Top Cities Where Property Prices Are Still Affordable

Top Cities Where Property Prices Are Still Affordable invite you to explore a landscape where homeownership remains within reach for many. In a world where property prices seem to soar in most urban areas, there are still hidden gems where affordability thrives.

This article delves into the nuances of property price trends, highlighting cities that not only maintain affordable housing options but also boast vibrant communities and a quality lifestyle. By understanding the economic indicators and factors influencing these markets, you can discover opportunities that may lead to your dream home.

Overview of Property Price Trends

In recent years, the landscape of property prices has seen significant fluctuations, influenced by a variety of factors. While many urban centers have experienced skyrocketing prices, certain cities remain surprisingly affordable. Understanding the underlying trends is crucial for potential buyers and investors looking for opportunities in the real estate market.Several factors contribute to the affordability of properties in specific cities.

A strong local economy, lower cost of living, and population trends all play vital roles. Economic indicators, such as employment rates, wage growth, and the availability of housing stock, provide insight into a city’s property market accessibility. Cities with robust job markets tend to attract more residents, driving up demand and, consequently, prices. However, in locations where job growth is steady but not explosive, property prices may remain within reach for many buyers.

Impact of Remote Work on Housing Demand

The rise of remote work has significantly shifted housing demand patterns across the country. Many individuals no longer feel tethered to large metropolitan areas, allowing them to explore affordable housing options in less populated cities. This trend has opened a new realm of possibilities, as people prioritize space, quality of life, and affordability over proximity to traditional workplaces.As remote work continues to be a staple for many companies, several notable trends have emerged:

- Increased Interest in Suburban and Rural Areas: Many homebuyers are now considering properties in suburban or rural areas where real estate prices are more affordable than urban centers. This shift allows them to enjoy larger homes and outdoor spaces, with many new homeowners prioritizing lifestyle over commute.

- Migration Patterns: With remote work flexibility, cities like Boise, Idaho, and Richmond, Virginia, have seen significant in-migration from more expensive cities like San Francisco and New York. These areas offer a lower cost of living and attractive community features.

- Temporary Housing Increases: Remote workers are also opting for short-term rentals or co-living spaces in different cities. This trend allows individuals to explore various locations before making a long-term investment in property.

The emergence of remote work has undeniably transformed the property market dynamics, allowing buyers to seek out properties that align with their lifestyle preferences rather than being confined to traditional job market hotspots.

“Remote work is not just a temporary trend; it has reshaped the ways in which people view their living environments and investment in real estate.”

Top Cities with Affordable Property Prices

Source: medium.com

Finding a home that fits within your budget can often feel like a daunting task, especially in today’s fluctuating property market. However, there are still cities where property prices remain affordable, making homeownership a more attainable dream. Here we explore five cities that not only offer reasonable housing costs but also provide a rich quality of life.

List of Cities with Affordable Property Prices

Understanding the uniqueness and offerings of each city is essential when considering a move. Below are five cities where property prices are still affordable, along with their characteristics and attractions that contribute to their affordability.

- Buffalo, New York: Buffalo is known for its stunning architecture and vibrant arts scene. The median home price is around $150,000, making it an attractive option for first-time homebuyers. The living cost is relatively low, and the city offers beautiful parks and lakeside views.

- Grand Rapids, Michigan: With a median home price of approximately $200,000, Grand Rapids boasts a thriving craft beer scene and a strong sense of community. The cost of living is affordable compared to national averages, enhancing its appeal to families and young professionals.

- Indianapolis, Indiana: Indianapolis offers a median home price of about $180,000. Known for its sports culture and robust job market, the city has low property taxes and a cost of living that is below the national average, making it a fantastic place for business and leisure.

- Des Moines, Iowa: With a median home price around $190,000, Des Moines is celebrated for its quality of life and booming job market. The city is home to several parks and cultural festivals, while its living costs are manageable for most households.

- Louisville, Kentucky: Louisville has a median home price of approximately $200,000. Renowned for the Kentucky Derby and its diverse culinary scene, it combines southern charm with urban convenience. The city offers a low cost of living and a rich historical backdrop.

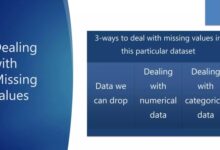

Comparison Table of Property Prices and Living Costs

Below is a comparison table highlighting the property prices, average income, and living costs in these cities, providing a clearer picture of what you can expect.

| City | Median Property Price | Average Income | Cost of Living Index |

|---|---|---|---|

| Buffalo, NY | $150,000 | $50,000 | 79 |

| Grand Rapids, MI | $200,000 | $60,000 | 83 |

| Indianapolis, IN | $180,000 | $54,000 | 85 |

| Des Moines, IA | $190,000 | $58,000 | 81 |

| Louisville, KY | $200,000 | $55,000 | 84 |

“Affordability doesn’t just mean lower prices; it also reflects a balanced lifestyle, with opportunities for growth and recreation.”

