Is Rent-To-Own Still A Smart Option In 2025?

Is Rent-to-Own Still a Smart Option in 2025? This question is becoming increasingly relevant as various housing market trends and consumer needs evolve. With affordability challenges in traditional home buying and the desire for flexibility among prospective homeowners, rent-to-own agreements have gained attention. Understanding the dynamics of this option is essential for anyone considering their future housing choices.

The rent-to-own model offers a unique pathway to home ownership that can cater to diverse financial situations. As we delve into the current landscape, market trends, and legal considerations, it becomes clear that this approach can be both beneficial and complex, necessitating careful evaluation by potential renters and buyers alike.

Overview of Rent-to-Own in 2025

The rent-to-own model has garnered significant attention in recent years, especially in the wake of fluctuating housing markets and evolving consumer preferences. This hybrid approach to homeownership allows tenants to rent a property with an option to purchase it after a set period, providing a pathway for individuals who may not be ready to buy outright. As we step into 2025, understanding the current landscape of rent-to-own agreements is crucial for potential renters and investors alike.The evolution of rent-to-own agreements reflects broader economic shifts and changing demographics.

Traditionally viewed as a niche option, rent-to-own has become more mainstream due to increased housing costs, rising interest rates, and the desire for flexible living arrangements. Many young professionals and first-time homebuyers are opting for rent-to-own agreements as a way to build equity while navigating financial uncertainties. Today, these agreements often come with tailored conditions that cater to the unique needs of tenants.

Current Market Trends Impacting Rent-to-Own Agreements

Several trends are shaping the rent-to-own market in 2025, influencing both tenant decisions and investor strategies. Firstly, the ongoing housing affordability crisis continues to push many potential buyers out of the traditional real estate market. Rent-to-own agreements provide a viable alternative, allowing individuals to secure a future home without the immediate financial burden of a large down payment. Secondly, technological advancements have enhanced the accessibility of these agreements.

Online platforms are now available, connecting landlords and tenants more efficiently, streamlining the process, and increasing transparency. Finally, demographic shifts, particularly among millennials and Gen Z, who prioritize flexibility and mobility, have further popularized rent-to-own agreements. These younger generations are more inclined to seek out living arrangements that offer both stability and the prospect of homeownership without the immediate pressures.In recent years, the popularity of rent-to-own has surged.

According to the National Association of Realtors, approximately 15% of home sales in 2024 involved rent-to-own arrangements, a marked increase from just 8% in 2019. This trend highlights a growing acceptance and reliance on rent-to-own as a legitimate option for achieving homeownership.Additionally, surveys indicate that around 60% of renters are familiar with the rent-to-own model, demonstrating a significant increase in awareness compared to previous years.

As the market continues to adapt, it is clear that rent-to-own is not only a smart option but also a growing preference for many looking to secure their financial futures in real estate.

Financial Implications of Rent-to-Own

Choosing a rent-to-own option can significantly impact your financial situation, especially in 2025. With fluctuating housing markets and diverse economic conditions, it’s essential to understand both the potential benefits and drawbacks of this alternative pathway to homeownership. This section dives into the financial aspects of rent-to-own agreements, helping you weigh the pros and cons before making a decision.One of the most appealing financial advantages of rent-to-own is the ability to lock in a purchase price while still renting.

This can be particularly beneficial in a rising real estate market, where property values increase over time. Rent-to-own agreements typically require renters to pay an additional amount on top of their rent, often referred to as an “option fee,” which is usually credited towards the purchase price of the home when the lease term ends. This can result in substantial savings if the market value of the property escalates.

Financial Benefits of Rent-to-Own

Understanding the financial benefits can motivate potential homeowners to consider this route. Here are some positive aspects to keep in mind:

- Equity Building: Renters accumulate equity through their option fees and additional rent payments that contribute to the purchase price, which can aid in homeownership.

- Flexible Terms: Rent-to-own contracts often have more flexible qualifications compared to traditional mortgages, making them a suitable option for those with low credit scores or unstable income.

- Locking in Price: The ability to lock in the purchase price can safeguard against rising home prices, ensuring the buyer pays a predetermined amount regardless of market changes.

Despite these benefits, potential renters should also be aware of the drawbacks and hidden costs that can arise with rent-to-own agreements.

Drawbacks and Hidden Costs of Rent-to-Own

While rent-to-own can present financial opportunities, it’s crucial to recognize the possible downsides. Understanding these elements can prevent unexpected financial strains later.

