Travel Insurance Tips For International Trips

Travel Insurance Tips for International Trips are essential for every globetrotter aiming for a hassle-free journey. As exciting as exploring new cultures and landscapes can be, it’s crucial to prepare for the unexpected bumps along the way. From sudden illnesses to trip cancellations, having the right travel insurance can be your safety net, ensuring that you’re covered no matter where your adventures lead you.

Understanding the various types of travel insurance available, the factors to consider while choosing a policy, and common exclusions can empower you to make informed decisions. With so many options out there, this guide will help clarify your choices, ensuring you select the best coverage tailored to your travel needs.

Importance of Travel Insurance

Travel insurance is a critical element when planning international trips. It provides a safety net against unexpected events that can occur while traveling, such as medical emergencies, trip cancellations, or lost luggage. Having travel insurance not only offers peace of mind but also ensures you are protected financially in various situations that could disrupt your travel plans.Traveling without insurance can expose you to significant risks.

Medical emergencies abroad can be exceedingly expensive, and without insurance, you may find yourself facing hefty hospital bills or needing to pay for emergency evacuations out of pocket. Additionally, unforeseen events like natural disasters, flight cancellations, or lost belongings can lead to frustration and financial strain. For instance, a traveler who experiences a sudden illness abroad may need to seek treatment immediately.

Without insurance, they would be responsible for all costs, which can amount to thousands of dollars depending on the nature of the treatment.

Situations Where Travel Insurance is Beneficial

Understanding the specific scenarios where travel insurance proves beneficial can highlight its importance even further. Here are some common situations:

- Medical Emergencies: If you fall ill or sustain an injury while traveling, insurance can cover medical expenses, ensuring you receive necessary care without financial worry.

- Trip Cancellation: If you need to cancel your trip due to unforeseen circumstances, such as illness or a family emergency, insurance can reimburse your non-refundable expenses.

- Lost or Stolen Belongings: In case your luggage is lost or stolen, travel insurance can help recover the costs associated with lost items or provide compensation for necessary purchases.

- Travel Delays: If your flight is delayed or canceled, insurance can cover accommodation or meal costs, mitigating the inconvenience.

- Emergency Evacuation: In cases of natural disasters or political unrest, insurance can cover the costs of emergency evacuation to safety.

“Travel insurance is not just an added expense; it is a crucial investment in your peace of mind while exploring the world.”

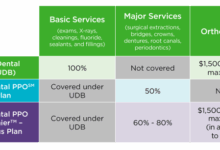

Types of Travel Insurance

Source: slideserve.com

When planning an international trip, understanding the different types of travel insurance available is essential for ensuring a worry-free experience. Various policies cater to specific needs, making it important to select the right one to cover potential risks during your travels. Below, we will delve into the main types of travel insurance and the nuances that set them apart.

Comprehensive Travel Insurance

Comprehensive travel insurance is a robust policy that combines multiple coverage types into one plan, offering extensive protection for international travelers. This type generally includes medical coverage, trip cancellation, baggage loss, and travel interruption. It’s ideal for travelers seeking all-around protection.

Medical Travel Insurance

Medical travel insurance focuses primarily on covering health-related issues that may arise while abroad. This type of policy typically pays for emergency medical expenses, hospitalization, and sometimes evacuation. It’s crucial for destinations where medical facilities may not meet travelers’ standards or where healthcare costs are significantly high.

Travel Cancellation Insurance

Travel cancellation insurance provides coverage for non-refundable expenses if a trip needs to be canceled for covered reasons, such as illness, job loss, or a family emergency. It is essential for travelers who have pre-paid for flights and accommodations, as it ensures that they won’t incur financial losses should unforeseen circumstances arise.

Adventure Sports Coverage

Adventure sports coverage is tailored for travelers engaging in high-risk activities such as skiing, scuba diving, or mountain climbing. Standard travel insurance policies may exclude such activities, making this additional coverage necessary for adventure enthusiasts who want to be protected from potential injuries or accidents.The differences in coverage options between adventure sports and standard insurance are critical. While standard policies may offer basic medical coverage, adventure sports packages often include specific medical evacuations and coverage for equipment loss or damage.

This specialized protection can make a significant difference in the event of an incident during a high-stakes activity.

“Adventure sports coverage can be the difference between a thrilling experience and a financial nightmare if something goes wrong.”

Factors to Consider When Choosing Travel Insurance

When planning an international trip, securing the appropriate travel insurance is an essential step. The variety of options available can be overwhelming, and understanding the key factors influencing your selection is crucial for ensuring that you have the right coverage tailored to your needs. This guide highlights the most important elements to consider when choosing travel insurance.

