Top 10 Real Estate Markets For Rental Income Growth

Top 10 Real Estate Markets for Rental Income Growth presents an intriguing exploration into the dynamic landscape of real estate investment. As more investors seek reliable income sources, understanding which markets are primed for rental income growth becomes essential. With various economic indicators and local trends playing significant roles, this guide aims to spotlight opportunities that can yield substantial returns while navigating the complexities of the rental property sector.

In the following sections, we will delve into the factors influencing rental income growth, the criteria for evaluating promising real estate markets, and highlight the top contenders recognized for their potential. By examining demographics, economic conditions, and emerging trends, investors can make informed decisions that align with their financial goals.

Overview of Real Estate Markets

The significance of rental income growth in real estate investment cannot be overstated. As investors seek to maximize their returns, understanding which markets are poised for growth can make a substantial difference in their portfolios. An increase in rental income not only enhances cash flow but also increases property value, ultimately leading to greater financial security for investors. Various factors contribute to rental income growth across different markets.

These include population growth, job opportunities, economic stability, and the demand for rental properties. Markets experiencing economic expansion often see a surge in rental prices as more individuals seek housing in these thriving areas. Additionally, changes in local laws, such as those affecting rental regulations, can directly impact rental income prospects.

Key Factors Driving Rental Income Growth

Understanding the driving forces behind rental income growth is essential for informed investment decisions. Several key factors contribute significantly to this growth:

- Population Growth: Areas with increasing populations often experience heightened demand for rental properties, leading to higher rental prices.

- Job Market Strength: Regions with robust job markets attract more residents, increasing the competition for rental units and pushing rental rates higher.

- Economic Indicators: Economic health indicators, such as GDP growth and employment rates, correlate positively with rental income growth.

- Supply and Demand: A limited supply of rental properties in high-demand areas naturally drives up prices, benefiting landlords.

- Rental Regulations: Changes in laws governing rent control or tenant protections can either restrict or enhance rental income potential.

Economic indicators play a crucial role in understanding the relationship between rental income growth and market conditions. Strong economic performance typically correlates with higher disposable income, which allows residents to afford increased rental prices.

“The stronger the economy, the higher the demand for rental properties, resulting in increased rental income for investors.”

In summary, a comprehensive analysis of real estate markets reveals that rental income growth is influenced by a multitude of factors, from demographic trends to economic health. By focusing on these key elements, investors can strategically position themselves in markets that are likely to yield higher returns.

Criteria for Evaluating Real Estate Markets

Assessing the potential for rental income growth in real estate involves analyzing various metrics that reflect the market’s health and future prospects. Understanding these criteria is essential for investors aiming to maximize their returns on rental properties. By evaluating factors such as population growth, employment opportunities, and housing affordability, investors can identify markets that are likely to yield significant rental income growth over time.

Metrics for Assessing Rental Income Growth

Several key metrics are utilized to evaluate the viability of real estate markets in terms of rental income. These metrics not only provide insights into current market conditions but also help predict future trends. Indicators like vacancy rates, rental yield, and historical rental price trends are critical in determining the attractiveness of a market.

- Vacancy Rates: Low vacancy rates indicate strong demand for rental properties, suggesting that landlords can command higher rents and enjoy lower turnover rates.

- Rental Yield: This metric, calculated as the annual rental income divided by the property’s purchase price, helps investors gauge the potential return on investment.

- Historical Rental Price Trends: Analyzing past rental price movements offers insights into the market’s resilience and growth trajectory.

Comparative Analysis of Markets

When comparing different real estate markets, several factors significantly influence the potential for rental income growth. Population growth, job opportunities, and housing affordability are three crucial elements that investors should assess.

- Population Growth: A steady increase in population often correlates with higher demand for rental housing. Cities experiencing population surges, such as Austin, Texas, often see robust rental income growth.

- Job Opportunities: Areas with a diverse and expanding job market attract new residents, leading to increased demand for rentals. For instance, cities like Seattle and San Francisco are renowned for their tech industries, boosting local economies.

