Understanding Deductibles In Health Insurance

Understanding Deductibles in Health Insurance is essential for anyone navigating the complexities of healthcare costs. Deductibles represent a significant aspect of health insurance plans, influencing both out-of-pocket expenses and medical decision-making. Gaining a solid grasp of what deductibles entail and how they function can empower individuals to make informed choices about their health coverage.

From differentiating between individual and family deductibles to exploring various types such as annual versus per-incident, it’s crucial to understand how these factors can impact your overall healthcare experience. By demystifying these concepts, we aim to equip you with the knowledge necessary to navigate your health plan effectively.

Introduction to Deductibles in Health Insurance

A deductible is a specific amount of money that an individual must pay out-of-pocket for healthcare services before their health insurance begins to cover the costs. Understanding deductibles is crucial when selecting a health plan because it directly impacts how much you will pay for medical expenses in a given year. Different plans may have varying deductible amounts, which can significantly influence your overall healthcare costs.Deductibles play a vital role in the cost-sharing structure of health insurance.

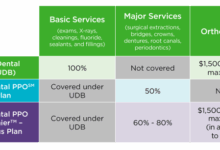

While similar to copayments and coinsurance, which are also cost-sharing features, deductibles are distinct in that they represent an initial threshold. Once the deductible is met, the insurance plan typically kicks in, covering a larger percentage of subsequent medical expenses. This understanding helps individuals evaluate their financial responsibility and make informed decisions when comparing different health insurance plans.

Differences Between Deductibles and Other Cost-Sharing Features

When reviewing health insurance plans, it’s essential to recognize how deductibles differ from copayments and coinsurance. Each of these components contributes to your overall spending on healthcare, but they operate in different ways:

- Deductibles: The total amount you must pay before insurance coverage starts. For example, if your deductible is $1,500, you’ll need to pay this amount out-of-pocket before your insurer begins to share costs for covered services.

- Copayments: A fixed fee you pay for specific services or medications at the time of care. For instance, a doctor’s visit might require a $25 copayment, regardless of whether you have met your deductible.

- Coinsurance: The percentage of the cost of a covered healthcare service you pay after meeting your deductible. If your plan includes a 20% coinsurance, after you’ve reached your $1,500 deductible, you would pay 20% of the subsequent costs for covered services.

Understanding these distinctions helps you evaluate your potential out-of-pocket expenses and choose a plan that aligns with your healthcare needs and budget. All three features—deductibles, copayments, and coinsurance—work together to determine how much you will ultimately pay for your healthcare services throughout the year.

“Deductibles, copayments, and coinsurance are integral components of health insurance, each influencing your financial responsibility differently.”

Types of Deductibles

Understanding the different types of deductibles is essential for navigating health insurance plans effectively. Deductibles can significantly impact your out-of-pocket expenses and how you manage your healthcare costs throughout the year. Let’s delve into the various kinds of deductibles and their unique characteristics.

Individual and Family Deductibles

Health insurance plans typically have either individual or family deductibles. An individual deductible applies to each member of the insurance plan, meaning that each person must meet their specified deductible amount before the insurance starts covering costs. Conversely, a family deductible aggregates the costs for all family members under the plan. Once the total of eligible expenses for the family reaches the family deductible amount, the insurance begins to pay for all family members, regardless of individual deductibles.A vital distinction between these two types of deductibles is that family plans often feature an individual deductible that is part of the family deductible.

For instance, in a family plan with an individual deductible of $2,000 and a family deductible of $4,000, if one family member reaches their individual deductible, the insurer will start covering that member’s costs, while other members will still need to meet their individual deductibles until the family deductible is reached.

Annual vs. Per-Incident Deductibles

Deductibles can also be categorized based on how they apply to claims, specifically annual and per-incident deductibles. An annual deductible is the amount you must pay each year before your health insurance begins to cover your medical expenses. This means that once you meet your annual deductible, your insurer will cover a portion of your costs according to the terms of your plan, usually until reaching an out-of-pocket maximum.In contrast, per-incident deductibles apply to specific medical incidents or treatments.

For example, if you have a per-incident deductible of $1,500 for surgery, you would need to pay that amount for each separate surgical procedure before your insurance kicks in, regardless of how many surgeries you have in a year. This type can lead to higher out-of-pocket costs if multiple incidents arise.

Deductibles in Health Insurance Plans

Different health insurance plans, such as high-deductible health plans (HDHPs) and traditional plans, have distinct deductible structures that can affect your overall healthcare costs. High-deductible health plans are designed to offer lower premiums paired with higher deductibles. These plans typically require individuals to meet a higher deductible (often above $1,400 for individual coverage in 2023) before any benefits kick in, which can make them attractive for those who don’t anticipate extensive medical care.