- Higher Rent Payments: Rent-to-own agreements often come with higher monthly payments compared to standard rentals, which can strain your budget.

- Non-Refundable Fees: The upfront option fee and additional rent payments may not be refundable if the buyer decides against purchasing the property.

- Maintenance Responsibilities: Renters may be responsible for maintenance and repairs, adding unexpected costs that can diminish savings.

When comparing rent-to-own costs with traditional mortgage options, it’s essential to consider the overall financial commitment of both routes.

Comparison with Traditional Mortgage Options

When evaluating rent-to-own against conventional mortgages, several factors should be considered to determine which option aligns best with a prospective homeowner’s financial goals.

| Factor | Rent-to-Own | Traditional Mortgage |

|---|---|---|

| Credit Requirements | More lenient | Stricter |

| Upfront Costs | Option fee + higher rent | Down payment + closing costs |

| Equity Accumulation | Partial equity through fees | Full equity through mortgage payments |

| Market Risk | Higher risk if prices decrease | Market fluctuation impacts overall value |

These comparisons highlight the trade-offs associated with rent-to-own agreements versus traditional mortgages. Each option has unique financial implications that cater to different individual circumstances and market conditions. Assessing these factors carefully can guide one to make an informed decision regarding their housing future.

Legal Considerations in Rent-to-Own Agreements

Source: grandluxuryproperties.com

Understanding the legal landscape of rent-to-own agreements is essential for both parties involved. These contracts often contain specific terms and conditions that dictate the rights and responsibilities of landlords and tenants. Familiarizing oneself with these legalities can prevent misunderstandings and potential disputes down the line.Rent-to-own contracts typically include several key legal terms and conditions that Artikel the framework of the agreement.

Common elements found in these contracts often include the purchase price of the property, the duration of the rental period, and the terms regarding maintenance and repair responsibilities. Additionally, they usually specify how the rental payments are applied towards the purchase price and any contingencies that could affect the final sale.

Key Legal Terms in Rent-to-Own Agreements

It’s important to understand the core components that make up a rent-to-own agreement. Here are some of the most significant legal terms one should be aware of:

- Option Fee: This is a non-refundable fee paid upfront that grants the tenant the option to purchase the property at a later date. It is often credited towards the purchase price.

- Rent Credit: A portion of the monthly rent may be credited towards the down payment or purchase price, incentivizing tenants to eventually buy the property.

- Maintenance Responsibilities: The contract should clearly Artikel which party is responsible for property maintenance and repairs during the rental period.

- Default Clauses: These clauses define the actions that can be taken if either party fails to meet their obligations, including late payments or failure to maintain the property.

- Purchase Agreement Timeline: This indicates when the tenant must decide to purchase the property, along with any deadlines for financing approval.

Rights and Responsibilities of Both Parties

In a rent-to-own agreement, both the landlord and tenant have specific rights and responsibilities that are vital to its success. Clear understanding and adherence to these can reduce the risk of disputes:

- Tenant Rights: Tenants have the right to occupy the property, to have the rental payments applied toward the purchase price, and to receive a written agreement outlining all terms.

- Tenant Responsibilities: Tenants must make timely rental payments, maintain the property in good condition, and fulfill any obligations laid out in the contract regarding decision timelines for purchase.

- Landlord Rights: Landlords have the right to collect rental payments, to enforce the terms of the agreement, and to retain the option fee if the tenant decides not to purchase the property.

- Landlord Responsibilities: Landlords must maintain the property in a habitable condition, address necessary repairs, and provide the tenant with a clear understanding of any obligations.

Common Legal Disputes in Rent-to-Own Situations

Disputes can arise in various forms within rent-to-own agreements. Understanding these potential conflicts can help parties navigate challenges more effectively. Examples of common legal disputes include:

- Misinterpretation of Terms: Disagreements over what constitutes a reasonable request for repairs or the application of rent credits can lead to disputes.

- Default Notices: Conflicts can arise if one party believes the other has defaulted on the agreement, leading to disputes over notices and potential eviction.

- Failure to Purchase: Issues may occur if a tenant decides not to exercise their option to purchase, especially regarding the forfeiture of the option fee.

- Maintenance Responsibilities: Disputes often surface over whether a landlord or tenant is liable for repairs or property upkeep, especially if not clearly defined in the contract.