- Housing Affordability: Markets where home prices are high relative to income may lead to greater demand for rental properties. In contrast, areas with affordable housing may see slower rental growth.

Impact of Local Regulations and Property Taxes

Local regulations and property tax rates play a significant role in shaping rental markets. Understanding these elements can help investors navigate potential challenges and opportunities.

- Local Regulations: Zoning laws, rent control measures, and tenant protection regulations can influence the rental landscape. Areas with favorable regulations for landlords typically see more robust market activity.

- Property Taxes: High property taxes can reduce overall profit margins for landlords. Investors should evaluate tax rates in different markets to ensure that their rental income can sustain these costs.

“Investors should always factor in local regulations and property taxes when evaluating rental markets, as these can significantly impact profitability.”

Top 10 Markets for Rental Income Growth

Source: isu.pub

Identifying real estate markets with strong rental income growth potential is crucial for investors looking to maximize their returns. The following markets have demonstrated significant growth trends, making them prime locations for rental investments in the coming years. These markets are characterized by robust economic conditions, increasing populations, and favorable real estate landscapes.Understanding the dynamics of these markets requires an examination of various factors, such as demographics, economic health, and current real estate trends.

The following sections detail the top ten markets that are recognized for their rental income growth potential.

Top 10 Markets Overview

Here’s a rundown of the top ten real estate markets for rental income growth. Each location presents unique opportunities and characteristics that contribute to its rental income potential:

- Austin, TexasKnown for its booming tech industry, Austin has seen a significant influx of young professionals. With a population growth rate of over 20% in the last decade, rental demand remains high.

- Orlando, FloridaWith tourism driving its economy, Orlando boasts a diverse population and strong job growth, particularly in healthcare and technology. Rental yields are buoyed by seasonal demand.

- Charlotte, North CarolinaCharlotte is a financial hub that attracts newcomers for its job opportunities and quality of life. Its vacancy rates have remained low, indicating consistent demand.

- Raleigh, North CarolinaThis city benefits from a strong education sector, with the Research Triangle drawing in students and professionals alike. The rental market is thriving with strong appreciation rates.

- Nashville, TennesseeWith a vibrant music scene and a growing economy, Nashville’s rental market has been on the rise. The influx of residents has led to increased rental prices and yields.

- Denver, ColoradoKnown for its outdoor lifestyle, Denver attracts a diverse population. The city’s strong economy and job market support a healthy rental sector with competitive pricing.

- Seattle, WashingtonAs a tech powerhouse, Seattle has seen significant housing demand. High rental prices are balanced by strong job growth, making it a prime market for investors.

- Phoenix, ArizonaPhoenix has experienced rapid growth due to its affordable housing and warm climate. The rental market is robust with low vacancy rates, making it attractive for investors.

- Dallas, TexasDallas’ diverse economy and strong job growth contribute to a vibrant rental market. The influx of new residents keeps demand for rental properties high.

- San Diego, California

Known for its desirable climate and lifestyle, San Diego has a steady rental market, although high property prices necessitate careful investment strategies.

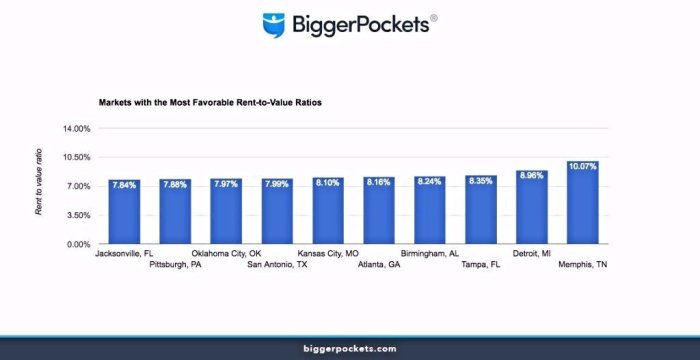

Market Comparisons

To provide a clearer picture of these markets, the following table compares key metrics such as rental yields, vacancy rates, and price appreciation. This data is critical for investors looking to make informed decisions based on quantifiable trends.