The upside of HDHPs is that they can be paired with Health Savings Accounts (HSAs), allowing individuals to save tax-free money for medical expenses.On the other hand, traditional plans often have lower deductibles and higher premiums. This structure enables more predictable healthcare costs, as the insurance starts covering expenses after a lower deductible is met. Traditional plans might also provide services like preventive care without requiring you to meet the deductible first, making them potentially more suitable for individuals who expect frequent medical visits.Overall, understanding these variations in deductibles is crucial for making informed decisions about health insurance, as they directly influence your financial responsibilities and healthcare accessibility.

How Deductibles Work

Source: thepennyhoarder.com

Understanding how deductibles work in health insurance is essential for navigating your medical costs effectively. A deductible is the amount you pay out-of-pocket for healthcare services before your insurance begins to cover the costs. Knowing this helps you anticipate expenses and manage your budget, especially during unexpected health situations.The process of how deductibles apply to medical expenses is straightforward. When you receive medical care, the first portion of the bill—up to your deductible amount—is your responsibility.

After you meet your deductible, your insurance typically covers a significant portion of the remaining costs, although you may still need to pay copayments or coinsurance. For instance, if your deductible is $1,000 and you have a medical procedure costing $2,500, you will pay the first $1,000. After that, your insurance will cover the remaining $1,500, minus any additional out-of-pocket costs you might incur.

Examples of Medical Services Requiring Deductible Payments

Many common medical services require you to pay your deductible first. Understanding which services fall under this category can help you plan your healthcare expenses. Here are some examples:

- Emergency Room Visits: Typically, any visit to the emergency room will require you to meet your deductible before insurance kicks in.

- Hospital Stays: If you require hospitalization for surgery or treatment, the costs associated with your stay may be subject to your deductible.

- Major Diagnostic Tests: Procedures like MRIs, CT scans, or other significant tests usually involve deductible payments before insurance starts covering costs.

- Specialist Visits: If you consult a specialist, especially for non-preventive services, you’ll likely need to pay your deductible first.

- Prescription Medications: Some plans may apply deductibles to specific medications, especially those that are not considered preventive.

Annual Reset of Deductibles and Its Implications

Deductibles typically reset annually, which can affect your financial planning for healthcare. At the beginning of each year, the amount you’ve paid toward your deductible resets to zero. This means that if you incurred significant medical expenses in the previous year, you must budget for those expenses again.The implications of this annual reset are crucial for policyholders. For instance, if you have a deductible of $2,000 and you’ve met it by September of one year, you will need to start over at the beginning of the next year.

This can lead to higher out-of-pocket expenses early in the year, especially if unexpected health issues arise.

Understanding the structure and timing of deductibles can help you optimize your healthcare spending and avoid unexpected financial burdens.

Strategies for Managing Deductibles

Navigating through health insurance deductibles can be a bit daunting, but with the right strategies, you can manage your out-of-pocket expenses effectively. It’s essential to plan and budget throughout the year, ensuring that unexpected medical costs don’t throw you off balance. Here, we’ll explore key strategies that help in managing deductibles while also maximizing your savings.

Budgeting for Deductible Payments

Creating a budget for your deductible payments is crucial for financial stability. By anticipating your healthcare needs, you can set aside the necessary funds throughout the year. Start by evaluating your past medical expenses to predict future costs. Consider the following steps for effective budgeting:

1. Estimate Annual Healthcare Costs

Look at your previous year’s medical bills to estimate how much you might spend this year, including routine visits and unexpected emergencies.

2. Divide by Months

Take your estimated annual costs and divide them by twelve to set aside a manageable monthly amount.

3. Use a Separate Savings Account

Consider opening a dedicated savings account for your healthcare expenses to avoid mixing these funds with your everyday spending.

4. Adjust as Necessary

Periodically review your budget and adjust your savings based on any changes in your health needs or insurance plan.

Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) can play a significant role in managing your healthcare costs, especially when it comes to meeting your deductible. HSAs offer a tax-advantaged way to save for medical expenses. Here are the advantages of using an HSA:

Tax Benefits

Contributions to an HSA are tax-deductible, reducing your taxable income. Additionally, any interest or investment earnings grow tax-free and withdrawals for qualified medical expenses are also tax-free.

Rollover Feature

Unlike Flexible Spending Accounts (FSAs), funds in an HSA roll over year after year, allowing you to save for future healthcare costs without the pressure of losing unspent funds.

