the interest paid on loans used to purchase or improve rental property. This is often one of the largest deductions for property owners.

- Property Tax Deduction: Property taxes assessed on real estate can be deducted from taxable income, providing additional savings.

- Operating Expenses Deduction: Costs associated with managing and maintaining rental properties, such as repairs, maintenance, and utilities, can be deducted.

- Professional Services: Fees paid for services from accountants, property managers, or legal advisors related to the property can also be deducted.

- Travel Expenses: Investors can deduct travel expenses incurred while managing or maintaining their rental properties, including mileage for site visits.

Depreciation is another significant tax advantage for real estate investors. It allows property owners to recover the costs of income-producing property through annual tax deductions.

Impact of Depreciation on Real Estate Investments

Depreciation is the process of allocating the cost of a tangible asset over its useful life. For real estate investors, this means that the value of a property is considered to decrease over time, allowing investors to claim a portion of the property’s value as a deduction each year. The IRS allows residential rental properties to be depreciated over a 27.5-year period, while commercial properties can be depreciated over 39 years.

Here’s how it works in a simplified format:

Annual Depreciation Expense = Cost of Property / Depreciation Period

For instance, if an investor purchases a rental property for $275,000, the annual depreciation would be:

$275,000 / 27.5 = $10,000

This $10,000 can be claimed as a deduction each year, reducing the taxable income and thereby the tax owed.

Strategies for Minimizing Tax Liabilities

Real estate investors often seek strategies to further minimize their tax liabilities. By leveraging specific tactics, investors can maximize their tax benefits effectively. Here are some strategies to consider:

- 1031 Exchange: This strategy allows investors to defer capital gains tax on the sale of a property by reinvesting the proceeds into a similar property.

- Cost Segregation: Through cost segregation studies, investors can accelerate depreciation deductions by identifying and segregating personal property components from the building.

- Real Estate Professional Status: Qualifying as a real estate professional allows investors to deduct losses from rental properties against ordinary income, reducing overall tax liabilities.

- Utilizing Losses: Investors can use losses from real estate investments to offset gains from other investments, optimizing tax efficiency across their portfolio.

- Entity Structuring: Forming an LLC or S-corp can provide tax advantages, allowing for more flexible income distribution and potential self-employment tax savings.

Building a Real Estate Portfolio

Source: gobankingrates.com

Creating a well-rounded real estate portfolio is an essential step towards long-term wealth accumulation. A diverse portfolio mitigates risks while enhancing potential returns, making it crucial for both novice and experienced investors. This section will delve into effective strategies for building and scaling a successful real estate investment portfolio.

Framework for Creating a Diversified Real Estate Portfolio

When constructing a diversified real estate portfolio, it is important to consider various factors that can contribute to stability and growth. A sound framework may include the following elements:

- Property Types: Invest in a mix of residential, commercial, and industrial properties to spread risk. Residential properties often provide cash flow, while commercial properties can yield higher returns over time.

- Geographic Diversification: Invest in different locations to reduce exposure to market fluctuations. Properties in various economic environments can offer stability and growth opportunities.

- Investment Strategies: Employ various strategies, such as buy-and-hold, fix-and-flip, and rental properties, to enhance cash flow and capital appreciation.

- Risk Management: Assess each investment’s risk profile and incorporate insurance and reserve funds to protect against unforeseen events.

Methods for Scaling a Real Estate Investment Business

Scaling a real estate investment business requires a combination of strategic planning, market understanding, and the right tools. Employing the following methods can lead to significant growth:

- Leverage Financing: Utilize leveraged financing options to acquire more properties without depleting your capital. This allows for greater purchasing power while managing cash flow effectively.

- Develop Relationships with Investors: Build partnerships with other investors to pool resources and share risk. Collaborative efforts can lead to larger deals and shared expertise.

- Utilize Technology: Invest in property management software and analytical tools to streamline operations. Technology can help in tracking performance, managing tenants, and analyzing market trends.

- Educate and Train: Continuously enhance your knowledge and skills, and consider mentoring or training others. A knowledgeable team can drive business growth and innovation.

