The Ultimate Guide To Buying A Second Home

Kicking off with The Ultimate Guide to Buying a Second Home, this journey will illuminate the essential aspects of purchasing a second property, whether it’s a cozy beachside retreat or a charming mountain cabin. Navigating the complexities of the real estate market can feel overwhelming, but with the right insights and strategies, you can make informed decisions that align with your financial goals and lifestyle aspirations.

From understanding current market trends to financial considerations, choosing the right location, and exploring various property types, this guide covers all the bases. You’ll gain a comprehensive overview of the buying process, as well as tips for managing and renting your second home effectively.

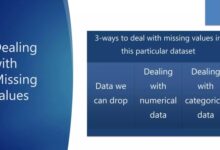

Understanding the Market

Source: cnb.com

The real estate market for second homes has evolved significantly in recent years, reflecting broader economic trends and shifts in consumer preferences. As more individuals seek to invest in vacation properties or retirement homes, understanding the current landscape is essential for making informed purchasing decisions. This section explores the prevailing trends, regional price influences, and optimal buying times that potential second home buyers should consider.

Current Trends in the Real Estate Market for Second Homes

Recent data indicates a surge in demand for second homes, primarily driven by the increasing popularity of remote work and a desire for more space. Many buyers are looking for properties in scenic or rural areas to escape urban congestion. Additionally, the pandemic has shifted priorities, with more people valuing well-being and leisure, leading to an uptick in purchases of vacation homes and investment properties.

Key trends include:

- Increased interest in properties located near water bodies, mountains, or other recreational areas.

- Growing preference for homes with outdoor spaces and amenities suitable for families and remote work.

- Rise in the use of technology in the buying process, such as virtual tours and online bidding systems.

Factors Influencing Second Home Prices in Various Regions

Second home prices are impacted by a variety of factors, including location, economic conditions, and market demand. Core elements such as proximity to urban centers, local amenities, and seasonal tourist attractions play a crucial role in determining property values. When evaluating regional price influences, consider the following:

- Supply and Demand: Areas with limited inventory and high demand often experience significant price hikes.

- Economic Health: Regions with strong job markets and economic growth tend to attract more buyers, driving up prices.

- Local Regulations: Zoning laws and property taxes can significantly affect the overall cost of ownership and investment attractiveness.

Best Times of Year to Buy a Second Home

Timing is critical when purchasing a second home. Market fluctuations can lead to better opportunities depending on the season. In many regions, the best times to buy a second home align with off-peak seasons when competition is lower and prices may be more favorable. Consider the following insights for optimal buying periods:

- The fall months often see a slowdown in buyer activity, making it a prime time for negotiations and potentially lower prices.

- Winter can offer excellent deals in regions with harsh weather, as sellers may be more motivated to sell quickly.

- Spring usually brings a surge in listings, providing a wide selection, though prices may be higher due to increased competition.

The ideal time to invest in a second home can depend greatly on local market conditions and personal readiness.

Financial Considerations

When considering the purchase of a second home, it’s essential to understand the financial implications involved. Beyond the purchase price, various costs and obligations come into play that can significantly impact your budget. From hidden fees to financing options and tax implications, being well-informed can save you from unpleasant surprises down the road.One of the first steps in preparing to buy a second home is to evaluate all the costs associated with the transaction.

This includes not only the price of the property but also additional expenses that might not be immediately apparent.

Costs Associated with Buying a Second Home

The costs tied to purchasing a second home can add up quickly. It’s crucial to account for these expenses to get a clear picture of what your investment will require. Here are the primary costs to keep in mind:

- Down Payment: Generally, a down payment of 10% to 20% is expected for a second home, depending on your lender’s requirements.

- Closing Costs: These are typically between 2% to 5% of the home’s purchase price and include fees for appraisal, title insurance, and legal services.

- Home Inspection Fees: A home inspection can cost between $300 and $500 and is a critical step to ensure the property is in good condition.

