What Is Term Life Insurance And How Does It Work?

What Is Term Life Insurance and How Does It Work? This question lays the foundation for understanding one of the most popular forms of life insurance. Term life insurance offers financial protection for a specified period, making it an essential tool in personal financial planning. Whether it’s securing your family’s future or ensuring debts are covered, this insurance serves various practical needs.

As we delve deeper, you’ll discover how term life insurance stands apart from its permanent counterparts, the mechanics behind premium payments, and the critical role it plays in providing peace of mind during life’s uncertainties.

Definition of Term Life Insurance

Term life insurance is a type of life insurance policy that provides coverage for a specific period, or “term,” typically ranging from one to thirty years. The primary purpose of term life insurance is to offer financial protection to beneficiaries in the event of the policyholder’s untimely death during the specified term. This form of insurance is particularly appealing due to its affordability compared to permanent life insurance options, making it a practical choice for those seeking to safeguard their loved ones financially.Term life insurance is beneficial in various situations.

For instance, young families often choose this type of insurance to ensure that their dependents can maintain their standard of living in case of unexpected loss. Similarly, individuals with significant debts, such as mortgages or student loans, may opt for term life insurance to ensure that these obligations do not burden their family members upon their passing. By covering these financial responsibilities, term life insurance serves as a safety net, providing peace of mind to the insured while also securing the financial future of their loved ones.

Differences Between Term Life Insurance and Other Types of Life Insurance

Understanding the distinctions between term life insurance and other types of life insurance is crucial for making informed financial decisions. The two main categories of life insurance include term life and permanent life insurance, the latter encompassing whole life and universal life insurance policies.One key difference lies in the duration of coverage. While term life insurance is temporary and expires at the end of the term, permanent life insurance offers lifelong coverage as long as premiums are paid.

This permanence often comes with a higher cost due to its cash value component, which can grow over time.Another significant distinction is the cash value accumulation. Permanent life insurance policies typically include a savings or investment component that builds cash value, providing policyholders with additional financial resources. In contrast, term life insurance does not accumulate any cash value; it purely provides a death benefit.Here are some additional differences that highlight the characteristics of each type of insurance:

- Cost: Term life insurance is generally more affordable than permanent life insurance due to its temporary nature.

- Flexibility: Term life insurance allows for adjustable coverage terms, while permanent insurance typically requires a commitment from the outset.

- Purpose: Term life insurance is primarily intended for temporary needs, such as income replacement, while permanent life insurance can serve as an investment and estate planning tool.

- Renewability: Most term policies can be renewed after the term ends, but premiums may increase based on the insured’s age and health status.

“Term life insurance is a practical and economical way to secure the financial future of your loved ones for a specified period.”

How Term Life Insurance Works

Term life insurance operates on a straightforward principle: you pay a premium for a specified period, and in return, your beneficiaries receive a death benefit if you pass away during that term. This type of policy is designed to provide financial security for a certain duration, commonly ranging from 10 to 30 years. Understanding the mechanics behind term life insurance is crucial for anyone considering this important financial tool.Premium payments are typically fixed and are based on factors such as your age, health, and the length of the term you choose.

For example, a healthier 30-year-old may pay significantly less than a 50-year-old with pre-existing health conditions. The amount you pay contributes to maintaining your coverage for the entire term, ensuring that if something unexpected occurs, your loved ones are financially protected.

Application Process and Underwriting

The process of applying for term life insurance involves several steps, beginning with filling out an application that requires personal information and health history. This information is crucial as it helps insurers assess risk and determine your premium. Once the application is submitted, the underwriting process begins. This typically involves:

- Medical Evaluation: Depending on the amount of coverage you want, you may need to undergo a medical exam, which could include blood tests and a physical check-up. Some policies also allow for no-exam options, but premiums may be higher.

- Review of Medical Records: Insurers often review your medical history to evaluate any potential risks related to your health.

- Risk Assessment: Based on the information gathered, the insurer will categorize you into a risk class, which directly affects your premium rate.

The underwriting process can take anywhere from a few days to several weeks, depending on the complexity of your application.

End of Term Options

As the end of your term life policy approaches, you have several choices that can help you make informed decisions about your future coverage needs. At this stage, policyholders typically face the following options:

- Renewal: Most term life policies offer a renewal option, allowing you to continue coverage for another term. However, the premium will likely increase based on your current age and health status.

- Conversion to Permanent Insurance: Many policies allow for conversion to a permanent life insurance policy, which does not expire and can build cash value. This can provide long-term security and flexibility.

