Tips For Buying Real Estate In A Competitive Market

Tips for Buying Real Estate in a Competitive Market is essential for anyone looking to navigate the intricacies of today’s housing landscape. With homes flying off the market and buyers competing fiercely for limited listings, understanding how to position yourself as a strong contender is crucial. This guide serves as your roadmap, simplifying the complexities of making a successful purchase amid the competitive frenzy.

From grasping the factors that fuel competition to preparing your finances and crafting irresistible offers, we’ll equip you with the knowledge needed to thrive in a bustling real estate environment. By leveraging the right tools and strategies, you can boost your chances of finding the perfect home without getting overwhelmed.

Understanding the Competitive Real Estate Market

In real estate, a competitive market is characterized by high demand and limited supply, leading to fast-paced transactions and often bidding wars. Understanding this environment is crucial for any buyer looking to navigate purchasing a home. A competitive real estate market typically arises when the number of interested buyers exceeds the available homes for sale. This imbalance can be attributed to various factors, including economic growth, low-interest rates, and demographic trends.

A strong job market often encourages more individuals to seek homeownership, while limited new construction can restrict the inventory available for sale.

Indicators of a Competitive Market

Identifying indicators of a competitive real estate market can help buyers determine the best time to enter the market. Some key trends and factors that signify competitiveness include:

- Low Inventory Levels: When the number of homes for sale is significantly lower than the number of buyers, it creates a tight market. For instance, a region may experience a 20% decrease in available homes compared to the previous year, demonstrating a shortage.

- Rising Home Prices: A consistent increase in home prices suggests strong demand. For example, if the average home price in a neighborhood rises from $300,000 to $350,000 in a year, it reflects competitive pressures.

- Short Time on Market: Homes that sell quickly, often within days or weeks, indicate high buyer interest and competition. Properties that receive multiple offers shortly after listing are a clear sign of a competitive market.

- Bidding Wars: The occurrence of multiple offers on a single property, often resulting in bids above the asking price, is a strong indicator of competition. This trend exemplifies how buyers are willing to pay more to secure a home in a sought-after area.

- Increased Buyer Activity: High levels of foot traffic at open houses and numerous inquiries about listings suggest heightened interest. If an open house attracts dozens of potential buyers, it indicates a strong demand for homes in that area.

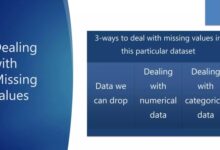

Preparing Financially for a Home Purchase

Source: website-files.com

Assessing your financial situation is crucial before diving into the competitive world of real estate. Understanding where you stand financially will not only guide your budget but also enhance your confidence when making offers on properties. Here’s how to get started with preparing financially for your home purchase.

Steps to Assess Personal Finances

Before looking at homes, it’s essential to take a close look at your current financial landscape. This includes understanding your income, expenses, and savings. A thorough assessment helps determine a realistic budget for your new home. Here are key steps to follow in assessing your personal finances:

- Calculate your total income: Include all sources such as salary, bonuses, and any additional income streams.

- List your monthly expenses: From rent to utilities and groceries, knowing your essential expenses helps in budgeting.

- Evaluate your savings: Check how much you have saved for a down payment and other costs associated with buying a home, such as closing costs and moving expenses.

- Review existing debts: Consider student loans, credit card debt, and car payments, as these will affect your debt-to-income ratio.

Getting Pre-Approved for a Mortgage

Pre-approval for a mortgage is a key step that signals to sellers you are a serious buyer. This process involves a lender examining your financial background to determine how much they are willing to lend you. The importance of getting pre-approved cannot be overstated:

Pre-approval gives you a competitive edge in a crowded market, showing sellers that you are financially capable of making an offer.

The steps to get pre-approved typically include gathering necessary documents such as:

- Proof of income (pay stubs, tax returns)

- Bank statements for asset verification

- Details about debts (credit cards, loans)

Once pre-approved, you’ll receive a letter from the lender indicating the loan amount you qualify for, thus giving you a clear budget for your home search.

Improving Credit Scores Before Buying a Home

A strong credit score can significantly affect your mortgage rates and terms. To enhance your credit score before purchasing a home, you can adopt several effective strategies:

- Pay bills on time: Consistent, timely payments positively impact your payment history, which comprises 35% of your credit score.