- Property Taxes: Be prepared for the ongoing property taxes that vary by location and can significantly affect your annual budget.

- Homeowners Insurance: Insurance rates can be higher for second homes, especially if they’re in vacation areas prone to natural disasters.

- Maintenance and Repairs: Budget for ongoing maintenance costs, which are typically estimated at 1% of the property’s value each year.

- HOA Fees: If the second home is part of a homeowners association, be aware of any monthly or annual fees associated with community amenities.

- Hidden Fees: These can include things like utilities setup, landscaping, or pool maintenance that might not be apparent at first glance.

Financing Options for Second Home Purchases

Deciding how to finance your second home is a critical aspect of the purchasing process. Multiple financing options cater to different financial situations and homebuyer profiles. Understanding these choices will help you make an informed decision:

| Financing Option | Description |

|---|---|

| Conventional Loans | Traditional mortgages that typically require a higher down payment but offer competitive interest rates. |

| FHA Loans | Government-backed loans that can have lower down payments but may come with restrictions on the type of properties eligible. |

| VA Loans | Available for eligible veterans, these loans often have no down payment and favorable terms. |

| Cash Purchase | Paying outright for the home without financing, which negates interest payments but may limit liquidity. |

| Home Equity Loans | Utilizing equity from your primary residence to finance the second home, which can offer lower rates but increases risk on your primary property. |

Tax Implications of Owning a Second Home

Owning a second home comes with specific tax implications that differ from those of a primary residence. Understanding these differences can help you optimize your tax situation and avoid unexpected liabilities. For instance, mortgage interest on a second home is generally deductible, similar to your primary residence, but only if you itemize your deductions on your tax return. Furthermore, property taxes paid on the second home are also deductible.

However, the total amount of state and local tax deductions is capped at $10,000, which includes both primary and secondary properties.It’s also worth noting that if you decide to rent out your second home for part of the year, you may be subject to different tax rules. Rental income must be reported, but you can also deduct related expenses, including maintenance, property management fees, and a portion of mortgage interest.In conclusion, while purchasing a second home can be a rewarding investment, it’s essential to consider the comprehensive financial landscape, including costs, financing options, and tax implications, to ensure a sound investment strategy.

Location Selection

Choosing the right location is essential when purchasing a second home, as it not only impacts your enjoyment but also your investment potential. A well-chosen location can enhance your lifestyle while providing opportunities for appreciation in property value. Factors such as climate, community, accessibility, and recreational activities should be weighed carefully to ensure you select a location that meets your needs and expectations.Evaluating potential locations should involve a thorough assessment of various desirable areas, each offering unique benefits and drawbacks.

Below is a list of noteworthy locations for second homes, along with their respective advantages and disadvantages, to help guide your decision-making process.

Desirable Locations for Second Homes

When considering a second home, it’s critical to analyze the unique attributes of various locations. We’ve compiled a selection of popular destinations often favored for second-home purchases, along with the pros and cons of each.

- Lake Tahoe, California/Nevada

- Pros: Stunning natural beauty, year-round recreational activities (skiing in winter, hiking in summer), and a strong rental market.

- Cons: High property prices and potential for heavy tourist traffic during peak seasons.

- Charleston, South Carolina

- Pros: Rich history, vibrant culture, and close proximity to beautiful beaches.

- Cons: Humid summers and the risk of hurricanes.

- Asheville, North Carolina

- Pros: Booming arts scene, access to the Blue Ridge Mountains, and a friendly community atmosphere.

- Cons: Increasing popularity has resulted in rising property values and limited inventory.

- Miami, Florida

- Pros: Year-round warm weather, vibrant nightlife, and a strong rental market for vacationers.

- Cons: High insurance costs due to hurricanes and a competitive real estate market.

Evaluating Local Amenities and Attractions

Understanding the local amenities and attractions is vital for assessing the appeal of a second home location. These factors not only enhance your personal experience but also contribute to the property’s investment value. Consider the following aspects when evaluating potential locations:

- Proximity to Essential Services: Evaluate the distance to grocery stores, hospitals, schools, and other essential services. A convenient location can significantly enhance your quality of life.