- Letting the Policy Expire: If you no longer feel the need for coverage, you can choose to let the policy expire. It’s important to consider your current financial situation and future needs before making this decision.

Understanding these options is vital, as it allows you to align your life insurance strategy with your changing financial circumstances and family needs. It’s advisable to review these choices well before the term ends to ensure that you maintain the level of protection necessary for your loved ones.

Benefits of Term Life Insurance

Source: excaliburbrokerage.com

Term life insurance offers a variety of advantages that make it a popular choice for many individuals and families. Unlike permanent life insurance, which can be more costly and complex, term life insurance provides straightforward coverage for a set period, making it an excellent option for those looking to ensure financial security without breaking the bank. Here are some of the key benefits of choosing term life insurance.

Key Advantages Over Permanent Life Insurance

One of the most significant benefits of term life insurance is its affordability compared to permanent life insurance. Policyholders often find that they can secure a substantial amount of coverage with lower premiums, allowing them to allocate their finances toward other priorities.

-

Lower Premiums:

Term life insurance typically costs less because it only provides coverage for a specific term, which reduces the insurance company’s risk and translates to more affordable monthly payments.

-

Flexibility:

Term policies can be tailored to fit your lifestyle and financial needs, generally offered in various lengths, such as 10, 20, or 30 years, allowing you to choose a term that aligns with your goals.

-

No Cash Value Component:

Unlike permanent life insurance, term policies don’t build cash value, which keeps the costs lower and simplifies the policy.

Affordability for Families

Affordability is a critical consideration for families, especially those managing everyday expenses and planning for future needs. Term life insurance offers a financial safety net without imposing significant financial strain.

-

Budget-Friendly Options:

Families can often purchase higher coverage amounts at a fraction of the cost of permanent insurance, ensuring that loved ones are protected in case of an untimely death.

-

Protection During Key Life Stages:

Many families choose term life insurance to cover essential years, such as when children are in their formative years, providing peace of mind knowing that their dependents will be taken care of financially.

Peace of Mind During Critical Life Events

Term life insurance plays a vital role in offering peace of mind during significant life changes and events. Knowing that there is a safety net in place can help individuals focus on what matters most during challenging times.

-

Home Buying:

Many families opt for term life insurance when purchasing a home, ensuring that the mortgage can be paid off in case of unexpected events, giving surviving family members stability.

-

Child Education:

Parents often consider term life insurance as a way to secure funds for their children’s education, ensuring that they can still pursue their dreams even in the unfortunate event of a parent’s passing.

-

Family Financial Planning:

With term life insurance, families can have the confidence to make long-term financial plans, knowing that there’s a financial cushion that can support loved ones if needed.

Factors Affecting Term Life Insurance Premiums

When considering term life insurance, understanding the factors that influence premium rates is essential for making informed decisions. Various elements can affect how much you pay for a policy, and grasping these can help you choose the right coverage at an optimal price.Age, health status, and lifestyle choices are primary variables that directly impact premium costs. Insurers assess these factors to evaluate risk; the higher the risk, the more you might pay.

For example, younger individuals typically enjoy lower premiums because they are viewed as less likely to make a claim compared to older individuals. Health plays a crucial role as well—those with chronic conditions or a history of serious illnesses may face higher premiums, while healthy individuals often secure better rates. Additionally, lifestyle factors such as smoking habits, alcohol consumption, and participation in hazardous activities can drive up costs.

Impact of Term Length and Coverage Amount on Premiums

The length of the term and the amount of coverage are significant determinants in calculating premiums. The duration of the policy directly correlates with the risk to the insurer. Typically, shorter-term policies tend to have lower premiums since the insurance company has less time to pay out a claim. Conversely, longer terms may result in higher premiums as they carry a greater risk over an extended period.The coverage amount is also a crucial element; higher coverage amounts lead to increased premiums.

Insurers calculate the potential payout when determining your rate. For instance, opting for a $500,000 policy will naturally cost more than a $250,000 policy. It’s essential to strike a balance between adequate coverage for your beneficiaries and what you can afford in terms of monthly payments.

Premium Variations Among Different Insurance Providers

Premiums can vary significantly from one insurance provider to another, even for the same level of coverage and term. This inconsistency can arise from differing underwriting criteria, company policies, and financial stability. Each insurer has its risk assessment methodologies, which can lead to discrepancies in pricing.When shopping for term life insurance, it’s beneficial to compare quotes from multiple providers. For instance, one company may offer a lower rate for a healthy non-smoker, while another might have competitive rates for older applicants.