| Market | Rental Yield (%) | Vacancy Rate (%) | Price Appreciation (Annual %) |

|---|---|---|---|

| Austin, TX | 5.4 | 7.2 | 8.5 |

| Orlando, FL | 6.0 | 5.5 | 7.0 |

| Charlotte, NC | 5.8 | 5.0 | 6.8 |

| Raleigh, NC | 5.6 | 4.8 | 7.2 |

| Nashville, TN | 5.2 | 6.0 | 8.0 |

| Denver, CO | 4.8 | 6.5 | 6.5 |

| Seattle, WA | 4.5 | 5.8 | 9.0 |

| Phoenix, AZ | 6.2 | 4.6 | 7.5 |

| Dallas, TX | 5.1 | 5.2 | 6.7 |

| San Diego, CA | 4.3 | 7.0 | 5.9 |

Each of these markets showcases unique strengths that contribute to their potential for rental income growth. By evaluating these factors, investors can make informed choices about where to invest their capital for maximum returns.

Emerging Markets with High Potential

Source: mashvisor.com

The real estate landscape is continuously evolving, with certain markets demonstrating exceptional potential for rental income growth. Investors are increasingly turning their attention to emerging markets, where both affordability and appreciation create lucrative opportunities. This section delves into select markets that are gaining traction among investors and showcases key trends influencing their attractiveness.Emerging real estate markets often exhibit significant characteristics such as population growth, economic development, and infrastructural advancements.

These factors contribute to increasing demand for rental properties, making them appealing to investors. Below are several markets that have shown promising signs for rental income growth:

Notable Emerging Markets

Several cities have emerged as real estate hubs, attracting attention from savvy investors. Notable examples include:

- Austin, Texas: Known for its vibrant tech scene, Austin has seen a boom in population and job opportunities, leading to a surge in rental demand. The city’s cultural attractions and lifestyle amenities further enhance its appeal.

- Boise, Idaho: Boise has become a hotspot for newcomers seeking affordability and quality of life. Its picturesque surroundings and growing job market have made it a popular choice for families and professionals alike.

- Raleigh-Durham, North Carolina: This area is celebrated for its educational institutions and burgeoning tech industry. The influx of young professionals and families is driving the rental market, resulting in consistent growth in rental income.

- Orlando, Florida: With tourism and entertainment at its core, Orlando’s real estate market benefits from a steady influx of visitors and new residents. The city’s ongoing infrastructural investments promise to bolster rental income growth further.

Investors have successfully leveraged these emerging markets through strategic property acquisitions and management practices. For instance, an investor in Austin purchased a property in a rapidly developing neighborhood. By renovating the property and targeting young professionals, they achieved a rental yield significantly above the market average. Additionally, a case study involving a group of investors in Boise involved purchasing multifamily properties during the early stages of market development.

Their strategy focused on enhancing property value through effective renovations and amenities, resulting in substantial returns as rental rates rose with increased demand.The trends underpinning these markets, such as demographic shifts and economic expansion, create a fertile ground for rental income growth. Investors who recognize and act upon these opportunities are poised for success in the dynamic landscape of real estate.

Risks Associated with Rental Income Investments

Investing in rental properties can be a lucrative venture, but it’s essential to understand the risks involved. While rental income can provide a steady cash flow, various factors can jeopardize this income, leading to financial strain for investors. Recognizing these risks allows investors to take proactive measures to safeguard their investments and maximize returns.One of the most significant risks investors face in rental markets is economic downturns.

These downturns can lead to increased vacancies, lower rental prices, and higher tenant turnover. Additionally, property management issues such as maintenance problems and tenant disputes can further complicate the investment landscape. Understanding these risks and implementing effective strategies is crucial for mitigating potential losses and ensuring a stable rental income.