Destination-Specific Coverage

Selecting a policy that provides coverage specific to your travel destination can significantly impact your travel experience. Different regions have varying risks associated with travel, including health care quality, local regulations, and emergency services. For instance, traveling to countries with high medical costs or limited access to quality healthcare necessitates comprehensive medical coverage. In contrast, areas prone to natural disasters may require additional provisions for trip cancellation or interruption due to unforeseen events.

- Health Care Facilities: In some destinations, healthcare may be inadequate, making it vital to have coverage that includes emergency medical evacuation.

- Local Regulations: Certain countries have specific insurance requirements for travelers, which must be addressed in your policy.

- Adventure Activities: If your itinerary includes activities like skiing, scuba diving, or other high-risk sports, ensure your policy covers these specific risks.

Policy Limits and Deductibles

Understanding the policy limits and deductibles is fundamental when selecting travel insurance. Policy limits refer to the maximum amount an insurer will pay for covered expenses, while deductibles are the amounts you must pay out-of-pocket before the insurance kicks in.High policy limits are essential, especially for medical expenses, as healthcare costs can skyrocket in some parts of the world. However, it’s just as important to consider the deductible amounts that could affect your financial liability during a claim.

- Medical Expenses: Policies with higher limits on medical expenses are recommended, as a single hospital stay abroad can quickly exceed average limits.

- Trip Cancellation Coverage: Ensure that the policy covers the entire cost of your trip, including accommodations and activities.

- Affordable Deductibles: Evaluate your comfort level with deductibles; a lower deductible can be beneficial if you anticipate needing to use your insurance.

“Choosing the right travel insurance is not just about the cost; it’s about ensuring peace of mind while you explore the world.”

Common Exclusions in Travel Insurance Policies

Travel insurance is a vital safety net for travelers, but it’s essential to understand that not all situations are covered. Familiarizing yourself with common exclusions helps you avoid nasty surprises when you need your insurance the most. This section Artikels common exclusions found in travel insurance policies, particularly around pre-existing conditions and specific scenarios that often aren’t covered.

Common Exclusions in Coverage

While travel insurance is designed to provide peace of mind, many policies come with exclusions that can limit their effectiveness. Here are some of the most frequently excluded circumstances:

- Pre-existing Medical Conditions: Most travel insurance policies do not cover medical issues that existed before purchasing the insurance. This exclusion can significantly affect travelers with chronic illnesses.

- High-Risk Activities: Engaging in activities such as skydiving, scuba diving, or extreme sports may not be covered unless you purchase additional coverage specifically for these risks.

- Traveling Against Medical Advice: If you travel when advised against it by a medical professional, your policy may not cover any related medical expenses.

- Non-Emergency Medical Treatments: Routine check-ups or procedures that are not considered emergencies are typically excluded from coverage.

- Acts of War and Terrorism: While some policies may offer limited coverage, many do not cover losses due to war or acts of terrorism.

“Understanding exclusions is as crucial as knowing what is covered.”

Impact of Pre-existing Medical Conditions on Coverage

Pre-existing medical conditions can significantly impact your travel insurance coverage. Insurers often consider a condition pre-existing if you have received medical advice, treatment, or diagnosis in the months leading up to your travel. It’s crucial to disclose any relevant medical history when purchasing insurance, as failure to do so may result in denied claims.For example, if a traveler with a history of heart issues has a medical emergency while abroad, their claim may be denied if the condition was not disclosed.

Some policies offer “waiver of exclusion” options, which may allow for some coverage if certain conditions are met, but this often requires additional premium payments.

Examples of Scenarios Typically Not Covered

Understanding the specific scenarios that typically fall outside the realm of travel insurance coverage can help you prepare better. Below are examples of common situations that may not be covered:

- Trip Cancellation for Non-Insured Reasons: If you cancel your trip for reasons not covered by your policy, such as a change of mind or scheduling issues, you will likely not be reimbursed.

- Accidents Caused by Intoxication: If you are involved in an accident while under the influence of alcohol or drugs, your claims might be denied.

- Illnesses Related to Epidemics: Policies may exclude coverage for illnesses that arise from known epidemics or pandemics unless specifically included in the terms.

- Travel to High-Risk Countries: If you travel to a country that the government has warned against visiting, your policy may not provide coverage for any incidents that occur during your stay.

How to File a Claim

Source: goatsontheroad.com

Filing a travel insurance claim can seem daunting, but understanding the process can make it much smoother. Knowing the correct steps and having the necessary documentation ready is essential for a successful claim. Below are the key steps to ensure that your claim is processed effectively.

Steps to File a Claim

To file a claim, follow these steps to ensure you cover all necessary actions:

1. Notify Your Insurance Provider

As soon as you encounter a situation that requires a claim, contact your insurance provider. Most companies have a dedicated claims department that can guide you through the process.