By obtaining personalized quotes and evaluating the fine print, you can identify the most cost-effective option for your circumstances.

“Understanding the factors that influence your premiums can empower you to make smarter insurance decisions.”

Common Misconceptions About Term Life Insurance

Many people harbor misconceptions about term life insurance, often leading to confusion and poor decision-making when it comes to financial planning. Understanding the reality behind these myths is crucial to ensure that consumers make informed choices about their life insurance needs. This section will clarify frequent misconceptions, highlight the limitations of term policies, and explain the nuances of renewability and convertibility.

Myths Surrounding Term Life Insurance

Term life insurance is surrounded by several myths that can mislead potential policyholders. Some of the most common misconceptions include:

- Term Life Insurance is Only for Young People: Many believe that term life insurance is only relevant for younger individuals with dependents. However, it can also be beneficial for older adults seeking temporary coverage or those with significant debts.

- If You Outlive the Term, You Lose Everything: It’s a common myth that policyholders receive no benefit if they outlive their term. While it’s true that term policies do not have a cash value, they provide financial protection during the specified term, ensuring peace of mind for beneficiaries.

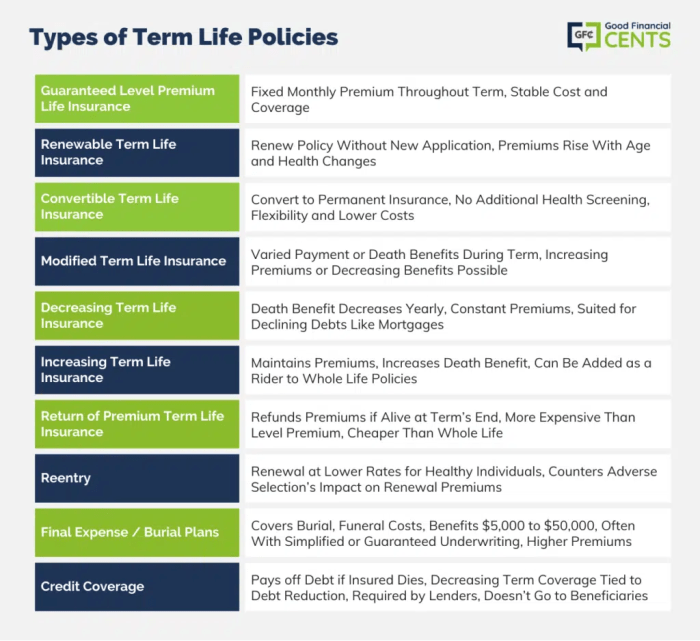

- All Term Policies Are the Same: Term life insurance comes in various forms, including level term, decreasing term, and increasing term. Each type serves different financial strategies and needs.

Limitations of Term Life Insurance

While term life insurance offers valuable protection, it does come with certain limitations that consumers should consider:

- No Cash Value Accumulation: Unlike whole life insurance, term life policies do not build cash value over time. This means that if the term expires without a claim, the policyholder does not receive any payout or investment return.

- Temporary Coverage: Term life insurance is designed for a fixed period, typically ranging from 10 to 30 years. Once the term ends, individuals must either purchase a new policy at potentially higher rates or risk being left without coverage.

- Renewal Premiums May Increase: If a policyholder chooses to renew their term policy after the initial period, they may face significantly higher premiums based on their age and health status at the time of renewal.

Renewability and Convertibility of Term Policies

Understanding the options for renewability and convertibility is essential for anyone considering term life insurance. Term life insurance policies typically offer two features:

- Renewability: Most term policies come with a renewal option, allowing policyholders to extend coverage beyond the initial term without needing to undergo additional health assessments. However, premiums will likely increase due to the insured’s age at renewal.

- Convertibility: Many term policies include a convertibility option, which allows policyholders to convert their term insurance into a permanent policy (like whole life) without a medical exam, typically within a specified period. This can be beneficial if the insured’s health deteriorates, making it difficult to secure a new permanent policy later on.

In conclusion, being aware of these misconceptions and understanding the limitations and options associated with term life insurance can empower consumers, leading to more informed decisions about their financial futures.

Choosing the Right Term Life Insurance Policy

Source: goodfinancialcents.com

Selecting the right term life insurance policy can feel overwhelming, but it’s essential to ensure that your financial protection aligns with your needs and goals. This guide will help you navigate the process of choosing a policy that suits your circumstances, empowering you to make informed decisions.When choosing a term life insurance policy, several critical factors should be considered to ensure you select the best fit for your needs.

