Is Pet Insurance Worth It In 2025?

Is Pet Insurance Worth It in 2025? As more people consider their furry friends as family members, the question of pet insurance becomes increasingly relevant. With veterinary costs on the rise and unexpected health issues lurking around the corner, pet owners are left wondering if insurance is a safety net or an unnecessary expense.

The landscape of pet insurance is evolving, with a growing number of policies that cater to various needs and budgets. Recent statistics reveal that pet ownership is at an all-time high, which correlates with a marked uptick in the acquisition of pet insurance plans. Understanding these dynamics can help pet owners make informed decisions about their pets’ health and financial safety.

Overview of Pet Insurance

Pet insurance serves as a safety net for pet owners, providing financial assistance for veterinary expenses related to their furry companions. The primary purpose of pet insurance is to alleviate the financial burden associated with unexpected medical costs, ensuring that pet owners can make the best choices for their pets’ health without worrying excessively about the expenses involved. As more people consider their pets as part of the family, the significance of pet insurance has grown substantially.Typically, pet insurance policies offer various coverage options to cater to different needs and budgets.

Pet owners can choose from accident-only plans, which cover injuries resulting from accidents, to comprehensive policies that encompass accidents, illnesses, hereditary conditions, and even wellness care. Common features of pet insurance include:

- Accident and Illness Coverage: This is the most comprehensive option, covering a wide range of medical issues, from broken bones to chronic illnesses.

- Preventive Care: Some plans offer coverage for routine check-ups, vaccinations, and dental care, promoting overall pet health.

- Hereditary and Congenital Conditions: Coverage for diseases that are genetically predisposed, ensuring that breeds prone to certain conditions are protected.

The pet ownership landscape has changed significantly over the past few years. According to the American Pet Products Association (APPA), approximately 67% of U.S. households, or about 85 million families, now own a pet. As a result, the pet insurance market has also seen considerable growth. In fact, the North American Pet Health Insurance Association (NAPHIA) reported that pet insurance premiums in the U.S.

rose by over 20% in 2022, highlighting a growing awareness and acceptance of insurance as a vital component of responsible pet ownership.

Types of Coverage Offered

Understanding the types of coverage available is essential for pet owners considering insurance. Each type of policy can differ significantly in what it covers and how costs are structured. Here’s a closer look at the common types of coverage offered:

- Accident-Only Plans: These plans are more affordable and cover medical expenses related solely to accidental injuries. Ideal for pet owners looking for basic coverage.

- Comprehensive Plans: These plans provide extensive coverage for both accidents and illnesses, including surgeries and hospital stays. They are designed for those who want peace of mind for a range of potential health issues.

- Wellness Plans: These are often offered as add-ons to standard policies, focusing on preventive care, such as vaccinations, flea control, and annual check-ups.

- Behavioral Coverage: Some policies include coverage for behavioral issues, which can be crucial for pets experiencing anxiety or aggression problems.

The rise in pet insurance is indicative of a broader cultural shift, as more people are recognizing the importance of planning for their pets’ healthcare needs. By securing insurance, pet owners can ensure that their beloved companions receive timely and effective medical treatment, fostering a healthier, happier life for their pets.

Cost Analysis of Pet Insurance

Pet insurance can be a significant investment for pet owners, and understanding the financial implications is crucial in deciding whether it’s worth it. As pet healthcare continues to evolve, assessing the costs associated with pet insurance in 2025 will help you make informed decisions about your furry friends’ health and well-being.The average cost of pet insurance premiums can vary widely depending on several factors.

In 2025, the typical monthly premium for dog insurance ranges from $30 to $70, while cat insurance averages between $15 and $40. These figures can fluctuate based on the coverage options chosen, the deductible amount, and the insurer’s pricing model.

Factors Influencing the Cost of Pet Insurance

Several key factors play a role in determining the cost of pet insurance premiums:

- Breed: Certain breeds are predisposed to specific health conditions, which can increase insurance costs. For example, breeds like Bulldogs and German Shepherds may incur higher premiums due to their susceptibility to genetic ailments.