Understanding these legal considerations is crucial for anyone involved in a rent-to-own agreement. Both parties should take the time to carefully review the terms of their contract and seek legal advice if necessary to ensure their rights are protected and responsibilities understood.

Target Demographics for Rent-to-Own

The rent-to-own model has gained traction as a viable homeownership pathway, especially amidst changing economic landscapes. In 2025, specific demographics are finding particular value in this option, leading to a notable shift in the housing market. Understanding these groups can provide insight into the effectiveness of rent-to-own strategies for aspiring homeowners.The appeal of rent-to-own arrangements is particularly strong among first-time homebuyers, millennials, and lower to middle-income families.

These groups often face barriers such as rising home prices, stringent lending requirements, and a lack of substantial credit history. Rent-to-own agreements offer these individuals a feasible solution to transition towards property ownership while allowing them to live in their future home during the process.

Primary Audiences Benefiting from Rent-to-Own

Several key demographics can greatly benefit from the rent-to-own approach. Recognizing and supporting these groups can lead to more successful transitions into homeownership.

- First-Time Homebuyers: Many individuals and families are entering the housing market for the first time, often lacking the savings required for a traditional down payment. Rent-to-own allows them to build equity while living in the home.

- Millennials: This generation, which tends to delay homeownership due to economic constraints, finds rent-to-own appealing because it combines flexibility with the opportunity to purchase a home without immediate commitment.

- Families with Lower Incomes: Economic pressures make it challenging for lower-income families to qualify for mortgages. Rent-to-own can be a strategic way for these families to secure housing while gradually improving their financial standing.

- Individuals with Poor Credit Histories: Traditional lending often excludes those with less-than-perfect credit. Rent-to-own agreements can provide these individuals with the chance to improve their credit scores over time while working towards ownership.

Demographic trends influencing the popularity of rent-to-own also include increasing urbanization and changing family structures. As more individuals move to urban areas for job opportunities, the demand for affordable housing options rises. Additionally, the trend of smaller household sizes makes the flexibility of renting appealing.

Successful Case Studies of Rent-to-Own

Real-life examples highlight how rent-to-own can effectively support aspiring homeowners in achieving their goals. One notable case is the Johnson family, who secured a rent-to-own agreement in a suburban neighborhood. They faced challenges due to limited savings and credit history. By opting for rent-to-own, they were able to gradually save for a down payment while ensuring their monthly payments contributed towards their eventual purchase.

After three years, they successfully transitioned to full homeowners.Another example is Sarah, a single professional who used rent-to-own to overcome the hurdles of rising market prices and a previously low credit score. Her agreement allowed her to live in the property while working on improving her financial situation. Within two years, she was able to refinance and purchase the home outright, paving the way for her financial independence.These stories demonstrate the effectiveness of rent-to-own arrangements in today’s housing market, showcasing how they can serve diverse demographics while providing a pathway to homeownership.

Market Comparison

Source: havenseniorinvestments.com

The landscape of housing options has evolved, and understanding the differences between rent-to-own, traditional renting, and outright purchasing is essential for potential homeowners. Each option presents unique benefits and challenges that can significantly affect your financial future and living situation. When contrasting rent-to-own with traditional renting, it’s important to highlight that rent-to-own agreements often serve as a bridge for renters aspiring to homeownership.

Unlike standard renting, where monthly payments contribute solely to the landlord’s income, rent-to-own agreements typically allocate a portion of rent towards the eventual purchase of the home. However, these arrangements can come with higher monthly costs and potential pitfalls if the buyer is unable to complete the purchase.

Comparison of Rent-to-Own, Renting, and Buying

Analyzing the distinct characteristics of each housing option is crucial for informed decision-making. The following table Artikels the primary advantages and disadvantages of rent-to-own compared to traditional renting and purchasing a home outright:

| Option | Advantages | Disadvantages |

|---|---|---|

| Rent-to-Own |

|

|

| Traditional Renting |

|

|

| Buying Outright |

|

|

In summary, each housing option carries its own weight of considerations—rent-to-own can serve as a stepping stone for those unable to purchase outright, while traditional renting offers flexibility and affordability. Buying outright stands as the most stable option but demands substantial financial commitment. An individual’s circumstances will largely dictate the most suitable choice.