2. Gather Documentation

Collect all relevant documents that support your claim. This includes receipts, medical reports, police reports (if applicable), and any correspondence with service providers.

3. Fill Out the Claim Form

Obtain the claim form from your insurance provider’s website or customer service. Fill it out thoroughly and accurately, providing all requested details.

4. Submit Your Claim

Send the completed claim form along with all gathered documentation to your insurance provider. This can often be done electronically through email or an online portal.

5. Follow Up

After submission, follow up with your insurance provider to confirm receipt of your claim and inquire about the expected timeline for processing.

Checklist of Necessary Documents

Having a comprehensive checklist can help ensure you don’t miss any critical documents while filing your claim. Below is a list of essential items to prepare:

Claim Form

Make sure it is completed and signed.

Proof of Travel

Include copies of your flight itinerary, boarding passes, or hotel bookings.

Receipts

Gather all relevant receipts, including accommodation, medical expenses, and any other costs incurred due to the claim.

Medical Reports

If applicable, include any medical documentation that supports your claim.

Police Report

For incidents like theft or accidents, a police report may be necessary.

Correspondence

Keep copies of any communication with service providers related to your claim.

Tips to Expedite the Claims Process

To speed up the claims process, consider the following tips. These strategies can help you avoid unnecessary delays and achieve faster resolutions:

Be Prompt

File your claim as soon as possible after the incident to avoid delays.

Double-Check Documentation

Ensure all documents are complete and accurate before submission. Incomplete claims can cause significant delays.

Utilize Online Tools

Many insurance providers offer online claim submission and tracking. Take advantage of these tools for quicker processing.

Communicate Clearly

Provide clear, concise information in your claim form, and maintain open communication with your provider throughout the process.

Keep Records

Document all interactions with your insurance provider, including dates, representatives’ names, and details discussed. This can prove invaluable in case of any disputes.

Being organized and proactive can significantly impact the speed and success of your travel insurance claim.

Comparing Travel Insurance Providers

Source: explosion.com

When planning an international trip, selecting the right travel insurance provider is crucial. With numerous options available, comparing different providers can help travelers find the best plan that suits their specific needs, ensuring peace of mind during their journey. Each provider offers unique features, coverage options, and customer service experiences that can significantly impact your travel experience.

Comparison of Popular Travel Insurance Providers

A well-structured comparison table can help travelers evaluate and choose the right travel insurance provider. Below is a table summarizing the offerings of some well-known travel insurance companies:

| Provider | Coverage Type | Maximum Coverage Amount | Deductibles | Customer Rating |

|---|---|---|---|---|

| Allianz Global Assistance | Comprehensive | $1,000,000 | $0 – $500 | 4.5/5 |

| Travel Guard | Basic & Comprehensive | $2,000,000 | $100 – $300 | 4/5 |

| World Nomads | Adventure Coverage | $100,000 | $0 | 4.3/5 |

| AXA Assistance USA | Comprehensive | $1,000,000 | $0 – $250 | 4.6/5 |

| InsureMyTrip | Comparative Platform | Varies by provider | Varies by provider | 4.2/5 |

Evaluating travel insurance providers involves more than just examining coverage amounts and deductibles. Key factors to consider include:

- Reputation: Look for providers with a strong reputation in the industry, as this can reflect their reliability and customer service quality.

- Claims Process: Assess how straightforward the claims process is. A provider with a user-friendly claims system can save time and stress during emergencies.

- Customer Service: Consider the availability of customer support, as having access to assistance at any time can be invaluable while traveling.

- Policy Flexibility: Determine if the policy allows modifications or extensions to suit changing travel plans.

- Exclusions: Review policy exclusions carefully to understand what is not covered, helping to prevent surprises during claims.

Impact of Customer Reviews

Customer reviews play a significant role in influencing the choice of travel insurance providers. They offer insight into real-life experiences with coverage claims, customer service interactions, and overall satisfaction. Positive reviews can highlight aspects such as responsive service, seamless claims processing, and comprehensive coverage, while negative reviews often call attention to issues like delayed claims or poor customer support.

“The most reliable way to evaluate a travel insurance provider is through the shared experiences of fellow travelers.”

When considering customer feedback, look for patterns in reviews, such as consistent praise for specific providers or frequent complaints about others. This information helps to create a well-rounded view of potential choices, enabling travelers to make informed decisions that enhance their travel experience.

Tips for Saving on Travel Insurance

Finding affordable travel insurance doesn’t have to be a daunting task. With a few smart strategies, you can secure comprehensive coverage that won’t break the bank. As travel costs can add up quickly, prioritizing affordable insurance options is essential. Here are some effective tips to help you save on travel insurance while ensuring you have the necessary protection for your international trips.