Economic Downturns and Market Fluctuations

Economic downturns can create several challenges for rental property investors. During recessions, job losses and wage stagnation can cause demand for rental properties to decline, leading to increased vacancies and lower rental rates. The impact of market fluctuations can severely affect rental income stability and growth. It’s essential to consider these potential challenges when investing in rental properties.To mitigate the risks associated with economic downturns, investors can adopt several strategies:

- Diverse Portfolio: Investing in various types of properties across different markets can reduce exposure to any single economic event.

- Emergency Fund: Maintaining a cash reserve can help cover unexpected expenses and periods of vacancy, providing a financial buffer during tough times.

- Long-term Leases: Securing long-term tenants can reduce vacancy rates and provide a more stable income stream, even during economic fluctuations.

- Market Research: Continually analyzing market trends and economic indicators can help investors make informed decisions about when to buy, sell, or hold properties.

Property Management Challenges

Property management issues can also pose significant risks to rental income. Problems such as delayed rent payments, tenant disputes, and costly maintenance can eat into profit margins and create stress for investors. Effective property management is vital to maintaining a positive rental income flow.To address these challenges, consider the following strategies:

- Professional Management Services: Hiring a reputable property management company can alleviate the burden of day-to-day operations and ensure timely rent collection.

- Clear Lease Agreements: Drafting detailed lease agreements can help mitigate disputes by clearly outlining tenant responsibilities and property rules.

- Regular Maintenance: Performing routine inspections and maintenance can prevent larger, costly repairs down the line, ensuring properties remain in good condition.

- Tenant Screening: Implementing a thorough tenant screening process can help identify reliable tenants, reducing the likelihood of missed rent payments and property damage.

Understanding the complexities of rental income investments and actively managing associated risks can lead to a more stable and profitable investment experience.

Investment Strategies for Maximizing Rental Income

Investing in rental properties can provide significant returns, but to truly maximize rental income, a strategic approach is essential. Understanding the nuances of the real estate market and leveraging effective management practices can significantly boost profitability. Below, we Artikel a step-by-step guide designed to optimize your investment returns and enhance your property management techniques.

Step-by-Step Guide for Maximizing Returns on Rental Properties

To ensure you are effectively maximizing returns, follow these strategic steps:

- Conduct Thorough Market Research: Assess local market trends, rental rates, and economic indicators. Understanding demand can help you choose properties in high-growth areas.

- Choose the Right Property: Look for properties that are undervalued or need minor repairs. This allows for immediate appreciation and can attract quality tenants.

- Calculate Investment Metrics: Use metrics like cash-on-cash return, cap rate, and gross rental yield to evaluate potential returns accurately.

- Enhance Property Appeal: Invest in minor renovations or landscaping to improve the property’s attractiveness, which can justify higher rental rates.

- Screen Tenants Diligently: Implement a thorough tenant screening process to minimize the risk of late payments or property damage.

- Set Competitive Rental Prices: Analyze comparable properties in the area to set a competitive price that maximizes occupancy while ensuring profitability.

- Regularly Review and Adjust Rents: Periodically assess rental prices to ensure they remain aligned with market rates, adjusting as necessary to maintain profitability.

- Utilize Professional Property Management: Consider hiring a property management firm to handle tenant relations and maintenance, allowing you to focus on strategic growth.

Best Practices for Property Management That Enhance Rental Income

Effective property management directly correlates with rental income growth. Here are best practices to adhere to:To enhance rental income, consider implementing the following practices:

- Prompt Maintenance and Repairs: Address maintenance issues swiftly to keep tenants satisfied and reduce turnover.

- Effective Communication: Maintain open lines of communication with tenants to foster positive relationships and encourage lease renewals.

- Regular Property Inspections: Schedule inspections to ensure the property is well-maintained and to identify any potential issues early.

- Utilize Technology for Management: Use property management software to streamline operations, track payments, and manage tenant communications effectively.

- Implement Flexible Payment Options: Offering multiple payment methods can improve on-time payments and tenant satisfaction.