- Reduce credit card balances: Aim to keep your credit utilization below 30% of your total credit limit.

- Limit new credit inquiries: Multiple hard inquiries in a short period can lower your score, so avoid applying for new credit accounts before securing a mortgage.

- Check your credit report: Regularly review your credit report for errors and dispute any inaccuracies that may negatively impact your score.

Improving your credit score can lead to better loan terms, saving you money over the life of your mortgage.

Researching Neighborhoods and Properties

When it comes to buying real estate, understanding the neighborhood and property is just as important as the actual home itself. A well-chosen neighborhood can enhance your quality of life and potentially increase your property’s value over time. This section dives into effective methods to evaluate neighborhoods and properties, ensuring you make an informed decision in a competitive market.

Methods for Evaluating Neighborhoods

Evaluating neighborhoods requires a multi-faceted approach. It’s important to consider various factors that contribute to the area’s livability and potential for future growth. Here are some effective methods for evaluating different neighborhoods:

1. Visit the Neighborhood

Take the time to walk or drive through the area at different times of the day. Observe the amenities, traffic patterns, and how well the neighborhood is maintained.

2. Check Local Schools

Research the reputation of schools in the area, as quality education is often a significant factor for families. Websites like GreatSchools provide ratings and reviews.

3. Explore Crime Rates

Review crime statistics for the neighborhood. Local police department websites often provide this information, allowing you to assess safety levels.

4. Investigate Future Developments

Look into any upcoming developments or zoning changes that might affect property values. Local government websites can provide insights into future projects.

5. Engage with the Community

Attend community events or visit local businesses to get a feel for the neighborhood culture and the friendliness of neighbors.

Checklist for Visiting Potential Properties

When visiting potential properties, having a checklist can help you stay organized and focused. This can ensure you don’t overlook critical details that could affect your buying decision. Here’s a handy checklist to consider:

Exterior Condition

Look for any wear and tear, roof condition, siding, and overall curb appeal.

Interior Features

Assess the layout, lighting, and space utilization. Measure rooms if necessary.

Systems and Appliances

Check the condition and age of HVAC systems, plumbing, and appliances.

Natural Light and Ventilation

Observe windows and airflow throughout the property.

Noise Levels

Take note of any noise from nearby roads, trains, or neighbors.

Proximity to Amenities

Ensure essential services like grocery stores, hospitals, and public transport are nearby.

“A well-organized visit can help you spot red flags early.”

Online Tools and Resources for Neighborhood Research

With technology at our fingertips, there are numerous online tools and resources available for researching neighborhoods. Utilizing these can provide a wealth of information that goes beyond what you see in person. Consider these valuable online resources:

NeighborhoodScout

This site offers demographic information, crime rates, and real estate trends, helping you gauge the area’s stability and growth potential.

Zillow and Realtor.com

Both platforms provide listings and insights into home values, historical price trends, and market dynamics.

Walk Score

This tool assesses how walkable an area is, which can be crucial for those who prefer urban living or rely on public transportation.

Local Forums and Social Media

Engaging in community forums or Facebook groups can provide personal insights and real-time feedback from residents.

Google Maps

Utilize the street view feature to virtually explore the neighborhood and check out local amenities like parks and shops.By leveraging these methods and resources, you can gain a comprehensive understanding of neighborhoods and properties, ensuring you make a well-informed decision in your real estate journey.

Making a Strong Offer

In a competitive real estate market, making a strong offer is essential to standing out among other potential buyers. A well-crafted offer not only reflects your serious intent but can also bridge the gap between landing your dream home and losing it to another buyer. Understanding the components that contribute to a powerful offer can set you apart and increase your chances of success.The elements of a strong purchase offer encompass several key aspects that must be carefully considered.

You’ll want to ensure that your offer price is attractive while also reflecting the market dynamics. This requires a thorough market analysis to determine a competitive offering price. Additionally, customizing your offer can catch the seller’s attention, potentially making your proposal more appealing than others.