- Age: As pets age, the likelihood of developing health issues increases, leading to higher insurance premiums. For instance, a 10-year-old dog will generally have a higher premium than a 2-year-old dog.

- Location: The cost of veterinary care varies significantly by region. Urban areas with higher living costs typically see higher pet insurance premiums than rural areas where veterinary services are less expensive.

- Coverage Type: The extent of coverage chosen, such as accident-only, illness, or comprehensive plans, directly affects the premium. Comprehensive plans that cover all veterinary expenses tend to be the most expensive.

Understanding these factors helps pet owners grasp why premiums differ and the importance of evaluating their pet’s specific needs. The cost of pet insurance can be compared to typical veterinary expenses over a pet’s lifetime, which can be substantial. For example, the average lifetime veterinary cost for a dog can be around $20,000 to $30,000, while for a cat, it may range from $15,000 to $25,000.

“Pet insurance can help mitigate the financial burden of unexpected medical bills, especially for serious health conditions that may incur significant costs.”

Considering the average pet insurance premium over a pet’s lifespan (approximately 12-15 years), pet owners may pay anywhere from $5,400 to $12,600 for dog insurance and $2,700 to $7,200 for cat insurance, depending on the chosen plan. In essence, while pet insurance represents a recurring expense, it can offer substantial savings when facing high veterinary costs, particularly for unexpected emergencies or chronic conditions.

Pet owners should weigh these costs against potential lifetime veterinary expenses to determine if pet insurance aligns with their financial and care strategies for their pets.

Benefits of Having Pet Insurance

Pet insurance can be a game-changer for pet owners, offering a financial safety net when you least expect it. With the rising costs of veterinary care, unexpected medical expenses can be daunting. Pet insurance provides a way to protect your wallet from these unforeseen expenses while ensuring your furry friends receive the necessary care without delay.One of the primary benefits of pet insurance is the financial protection it offers against unexpected veterinary bills.

Pet owners can find themselves in challenging situations when their pets encounter accidents or illnesses that require immediate medical attention. For instance, a simple incident such as a dog ingesting something harmful could result in an emergency visit, diagnostic tests, and treatment, which can add up quickly into hundreds or even thousands of dollars. Having insurance means that you won’t be forced to make a heartbreaking decision based on finances, and you can focus on getting your pet the help they need.

Case Studies Illustrating Cost Savings

Numerous pet owners have shared experiences where having insurance saved them from significant out-of-pocket expenses. Here are a few notable examples:

Bella’s Broken Leg

Bella, a five-year-old lab, broke her leg while playing at the park. The total cost of the surgery and rehabilitation was around $5,000. Luckily, Bella’s owner had pet insurance that covered 80% of the medical expenses, leaving them with just $1,000 to pay. This financial relief allowed Bella’s owner to prioritize her recovery without the stress of an unexpected financial burden.

Max’s Surgery for Digestive Issues

Max, a rescue cat, developed severe digestive issues which required surgery. The vet estimated the cost of the procedure at $3,500. Max’s pet insurance covered a large portion of the bill, allowing his owner to afford the treatment without sacrificing other essential expenses. This experience underscored the peace of mind that comes from knowing that finances won’t dictate the level of care your pet receives.

Lola’s Emergency Care

Lola, a small terrier, was rushed to the emergency vet after swallowing a foreign object. The diagnostic and treatment costs totaled $2,200. With the financial support from her pet insurance, her owner only had to pay a fraction of that amount. The relief felt by Lola’s owner was immense, knowing they could focus on Lola’s recovery instead of worrying about the financial implications.These cases illustrate not only the potential savings that pet insurance can provide but also the peace of mind it delivers to pet owners.

Knowing that you are safeguarded against high veterinary costs allows for better decision-making when it comes to your pet’s health. Investing in pet insurance can ultimately be one of the best choices you make for your pet’s well-being and your financial health.