Utilizing Technology and Data Analysis in Rental Property Investment Decisions

Technology and data analysis play crucial roles in modern real estate investment strategies. Leveraging these tools can lead to more informed decisions.Incorporating technology effectively can maximize rental income through the following methods:

- Data-Driven Market Analysis: Use platforms that provide analytics on rental trends, demographic shifts, and economic indicators to make informed investment choices.

- Online Marketing Strategies: Utilize social media and property listing sites to reach a broader audience and attract potential tenants quickly.

- Smart Home Technology: Implement smart home features that appeal to tech-savvy renters, potentially allowing for premium rental rates.

- Virtual Tours and Augmented Reality: Offer virtual property tours to attract potential tenants who prefer online viewing, especially in a post-pandemic market.

- Data Analytics for Tenant Behavior: Analyze tenant data to understand preferences and behaviors, which can inform decisions on property upgrades and amenities.

Future Trends in Real Estate Markets

As we look towards the future of real estate markets, several trends are poised to significantly influence rental income growth. These trends are shaped by various factors including technological advancements, changing consumer preferences, and overarching societal shifts. Understanding these trends is crucial for investors aiming to maximize their portfolios in the evolving landscape of real estate.

Sustainability and Green Building Practices

The increasing awareness of environmental issues is driving a substantial shift towards sustainability in real estate. Landlords and property developers are now focusing on implementing green building practices, which not only reduce environmental impact but also appeal to a growing demographic of eco-conscious renters. Properties that emphasize energy efficiency, sustainable materials, and reduced carbon footprints are becoming more attractive.

- Energy-efficient appliances and smart home technologies are in demand, as they reduce utility costs and enhance tenant comfort.

- Green certifications, such as LEED (Leadership in Energy and Environmental Design), are increasingly sought after by renters, signaling a property’s commitment to sustainability.

- Outdoor spaces with gardens, urban farming, and green rooftops are being prioritized, providing tenants with a connection to nature.

The incorporation of these sustainable practices not only enhances the property’s value but also contributes to long-term rental income growth.

Demographic Shifts and Rental Market Impacts

Demographic changes, including aging populations and the rise of remote work, are reshaping rental markets. As more individuals work from home, the demand for rental properties in suburban and rural areas is increasing, leading to a shift in rental prices and availability.

- Aging populations tend to prefer rental options that offer amenities catered to their lifestyle, such as single-level living and proximity to healthcare services.

- Remote work has allowed families to seek larger living spaces outside of urban centers, driving up demand in previously overlooked markets.

This trend indicates a shift in rental strategies, with investors needing to adapt to changing tenant preferences that include space, comfort, and access to community resources.

“The future of real estate lies in understanding and adapting to the evolving needs of tenants, particularly as demographic shifts redefine traditional rental markets.”

Final Wrap-Up

Source: carrot.com

In conclusion, the journey through the Top 10 Real Estate Markets for Rental Income Growth underscores not only the potential for lucrative investments but also the importance of thorough analysis and strategic planning. As markets evolve and new opportunities emerge, staying informed about trends and risks will be crucial for success in rental investments. Whether you’re an experienced investor or just beginning, these insights can serve as a foundation for achieving your rental income objectives.

FAQ Overview

What factors should I consider before investing in rental properties?

Look for population growth, job opportunities, housing affordability, and local regulations that can impact rental income.

How can I mitigate risks associated with rental investments?

Diversifying your portfolio, conducting thorough market research, and maintaining a solid property management plan can help manage risks effectively.

What role does technology play in rental property investments?

Technology helps investors analyze data for better decision-making, manage properties efficiently, and enhance tenant communication.

Are emerging markets worth the investment?

Yes, emerging markets often present unique opportunities for growth and can offer high returns, especially if you identify trends early.

How do economic downturns affect rental income stability?

Economic downturns can lead to increased vacancy rates and lower rental prices, making it essential to have a contingency plan in place.