Elements of a Strong Purchase Offer

In order to create a compelling offer, be aware of the following crucial components:

- Competitive Offering Price: Start with a price that not only meets your budget but also aligns with comparable sales in the area. A well-researched price will convey seriousness and readiness to buy.

- Contingency Terms: Minimize contingencies where possible. This demonstrates to the seller that you are a serious buyer who is willing to proceed without lengthy conditions, making your offer more attractive.

- Earnest Money Deposit: Increase your earnest money deposit to show commitment. A larger deposit may indicate to sellers that you are serious about following through with the purchase.

- Flexible Closing Date: Offering flexibility on the closing date can appeal to sellers who may need more time to move or adjust their plans. This personal touch can make your offer more inviting.

- Personal Touch: Including a personal letter to the sellers can create an emotional connection, highlighting your enthusiasm for their home and why it suits you and your family. This can often sway their decision in your favor.

Steps to Determine the Right Offering Price

Establishing the right offering price involves a systematic approach. Here’s how to accurately assess a competitive bid:

1. Market Analysis

Research recent sales of similar homes in the neighborhood to understand pricing trends. Analyze factors such as the property’s size, condition, and unique features.

2. Consult with a Real Estate Agent

An experienced agent can provide insights into the local market and suggest a strategic price point based on their expertise and current market conditions.

3. Evaluate Days on Market

Consider how long the home has been on the market. If it has only been listed for a short time, a higher offer may be necessary to secure the property. Conversely, if it has been listed for months, you may have more negotiation power.

4. Assess Seller Motivation

Understand the seller’s situation. A motivated seller may be more flexible on price or terms, while others may expect full asking price or more.

“A well-researched offer price reflects both market conditions and genuine interest.”

Tactics for Customizing Offers

Customizing your offer can make a significant difference in a competitive market. Here are some effective tactics to consider:

Personalized Communications

Send a heartfelt letter to the seller expressing why their home appeals to you. Share personal stories that resonate with the seller’s experiences.

Above Asking Price

If financially feasible, consider placing an offer above the asking price, especially for highly sought-after properties. This demonstrates strong competition in your intent.

All-Cash Offers

If possible, making an all-cash offer eliminates financing contingencies, making your offer more appealing and secure for the seller.

Incorporate Home Warranty

Offering a home warranty can alleviate concerns for sellers about potential repairs after sale, showcasing your understanding of their needs.

Quick Inspection and Closing

Commit to a quick inspection and closing timeline. This not only simplifies the process for the seller but also demonstrates your eagerness and readiness to complete the transaction.By employing these strategies, you can enhance your offer and position yourself favorably in a competitive real estate market.

Navigating Bidding Wars

Source: site-static.com

In today’s competitive real estate landscape, bidding wars have become increasingly common. For buyers, understanding how to navigate these situations can mean the difference between securing their dream home or losing out to a more aggressive competitor. This section covers essential strategies to handle multiple offer situations, stand out in a bidding war, and emphasizes the importance of flexibility in negotiations.

Strategies for Handling Multiple Offer Situations

Navigating a bidding war requires a combination of strategy, preparation, and understanding the local market dynamics. Here are some effective strategies to consider when faced with multiple offers:

-

Be Prepared to Act Quickly:

In a bidding war, time is of the essence. Being pre-approved for a mortgage and having all your financial documents in order can allow you to make a swift offer when you find the right property.

-

Offer More Than the Asking Price:

Consider offering a price above the asking price that reflects the property’s true market value. This can demonstrate your seriousness and willingness to compete.

-

Limit Contingencies:

While it’s important to protect your interests, limiting or waiving certain contingencies can make your offer more appealing. For example, waiving the inspection contingency could expedite the process and make your offer stand out.

-

Include an Escalation Clause:

An escalation clause automatically increases your offer by a certain amount if competing bids are submitted, demonstrating your commitment to securing the property without going too far over budget.

Standing Out in a Bidding War

In a bidding war, distinguishing yourself from other potential buyers is crucial. Here are some ways to make your offer more attractive:

-

Write a Personal Letter:

A heartfelt letter to the seller explaining why you love their home can create an emotional connection and sway their decision in your favor.