Potential Drawbacks of Pet Insurance

While pet insurance can provide peace of mind for pet owners, it’s essential to be aware of its limitations. Many policies come with specific restrictions and conditions that could affect the overall value of the coverage. Understanding these drawbacks can help pet owners make informed decisions about whether pet insurance is the best option for their furry friends.One common limitation found in pet insurance policies is the presence of waiting periods.

These are periods where no claims can be made after the policy is purchased, typically lasting from a few days to several weeks. During this time, pet owners cannot file claims for any medical issues that arise. Additionally, many policies include exclusions for pre-existing conditions, meaning that if a pet has been diagnosed with a health issue before the policy is effective, that issue will not be covered.

This can lead to frustrating situations where pet owners find they are responsible for significant out-of-pocket expenses for conditions that could have been covered had they been insured from the outset.

Cost-Effectiveness of Pet Insurance

Evaluating the cost-effectiveness of pet insurance is crucial for pet owners. In some cases, the premiums paid might outweigh the benefits received, particularly for older pets or those with ongoing health issues. The cost of premiums can add up quickly, and if claims are infrequent or if the pet remains healthy, owners may find themselves paying significantly more than they would in direct veterinary costs.To better understand when pet insurance might not be a cost-effective solution, consider these points:

- High deductible plans can result in high out-of-pocket costs before insurance kicks in.

- Pets that require only routine care may not benefit from comprehensive coverage.

- Plans with limited coverage can leave owners paying for common treatments like vaccinations or minor injuries.

Alternative Financial Strategies

For some pet owners, alternative financial strategies may be more beneficial than purchasing pet insurance. These strategies can help manage veterinary costs effectively without the constraints of traditional insurance policies. Here are a few alternatives to consider:

- Creating a dedicated savings account for pet expenses, allowing for direct payment of vet bills when necessary.

- Using a pet care credit card that offers rewards or cashback for veterinary care, which can help spread out payments.

- Participating in wellness plans offered by some veterinary clinics, which provide routine care for a monthly fee, covering vaccinations and check-ups.

Strategies like dedicated savings accounts can provide financial flexibility and allow for responsible budgeting for unexpected pet expenses.

Future Trends in Pet Insurance for 2025

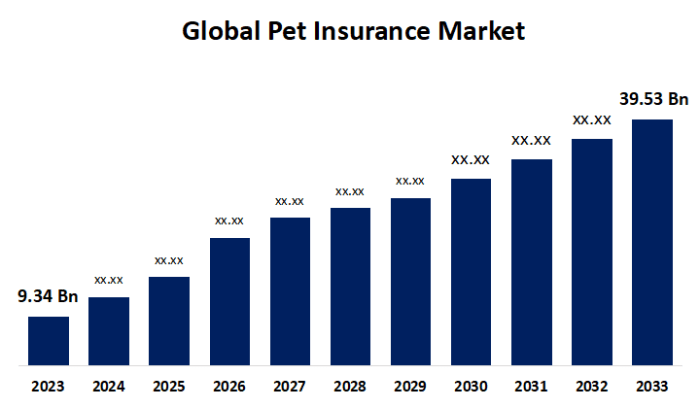

Source: insfindrq.com

As the pet insurance industry continues to evolve, several future trends are expected to shape the market in 2025. The ongoing advancements in technology, alongside changing consumer preferences and an increasing focus on pet health, will dramatically influence how pet insurance is offered and utilized. Understanding these trends can help pet owners make informed choices about their pet’s insurance needs.The integration of technology into the pet insurance landscape is set to revolutionize the way policies are managed and claims processed.

With the rise of telehealth services and mobile apps, pet owners can expect a more streamlined experience in accessing veterinary care and managing their insurance claims.