Future Outlook for Rent-to-Own

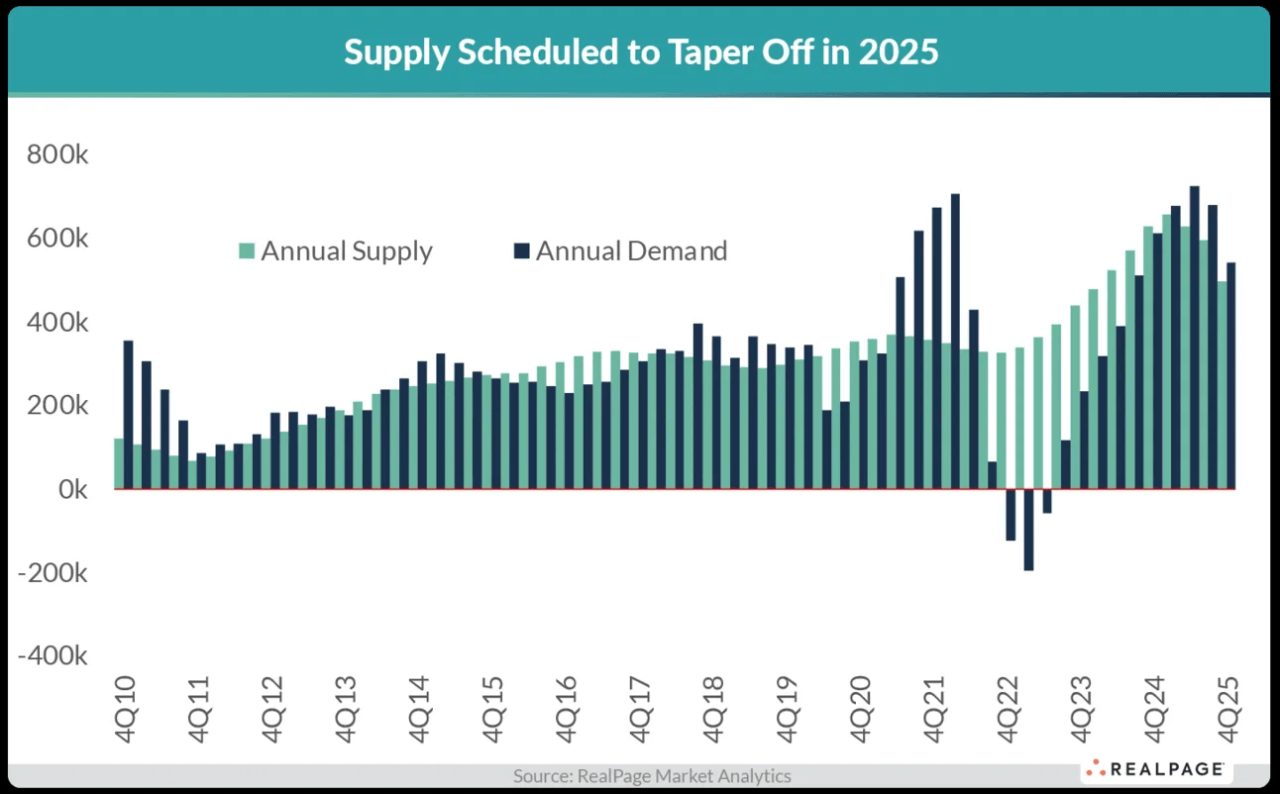

As we look ahead to the next 5-10 years, the rent-to-own market is poised for notable evolution, driven by changing economic conditions and consumer preferences. With housing affordability continuing to be a significant concern for many potential homebuyers, the rent-to-own model may become an increasingly attractive option for those seeking to transition from renting to owning. Several key trends and innovations are expected to shape the landscape of rent-to-own agreements in the coming years.

Projected Market Trends

The rent-to-own market is anticipated to grow steadily, fueled by several factors that influence housing demand. Rising home prices and constrained inventory in many regions could make rent-to-own agreements more appealing. Moreover, millennials and Gen Z, who often face student debt and high living costs, may lean towards rent-to-own as a pathway to homeownership.

Increased Demand

A survey conducted by the National Association of Realtors (NAR) indicated that over 60% of potential homebuyers are considering alternative methods of purchasing homes, including rent-to-own options.

Regional Growth

Markets with high rental populations, especially urban centers, are likely to see a surge in rent-to-own listings. Cities such as Austin, Texas, and Raleigh, North Carolina, are seeing increased interest due to their vibrant job markets and high rental rates.