The unique characteristics of each city contribute significantly to their affordability. For instance, cities like Buffalo and Indianapolis benefit from a lower cost of living due to their strong local economies and community-oriented environments. Grand Rapids and Des Moines thrive on their vibrant local cultures and attractions, while Louisville’s rich history and culinary diversity make it a captivating place to live, all at reasonable housing prices.

Each city offers something special, making them not only affordable but also desirable places to call home.

Factors Influencing Affordability

Source: thestreet.com

The affordability of property prices is influenced by a variety of factors that shape the housing market landscape. Understanding these elements can provide valuable insight into why certain cities remain accessible for homebuyers while others do not. Local government policies, population trends, and financial aspects play a crucial role in determining property affordability.

Local Government Policies and Affordable Housing

Government policies significantly impact housing affordability through zoning laws, tax incentives, and development regulations. Cities that prioritize affordable housing often implement policies that encourage the construction of low-cost units, which can help stabilize the market. For instance, some municipalities offer tax credits to developers who commit to creating affordable housing. This not only incentivizes the construction of new homes but also ensures that existing properties are maintained at reasonable price points.

Key policies influencing affordability include:

- Zoning Regulations: Flexible zoning laws can facilitate higher density developments, allowing for more housing options in urban areas.

- Incentives for Developers: Tax breaks and subsidies can motivate developers to build affordable housing units.

- Rent Control Measures: These policies can help keep rental prices stable, indirectly affecting the overall housing market.

Population Trends Affecting Property Prices

Population dynamics play a critical role in shaping property markets. Regions experiencing population growth typically see increased demand for housing, which can drive prices upwards. Conversely, areas with declining populations may face stagnating or declining property values. Current trends indicate that many individuals are migrating towards suburban and rural areas, seeking affordable living options, particularly post-pandemic.Factors related to population trends include:

- Urbanization: Cities attracting younger demographics often witness surges in housing demand.

- Migration Patterns: The influx of residents from higher-cost areas contributes to rising property prices in more affordable regions.

- Job Opportunities: Employment growth in certain cities can attract more people, further driving up the demand for housing.

Impact of Interest Rates and Financing Options

Interest rates are a fundamental aspect of the housing market that can greatly influence a buyer’s purchasing power. Lower interest rates generally make borrowing more affordable, encouraging potential homeowners to enter the market. Conversely, when rates rise, financing a home purchase becomes more expensive, which can dampen demand and subsequently stabilize prices.Important considerations regarding interest rates include:

- Current Rate Trends: As of late 2023, many buyers have adjusted their strategies in response to fluctuating interest rates, often seeking fixed-rate mortgages to lock in lower payments.

- Government Programs: Various programs exist to assist first-time buyers, providing access to lower interest rates or down payment assistance.

- Credit Availability: As lenders tighten their credit requirements in response to economic conditions, the pool of affordable financing options may shrink, impacting overall affordability.

“Understanding the interplay between local policies, population growth, and financial conditions is essential for grasping the complexities of property affordability.”

Strategies for Homebuyers in Affordable Markets

Navigating the property market in affordable cities requires careful planning and informed decision-making. For homebuyers looking to make the most of their investment, understanding how to approach these markets is essential. Affordable cities can offer great opportunities but may also come with unique challenges. Here are some strategies to keep in mind.

Tips for Navigating the Property Market

To successfully navigate the property market in affordable cities, homebuyers should implement several key strategies. Being proactive and informed can make a significant difference in the buying experience.

- Assess your budget: Determine your purchasing power and stick to a budget that allows for potential renovations or unexpected costs.

- Research neighborhoods: Identify areas that are not only affordable but have potential for growth. Look for signs of development, such as new businesses or infrastructure projects.

- Attend open houses: Engage with the local market by visiting open houses, which can provide firsthand experience of property conditions and neighborhood vibes.

- Be patient: The ideal property may take time to find. Don’t rush; wait for the right opportunity that meets your needs and budget.

- Consider fixer-uppers: Properties that need some work can often be purchased at a lower price, allowing you to invest in renovations that increase their value.

Importance of Thorough Research and Utilizing Local Real Estate Agents

Thorough research is a cornerstone of successful homebuying, particularly in affordable markets. Local real estate agents can be invaluable resources, offering insights and expertise that can guide buyers through complex transactions.Utilizing local real estate agents is essential for several reasons. They possess deep knowledge of the market trends, neighborhood dynamics, and can access listings that might not be publicly available.

Working with an agent can streamline communication and help negotiate better deals.