-

Flexible Closing Dates:

Being open to flexible closing dates can appeal to sellers who may need extra time to relocate or finalize their next purchase. This shows your willingness to accommodate their needs.

-

Offer a Larger Earnest Money Deposit:

A larger earnest money deposit can signal to the seller that you are serious about your offer and financially capable of following through with the purchase.

Importance of Flexibility in Terms and Timelines

Flexibility during negotiations can play a pivotal role in the outcome of a bidding war. Sellers often have personal circumstances that may influence their decision-making process. Being adaptable can lead to a successful transaction:

-

Understanding Seller Needs:

Take the time to understand the seller’s preferred timelines and needs. Being able to adjust your offer based on their circumstances can significantly improve your chances.

-

Willingness to Compromise:

Compromising on certain terms, such as the closing date or minor repairs, can make your offer more appealing. It shows you are not just focused on your own needs but are also considering the seller’s situation.

-

Quick Response Times:

Being responsive and ready to make decisions quickly can demonstrate your commitment, giving you an edge over other buyers who may hesitate.

Working with Real Estate Professionals

Navigating a competitive real estate market can be daunting, but partnering with the right real estate professionals can make a world of difference. Whether buying your first home or investing in property, understanding the roles of agents and how to effectively communicate with them is essential for a successful transaction.Real estate agents play critical roles in competitive markets, serving as guides and advocates for buyers.

They possess valuable knowledge about local markets, pricing strategies, and negotiation tactics. A proficient agent can help streamline the buying process, ensuring you don’t miss out on potential opportunities.

Key Roles of Real Estate Agents

Understanding the various roles real estate agents play is vital, especially in a competitive landscape. Here are some key responsibilities they undertake:

- Market Analysis: Agents provide insights into current market trends, helping you make informed decisions about pricing and offers.

- Property Listings: They have access to MLS databases, showcasing properties that may not yet be widely advertised to the public.

- Negotiation Expertise: Skilled agents negotiate on your behalf, aiming to secure the best terms and price for your purchase.

- Access to Resources: Agents often have connections with mortgage lenders, inspectors, and other professionals who can assist in the buying process.

Choosing the Right Agent

Selecting the right real estate agent involves evaluating their experience, expertise, and compatibility with your needs. Here are some tips to consider:

- Research Credentials: Look for agents with proven track records in your desired neighborhoods and positive client reviews.

- Interview Multiple Agents: Schedule consultations with several agents to gauge their understanding of the market and your specific requirements.

- Assess Communication Styles: Choose an agent whose communication style aligns with your preferences, ensuring smooth and effective interactions.

- Specialization Matters: If you’re looking for a particular type of property, such as investment properties or luxury homes, find an agent specializing in that area.

Communicating Effectively with Professionals

Clear communication with your real estate agent is essential for a successful buying experience. Here are some strategies to enhance your communication:

- Set Clear Expectations: Discuss your needs, preferences, and budget upfront to align your goals from the start.

- Be Honest About Your Concerns: Share any reservations or specific requirements you have, allowing your agent to tailor their search accordingly.

- Stay Informed: Regularly check in with your agent for updates and be proactive in asking questions about properties or the buying process.

- Utilize Technology: Use messaging apps or email for quick communication, and participate in virtual tours to stay engaged without needing to be physically present.

Understanding Market Conditions and Timing

Timing is a critical factor in the real estate market. The right timing can lead to significant savings and a smoother purchasing process, while poor timing may result in missed opportunities or overpaying for a property. Understanding the nuances of market conditions helps buyers strategically enter the market, ensuring they make informed decisions that align with their financial goals.Recognizing the best times to dive into the market requires careful observation of various indicators.

Economic trends, interest rates, and seasonal patterns all play essential roles in determining when to buy. Buyers should keep a close watch on these factors to maximize their chances of success.

Identifying Optimal Buying Times

To effectively determine the best times to enter the real estate market, buyers should consider several key indicators. These indicators help in assessing whether the market is favorable for a purchase.

- Interest Rates: Lower interest rates can significantly impact mortgage payments, making homes more affordable. Monitoring the Federal Reserve’s actions and economic forecasts can guide buyers on when to act.