- Recreational Activities: Research available outdoor activities such as hiking, fishing, skiing, or golfing. A location rich in amenities can make your second home a more enjoyable retreat.

- Cultural Attractions: Look into local theaters, museums, and music venues. A vibrant cultural scene can greatly contribute to the enjoyment of living in the area.

- Community Events: Investigate whether the area hosts farmer’s markets, festivals, or other community gatherings. These events can foster a sense of belonging and connection.

- Accessibility: Assess transportation options, such as proximity to airports or public transit. Good accessibility can make visiting your second home more convenient and appealing.

Evaluating local amenities and attractions ensures that your second home meets both leisure and lifestyle needs, enhancing the overall ownership experience.

Property Types

When considering a second home, it’s essential to understand the various property types available. Each type offers unique benefits and caters to different lifestyles and investment goals. Selecting the right property can significantly impact your enjoyment and the potential return on investment for your second home.The primary property types for second home purchases include single-family homes, condos, and townhouses. Each of these options has distinctive features and benefits that suit different buyer preferences and needs.

Here’s a closer look at these options:

Single-Family Homes

Single-family homes are typically standalone structures that provide privacy and ample space. They often come with a yard or outdoor area, making them ideal for families or individuals seeking more room. Benefits of single-family homes include:

- Privacy: They offer a greater level of privacy compared to other property types.

- Space: Ample living space, including multiple bedrooms and outdoor areas.

- Value Appreciation: They tend to appreciate in value more than condos or townhouses over time.

However, potential drawbacks include higher maintenance responsibilities and costs.

Condos

Condos, or condominiums, are individual units within a larger building or complex. They often come with shared amenities such as pools, gyms, and security, providing a community feel.Key points about condos include:

- Lower Maintenance: Maintenance is managed by the homeowners’ association, reducing individual responsibility.

- Amenities: Access to shared amenities that may not be affordable in a single-family home.

- Affordability: Generally lower purchase prices compared to single-family homes in similar areas.

On the downside, condo owners must adhere to association rules and fees, which can sometimes be restrictive and costly.

Townhouses

Townhouses are similar to single-family homes but share one or two walls with adjacent properties. They typically feature multiple levels, offering a balance between space and maintenance responsibilities.Considerations for townhouses include:

- Less Maintenance: Like condos, townhouses often have lower maintenance obligations than single-family homes.

- Community: They foster a neighborhood feel, often with shared amenities like parks or pools.

- Affordability: Usually priced between condos and single-family homes, they can be a budget-friendly option.

The main downside is the potential for noise from neighbors and limited outdoor space compared to single-family homes.

New Builds vs. Older Properties

When purchasing a second home, buyers often face the choice between new builds and older properties. Each option presents distinct pros and cons that can influence your decision.New builds offer modern designs, energy efficiency, and the advantage of customizing finishes. They typically require less immediate maintenance. However, they may come at a premium price and could be located in developing areas with limited amenities initially.Older properties, on the other hand, carry character and established neighborhoods.

They often come with lower initial purchase prices and may appreciate in value due to their location and vintage appeal. However, they may require renovations and maintenance, which could lead to additional costs.In summary, understanding the various property types and their implications is crucial for making an informed decision about your second home investment.

The Buying Process

Navigating the buying process for a second home can seem daunting, but breaking it down into manageable steps can simplify the experience. This section will guide you through making an offer, understanding the role of real estate agents, and provide valuable tips for negotiating a favorable deal.

Making an Offer on a Second Home

Crafting a compelling offer is crucial when purchasing a second home. This process involves several key steps to ensure your offer stands out in a competitive market.

1. Research Comparable Properties

Investigate similar properties in the area to gauge a fair market price. Understanding the pricing of comparable homes will empower you to make an informed offer.

2. Determine Your Offer Price

Based on your research and budget, establish your offer price. Consider the condition of the property and any potential repairs needed.