Investment Options

Once your HSA balance reaches a certain threshold, you can invest the funds in various options, potentially growing your savings over time.Understanding the benefits of HSAs can empower you to use them strategically, ensuring that you have the necessary funds available for deductible payments and other out-of-pocket expenses.

Preventive Services that Do Not Require a Deductible Payment

Many preventive services are designed to catch health issues early and are often covered by insurance without requiring you to pay a deductible. These services can help you maintain your health and avoid more significant medical costs down the road. Here’s a list of common preventive services typically covered:

Annual Physical Exams

Regular check-ups can help monitor your overall health and identify any early signs of disease.

Vaccinations

Immunizations, including flu shots and vaccines for children, are usually covered without a deductible.

Screenings for Chronic Conditions

Services such as cholesterol checks, blood pressure screenings, and diabetes screenings are often available at no cost.

Cancer Screenings

Routine screenings like mammograms and colonoscopies are covered for early detection of cancer.Understanding these preventive services is essential as they not only help in maintaining your health but also reduce the potential for higher costs associated with untreated conditions.

Impact of Deductibles on Healthcare Choices

Source: medicalnewshome.com

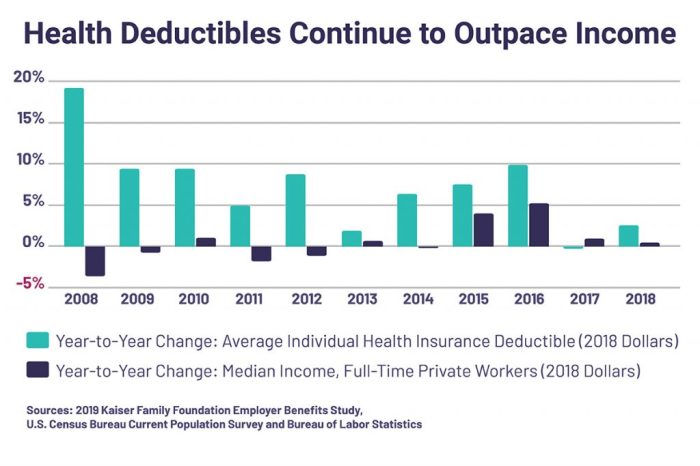

High deductibles have a significant impact on healthcare decisions for consumers. With rising healthcare costs, patients often face tough choices about whether to seek medical care, which can lead to delayed treatment or avoidance of necessary services altogether. Understanding how deductibles work is essential for making informed healthcare decisions, as they play a vital role in determining out-of-pocket costs.Patients enrolled in high deductible health plans (HDHPs) may find themselves grappling with the financial implications of seeking care.

The prospect of having to pay a large sum before insurance kicks in can discourage individuals from pursuing necessary treatments or check-ups. As a result, some may prioritize minor health issues over preventive care, which can lead to long-term health complications and higher costs down the line.

Comparison of High Deductible Plans versus Lower Deductible Plans

When weighing the options between high deductible plans and lower deductible plans, it is crucial to consider both the benefits and challenges each type presents. Here’s a look at how these plans stack up against each other:High Deductible Plans:

Lower Premiums

Monthly premiums are generally lower, making them more affordable in the short term.

Health Savings Accounts (HSAs)

Often paired with HSAs, allowing tax-free savings for medical expenses.

Potential for Cost Savings

If healthy and not needing frequent medical care, patients can save money compared to lower deductible plans.Lower Deductible Plans:

Higher Premiums

Monthly premiums are typically higher, impacting short-term budgets.

Lower Out-of-Pocket Costs

Patients may face less financial strain when accessing healthcare services due to lower deductibles.

Better Access to Preventive Care

Encourages regular check-ups and timely medical interventions, which can lead to better health outcomes.Understanding the pros and cons of each plan type can empower consumers to select a health insurance strategy that aligns with their healthcare needs and financial situation. By analyzing personal health requirements and potential future medical expenses, individuals can make more informed choices that better suit their circumstances.

“A comprehensive understanding of deductibles enables patients to navigate their healthcare choices wisely, balancing cost with care needs.”

Special Considerations

The landscape of health insurance is complex, particularly when it comes to deductibles, which can significantly impact various demographic groups. Understanding these nuances is essential in addressing the broader implications of high deductibles on access to healthcare and financial stability.Certain groups are disproportionately affected by high deductibles in health insurance. Low-income families often face the most significant challenges, as they may already be struggling with limited financial resources.

The burden of high deductibles can exacerbate their situation, making necessary healthcare services less accessible. Additionally, chronically ill individuals or those with ongoing health conditions may find themselves particularly disadvantaged, as their medical expenses can quickly accumulate, leading to financial distress.