- Market Inventory Levels: A higher inventory usually leads to lower prices, providing buyers with more options. Observing local listings will help assess whether it’s a buyer’s market or a seller’s market.

- Seasonal Trends: Real estate activity often fluctuates with the seasons. Spring and summer typically see more listings, while fall and winter may have less competition.

- Economic Indicators: Employment rates, inflation, and local economic conditions can all affect market stability. Strong job growth, for example, can indicate a healthy market.

Analyzing Seasonal Trends

Understanding seasonal trends is essential for buyers aiming to capitalize on market fluctuations. Each season brings its characteristics, influencing buyer behavior and market availability.

- Spring/Summer: Generally considered peak buying seasons, these months see increased listings and buyer activity. Families often prefer to move during the summer, avoiding disruptions to their children’s school year.

- Fall: As summer ends, activity often slows down. However, motivated sellers may be willing to negotiate, presenting opportunities for savvy buyers.

- Winter: This season usually sees the least amount of inventory and buyer interest. However, those who do list in winter may be more motivated to sell, providing potential bargains.

Analyzing these seasonal trends allows buyers to plan their entry into the market strategically. Tracking local sales data over several years can also reveal patterns that may not be immediately obvious, helping buyers make informed decisions based on historical performance.

“Timing your home purchase can be as crucial as the price of the property itself.”

Utilizing Technology and Tools

In today’s competitive real estate market, harnessing technology can provide significant advantages to homebuyers. With a plethora of apps and websites designed specifically for property searches, buyers can streamline their search process and make informed decisions. Additionally, innovative tools such as virtual tours and social media platforms can further enhance the home-buying experience.

Useful Apps and Websites for Home Buyers

Leveraging the right technology can simplify the home-buying process. A selection of apps and websites geared toward buyers can assist in finding properties, tracking market trends, and connecting with real estate professionals. Here are some notable options:

- Zillow: A comprehensive site that allows users to view listings, get estimates on property values, and read reviews of local agents.

- Realtor.com: Offers extensive property listings and features like market snapshots and neighborhood insights.

- Redfin: Known for its user-friendly interface and real-time updates, Redfin provides detailed information on homes, including price history and virtual tour options.

- Trulia: Focuses on neighborhood information, providing crime maps, school ratings, and community insights alongside property listings.

- Homesnap: An app that allows users to take photos of homes and instantly receive information about them, including pricing and nearby homes for sale.

Virtual Tours and Their Benefits

Virtual tours have become an essential tool for buyers in a competitive market. These immersive experiences allow potential buyers to explore properties from the comfort of their homes. Key benefits include:

- Time-saving: Buyers can virtually tour multiple homes in a short period, eliminating the need for numerous in-person visits.

- Detailed exploration: Virtual tours often provide a 360-degree view of each room, allowing buyers to assess layouts and features closely.

- Accessibility: For buyers unable to travel to various locations, virtual tours offer a way to explore properties regardless of distance.

- Enhanced engagement: Many tours incorporate interactive elements, such as the ability to click on features for more information, making the experience more engaging.

The Role of Social Media in Finding Homes

Social media has transformed the way buyers discover homes and network with real estate professionals. Platforms like Facebook, Instagram, and LinkedIn are valuable for more than just social interactions; they serve as tools for finding listings and connecting with agents.

- Groups and Pages: Many real estate agents create dedicated groups or pages to share listings and market insights, providing a direct line to potential buyers.

- Marketplace Features: Facebook Marketplace allows users to browse local listings and even connect directly with sellers.

- Networking: Buyers can follow real estate influencers and industry experts on platforms like Instagram to stay updated on market trends and tips.

- Community Engagement: Local neighborhood groups can provide insights into local events, amenities, and general community sentiment, helping buyers choose the right area.

Finalizing the Purchase

Completing the purchase of a home is an exciting yet intricate step that requires careful navigation. This phase, known as closing, wraps up all the necessary legal formalities and financial transactions to transfer ownership from the seller to the buyer. Being well-prepared can help ensure a smooth transition and prevent any last-minute surprises.The closing process involves several crucial steps, and it’s important to approach them with diligence.