Here’s a checklist to help you:

Factors to Consider When Selecting a Term Life Insurance Policy

Understanding the elements that influence your policy choice is crucial. Here are key factors to keep in mind:

- Coverage Amount: Determine how much coverage you need based on your financial obligations, such as mortgage, education, and living expenses.

- Term Length: Choose a term that matches your financial responsibilities. Common term lengths include 10, 20, or 30 years.

- Premium Costs: Evaluate what you can afford monthly or annually without straining your budget.

- Insurer Reputation: Research the insurance provider’s financial stability and customer service reviews to ensure reliability.

- Riders and Additional Benefits: Look for additional options that can be added to your policy, such as accelerated death benefits or waiver of premium.

- Conversion Options: Check if the policy allows for conversion to a permanent policy without additional underwriting.

Best Practices for Comparing Different Policies

Comparing policies from multiple insurers is an effective way to find the best coverage. Here are some best practices to guide your comparison:

- Request Quotes: Obtain quotes from various insurers to understand the price range for similar coverage amounts and terms.

- Review Policy Terms: Examine the fine print of policies. Pay attention to exclusions, limitations, and any conditions that may affect your claims.

- Use Comparison Tools: Utilize online comparison tools that allow you to see multiple policies side by side, making it easier to evaluate your options.

- Consult with an Agent: Consider seeking advice from a licensed insurance agent who can provide insights and help clarify complex terms.

- Check for Discounts: Inquire about any available discounts, such as those for bundling policies or maintaining good health.

Understanding Policy Terms and Conditions

A clear understanding of your policy’s terms and conditions is essential to avoid surprises when you need to make a claim. Here’s a brief guide to help you navigate these aspects:

- Insured Events: Clearly identify what events are covered under the policy and any exclusions that may apply.

- Premium Payment Frequency: Understand how often you’ll need to make premium payments, whether monthly, quarterly, or annually.

- Death Benefit Payout: Familiarize yourself with how and when the death benefit will be paid to beneficiaries following a claim.

- Policy Renewal Conditions: Know the terms under which you can renew the policy after the initial term expires.

- Grace Period: Be aware of the grace period for late payments to prevent unintentional lapses in coverage.

“Taking the time to understand your policy’s terms can make a significant difference in your family’s financial security.”

Claim Process for Term Life Insurance

Filing a claim for term life insurance can feel overwhelming during a time of loss. However, understanding the process and knowing the necessary steps can ease some of that burden. The claim process is designed to ensure that beneficiaries receive the benefits they are entitled to, providing financial support during a difficult time.To successfully file a claim after the insured individual passes away, beneficiaries need to follow several essential steps.

These steps facilitate a smooth and efficient claims process, ensuring that all necessary information is submitted to the insurance provider.

Steps to File a Claim

The following steps Artikel the process beneficiaries should follow to initiate a claim:

1. Notify the Insurance Company

The first step is to contact the insurance company as soon as possible. This can usually be done via a dedicated claims hotline or the company’s website.

2. Obtain the Death Certificate

A certified copy of the death certificate is a critical document needed for the claim. It serves as proof of the insured’s passing and is required by the insurance company.

3. Complete the Claim Form

The insurance company will provide a claim form, which must be filled out accurately. This form typically requests information about the insured, the policy details, and the beneficiaries.

4. Submit Required Documentation

Along with the claim form and death certificate, other documentation may be necessary. This can include:

A copy of the insurance policy

Identification of the claimant

Any additional documents that may be required by the insurer

5. Follow Up

After submitting the claim, it’s important to follow up with the insurance company to ensure the claim is being processed and to address any additional requests for information.

Documentation Required for Claims

The necessary documentation plays a crucial role in the claims process. Below is a list of the essential documents that beneficiaries might need to submit:

Death Certificate

A certified copy is required to confirm the passing of the insured.

Claim Form

Completed form provided by the insurance company.

Insurance Policy

Copy of the original policy for reference.

Proof of Identity

Such as a government-issued ID or driver’s license of the beneficiary.

Additional Documentation

This may include medical records or a coroner’s report, depending on the circumstances of the death.

Timeline for Claims Processing

The timeline for processing a life insurance claim can vary based on multiple factors. Generally, the process may take anywhere from a few days to several weeks. Here are some important factors affecting the timeline:

Completeness of Documentation

If all required documents are submitted correctly, the claim is likely to process faster. Incomplete or incorrect submissions can lead to delays.