3. Submit an Earnest Money Deposit

This deposit demonstrates your serious intent to buy. Typically, it ranges from 1% to 3% of the purchase price and is held in an escrow account until the closing.

4. Include Contingencies

Contingencies protect you as a buyer. Common contingencies include financing, home inspection, or appraisal contingencies, allowing you to back out of the deal under specific conditions.

5. Write a Personal Letter

Sometimes a personal touch can sway the seller. Writing a letter explaining why you love the home can create a connection that makes your offer more appealing.

The Role of Real Estate Agents

A real estate agent plays a pivotal role in the second home purchasing process, acting as both guide and negotiator through various stages.

Market Expertise

Agents have comprehensive knowledge of current market trends, pricing, and available properties, which can save you significant time and effort in your search.

Negotiation Skills

Experienced agents are skilled negotiators who advocate for your interests. They help in crafting offers, counteroffers, and navigating any complexities that arise during the transaction.

Paperwork and Legalities

The buying process involves a significant amount of documentation. Real estate agents help you navigate this paperwork, ensuring that everything is completed correctly and submitted on time.

Connecting You with Professionals

Agents often provide referrals to other professionals needed throughout the buying process, such as mortgage brokers, home inspectors, and lawyers.

Tips for Negotiating the Best Deal

Negotiating for a second home can significantly impact the overall cost and value of your purchase. Here are some important strategies to consider.

Be Prepared to Walk Away

Establish your budget and stick to it. If negotiations exceed your limits, being willing to walk away can provide leverage in discussions.

Understand Seller Motivations

Knowing why the seller is moving can give you insight into how flexible they may be regarding price or terms. For instance, a seller who needs to move quickly may be more amenable to lower offers.

Highlight Your Strengths as a Buyer

If you have pre-approved financing or are a cash buyer, make sure to communicate these strengths. Sellers often prefer buyers who can close quickly and smoothly.

Be Mindful of Timing

The time of year can influence negotiations. In a slower market or off-peak season, you may find more room to negotiate than during the height of the buying season when competition is fierce.

Offer a Shorter Contingency Period

Reducing the length of your contingencies can be appealing to sellers, showing that you are committed and ready to proceed quickly.

“In real estate, it’s not just about the price—it’s about the terms and your ability to create a win-win situation for both parties.”

Maintenance and Management

Owning a second home can be a rewarding experience, but it also comes with a unique set of responsibilities that require attention and management. From regular upkeep to emergency repairs, understanding these duties is essential for maintaining the value and enjoyment of your property. Proper management can ensure that your second home remains a source of joy rather than a burden, allowing you to focus on making memories rather than managing stress.

A significant part of managing a second home involves regular maintenance and addressing any issues that may arise. This ensures the property remains safe, comfortable, and in good condition for your use, as well as for any potential renters if you choose to rent it out. Proper upkeep involves regular inspections, timely repairs, and keeping up with seasonal maintenance tasks.

Responsibilities of Owning a Second Home

The responsibilities of owning a second home can be categorized into several key areas that require consistent attention and action. Awareness of these can help you manage your property effectively:

- Routine Maintenance: This includes tasks such as lawn care, cleaning gutters, and servicing HVAC systems. Regular checks and maintenance can prevent larger, more costly issues from developing.

- Seasonal Preparations: Depending on the location, your property may need to be winterized or prepared for summer months. This could involve draining pipes, clearing snow, or inspecting roofs.

- Emergency Repairs: Owning a second home means being prepared for unexpected repairs. Whether it’s a leaky roof or a malfunctioning heating system, having a plan in place is essential.

- Legal and Financial Responsibilities: Keeping track of property taxes, insurance, and local regulations is necessary to avoid potential legal complications.

Recommended Services for Managing a Second Home Remotely

Managing a second home from afar can be challenging, but several services can help streamline the process and provide peace of mind. These services can handle various aspects of property management effectively:

- Property Management Companies: Hiring a property management company can significantly reduce the workload. They can manage everything from tenant screening to maintenance calls.