“Understanding the local market can mean the difference between a good investment and a regrettable purchase.”

Methods for Evaluating Long-term Investment Potential

When evaluating long-term investment potential in affordable areas, it is crucial to look beyond immediate price tags and consider the broader economic and social factors that influence property values. Some effective methods include:

- Analyzing economic indicators: Look at job growth, unemployment rates, and population trends. Areas with strong economic fundamentals are likely to see property values rise over time.

- Studying historical price trends: Researching price appreciation over the past years gives insights into how properties have performed and may continue to perform.

- Evaluating local infrastructure: Consider future developments such as public transportation upgrades or new schools, as these often enhance property value and desirability.

- Assessing rental demand: In affordable markets, high rental demand can indicate strong investment potential, especially if you consider renting out the property in the future.

- Connecting with community initiatives: Engage with local groups to understand community plans and improvements that could enhance neighborhood appeal.

Future Trends in Affordable Housing

Source: forbes.com

As we look ahead at the changing landscape of affordable housing, several trends are emerging that could reshape the way we perceive property prices in urban developments. Shifts in demographics, economic conditions, and technological advancements are all playing a role in shaping this market. Understanding these dynamics is essential for both homebuyers and investors seeking to navigate the future of affordable real estate.One significant trend is the increasing role of remote work in influencing housing choices.

With more individuals opting for flexible work arrangements, there is a growing demand for homes in suburban and rural areas that offer more space at a lower cost. This shift is expected to drive property prices down in these regions while potentially increasing prices in metropolitan areas that remain desirable for their amenities.

Emerging Trends in Urban Development

The ongoing urbanization process will significantly impact housing affordability and availability. Key trends include:

Mixed-Use Developments

Many cities are increasingly favoring developments that combine residential, commercial, and recreational spaces. This approach not only maximizes land use but also enhances community living, encouraging lower property prices by creating diverse housing options within urban centers.

Transit-Oriented Development

As cities invest in public transportation, property values near transit hubs are likely to rise. However, this also presents an opportunity for affordable housing projects that ensure accessibility, thereby influencing future market dynamics.

Sustainability Initiatives

There is a growing emphasis on environmentally friendly building practices, which can initially increase costs but lead to long-term savings on utility bills. The integration of green technologies in affordable housing could attract a new demographic of eco-conscious buyers.

Adaptive Reuse of Buildings

Converting underutilized or vacant properties into affordable housing is becoming a trend in many urban areas. This not only revitalizes neighborhoods but also provides cost-effective solutions to housing shortages.As these trends gain traction, predictions indicate that property prices in identified cities may stabilize or even decrease in certain areas over the next decade, especially in places that embrace such developments.

“The integration of innovative urban planning strategies will provide sustainable solutions to housing affordability.”

The potential effects of economic changes on the affordable housing market cannot be overlooked. Factors such as interest rates, inflation, and job market fluctuations will play a crucial role in shaping property prices. For instance, if interest rates rise significantly, homebuyers may face higher mortgage costs, leading to decreased demand and a potential dip in prices. Conversely, a robust economy with low unemployment rates can boost consumer confidence and drive demand, thereby increasing prices.In summary, the future of affordable housing is closely tied to urban development trends, economic conditions, and societal shifts.

With the right strategies and foresight, cities can enhance their housing markets while ensuring that affordability remains a priority.

Case Studies of Affordable Cities

Cities that have successfully maintained lower property prices offer invaluable insights for both homebuyers and policymakers. By analyzing these successful case studies, we can uncover strategies that have proven effective in keeping housing affordable amidst rising costs in other urban areas. One notable case study is the city of Pittsburgh, Pennsylvania. Over the past decade, Pittsburgh has transformed its economy while keeping housing prices relatively stable.

Factors contributing to this include the city’s investment in local infrastructure and its focus on attracting tech and healthcare industries, which have led to job creation without dramatically inflating housing prices.

Successful Approaches to Keeping Property Prices Low

Exploring the strategies employed by cities like Pittsburgh reveals key lessons that can be applied elsewhere. Here are some significant takeaways from these successful cities:

- Investment in Infrastructure: Cities that invest in public transport, parks, and community facilities create appealing neighborhoods that remain attractive without overinflating property values.

- Diverse Economic Opportunities: By promoting a variety of industries, cities avoid over-reliance on a single sector that can lead to rapid price increases, as seen in tech-dominant cities.

- Affordable Housing Initiatives: Programs that support affordable housing projects, including subsidies and zoning reforms, help ensure a portion of the market remains accessible to low and middle-income families.

- Community Engagement: Involving the community in urban planning ensures that developments meet local needs without compromising affordability.

- Preservation of Historical Areas: Renovating and preserving historical homes rather than demolishing them can maintain a city’s character while keeping housing prices stable.