Advancements in Technology in Pet Insurance

The implementation of innovative technologies will play a crucial role in enhancing pet insurance services. Here are some key advancements expected to influence the pet insurance market:

- Telemedicine for Pets: Virtual consultations with veterinarians will become more commonplace, allowing pet owners to seek medical advice without needing to travel. This convenience not only improves pet health outcomes but also simplifies the claims process.

- AI-Driven Claims Processing: Insurers are likely to adopt artificial intelligence to automate claims assessments. This will lead to faster approvals and heightened accuracy in evaluating claims, thus enhancing customer satisfaction.

- Wearable Technology: The use of smart collars and health monitoring devices will allow pet owners to track their pets’ health in real-time. Insurers may offer discounts or tailored policies based on this data, encouraging proactive health management.

- Mobile Apps: User-friendly mobile applications will facilitate easy claims submission and tracking, as well as providing reminders for vaccinations and check-ups, making it simpler for pet owners to manage their insurance coverage.

The evolving nature of pet insurance policies is also expected to follow suit, aiming to align more closely with consumer needs.

Evolution of Pet Insurance Policies

The future of pet insurance policies will bring about significant changes to better serve pet owners. Here are some anticipated enhancements:

- Flexible Coverage Options: Companies are likely to introduce customizable plans that allow pet owners to select coverage levels suited to their pets’ specific needs. This flexibility will empower consumers to tailor their policies, providing peace of mind without overspending.

- Preventive Care Coverage: With a growing emphasis on preventive health, more insurers may start offering coverage that includes routine check-ups, vaccinations, and wellness programs, promoting overall pet health and potentially reducing larger health expenditures over time.

- Integration with Pet Services: Pet insurance may expand to include services beyond health care, such as pet sitting, grooming, and training. This all-in-one approach aims to deliver comprehensive care solutions for pet owners.

- Increased Education and Resources: Insurers might invest in educational resources to help pet owners better understand their policies and the importance of pet health, fostering a more informed customer base.

“The future of pet insurance lies in integrating technology and flexible policy options to meet the evolving needs of pet owners.”

These trends indicate a dynamic shift in the pet insurance landscape, driven by technology and consumer demand for tailored, comprehensive pet care solutions. As we approach 2025, pet owners can look forward to a more accessible, efficient, and beneficial insurance experience.

Personalizing Pet Insurance Choices

Source: market.us

Selecting the right pet insurance is crucial for pet owners who want to ensure their furry friends receive the best possible care without breaking the bank. With a multitude of options on the market, personalizing your insurance choices to fit your pet’s unique needs and your financial situation can make a significant difference in your overall experience. Understanding the variety of pet insurance providers and their offerings requires a thoughtful approach.

Evaluating the coverage options, limitations, and costs associated with different plans is essential in finding the perfect fit. Pet insurance is not a one-size-fits-all solution, so let’s explore a framework you can use to navigate your choices effectively.

Framework for Evaluating Pet Insurance Providers

When choosing a pet insurance provider, it’s important to assess several factors to make an informed decision. Here’s a structured approach to help guide you:

1. Coverage Options

Investigate the types of coverage available, including accident-only, accident and illness, or wellness plans. Ensure the plan meets your pet’s specific needs based on their age, breed, and health status.

2. Premium Costs

Compare the monthly premium costs across various providers. Look for a balance between affordability and comprehensive coverage.

3. Deductibles and Reimbursement Rates

Understand the deductibles, which is the amount you pay out of pocket before the insurance kicks in, as well as reimbursement rates, which indicate how much of the vet bill will be covered by the insurance after the deductible.

4. Exclusions and Waiting Periods

Identify any exclusions in the policy that may affect your coverage. Additionally, waiting periods before coverage begins can have a significant impact if your pet needs immediate medical attention.

5. Customer Reviews and Reputation

Research customer reviews and ratings for each provider. A reputable insurer will have positive feedback regarding their claims process, customer service, and overall satisfaction.

6. Additional Features

Look for any unique offerings, such as coverage for preventive care, behavioral therapy, or alternative treatments, which may add value to your policy.