Importance of Networking within the Real Estate Industry

Networking is a critical aspect of succeeding in real estate investing. Establishing and maintaining relationships can lead to valuable opportunities and insights. Here are some key benefits of networking:

- Access to Exclusive Deals: Networking can provide access to off-market deals and investment opportunities that are not publicly advertised.

- Partnership Opportunities: Connections with other investors, developers, and real estate agents can lead to lucrative partnerships, sharing of resources, and joint ventures.

- Market Insights: Engaging with peers helps gather information about market trends, investment strategies, and emerging neighborhoods that can inform decision-making.

- Professional Growth: Networking can foster mentorship opportunities, allowing individuals to learn from experienced professionals and improve their investment strategies.

Overcoming Challenges in Real Estate Investment

Real estate investment can be a lucrative avenue for building wealth, but it’s not without its hurdles. Investors often encounter a variety of challenges that can affect their profitability and decision-making process. Recognizing these obstacles and developing effective strategies to overcome them is essential for success in this competitive field.Common challenges faced by real estate investors include market fluctuations, property vacancies, and financial constraints.

Understanding how to tackle these issues is crucial for maintaining a profitable portfolio. Flexibility and adaptability are key traits that can help investors navigate these difficulties.

Market Downturns and Vacancies

Market downturns can significantly impact property values and rental income. When the economy slows, potential buyers or tenants may hesitate, leading to increased vacancies. To mitigate the risks associated with these downturns, investors can adopt several strategies:

- Maintaining Cash Reserves: Having a financial cushion can help cover costs during periods of low income, ensuring that properties remain operational.

- Diversifying Investments: Investing in different types of properties or in various locations can reduce risk. For instance, combining residential and commercial real estate can provide a balanced income stream.

- Flexible Leasing Options: Offering short-term leases or rent incentives during downturns can attract tenants, reducing the risk of prolonged vacancies.

Importance of Adaptability in Real Estate Investing

Being adaptable in the face of changing market conditions is vital for long-term success. An investor’s ability to pivot and adjust strategies can make a significant difference in overcoming challenges. Adaptable investors are more likely to recognize emerging opportunities and trends.Investors should continuously educate themselves about market dynamics, technological advancements, and changing consumer preferences. For example, incorporating technology such as virtual tours and online leasing can enhance property appeal.

“Success in real estate is not just about buying properties but also about responding to market changes with agility.”

Staying informed and open to new strategies allows investors to navigate obstacles effectively and capitalize on new opportunities as they arise. By embracing adaptability and fostering resilience, investors can build a robust portfolio that withstands the test of time and market fluctuations.

Utilizing Technology in Real Estate

In the evolving landscape of real estate, technology plays a pivotal role in enhancing investment strategies and streamlining operations. Various tools and software not only make property management and market analysis more efficient but also empower investors with data-driven insights to make informed decisions. The integration of technology into real estate investment strategies offers a significant competitive advantage. With the rise of proptech, investors can leverage tools that enhance their ability to analyze properties, understand market trends, and connect with potential buyers or tenants more effectively.

Technology reduces the manual workload, minimizes errors, and provides transparency across various processes.

Role of Property Management Software

Property management software revolutionizes the way property managers handle their portfolios. By automating routine tasks, these platforms improve efficiency and allow managers to focus on strategic initiatives. Essential functions such as rent collection, maintenance requests, and tenant communication can be managed seamlessly through these systems.Some key benefits of property management software include:

- Centralized Data Management: All property information, tenant details, and financial records are stored in one place, making access and updates straightforward.

- Automated Communication: Automated notifications and reminders can be sent to tenants regarding rent due dates, lease renewals, or maintenance updates, improving tenant satisfaction.

- Financial Reporting: Comprehensive financial reports can be generated quickly, enabling property owners to track cash flow and overall portfolio performance accurately.

- Maintenance Tracking: Tenants can easily submit maintenance requests through the platform, streamlining the process for property managers.

- Tenant Screening: Many software solutions provide tenant screening features to assess potential renters based on credit scores and rental history.