- Local Handyman Services: Having a reliable handyman or service provider can ensure that minor issues are addressed quickly without you needing to be present.

- Cleaning Services: Regular cleaning services can keep the property in pristine condition, especially if it is rented out between your visits.

- Landscaping Services: Professional landscaping can maintain the aesthetics of the property and ensure that outdoor spaces remain enjoyable and inviting.

- Home Monitoring Systems: Investing in smart home technology can allow you to monitor the property remotely, keeping an eye on security and utilities.

Benefits of Hiring a Property Management Company for Rental Properties

For those who choose to rent out their second home, hiring a property management company can bring numerous benefits. These companies specialize in maximizing rental potential while minimizing owner stress.

Property management companies can handle tenant relations, maintenance issues, and marketing, allowing owners to focus on other priorities.

The advantages of utilizing a property management company include:

- Tenant Screening: They conduct thorough background checks, ensuring reliable and responsible tenants.

- Marketing and Advertising: They have the expertise to market your property effectively, reaching a wider audience and minimizing vacancy periods.

- Maintenance Coordination: Property managers can quickly address repairs and maintenance, often at reduced costs due to established relationships with local contractors.

- Legal Compliance: They ensure that your rental complies with local rental laws, avoiding potential legal issues.

- Time Savings: Managing a rental property can be time-consuming. A property management company allows owners to enjoy their second home without the added stress of management duties.

Rental Considerations

Source: assetzproperty.com

Investing in a second home offers exciting opportunities beyond personal enjoyment, particularly in the realm of rental income. This can significantly offset ownership costs or even generate a profit, depending on how well you understand the rental market and the necessary legal requirements in your region. Properly preparing your property for short-term rentals can enhance the guest experience and maximize your earnings.The potential for rental income from a second home is substantial, especially in popular tourist destinations or urban areas with high rental demand.

To maximize this income, property owners should focus on effective marketing strategies, competitive pricing, and providing amenities that attract renters. Researching peak seasons and average rental rates in your area is a crucial step to ensure your property stands out in the marketplace.

Legal Requirements for Renting Out a Second Home

Understanding the legal landscape surrounding rental properties is essential for compliance and to avoid potential pitfalls. Different regions may have varying regulations regarding short-term rentals, including licensing, zoning laws, and taxation. Here are some key legal considerations to keep in mind:

Licensing

Many municipalities require a rental license or registration for short-term rentals. This often involves a fee and compliance with safety standards.

Zoning Laws

Ensure your property is in a zone that allows for short-term rentals. Zoning ordinances can vary widely, and some areas may restrict such activities.

Taxation

Be aware of local occupancy taxes, which may apply to short-term rentals. It’s vital to understand how to properly collect and remit these taxes.

Insurance

Consider obtaining a landlord insurance policy that covers short-term rentals, protecting against potential damages or liability claims.

Preparing a Second Home for Short-Term Rentals

Before listing your second home for rent, it’s crucial to ensure that it meets the needs and expectations of potential guests. The following checklist can help streamline this preparation process:

1. Clean and Declutter

Ensure the space is clean, organized, and free of personal items to create a welcoming atmosphere.

2. Safety Measures

Install smoke detectors, carbon monoxide detectors, and fire extinguishers. Ensure all exits are easily accessible.

3. Furnish and Equip

Provide essential furniture, kitchen appliances, and amenities like Wi-Fi, linens, and toiletries to enhance guest comfort.

4. Photography

Hire a professional photographer to capture high-quality images that showcase the property beautifully online.

5. Create a Guidebook

Compile a guidebook with house rules, local attractions, and tips for enjoying the area, providing a personalized touch for guests.

6. Set Competitive Pricing

Research similar properties in your area to set an attractive yet competitive rental price.

7. List on Multiple Platforms

Increase visibility by listing your property on popular rental platforms like Airbnb, Vrbo, and Booking.com.