From reviewing final documents to managing financial commitments, each step requires careful attention. Buyers must remain vigilant about potential pitfalls that could arise during final negotiations to avoid any setbacks.

Steps for Completing the Closing Process

Being aware of the steps to finalize a home purchase can significantly ease the process. Here’s a breakdown of the key steps involved in closing:

1. Final Walkthrough

It’s essential to conduct a final walkthrough of the property before closing day. This ensures that the property is in the agreed-upon condition and that any requested repairs have been completed.

2. Review Closing Disclosure

A Closing Disclosure form will be provided, detailing all costs associated with the closing process. Take the time to review this document thoroughly to ensure all charges are accurate.

3. Secure Financing

Ensure that your mortgage is finalized and that funds are available for the down payment and closing costs. Coordinate with your lender ahead of time.

4. Schedule Closing Appointment

Coordinate with all parties involved, including the seller, agents, and attorneys, to schedule the closing appointment. Confirm the date, time, and location.

5. Sign Documents

During the closing appointment, you will be required to sign numerous documents, including the mortgage agreement, title transfer documents, and various disclosures.

6. Transfer Funds

Bring a certified check or wire transfer funds for your down payment and closing costs. Ensure the amount matches what was discussed in the Closing Disclosure.

7. Receive Keys

Once all documents are signed and funds are transferred, you will receive the keys to your new home!

Common Pitfalls to Avoid During Final Negotiations

Navigating final negotiations can be tricky, and certain pitfalls should be avoided to ensure a successful closing. Here are some common issues:

Neglecting Details

Failing to read or understand the terms in the closing documents can lead to unexpected costs or obligations. Always ask for clarification on any unclear sections.

Last-Minute Changes

Making changes to the purchase agreement right before closing can create confusion and delays. Stick to the agreed-upon terms unless absolutely necessary.

Forgetting About Final Costs

It’s crucial to account for closing costs that may arise unexpectedly. Ask your agent for estimates of these expenses beforehand.

Ignoring Deadlines

Ensure that all documents are submitted in a timely manner. Missing deadlines can jeopardize the closing process.

Not Confirming Financing

Ensure your financing is in order and that you are not unexpectedly denied the mortgage at the last minute.

Checklist of Documents Needed at Closing

Having the necessary documents ready for closing is vital for a smooth process. Here’s a checklist of the documents you should have prepared:

Government-issued ID

Required for identification purposes.

Closing Disclosure

Review this document thoroughly before signing.

Homeowner’s Insurance Policy

Proof of insurance is usually required before closing.

Mortgage Application

A copy of your mortgage application for reference.

Survey or Title Documents

Documentation regarding property boundaries and title history.

Proof of Funds

Evidence of the funds available for the down payment and closing costs.

Powers of Attorney

If applicable, any documents authorizing someone else to sign on your behalf.

Any Local Requirements

Certain areas may have additional documentation requirement; consult your real estate agent.This checklist can serve as a helpful guide to ensure you have everything you need, contributing to a hassle-free closing experience.

Conclusive Thoughts

Source: riinsiders.com

In conclusion, navigating the competitive real estate market requires a blend of preparation, insight, and strategy. By understanding the landscape, preparing your finances, and working effectively with real estate professionals, you can elevate your home-buying experience. Remember that staying informed and adaptable is key to standing out and making wise decisions in this fast-paced environment.

FAQ Compilation

What should I do to improve my credit score before buying?

Pay down existing debts, ensure timely bill payments, and rectify any inaccuracies on your credit report to boost your credit score before applying for a mortgage.

How can I make my offer more appealing to sellers?

Consider offering a higher earnest money deposit, flexible closing dates, or waiving certain contingencies to enhance your offer’s attractiveness to sellers.

Is it better to buy a home in spring or fall?

Spring often sees more listings and heightened competition, while fall may offer more negotiating opportunities and potentially better prices, so choose based on your priorities.

What role do real estate agents play in a competitive market?

Real estate agents provide market insights, help with pricing strategies, and assist in negotiations, making them invaluable allies in a competitive landscape.

Are virtual tours effective for home buying?

Yes, virtual tours can save time and help you narrow down choices by offering a realistic view of properties from the comfort of your home.