Regulations Impacting Deductibles

State and federal regulations play a crucial role in shaping the deductibles that consumers encounter in their health plans. These regulations aim to ensure fairness and transparency in health insurance.

- Under the Affordable Care Act (ACA), there are specific limits on annual out-of-pocket expenses, which include deductibles. For 2023, the out-of-pocket maximum for individual coverage is capped at $8,700 and $17,400 for family coverage.

- Some states have enacted additional protections, such as requiring insurers to offer plans with lower deductibles or mandating that certain essential health benefits are covered before the deductible is met.

- Regulatory bodies, like the Centers for Medicare & Medicaid Services (CMS), oversee compliance with these rules, ensuring that health plans offer adequate protections for consumers.

Surprise Billing and Its Connection to Deductibles

Surprise billing occurs when consumers receive unexpected charges for out-of-network services, often leading to significant financial strain. Deductibles can complicate this scenario, as individuals may not realize that a service is considered out-of-network until they receive the bill.The interplay between deductibles and surprise billing can lead to unexpected costs for patients, particularly when they receive treatment at an in-network facility but are treated by an out-of-network provider.

For instance, if a patient undergoes surgery at an in-network hospital but is assisted by an out-of-network anesthesiologist, they may face higher out-of-pocket costs that exacerbate their deductible obligations.

Understanding the implications of surprise billing is critical, particularly in contexts where high deductibles are involved. Consumers should be aware of their rights and the resources available to mitigate these unexpected expenses.

Conclusion and Future Trends

The landscape of health insurance deductibles is continuously evolving, influenced by an array of factors including policy changes, technological advancements, and shifts in consumer behavior. As patients and providers adapt, understanding these dynamics becomes essential for managing healthcare costs effectively. Emerging trends suggest that deductibles are not only becoming more prevalent but also more complex, with various plan structures tailored to different consumer needs.

One notable evolution is the rise of high-deductible health plans (HDHPs), which often come with lower premiums but shift more costs to patients. This trend is reshaping how individuals approach their healthcare choices, as they must weigh the immediate financial burden against long-term health outcomes.

Impact of Technology on Deductibles

Technology plays a crucial role in reshaping how patients understand and manage their deductibles. With the availability of numerous digital tools, patients now have unprecedented access to information regarding their healthcare expenses. Apps and online platforms allow users to track their medical spending in real-time, providing clarity on how much has been applied to their deductibles. These advancements facilitate proactive healthcare management.

For instance, telehealth services, which have surged in popularity, often come with lower out-of-pocket costs, enabling patients to receive care without significant impacts on their deductibles. Furthermore, personalized health management platforms use data analytics to alert patients about their deductible status and potential costs for upcoming treatments, empowering them with more informed decision-making.

Potential Policy Changes Affecting Deductibles

The regulatory environment surrounding health insurance is constantly shifting, with potential policy changes on the horizon that could significantly impact deductibles. Legislative efforts aimed at increasing transparency in healthcare pricing are gaining traction, which could lead to more informed consumers who are better equipped to manage their healthcare expenses.One example includes proposals to limit the amount individuals pay toward their deductible, making healthcare more accessible.

Additionally, there are discussions around implementing value-based care models that could align reimbursement rates with patient outcomes rather than service volume, potentially leading to lower deductibles in the long run. These changes emphasize a growing focus on affordability and patient satisfaction, reflecting the evolving nature of the healthcare system. In summary, as the healthcare landscape continues to transform, the management of deductibles will also evolve, influenced by factors like technology and policy reforms.

Staying informed about these trends is vital for individuals navigating their health insurance options.

Last Word

Source: alliancehealth.com

In summary, comprehending deductibles is a vital step in managing your health insurance effectively. As the healthcare landscape continues to evolve, staying informed about how deductibles work can lead to smarter healthcare decisions and potential cost savings. Embracing this knowledge ensures you’re better prepared to face the challenges of medical expenses in a changing environment.

Question & Answer Hub

What happens if I don’t meet my deductible?

If you don’t meet your deductible, you will be responsible for the full cost of your medical expenses until you reach that threshold.

Can my deductible change each year?

Yes, deductibles can change annually based on your health plan or any policy adjustments made by your insurer.

Are there any services that don’t require meeting the deductible?

Yes, many preventive services like vaccinations and screenings may not require you to meet your deductible before coverage kicks in.

Do all health insurance plans have deductibles?

No, not all health plans have deductibles; some plans, particularly those with a low premium, may have no deductible but may have higher copays or coinsurance.

How is my deductible applied to prescription medications?

Typically, your deductible will apply to prescription medications unless you have a specific copay for certain tiers of drugs.