The contrast between cities managing to keep property prices low and those experiencing rising costs illustrates how different approaches yield varied outcomes. Cities like San Francisco and New York have seen skyrocketing property prices due to factors such as limited land availability, high demand, and concentrated wealth. These cities often struggle with regulatory hurdles that inhibit new housing development, while affordable cities prioritize growth and community needs.

“By focusing on inclusive growth and sustainable development, cities can create an environment where housing remains accessible for all.”

The ongoing analysis of cities that successfully keep property prices down serves as a blueprint for regions grappling with affordability challenges. Learning from these case studies can inform policies aimed at balancing economic growth with housing availability, ultimately striving for sustainable urban living.

Resources for Further Research

Understanding property prices and housing trends is crucial for anyone interested in the real estate market, especially when looking for affordable options. Fortunately, a plethora of resources exists to aid potential buyers and investors in their search for relevant data and insights.Numerous organizations and websites compile and analyze data on property prices and trends, offering valuable information for prospective homeowners.

Staying informed through these channels can provide insights into current market conditions and future trends.

Organizations and Websites

Several reputable organizations and websites focus on real estate data, making them essential resources for anyone researching property prices and housing trends. These platforms provide comprehensive analyses, statistics, and reports that can help buyers make informed decisions.

- National Association of Realtors (NAR): This organization provides extensive research reports, market data, and housing statistics that are invaluable for understanding national and local market trends.

- Zillow: A popular online real estate marketplace that offers data on property values, rental prices, and housing trends, making it a go-to site for prospective buyers.

- Realtor.com: Similar to Zillow, this website provides listings and market analysis, showcasing trends and price changes in various neighborhoods.

- CoreLogic: A data analytics company that provides detailed reports on property prices, foreclosures, and market forecasts, catering to both homebuyers and investors.

- Redfin: This real estate brokerage offers a user-friendly platform that displays current listings, as well as historical price trends and market insights.

- Federal Housing Finance Agency (FHFA): The FHFA provides regular reports on home price indices, giving a clear picture of price trends over time.

Books and Publications

In addition to online resources, there are several books and publications that provide deeper insights into real estate and housing affordability. These texts can serve as valuable tools for understanding market dynamics.

- “The Millionaire Real Estate Investor” by Gary Keller: This book offers insights into investing in real estate, including strategies for identifying profitable properties.

- “Real Estate Investing for Dummies” by Eric Tyson and Robert S. Griswold: A comprehensive guide that covers the basics of real estate investing, making it accessible for beginners and seasoned investors alike.

- “Affordable Housing in the Urban Global Economy” by R. Allen Hays: This publication explores the challenges and solutions regarding affordable housing in urban settings.

- “The Book on Rental Property Investing” by Brandon Turner: This resource provides strategies and advice for investors focusing on rental properties, emphasizing affordability and market research.

Community Resources for Homebuyers

Potential buyers in affordable cities can also access various community resources designed to support their journey toward homeownership. These resources can provide crucial assistance, from financial education to local housing programs.

- Local Housing Authorities: Many cities have housing authorities that offer programs for first-time homebuyers, including down payment assistance and educational workshops.

- Nonprofit Organizations: Organizations like Habitat for Humanity and local community development groups often provide resources, support, and sometimes even affordable housing options for low-to-moderate-income families.

- Financial Counseling Services: Many community organizations offer free or low-cost financial counseling to help buyers navigate the mortgage process and improve their financial literacy.

- City and State Programs: Various cities and states have programs specifically designed to promote affordable housing, including tax credits and incentives for homebuyers.

Final Thoughts

In conclusion, knowing the Top Cities Where Property Prices Are Still Affordable opens doors to potential homebuyers seeking a balance of cost and quality of life. As we’ve seen, various factors contribute to these markets’ sustainability, making them attractive destinations for future investment and habitation.

Key Questions Answered

What are the top cities with affordable property prices?

Some of the top cities include Pittsburgh, Indianapolis, Memphis, Oklahoma City, and Buffalo, all known for their low housing costs and strong community vibes.

How can I find affordable properties in these cities?

Utilizing local real estate agents, online property platforms, and community boards can help you locate affordable properties in your desired city.

Are there specific government policies that help maintain affordability?

Yes, many cities implement policies such as zoning regulations, housing subsidies, and incentives for builders to create affordable housing units.

What role does remote work play in housing affordability?

Remote work has allowed people to move away from high-cost areas, increasing demand in more affordable cities, which can help stabilize or even lower prices in those markets.

How can I ensure a long-term investment in affordable areas?

Conducting thorough market research, understanding local economic conditions, and evaluating neighborhood trends can provide insights into potential long-term value.