Checklist for Choosing a Pet Insurance Policy

Having a comprehensive checklist can streamline the decision-making process. Here are essential points to consider:

Type of Coverage Needed

Assess whether you need basic accident coverage, a more comprehensive plan, or additional wellness options.

Budget for Premiums

Determine your monthly budget for insurance premiums to avoid financial strain.

Review of Policy Terms

Carefully analyze policy documents to understand coverage details, exclusions, and limitations.

Comparison of Multiple Quotes

Request quotes from at least three different providers to compare costs and benefits effectively.

Assessing Customer Support

Check the availability of customer service and support channels, such as phone, email, or live chat.

Claims Process Evaluation

Review how claims are submitted and processed, including any associated timelines and requirements.

Understanding Policy Details Before Committing

Taking the time to thoroughly understand the policy details is key before making a commitment. Policies can vary widely, and fine print often contains crucial information that impacts your coverage. It’s essential to:

Read the Full Policy Document

Instead of just relying on a summary, read through the entire policy to understand the specifics of what is covered and excluded.

Clarification of Terms

Don’t hesitate to ask the insurance provider to clarify any terms or conditions that are unclear. Understanding the language of insurance can prevent surprises later.

Calculate Potential Costs

Estimate potential out-of-pocket costs based on your pet’s health history and any anticipated medical issues.

Consider Future Needs

Anticipate how your pet’s health needs may change as they age. Policies that seem suitable now may need to be reassessed down the line.Understanding these elements can significantly affect your satisfaction with your chosen pet insurance provider. By personalizing your choices based on a thorough evaluation framework, using a detailed checklist, and understanding policy specifics, you can find a plan that suits both your pet’s needs and your financial situation.

Real-Life Experiences with Pet Insurance

Pet insurance can be a game-changer for pet owners facing unexpected medical expenses. Understanding real-life experiences and testimonials helps shed light on the effectiveness and limitations of such policies. As we explore these narratives, we uncover the reality of pet insurance beyond the statistics, revealing both the triumphs and challenges faced by pet owners.Real users provide valuable insights into the world of pet insurance, sharing their stories, concerns, and the lessons learned along the way.

These experiences often highlight misconceptions and clarify the actual benefits and drawbacks associated with pet insurance.

Testimonials from Pet Owners

Many pet owners have shared their experiences with insurance companies, revealing a range of outcomes. Here are a few notable testimonials:

- “When my dog developed a sudden illness, I was overwhelmed. Thankfully, my pet insurance covered most of the medical expenses. It was a huge relief during a stressful time.”

- Sarah H.

- “I initially thought pet insurance was a waste of money, but after my cat had an emergency surgery, I was grateful I had it. The reimbursement process was straightforward and I didn’t have to worry about the costs.”

- John K.

These testimonials reflect a common appreciation for the security that pet insurance can provide during unforeseen circumstances.

Common Misconceptions

Many pet owners enter the world of pet insurance with certain misconceptions that can influence their decisions. Personal stories often reveal these misunderstandings, emphasizing the importance of clear information. Some prevalent misconceptions include:

Insurance will cover all veterinary expenses

Many believe that pet insurance will cover every procedure or treatment, but most policies have limitations and exclusions, especially for pre-existing conditions.

Pet insurance is too expensive

While some policies can be costly, there are affordable options available. Many owners find that the peace of mind it brings is worth the investment.

It’s unnecessary for healthy pets

Some owners assume that if their pet is healthy now, insurance isn’t needed. However, emergencies can happen at any time, and having insurance can save a significant amount of money in the long run.

Pros and Cons from Real Users

To further illustrate the sentiments around pet insurance, many users have shared their lists of pros and cons based on their experiences. Understanding these can help potential customers make informed decisions.

- Pros:

- Financial peace of mind in emergencies.

- Access to a wider range of treatments and specialists.

- Reimbursement can alleviate the burden of unexpected veterinary bills.