Consumer Awareness

As more individuals become educated on the rent-to-own process, demand is likely to rise. Educational resources and workshops being offered by real estate agencies and financial institutions will help demystify the model.

“With increasing educational resources, consumers are expected to become more savvy about their options, making rent-to-own a viable solution.”

Real Estate Analyst

Innovations and Changes in Policy

Innovations and regulatory changes are likely to have a significant impact on rent-to-own practices. Policies designed to enhance housing accessibility can reshape the landscape for prospective homeowners.

Flexible Financing Options

Lending institutions are beginning to offer more flexible financing for rent-to-own agreements, allowing for lower down payments and tailored payment plans.

Government Initiatives

Local and state governments may introduce programs encouraging rent-to-own arrangements, providing tax incentives for landlords and protections for tenants.

Digital Platforms

The rise of technology and online platforms is streamlining the rent-to-own process. Companies are now offering simplified platforms where users can manage their agreements, make payments, and access resources with ease.

Expert Opinions on the Future of Rent-to-Own

Thought leaders in the real estate industry offer insights into the future of rent-to-own as a viable housing choice. Many experts suggest that adaptability and consumer-centric practices will drive the evolution of this model.

Increased Flexibility

Real estate experts contend that the rent-to-own model will need to evolve to offer more flexibility in terms of contract terms and conditions, catering to diverse consumer needs.

Emphasis on Transparency

Experts advocate for increased transparency in agreements, ensuring that potential buyers fully understand the terms, including maintenance responsibilities and potential pitfalls.

Sustainable Practices

There is a growing trend towards sustainability in housing, with rent-to-own agreements incorporating eco-friendly options and energy-efficient homes as part of their offerings.In summary, the future outlook for rent-to-own is promising. As economic factors, technological advances, and regulatory developments converge, this housing option may become a quintessential pathway for many aspiring homeowners.

Alternatives to Rent-to-Own

Source: beehiiv.com

For many homebuyers, rent-to-own can seem like an appealing path toward homeownership. However, it’s not the only option available. As the housing market evolves in 2025, numerous alternatives exist that may better suit individual needs and financial situations. Exploring these alternatives can provide prospective homeowners with greater flexibility and potentially less risk. Various housing options can serve as viable alternatives to rent-to-own agreements, allowing individuals to find the right fit for their financial and personal situations.

Understanding these options is crucial for making informed decisions in the ever-changing housing landscape.

Housing Options Beyond Rent-to-Own

Several alternative housing options offer distinct advantages over rent-to-own agreements. Here are some noteworthy alternatives:

- Conventional Mortgages: Securing a traditional mortgage remains a leading option for most homebuyers. With fixed-rate loans, buyers can benefit from predictable monthly payments, assuming they qualify based on creditworthiness and down payment ability.

- Lease Options: Similar to rent-to-own, lease options allow tenants to lease a property with the option to buy at a later date. However, they usually require less upfront payment and can provide more flexible terms.

- Shared Equity Programs: This innovative financing method involves a partnership between buyers and investors, where both share in the home’s equity growth. This option can make homeownership more accessible, especially for those facing high property prices.

- Government Assistance Programs: Various state and federal programs exist to assist first-time homebuyers. These initiatives often provide down payment assistance, reduced mortgage insurance, or favorable interest rates.

- Co-Ownership Models: Co-ownership arrangements allow multiple buyers to purchase a property together, sharing the financial burden and maintenance costs. This strategy can be particularly appealing in high-cost areas.

Understanding these alternatives can empower potential homeowners to make informed choices that align with their financial goals and lifestyle preferences. Each method has its own implications and suitability based on individual circumstances.

Programs and Initiatives Supporting Home Buying

Numerous programs aim to assist individuals in navigating the home buying process more effectively. These initiatives often focus on affordability and inclusivity, making homeownership attainable for a broader audience. Here are some significant examples:

- Federal Housing Administration (FHA) Loans: FHA loans provide lower down payment options and are designed for low-to-moderate-income borrowers who may struggle with credit issues. This program has opened doors for many first-time homebuyers.

- State Housing Finance Agencies (HFAs): Many states offer specific programs that provide low-interest loans, down payment assistance, or grants to help first-time buyers overcome financial barriers.

- Good Neighbor Next Door Program: This federal initiative offers significant discounts on homes to certain public service professionals, such as teachers, law enforcement officers, and firefighters, promoting community stability.