Proper preparation and understanding of rental regulations can transform your second home into a profitable investment.

Long-term Investment Strategies

Owning a second home can provide numerous long-term benefits, particularly as a strategic investment. Not only does it serve as a personal retreat or vacation spot, but it can also appreciate in value over time, offering financial returns that enhance your overall portfolio. Understanding the investment potential of a second home requires a strategic approach that emphasizes maximizing both its value and income-generating capabilities.Investing in a second home compares favorably to other real estate options such as rental properties or commercial real estate.

While traditional rental properties often require extensive management and tenant oversight, a second home can provide a dual purpose: personal enjoyment and investment appreciation. Over time, second homes may appreciate in value at a rate comparable to or exceeding that of other properties, especially in desirable locations. Furthermore, they can be rented out when not in use, adding another layer of financial benefit.

Benefits of Long-term Ownership

The long-term benefits of owning a second home extend beyond mere appreciation. These advantages can be categorized as follows:

- Appreciation Potential: Real estate generally appreciates, and second homes in sought-after areas can see significant value increases over time, contributing to wealth accumulation.

- Tax Advantages: Expenses related to property maintenance, mortgage interest, and taxes may be deductible, providing financial relief and incentivizing ownership.

- Rental Income Opportunities: If you choose to rent your second home, it can generate a steady income stream, allowing you to offset mortgage payments or fund improvements.

- Diversification: A second home adds diversity to your investment portfolio, reducing risk by spreading your assets across different types of real estate.

Enhancing Value Over Time

Maximizing the value of your second home necessitates proactive strategies. Consider the following actions for increasing your property’s worth:

- Regular Maintenance: Keeping the property in excellent condition prevents depreciation and can increase its market value.

- Renovations and Upgrades: Investing in modern amenities, such as energy-efficient appliances or updated bathrooms, can significantly boost the property’s appeal and value.

- Landscape Improvements: Curb appeal is crucial; enhancing landscaping can make the property more attractive to potential buyers or renters.

- Smart Technology Installation: Incorporating smart home technology, like security systems and automated lighting, can appeal to modern buyers and renters, increasing demand.

Comparison with Other Real Estate Investments

When assessing second home ownership against other real estate investments, several factors should be considered:

- Management Ease: Second homes often require less day-to-day management compared to traditional rental properties, which can demand attention from tenants.

- Personal Use: Unlike commercial real estate or other investment properties, a second home offers personal enjoyment without sacrificing financial investment.

- Market Stability: Well-located second homes in desirable areas tend to weather market fluctuations better than other types of investment properties.

End of Discussion

Source: realgeeks.media

In summary, The Ultimate Guide to Buying a Second Home equips you with the knowledge and tools necessary to embark on this exciting venture confidently. By considering market trends, financial implications, and strategic choices, you’ll be well-prepared to secure a property that not only serves as a delightful getaway but also a smart investment for the future.

Answers to Common Questions

What are the main costs associated with buying a second home?

Beyond the purchase price, expect costs like closing fees, property taxes, insurance, and maintenance, which can add up significantly.

How does owning a second home affect my taxes?

Owning a second home may allow for mortgage interest deductions, but you’ll also need to report rental income and potentially face different tax implications depending on usage.

Is it better to buy a new build or an older property?

New builds often require less immediate maintenance and come with modern amenities, while older properties may offer charm and established neighborhoods but could need renovations.

How can I find the right location for my second home?

Consider factors like accessibility, local attractions, climate, and both current and future property values to determine the best location for your needs.

What should I look for in a property management service?

Seek a property management company with a good reputation, transparent fees, and a solid understanding of local rental laws to ensure your investment is well cared for.

Can I rent out my second home year-round?

Yes, but be aware of local regulations regarding short-term rentals, zoning laws, and potential restrictions that may apply to your property.

What are the benefits of renting out my second home?

Renting can provide significant rental income, help cover expenses, and keep your property maintained when you’re not using it.