- Cons:

- Premiums can increase as pets age.

- Not all conditions may be covered, particularly pre-existing ones.

- Some policies may have a waiting period before coverage begins.

The real-life experiences of pet owners reveal that while pet insurance can indeed serve as a safety net, it is crucial to thoroughly understand the terms and limitations before committing. Each story provides context to the various factors influencing the decision to invest in pet insurance, making it evident that this choice is as unique as the pets themselves.

Resources for Pet Owners

For pet owners navigating the world of pet insurance, having access to reliable resources is essential. In 2025, various online tools, organizations, and community resources simplify the process of understanding and comparing pet insurance options, ensuring that pet owners can make informed choices tailored to their needs.

Online Tools and Calculators for Pet Insurance

Multiple online platforms provide pet owners with the ability to compare insurance plans and calculate costs effectively. These tools help pet owners evaluate different policies based on their pet’s specific needs and circumstances.

- Pet Insurance Comparison Sites: Websites like PetInsuranceReview.com and Canine Journal offer comprehensive comparisons of different pet insurance providers, including coverage details and customer reviews.

- Cost Calculators: Tools available on sites like Compare.com allow users to estimate potential insurance costs based on their pet’s breed, age, and health status, helping them budget accordingly.

- Coverage Evaluators: Platforms like PetFirst and Embrace feature tools that enable owners to input their pet’s health history and receive tailored recommendations on the best insurance plans available.

Organizations and Websites for Information on Pet Insurance

Numerous organizations and websites serve as reputable sources of information regarding pet insurance options, providing pet owners with industry insights and relevant updates.

- The North American Pet Health Insurance Association (NAPHIA): This organization provides resources, statistics, and educational materials regarding the pet insurance market, helping owners make informed decisions.

- American Kennel Club (AKC): The AKC offers a wealth of information on pet insurance, including tips on what to look for in a policy and how to choose the right coverage for different breeds.

- Pawlicy Advisor: A unique platform that connects pet owners with tailored insurance options based on their specific needs and preferences, along with detailed guides on understanding pet insurance.

Community Resources for Guidance

Local veterinary offices and pet advocacy groups play a significant role in providing guidance to pet owners regarding insurance options. These resources can offer personalized advice based on firsthand knowledge of pet health needs.

- Veterinary Offices: Many veterinarians are familiar with various pet insurance policies and can provide insights into the best options for specific pet breeds or health conditions, often mentioning which insurers they work closely with.

- Pet Advocacy Groups: Organizations like the Humane Society and local rescue groups often have resources or advice on navigating pet insurance and can recommend trusted providers based on member experiences.

- Community Workshops: Some communities offer workshops and seminars led by veterinarians or pet insurance experts, providing valuable face-to-face opportunities for pet owners to learn more about their options.

Last Point

Source: sphericalinsights.com

In conclusion, navigating the world of pet insurance in 2025 requires careful consideration of costs, benefits, and personal circumstances. While it can provide peace of mind and financial protection against unforeseen medical expenses, potential drawbacks and alternative options must also be weighed. Ultimately, the decision comes down to each pet owner’s unique situation and their commitment to their pet’s well-being.

Expert Answers

What factors should I consider when choosing a pet insurance policy?

Consider factors such as coverage options, premium costs, waiting periods, exclusions, and the insurer’s reputation before making a choice.

Are there specific breeds that might have higher insurance costs?

Yes, some breeds are predisposed to certain health issues, leading to higher insurance premiums due to the increased risk of claims.

Can I use any veterinarian with pet insurance?

This varies by policy; some plans allow you to visit any vet, while others may require you to use a network of approved providers.

What are typical exclusions in pet insurance policies?

Common exclusions include pre-existing conditions, certain hereditary conditions, and preventive care services.

Is there a difference between accident-only and comprehensive pet insurance?

Yes, accident-only insurance covers injuries from accidents, while comprehensive insurance covers both accidents and illnesses.