These programs and initiatives can serve as valuable resources for those looking to enter the housing market, providing financial support and educational resources to pave the way toward ownership.

Viability of Other Financing Methods

Apart from traditional purchasing options, various innovative financing methods can help prospective buyers secure a home without the constraints of a rent-to-own agreement. Each method has unique benefits and potential risks.

- Lease Purchase Agreements: These agreements allow tenants to lease a property with an option to purchase it during or at the end of the lease term. Financially, this can help buyers save for a down payment while locking in the purchase price.

- Home Equity Sharing: With home equity sharing, individuals can partner with investors who provide funding for a down payment in exchange for a percentage of home appreciation. This model can help alleviate the financial burden of purchasing a home outright.

- Renting with Intent to Buy: Renting with the intention to buy can be a practical approach, where the tenant saves for a down payment while living in the property. This allows time to assess whether the property meets long-term needs.

These financing methods can provide greater flexibility and potentially lower upfront costs, allowing buyers to enter the market more comfortably, especially in today’s competitive environment.

Success Stories and Challenges in Rent-to-Own

The rent-to-own model has become increasingly popular among individuals looking to transition from renting to homeownership. Many have successfully navigated this route, leading to fulfilling homeownership experiences. However, the journey is not without its challenges, requiring careful planning and understanding of the process.

Testimonials from Rent-to-Own Participants

Real-life experiences can provide insight into the rent-to-own journey. Below are testimonials from individuals who have successfully navigated this path:

-

“I never thought I’d be able to buy a home, but the rent-to-own option allowed me to save and improve my credit while living in my dream house!”

-Sarah M. -

“The rent-to-own model gave me the flexibility I needed. I was able to lock in a price while I worked on my down payment.”

-James T. -

“Initially, I was skeptical, but seeing my rent go toward my future home was a game changer. It made the transition to ownership so much smoother.”

-Emily R.

Common Challenges in Rent-to-Own Agreements

Navigating the rent-to-own process comes with its own set of challenges. Understanding these can help prospective buyers prepare better:

1. Unclear Terms

Many renters struggle with vague contract terms, which can lead to confusion.

2. Maintenance Responsibilities

Rent-to-own agreements often place maintenance responsibilities on the tenant, which can be a financial burden if not planned for.

3. Financing Issues

Obtaining financing at the end of the rental period can be challenging if the tenant’s credit score has not improved or if the housing market fluctuates.To overcome these challenges, it’s crucial to seek legal advice, thoroughly read contracts, and maintain open communication with the landlord to clarify expectations.

Success Metrics for Transitioning to Ownership

The success of transitioning from renting to ownership through rent-to-own can be measured by several factors. These metrics highlight the potential benefits of this approach:

- Improved Credit Scores: Many renters saw their credit scores rise, enabling better financing options for their new homes.

- Equity Building: Participants accumulate equity during the rental phase, which can significantly benefit them when transitioning to ownership.

- Stability and Security: Successfully moving to ownership often results in increased stability, allowing families to plant roots in their communities.

Last Point

In summary, the rent-to-own option presents a compelling case for those navigating the complexities of home ownership in 2025. As we explored its advantages, financial implications, and the evolving market, it’s evident that while there are risks, the opportunity for a smoother transition into home ownership remains. As you consider your housing future, weigh the pros and cons carefully and stay informed about alternatives that may also suit your needs.

FAQs

What are the potential benefits of rent-to-own?

Rent-to-own can provide a pathway to homeownership for those who may not qualify for traditional loans, allowing time to improve credit scores while living in the home.

Are there hidden costs in rent-to-own agreements?

Yes, potential hidden costs can include maintenance fees, higher rent payments, and the cost of repairs that may fall to the tenant.

Who typically benefits most from rent-to-own?

Individuals with unstable credit histories or those needing time to save for a down payment often benefit from rent-to-own arrangements.

How does rent-to-own compare to traditional renting?

Unlike traditional renting, rent-to-own builds equity over time, but it usually involves a higher monthly payment and a commitment to purchase.

What should I look for in a rent-to-own contract?

Key elements include purchase price, rent credits, maintenance responsibilities, and the length of the rental period before purchase.

Are there alternatives to rent-to-own?

Yes, alternatives include lease options, shared equity programs, and government-assisted home-buying initiatives that can provide financial support.