Strategies for Finding Affordable Coverage

When searching for travel insurance, consider the following tips to ensure you’re getting the best deal without skimping on coverage:

- Shop Around: Compare quotes from multiple providers to find competitive rates. Websites and comparison tools can help you easily view and evaluate different policies side by side.

- Adjust Your Coverage: Tailor your policy based on your specific needs. For instance, if you’re traveling for leisure and not engaging in high-risk activities, you can opt for a basic plan rather than comprehensive coverage.

- Look for Discounts: Some insurers offer discounts for groups, families, or if you purchase insurance for multiple trips. Always ask about any available discounts that might apply to you.

Benefits of Early Purchasing

Buying travel insurance early can be significantly beneficial compared to waiting until the last minute. Here’s why:

- Lower Premiums: Purchasing early often results in lower premiums. Insurers may charge higher rates as your travel date approaches, especially if you’re booking last-minute trips.

- Better Coverage Options: Early shoppers typically have access to a wider selection of plans and can choose policies that best meet their needs without being pressured by time constraints.

- Peace of Mind: Securing insurance early provides peace of mind, knowing you’re covered for unforeseen circumstances that may arise before your trip.

Bundling Travel Insurance with Other Services

Bundling your travel insurance with other travel services can lead to significant savings. Consider the following advantages of this approach:

- Combined Discounts: Many travel agencies and airlines offer package deals that combine flights, accommodations, and insurance at a discounted rate.

- Streamlined Processes: Bundling simplifies booking and management, allowing you to handle all aspects of your trip through a single provider.

- Potential for Added Benefits: Some bundled packages may include additional benefits such as trip cancellation coverage or enhanced medical benefits, providing greater overall value.

“The key to saving on travel insurance lies in proactive planning and informed decision-making.”

Frequently Overlooked Tips for Travelers

Traveling internationally can be exhilarating, but ensuring that you are adequately protected through your travel insurance is crucial. While many travelers understand the basics of what insurance covers, there are often overlooked tips that can significantly enhance your coverage and peace of mind during your trip. Let’s highlight some of these essential yet frequently ignored strategies to maximize your travel insurance experience.

Overlooked Tips to Enhance Travel Protection

Many travelers miss vital details that could improve their insurance protection. Recognizing these can save you from unwanted surprises when you’re abroad. Here are some tips worth considering:

- Understand the Policy’s Fine Print: Before purchasing, thoroughly read the fine print of your insurance policy. Many exclusions and limitations are often hidden in this information, which can affect your coverage during a claim.

- Emergency Contact Information: Always keep a list of emergency contacts accessible during your travels. This should include your insurance provider’s contact details, local emergency services, and family or friends back home.

- Check Coverage Limits: Ensure that you are aware of the limits on medical coverage, especially if you are traveling to a country where healthcare costs are high. Adjust your policy if necessary to avoid being underinsured.

- Declare Pre-existing Conditions: If you have any pre-existing medical conditions, be upfront about them when purchasing your insurance. Failing to declare can lead to claims being rejected.

- Consider Adventure Activities Coverage: If your travel plans include adventure sports or activities like skiing or scuba diving, confirm whether your policy includes coverage for these activities; if not, consider adding a rider.

- Keep Documentation Safe: Maintain copies of your insurance policy and any related documents in a secure yet accessible location, such as a password-protected cloud service or physical copies in a safe spot in your luggage.

- Review COVID-19 Coverage: In the current travel climate, ensure your policy addresses COVID-19-related cancellations or medical emergencies, as these are not always included in standard plans.

“Being informed is your best strategy for safe and worry-free travel.”

Ultimate Conclusion

In conclusion, Travel Insurance Tips for International Trips highlight the importance of safeguarding your travel plans against unforeseen events. By being proactive in choosing the right insurance, understanding what is covered, and knowing how to file a claim, you can travel with peace of mind. As you embark on your next adventure, remember that a little preparation can go a long way in making your trip enjoyable and secure.

Expert Answers

Do I really need travel insurance?

Yes, travel insurance protects you from unexpected events like medical emergencies, trip cancellations, or lost belongings.

How much does travel insurance typically cost?

The cost varies based on factors like your age, destination, and the level of coverage, generally ranging from 4% to 10% of your trip cost.

Can I purchase travel insurance after my trip has started?

Most companies allow you to purchase travel insurance after your trip has begun, but coverage may be limited to unforeseen events that occur after the policy purchase.

What should I do if I need to file a claim?

Gather all necessary documentation, such as receipts and reports, and follow your insurance provider’s specific claim procedures.

Are adventure sports covered under travel insurance?

It depends on the policy; many standard plans don’t cover adventure sports, so you may need specialized insurance for those activities.