Online Tools for Real Estate Analysis and Marketing

Numerous online tools facilitate real estate analysis and marketing, providing investors with the necessary resources to make informed decisions. These platforms can range from market analytics to marketing solutions that help reach potential buyers effectively.Examples of online tools include:

- Zillow: This tool offers property valuation estimates (Zestimates) and allows users to access comprehensive property data, including sales history and neighborhood information.

- CoStar: A leader in commercial real estate analytics, CoStar provides data on property availability, pricing, and market trends, essential for commercial investors.

- Reonomy: This platform utilizes big data to provide insights into commercial properties, helping users discover ownership details and asset history.

- Mashvisor: This tool specializes in investment property analysis, helping investors identify lucrative rental properties through comprehensive data analytics.

- Canva: For marketing purposes, Canva enables real estate professionals to design visually appealing marketing materials, such as flyers, brochures, and social media posts, enhancing their marketing efforts.

The effective use of these technologies not only streamlines operations but also enhances the decision-making process in real estate investments, paving the way for sustainable long-term wealth building.

Future Trends in Real Estate Investment

As we look ahead, the real estate landscape continues to evolve, driven by various factors including technology, economic shifts, and changing consumer preferences. Investors who remain informed about these trends can capitalize on opportunities that may arise, ensuring a robust strategy for long-term wealth creation. Understanding these future trends is essential for making informed decisions in this dynamic market.

Emerging Trends in the Real Estate Market

The real estate market is witnessing several emerging trends that are shaping investment strategies. These trends include the rise of remote work, urbanization, and the increasing demand for mixed-use developments.

- The shift towards remote work has led to increased demand for properties in suburban areas as people seek more space and affordable living options.

- Urban areas are seeing a resurgence as young professionals gravitate towards cities for their amenities and lifestyle, influencing rental markets significantly.

- Mixed-use developments are on the rise, combining residential, commercial, and recreational spaces to create vibrant communities that cater to a live-work-play lifestyle.

Economic Factors Influencing Real Estate Investments

Economic conditions heavily influence the real estate market. Interest rates, inflation, and employment rates are just a few of the factors that can impact investment decisions.

- Low interest rates generally encourage borrowing, making it easier for investors to finance properties and leading to increased market activity.

- Inflation can erode purchasing power but can also drive up property values and rents, making real estate a hedge against inflation.

- Strong employment rates typically correlate with a healthy housing market, as more individuals can afford to buy or rent, thereby boosting demand.

Impact of Sustainability and Green Building Practices in Real Estate

Sustainability is becoming a significant focus in real estate, influencing both investment strategies and property management practices. Investors are increasingly looking at green buildings as a means to attract tenants while also reducing operational costs.

- Green building certifications, such as LEED (Leadership in Energy and Environmental Design), are gaining importance, with properties that have these certifications often commanding higher rents and occupancy rates.

- Investments in energy-efficient technologies can result in lower utility costs, improving overall returns on investment.

- Additionally, there is a growing preference among consumers for sustainable living spaces, which can lead to higher demand for eco-friendly properties.

“Sustainable real estate practices not only benefit the environment but also create long-term value for investors.”

Closing Notes

Source: caliberco.com

In conclusion, delving into the realm of real estate investment opens up a multitude of pathways toward building long-term wealth. By understanding the various aspects of real estate, from finance to management, and embracing adaptability in your investment approach, you can maximize your opportunities for financial success. Embrace these insights and step confidently into the future of your real estate journey.

Clarifying Questions

What is the best type of real estate investment for beginners?

Residential properties are often recommended for beginners due to their familiarity and consistent demand.

How can I increase the value of my property?

Upgrading kitchen and bathrooms, enhancing curb appeal, and maintaining the property can significantly increase its value.

What should I consider when choosing a rental property?

Factors like location, potential rental income, property condition, and nearby amenities are crucial when selecting a rental property.

Is it necessary to hire a property manager?

While not mandatory, a property manager can alleviate the stress of managing rentals, especially for those with multiple properties or limited time.

How does leverage work in real estate?

Leverage allows you to use borrowed funds to invest in real estate, potentially increasing your returns while minimizing your initial investment.