Insurance Company Policies

Each insurer has its own claims processing guidelines which can impact the timeline.

Investigation Needs

In cases of suspicious circumstances surrounding the death, the insurance company may need to conduct an investigation, which can extend the processing time.

Challenges Beneficiaries Might Face

While the claims process is designed to be straightforward, beneficiaries may encounter challenges along the way. Some common issues include:

Delayed Payments

If there are discrepancies in the submitted documents or if additional information is required, this can lead to delays in payment.

Claim Denials

Some claims may be denied due to reasons such as policy exclusions or misrepresentation during the application process.

Communication Barriers

Beneficiaries may experience difficulties reaching representatives or receiving timely updates on their claims.In summary, understanding the claims process, the required documentation, and potential challenges can significantly ease the burden for beneficiaries during a challenging time. Being prepared and informed helps ensure a smoother experience as they navigate this important process.

Real-life Scenarios Illustrating Term Life Insurance

Source: goodfinancialcents.com

Term life insurance serves as a critical financial safety net for individuals and families, especially during unforeseen circumstances. Real-life scenarios can vividly demonstrate the importance of having such coverage in place. These stories highlight the stark differences in outcomes for families affected by the loss of a primary income earner, illustrating how term life insurance can provide significant peace of mind during turbulent times.One of the most resonant aspects of term life insurance is its ability to protect loved ones financially in the event of a tragedy.

The contrast between families with and without coverage unveils profound insights into the benefits of this insurance product. Here are a few case studies that underscore these points:

Case Study: The Smith Family

In this scenario, John Smith, a 35-year-old father of two, purchased a 20-year term life insurance policy worth $500,000. Tragically, John passed away in a car accident just three years after securing the policy. The financial implications were significant; thanks to his term life insurance, his wife, Lisa, was able to maintain their home and support their children’s education without the added stress of financial burdens.

The payout from the policy covered their mortgage and provided for daily living expenses, allowing Lisa to grieve without the pressure of immediate financial concern.

Case Study: The Johnson Family

Conversely, let’s examine the Johnson family, where Mark, a 40-year-old husband and father of three, chose not to invest in term life insurance, believing it was an unnecessary expense. After Mark’s unexpected death due to health complications, his family faced daunting challenges. With no coverage in place, they struggled to pay their bills, leading to the loss of their home and the inability to fund their children’s education.

This unfortunate situation illustrates how the absence of term life insurance can lead to financial instability and emotional turmoil for a family left behind.

Narrative of Peace of Mind

Consider the narrative of Sarah, a 30-year-old single professional who recently acquired a term life insurance policy. Sarah’s decision stemmed from a desire to ensure her aging parents wouldn’t face financial strain in the event of her passing. Knowing that her policy would cover her student loans and other debts, Sarah felt a sense of relief. She described the comfort that came from knowing her family would be taken care of, should the unthinkable happen.

This peace of mind allowed Sarah to focus on her career and enjoy life, free from the gnawing worry about her financial legacy.In summary, real-life scenarios underline the essential role of term life insurance in safeguarding families against financial hardship after the loss of a loved one. The juxtaposition of families with coverage versus those without illustrates the profound impact this insurance can have, not just in terms of monetary value, but also in the emotional peace it provides during challenging times.

Last Recap

In conclusion, term life insurance is more than just a policy; it’s a strategic decision that can safeguard your loved ones against financial hardship in times of need. By understanding its workings, benefits, and the factors influencing premiums, you can make an informed choice that aligns with your financial goals. With the right policy in place, you can confidently navigate life’s challenges while ensuring your family’s future remains secure.

Question & Answer Hub

What happens if I outlive my term life insurance policy?

If you outlive your term life insurance, the policy simply expires, and no benefits are paid. However, some policies may offer renewal options or the ability to convert to a permanent policy.

Can I change my coverage amount after purchasing a policy?

Many insurers allow you to adjust your coverage amount, though it may require a new application or a premium adjustment based on your current health and age.

Is term life insurance refundable?

Standard term life insurance policies are not refundable; however, some policies offer a return of premium option, which pays back some or all premiums if you outlive the term.

How does my health impact my term life insurance premiums?

Your health significantly influences your premiums; healthier individuals typically receive lower rates. Insurers assess your medical history during underwriting to determine risk.

Can I have more than one term life insurance policy?

Yes, you can own multiple term life insurance policies, which can help you tailor coverage according to your specific financial needs.